Get the free Rtgs form of axis bank download

Get, Create, Make and Sign rtgs form of axis

Editing rtgs form of axis online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rtgs form of axis

How to fill out rtgs form of axis

Who needs rtgs form of axis?

Understanding the RTGS Form of Axis Bank: A Comprehensive Guide

Understanding RTGS: A brief overview

Real-Time Gross Settlement (RTGS) is a robust electronic payment system used by banks to facilitate interbank transactions, transferring funds in real-time and on a gross basis. This means transactions are settled individually and immediately without netting against other transactions. RTGS is significant in the banking system as it enables high-value transactions to be completed efficiently, contributing to the smooth functioning of the financial market.

One of the key advantages of using RTGS over other transfer systems, such as NEFT, is the speed of transaction processing. While NEFT operates in batches, RTGS transactions are instantaneous, making them ideal for urgent fund transfers. Furthermore, RTGS transactions often have a higher confidence level among businesses and individuals, knowing that their money is moved securely and without delay.

RTGS form of Axis Bank: An introduction

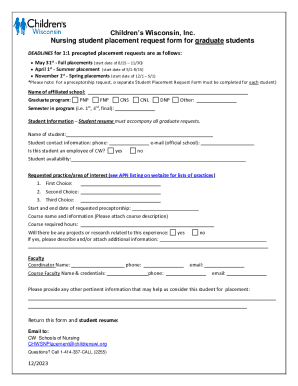

The RTGS Form of Axis Bank is a specific document that clients must fill out to initiate a fund transfer through the RTGS system. This form is crucial as it captures all necessary details to process the transaction accurately. Using the RTGS Form for fund transfers not only ensures that funds are transferred securely but also allows for tracking and managing payments efficiently.

To utilize RTGS services, customers must meet certain eligibility requirements. Typically, this includes maintaining a savings or current account with Axis Bank, ensuring adequate funds in the account for the transaction, and complying with any regulatory norms set by the Reserve Bank of India.

Detailed instructions for filling the RTGS form

Collecting necessary information

Before filling out the RTGS form, it is vital to gather the necessary information to avoid delays. The required details include:

Step-by-step guide to filling the RTGS form

Filling out the RTGS form requires careful attention to detail to ensure accurate processing. The form is divided into clear sections, typically requiring you to enter:

It's crucial to double-check all entries for accuracy before submission to avoid any potential delays or rejections.

Editing and managing the RTGS form

If you need to edit or modify a filled RTGS form after submission, it can be a bit complex, depending on the stage of processing. Generally, it is advisable to contact Axis Bank customer service immediately to rectify any errors.

Common mistakes to avoid while filling out the form include incorrect IFSC codes, missing beneficiary details, and mismatched amounts. Ensuring all required fields are filled and cross-verifying everything can help prevent delays.

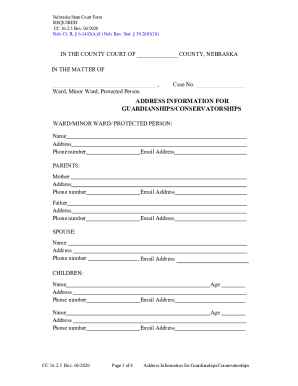

Submission process for RTGS form

How to submit the RTGS form online

To submit the RTGS form online, follow these steps:

Offline submission process

For offline submission, you can print the RTGS form after filling it out and take it to your nearest Axis Bank branch. Hand it over at the counter, ensuring you have a valid identification document for any verification needs.

What happens after submission?

After submission, the expected timelines for transaction processing are generally quite quick, with most transactions being completed on the same day. However, during peak hours or if additional verification is required, it may take longer. You can track the status of your RTGS transaction through the 'Transaction History' section of your Axis Bank online banking account.

Important points related to RTGS transactions

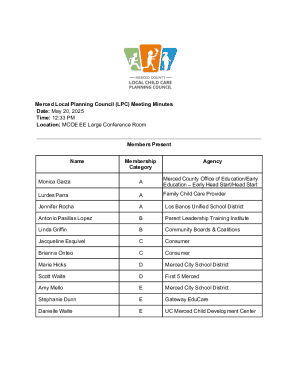

Fees and charges associated with RTGS

Axis Bank applies a nominal fee for RTGS transactions, which varies based on the amount being transferred. Typically, the charges are structured as follows:

Limits on RTGS transactions

RTGS transactions have both minimum and maximum transfer limits that clients must adhere to. The minimum limit for RTGS transactions is ₹2 lakh, while there is no upper limit for fund transfers. This is particularly beneficial for businesses looking to transact larger amounts.

Timing of transactions

RTGS services are available from 7:00 AM to 6:00 PM on weekdays and from 7:00 AM to 2:00 PM on Saturdays. Transactions initiated after cutoff times may be processed the following business day.

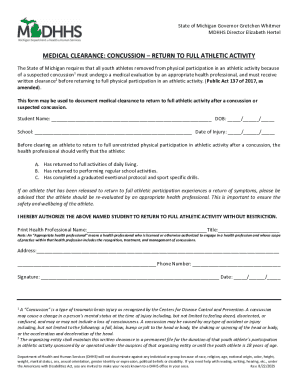

Safety and security while using RTGS

When using RTGS services, it's crucial to safeguard your personal and financial information. Here are some tips:

In case of suspicious activity or errors in transactions, contact Axis Bank's customer service immediately for assistance.

FAQs about the RTGS form of Axis Bank

Clients often have questions regarding the RTGS process. Here are some of the most common queries:

Testimonials from users

Various users have shared their experiences with Axis Bank's RTGS services. Individuals often appreciate the speed and reliability of transactions, while businesses highlight the ease of tracking payments. Some clients report using RTGS for crucial fund transfers that were completed on the same day, significantly aiding their cash flow management.

In certain case studies, teams utilized the RTGS feature for urgent vendor payments, avoiding penalties and enhancing supplier relationships. These real-world examples reflect the advantages of using RTGS, reinforcing its importance.

Additional tools and resources

For customers looking to manage their RTGS forms effectively, pdfFiller provides invaluable tools that streamline the editing and management of PDFs. Users can access online solutions to edit RTGS forms or download templates from the website.

Additionally, interactive tools on pdfFiller allow clients to create and manage documents, enhancing efficiency and user experience in completing the RTGS form and other related banking documents.

Related forms and templates

Aside from the RTGS form, pdfFiller hosts a variety of essential banking forms. Clients can easily search for and utilize templates relevant to fund transfers, loans, and account management, creating a seamless connection for all their banking documentation needs.

Contacting Axis Bank for assistance

Axis Bank provides multiple channels for customer support regarding RTGS transactions. Clients can reach out via phone, email, or through their online banking support portal. It is crucial to seek immediate assistance if any issues arise during the form submission process or with the transaction itself.

Engaging with customer service ensures clarity and prompt resolution of any concerns, making the banking experience smoother.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rtgs form of axis in Gmail?

How can I send rtgs form of axis to be eSigned by others?

Can I create an electronic signature for signing my rtgs form of axis in Gmail?

What is rtgs form of axis?

Who is required to file rtgs form of axis?

How to fill out rtgs form of axis?

What is the purpose of rtgs form of axis?

What information must be reported on rtgs form of axis?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.