Get the free Beneficiary Verification of Coverage

Get, Create, Make and Sign beneficiary verification of coverage

Editing beneficiary verification of coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary verification of coverage

How to fill out beneficiary verification of coverage

Who needs beneficiary verification of coverage?

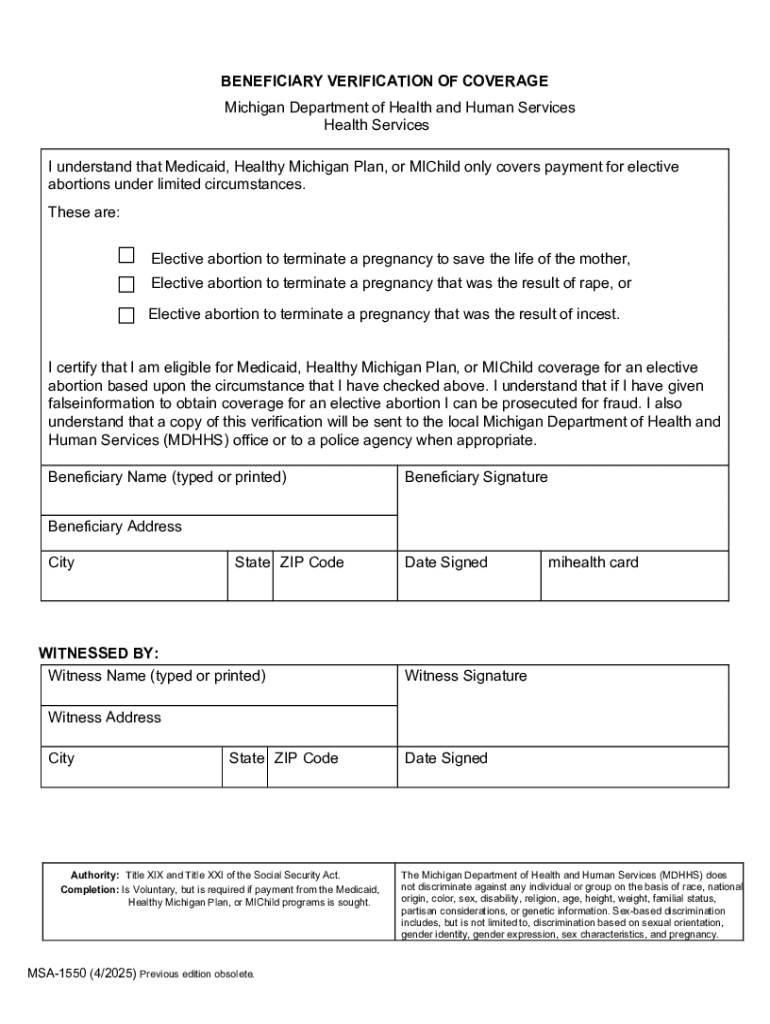

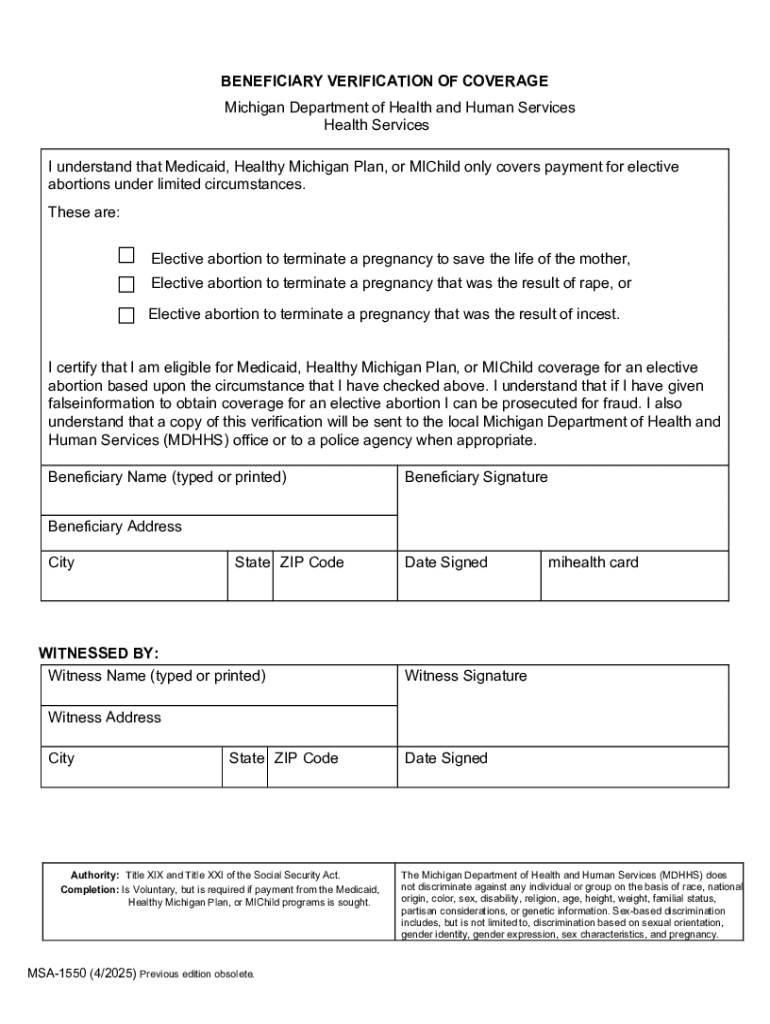

Beneficiary Verification of Coverage Form

Understanding the beneficiary verification of coverage form

The beneficiary verification of coverage form is a critical document that ensures the correct identification and verification of beneficiaries tied to an individual's insurance policies. It serves to confirm who will receive benefits from policies, such as life insurance or group term life, upon the policyholder's passing. This form is essential because it guarantees that these benefits are allocated to the rightful heirs as per the policyholder’s intentions.

Verifying beneficiaries is vital for a few reasons: it prevents disputes among family members, ensures that financial support reaches intended recipients promptly, and aids in maintaining your legacy as the policyholder. Accurate beneficiary information not only simplifies claims processes for beneficiaries but also enhances the peace of mind of policyholders.

Who needs to complete the beneficiary verification of coverage form?

Individuals holding life insurance policies should complete the beneficiary verification of coverage form. This includes policyholders with various insurance coverages, such as life insurance and accidental death benefits, regardless of the amount of coverage. Additionally, employees of organizations offering benefits under group plans, including employer-sponsored life insurance, must also provide this information to ensure their benefits distribution is correctly managed.

It's important for employees to know that regular verification is required, especially when there are life changes such as marriage, divorce, or childbirth. As life events unfold, it's crucial to reassess beneficiaries to align them with current realities.

Key components of the beneficiary verification of coverage form

The beneficiary verification of coverage form consists of several key sections, each designed to capture relevant data efficiently. A clear understanding of each section helps ensure all necessary information is provided.

Common terms to know

Familiarizing oneself with key terms related to the beneficiary verification of coverage form is beneficial for policyholders. Understanding terminology helps prevent confusion and ensures accurate completion of the form.

Step-by-step guide to completing the beneficiary verification of coverage form

Completing the beneficiary verification of coverage form may seem daunting, but following a systematic approach ensures accuracy and compliance. Here’s a straightforward guide to help you through the process.

Editing, signing, and managing your beneficiary verification of coverage form

Managing your completed beneficiary verification of coverage form doesn’t have to be tedious. Utilizing pdfFiller allows for efficient edits to PDF documents, providing you the flexibility to adjust beneficiary information as needed over time.

eSigning your document within pdfFiller ensures that your changes are both legally binding and secure. Furthermore, collaborating with financial advisors or family members can enhance your beneficiary choices, allowing multiple perspectives to shape your decisions.

Storing your completed form in the cloud is another strong feature of pdfFiller. You can access your documents from anywhere, which is particularly advantageous as you’ll want to keep your form updated in the event of any significant life changes.

Troubleshooting common issues

Encounters with errors while completing the beneficiary verification of coverage form is not uncommon. Common issues include improperly filled entries, missing signatures, or errors in beneficiary information. It is crucial to address these problems promptly to avoid delays in claims upon the policyholder's death.

Implementation of the beneficiary verification of coverage form in different scenarios

Employers play a significant role in managing group benefits and should encourage regular verification of beneficiaries among their employees. This proactive approach can prevent potential complications and ensure that benefits are allocated correctly.

Changing life circumstances such as marriage, divorce, or the birth of a child can significantly impact beneficiary choices. It is vital for individuals to assess their beneficiaries in the context of these changes to ensure that their present preferences are accurately reflected in their documents.

Additionally, special considerations must be made when minors are named as beneficiaries, as guardianship implications arise. In such cases, setting up a trust or designating a responsible adult to manage the funds can provide better security and clarity.

Ensuring compliance and legal acknowledgment

Understanding the legal implications of your beneficiary verification of coverage form is crucial. As a policyholder, you have specific rights and responsibilities that influence how your policy benefits are distributed. Familiarizing yourself with these legal aspects empowers you to make informed decisions pertinent to your beneficiaries.

To ensure that your form meets all legal requirements, it’s advisable to consult with legal or financial professionals who specialize in estate planning and insurance. Their expertise can help avoid potential pitfalls that may arise due to poorly defined beneficiary designations.

Best practices for keeping your beneficiary information current

Regularly reviewing your beneficiary designations is a best practice that enhances clarity in your financial matters. Financial experts recommend revisiting your choices every few years or after significant life events.

Utilizing pdfFiller for continuous document management

pdfFiller proves to be an indispensable tool for maintaining ongoing document management. It allows users to track changes made to the beneficiary verification of coverage form effectively, ensuring that all revisions are recorded.

Moreover, archiving older documents securely is an added advantage. Creating a secure history of your beneficiary changes not only provides a point of reference for the future but ensures that you and your heirs remain informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary verification of coverage from Google Drive?

How do I edit beneficiary verification of coverage on an iOS device?

Can I edit beneficiary verification of coverage on an Android device?

What is beneficiary verification of coverage?

Who is required to file beneficiary verification of coverage?

How to fill out beneficiary verification of coverage?

What is the purpose of beneficiary verification of coverage?

What information must be reported on beneficiary verification of coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.