Get the free Lease – Flood Disclosure

Get, Create, Make and Sign lease flood disclosure

How to edit lease flood disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lease flood disclosure

How to fill out lease flood disclosure

Who needs lease flood disclosure?

Lease Flood Disclosure Form: A Comprehensive How-to Guide

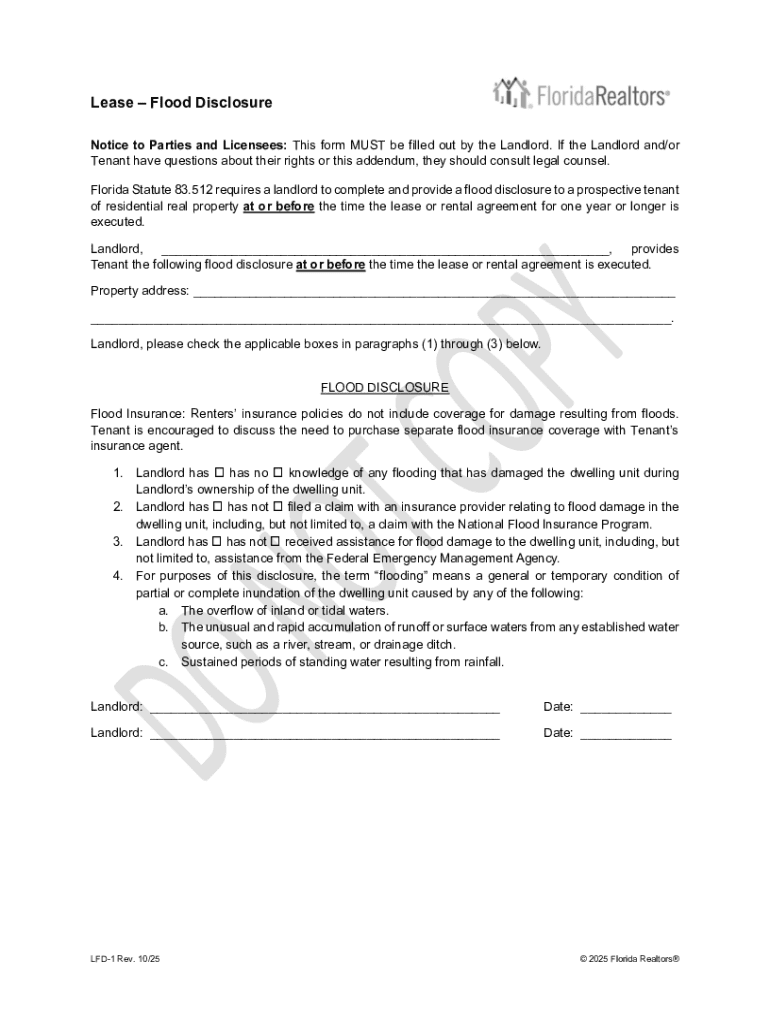

Understanding the Lease Flood Disclosure Form

The lease flood disclosure form is a crucial document that serves to inform tenants about potential flood risks associated with a rental property. Its primary purpose is to promote transparency in leasing agreements, ensuring that tenants are aware of any existing hazards before they enter into a contract with a landlord.

Transparency is especially important in real estate transactions, where the stakes can be high. A well-informed tenant can make better choices regarding their living situations, while landlords can protect themselves from potential legal ramifications for failing to disclose critical property information.

Flood risks can vary widely based on the property's location, the history of flooding events, and environmental regulations. A comprehensive understanding of these aspects is essential for both landlords and tenants to navigate the leasing landscape effectively.

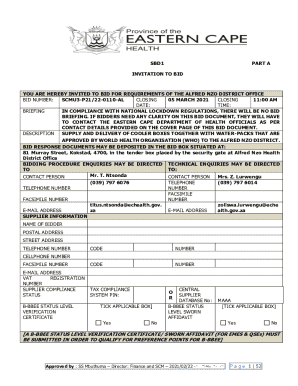

Navigating Florida’s New Flood Disclosure Law (Effective October 1, 2025)

The state of Florida is set to implement a new flood disclosure law, § 83.512, effective October 1, 2025. This law introduces key provisions that aim to enhance the level of disclosure landlords must provide their tenants regarding flood risks.

Landlords will be required to give specific details about any declared flood zones affecting the property or its proximity, thereby fostering a culture of responsibility among rental property owners.

The timeline for implementation is critical as it gives landlords time to prepare for compliance. The impact on residential leases will be significant, potentially changing how leases are drafted and negotiated across the state.

What landlords must do regarding flood disclosure

Following the new law, landlords have clear legal obligations concerning flood disclosures. Understanding these obligations is essential to avoid potential fines or lawsuits due to non-compliance with the law.

Steps for completing the lease flood disclosure form include accessing the form through government or real estate websites, filling out all required sections accurately, and ensuring that all information is up-to-date. Best practices suggest that landlords discuss these flood risks actively with potential tenants, allowing for questions and clarifications.

The required flood disclosure form: key elements

The lease flood disclosure form typically includes several key sections that landlords must complete comprehensively. Understanding these sections not only aids in compliance but also protects landlords' interests legally.

Accurate information on these elements is pivotal for landlords, as it forms the basis for legal protection against claims of non-disclosure should any issues arise in the future.

Tenant remedies for non-disclosure

Tenants in Florida have specific rights under state law when it comes to non-disclosure regarding flood risks. If a landlord fails to disclose relevant flood information, tenants may have several remedies at their disposal.

The consequences for landlords who neglect their disclosure obligations can be severe, including fines, legal action, and potentially even the loss of a lease agreement. It’s vital for landlords to understand and adhere to these laws.

Why this matters for landlords

For landlords, compliance with the new flood disclosure law holds significant financial implications. Failing to provide necessary disclosures can result in costly legal disputes and restore tenants’ trust after a nondisclosure incident can be incredibly difficult.

Moreover, by adhering to best practices in disclosure, landlords can establish their properties as reliable and desirable, thus improving occupancy rates.

Why this matters for tenants

For tenants, understanding the lease flood disclosure form and their rights is essential in making informed rental decisions. Evaluating potential rental properties for flood risks becomes a key part of the decision-making process.

Ultimately, a well-informed tenant is more likely to find a property that meets their unique needs while minimizing any future risks caused by flooding.

Interactive tools for document management with pdfFiller

pdfFiller empowers you to manage your lease flood disclosure forms efficiently through powerful interactive tools. With features that allow users to edit, customize, and eSign documents, managing paperwork becomes a seamless experience.

The tools included in pdfFiller ensure that all necessary documentation, including disclosures related to flood risks, are handled efficiently, allowing landlords to focus on what truly matters—providing quality housing.

Managing your documents effectively in the cloud

Using pdfFiller for document management offers numerous benefits that streamline the entire process for landlords and tenants alike. By leveraging cloud-based solutions, users can access their documents from anywhere, at any time.

These features can significantly reduce the burden of document management, making it easier to stay compliant with flood disclosure requirements.

Case studies and recent best practices in flood disclosure

Learning from case studies focused on flood disclosure practices offers valuable insights. For instance, some landlords have developed specialized training to ensure that all staff understand the flood risks associated with their properties and the intricacies of the lease flood disclosure form.

Adopting these best practices not only safeguards an entire rental community but also ensures that all parties involved understand their responsibilities.

Frequently asked questions (FAQs)

The lease flood disclosure form generates numerous questions, particularly regarding the legal responsibilities of landlords. It's essential for both landlords and tenants to have clarity on these matters.

Providing thorough answers to these common questions equips everyone involved to make informed decisions regarding flood risks and leasing arrangements.

Recent posts and discussions in the real estate community

Conversations surrounding flood disclosure have intensified recently, with a notable increase in public awareness regarding climate change and extreme weather patterns. These factors have directly influenced local and national trends affecting leasing agreements and flood risk disclosures.

Engaging with these discussions can provide invaluable insights for both landlords and tenants navigating the complexities of lease agreements in flood-prone areas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lease flood disclosure for eSignature?

How do I edit lease flood disclosure in Chrome?

How do I edit lease flood disclosure on an iOS device?

What is lease flood disclosure?

Who is required to file lease flood disclosure?

How to fill out lease flood disclosure?

What is the purpose of lease flood disclosure?

What information must be reported on lease flood disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.