Get the free Accidental Death and Dismemberment Claim Form

Get, Create, Make and Sign accidental death and dismemberment

How to edit accidental death and dismemberment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accidental death and dismemberment

How to fill out accidental death and dismemberment

Who needs accidental death and dismemberment?

Accidental Death and Dismemberment Form - How-to Guide

Overview of accidental death and dismemberment (AD&) insurance

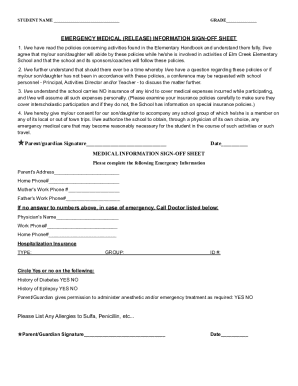

Accidental Death and Dismemberment (AD&D) insurance is a type of policy that provides financial coverage for individuals and their beneficiaries when death or severe injury occurs due to an accident. Unlike other life insurance policies, which cover death regardless of the cause, AD&D specifically pertains to accidental losses. Understanding this insurance is crucial as it serves as an additional safety net for individuals and families, particularly in high-risk occupations or lifestyles.

Common scenarios that might lead to AD&D claims include vehicle accidents, falls, drowning, or other unintentional incidents. These situations can have life-changing impacts, making it vital for individuals to have the right coverage in place. Moreover, AD&D insurance can complement traditional health insurance, providing broader protection against unexpected events.

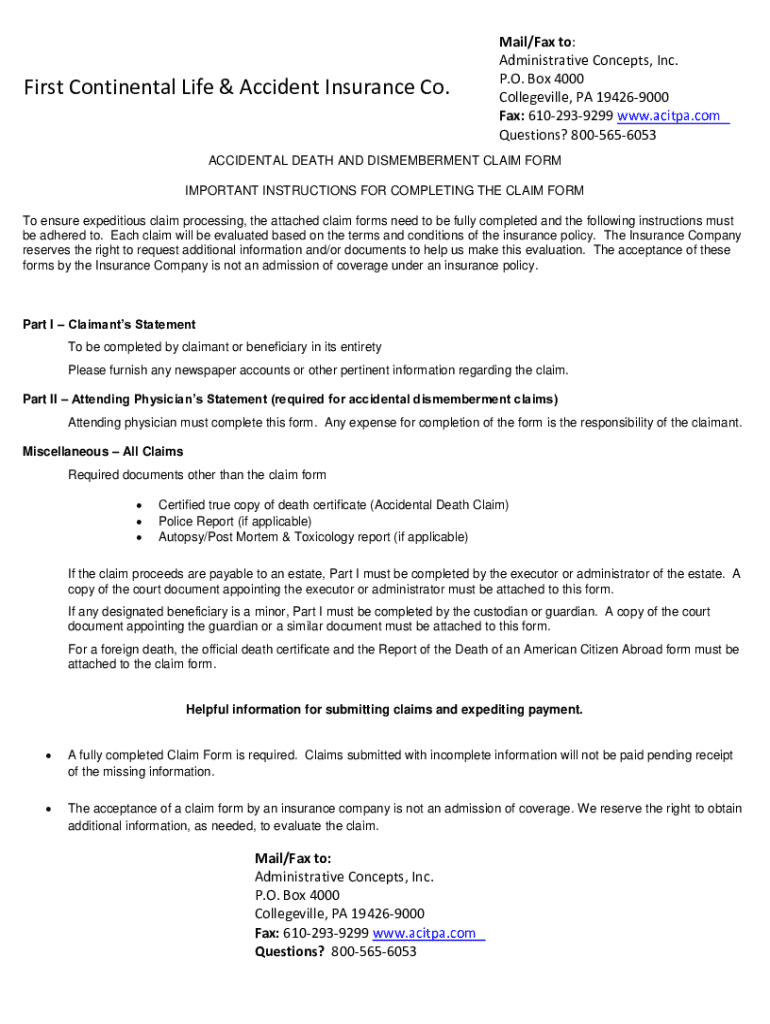

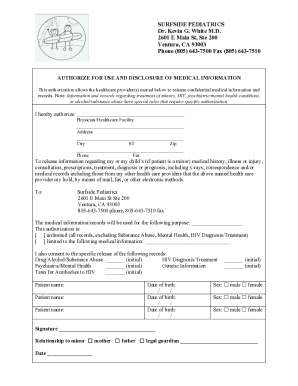

Understanding the AD& form

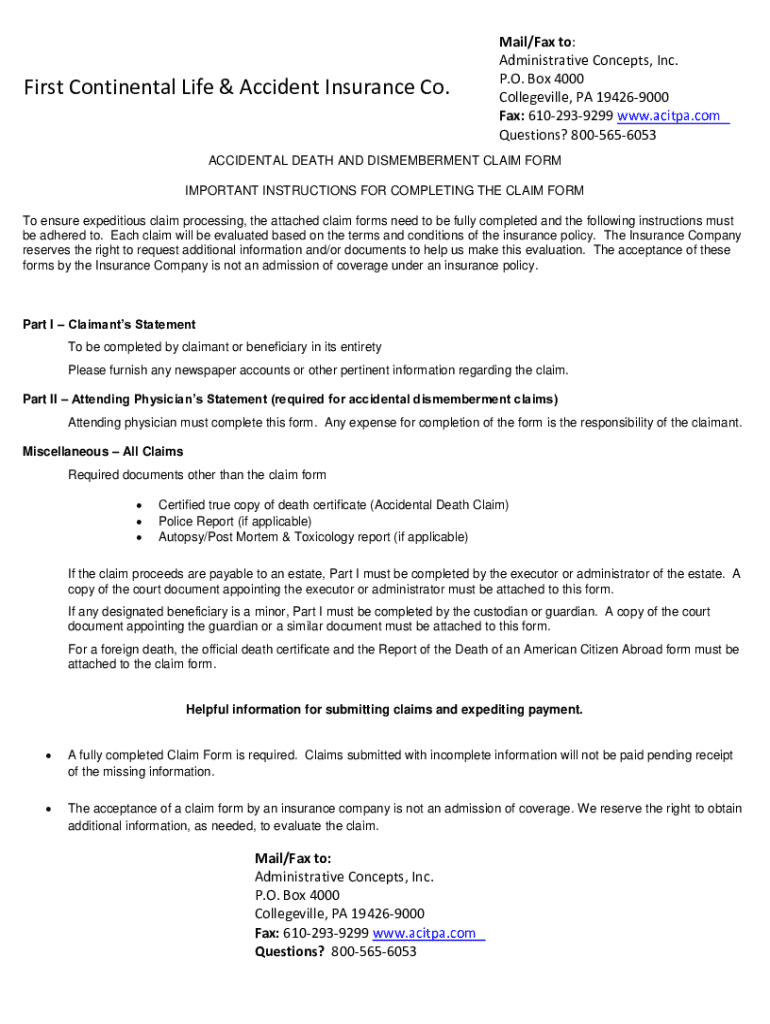

The Accidental Death and Dismemberment form is a crucial document that initiates the claims process. It provides the insurance company with essential information about the incident, the insured person, and the beneficiaries. Completing this form accurately is vital to ensure a smooth claims process.

Key sections of the AD&D form include personal information, a description of the incident, beneficiary designation, and supporting documentation requirements. Each section has specific requirements to help the insurance company assess the claim quickly and fairly.

Step-by-step guide to filling out the AD& form

Filling out the AD&D form correctly is essential for a successful claim. Here’s a step-by-step guide to ensure accuracy and completeness.

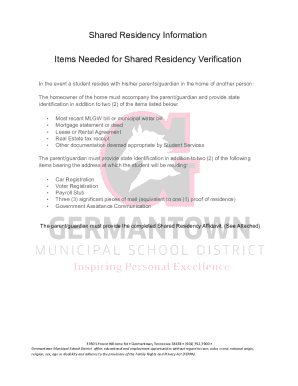

Step 1 involves preparing your information. This requires collecting all necessary documents, including police reports, medical records, and any other supportive data. It's also important to identify the correct version of the AD&D form that corresponds with your insurance provider.

Step 2 is completing the personal information section. Here, it’s crucial to provide accurate details. Double-check names, addresses, and contact numbers to avoid delays.

Step 3 focuses on describing the incident. This is your opportunity to detail what happened clearly. Include all pertinent information, as this will shape the outcome of your claim. Being precise and factual is imperative.

Step 4 involves designating beneficiaries. Ensure their details are correct, as this affects who will receive any funds post-claim.

Finally, Step 5 is reviewing the form. Double-check for common mistakes such as incorrect dates, misspelled names, or incomplete sections. After filling out the form, a thorough review can save time and prevent claim denials.

Submitting your AD& claim

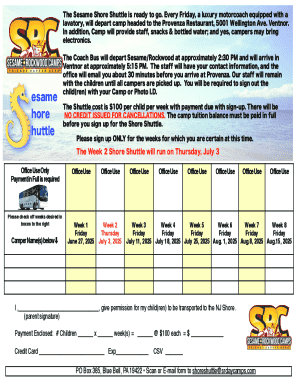

After completing the AD&D form, the next step is to submit your claim. Depending on your insurance provider, you may have several options for submission. Electronic submissions are typically faster and can be done online using tools like pdfFiller.

To submit online, visit the pdfFiller site, and follow the instructions for uploading your completed form. The benefits of using a cloud-based platform like pdfFiller include easy accessibility and the ability to save your work.

If opting for physical mailing, ensure to format the envelope correctly. Include your policy number and address it to the claims department of your insurance provider. Consider using certified mail to track your submission.

Managing your AD& claim

Once you've submitted your AD&D claim, managing it effectively is crucial. You can use pdfFiller to track the status of your submission easily. Check in regularly for updates and maintain records of all correspondences regarding your claim.

Understanding the review process is vital. After submitting the AD&D form, your insurer will begin a thorough review, analyzing the details provided. Familiarize yourself with the timeframes for claim decisions, as processing can vary based on the complexity of the claim and the provider's policies.

Common challenges and solutions

Filing an AD&D claim can come with challenges, primarily due to claim denials. Common reasons for denials include inaccurate information, missing documentation, or policy exclusions. It’s critical to thoroughly read the policy and understand what is covered.

If your claim is denied, don't panic. First, request a detailed explanation from your insurer. Often, claims can be appealed with additional documentation or clarifications. Utilizing pdfFiller can assist with making necessary revisions and resubmissions of your claim, ensuring you present the strongest case possible.

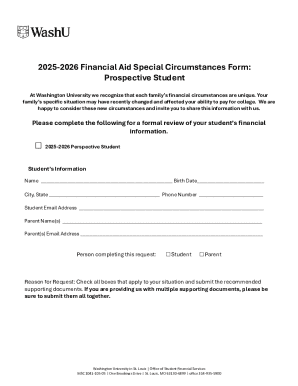

Accessing your documents in the future

Long after the claim is submitted, having access to your AD&D documents is essential. Using pdfFiller for document management enables users to store their claims and associated documents safely, allowing easy retrieval in the future.

Digital document management comes with multiple benefits, including enhanced security, collaborative features, and ease of access from anywhere. Embracing a digital approach helps in keeping all your important documents organized, providing peace of mind.

Tips for teams and individuals regarding AD& form management

For teams managing AD&D claims, collaboration tools within pdfFiller can streamline the process. These features enable simultaneous updates and reviews, ensuring every member is on the same page throughout the claims process.

Sharing and reviewing claims with colleagues can enhance accuracy and prevent oversights. Encourage team members to familiarize themselves with claim requirements and deadlines to remain organized and efficient in submitting claims.

Frequently asked questions (FAQs)

The typical processing time for an AD&D claim can vary widely, ranging from a few weeks to several months, depending on the insurer and the complexity of the incident. It's common for insurers to require additional documentation, which may extend processing times.

You can modify your AD&D form even after submission, but be mindful that doing so may delay processing. Notify your insurer as soon as possible of any changes to ensure they have the most accurate information.

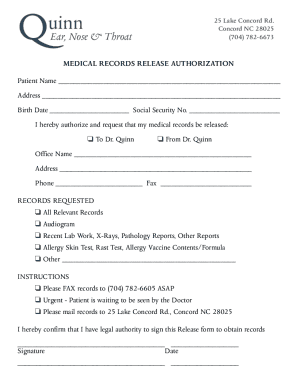

During the claims process, additional documentation may be requested, such as autopsy reports, medical treatment records, or even witness statements, depending on the nature of the claim.

Resources

For those seeking more information or examples, resources including sample AD&D forms can be found on various insurance websites. Additionally, familiarize yourself with local laws relating to accidental death and dismemberment to fully understand your rights and options.

External resources such as consumer advocacy groups can also provide insights into the claims process and additional support. Always verify that the resources you use are up-to-date and relevant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify accidental death and dismemberment without leaving Google Drive?

How do I make edits in accidental death and dismemberment without leaving Chrome?

How do I fill out accidental death and dismemberment on an Android device?

What is accidental death and dismemberment?

Who is required to file accidental death and dismemberment?

How to fill out accidental death and dismemberment?

What is the purpose of accidental death and dismemberment?

What information must be reported on accidental death and dismemberment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.