Get the free An employer's guide to chronic kidney disease (CKD)

Get, Create, Make and Sign an employer039s guide to

Editing an employer039s guide to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out an employer039s guide to

How to fill out an employer039s guide to

Who needs an employer039s guide to?

An employer's guide to form

Understanding the importance of accurate forms

Proper form completion is critical for employers as it underpins compliance with legal obligations and regulations. Inaccurate or incomplete forms can lead to costly fines and penalties, which ultimately affect the financial health of an organization. Furthermore, they can contribute to poor employee relations. When forms are not handled correctly, it creates confusion and frustration among employees, potentially diminishing morale and productivity.

Common employer forms include essential documents like the W-2, I-9, and various tax forms. Each one serves specific purposes: the W-2 details annual wages and tax withholdings, the I-9 verifies the identity and employment authorization of individuals, and tax forms facilitate compliance with state and federal regulations. Ensuring that these forms are filled out accurately from the start can streamline many administrative processes.

Navigating the form creation process

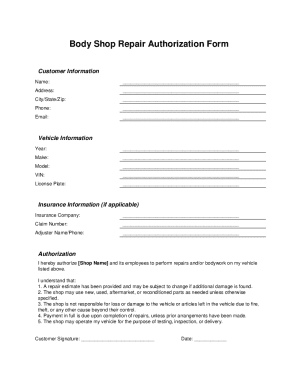

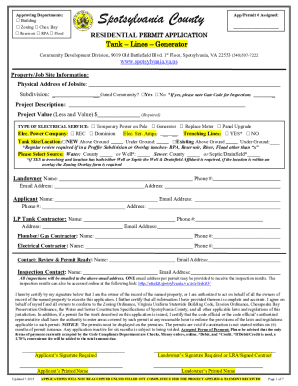

Employers often require various types of forms to facilitate day-to-day operations. These include employment applications, tax documents, performance reviews, and much more. Identifying the exact need for the form is the first step toward creating a useful document. Consider who will utilize it, and the information necessary for its completion.

Next, choose the right format for your forms. Various options such as PDFs or online forms exist, each with unique benefits. PDFs can be easily shared and printed, while online forms allow for real-time input from multiple users, thereby increasing efficiency. Tools like pdfFiller offer the ability to create versatile forms tailored to specific needs, further aiding in the management of documents.

Interactive tools for form management

pdfFiller provides a user-friendly platform perfect for document creation and management. Its editing tools include templates that can save significant time; drag-and-drop functionality makes it easy to incorporate necessary data or sections. Custom design options enable employers to create forms that reflect their branding and organizational needs.

Collaboration becomes seamless with pdfFiller. Employers can invite team members to review and provide feedback, ensuring that the final document aligns with objectives. The version control and tracking history features offer peace of mind, as they allow you to track changes and revert to previous versions if necessary.

Filling out employer forms: best practices

Before filling out a form, it’s essential to gather all the necessary information and documentation. This makes the process smoother and reduces the likelihood of mistakes. Additionally, understanding the specific requirements for each form, such as which identification documents to include with the I-9, can save time and mitigate errors.

When filling out forms like the W-2 and I-9, attention to detail is crucial. Common pitfalls include entering incorrect taxpayer registration numbers or omitting critical information like signatures. By establishing a checklist that includes each necessary field, employers can ensure accuracy and completeness, reducing the risk of backtracking later on.

Editing, signing, and submitting forms

Editing and proofreading forms before submission can prevent errors that may have repercussions. Utilizing tools within pdfFiller can aid in revising documents to ensure accuracy. A checklist can streamline this process, allowing you to confirm each form's completion and compliance with applicable laws.

An additional advantage of using pdfFiller is its eSigning capabilities. Implementing eSignature functionality simplifies the signing process, making it a convenient option for both employers and employees. The legal standing of eSigns varies by jurisdiction, so it's crucial to understand local laws and regulations regarding digital signatures to avoid future compliance headaches.

Managing and storing completed forms

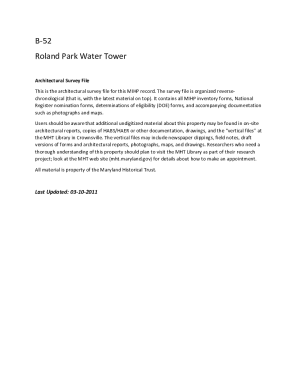

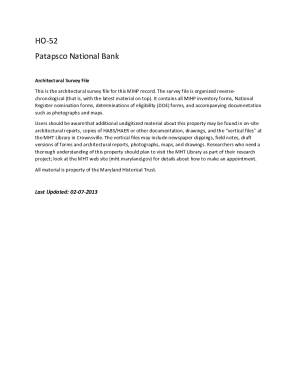

Once forms are completed and submitted, organized digital storage is vital for future access and compliance. Tools available in pdfFiller can aid in managing files effectively. Employing a systematic filing structure allows for easy navigation, ensuring that important documents can be retrieved quickly when needed.

Retention policies play a crucial role in compliance. Employers must be familiar with how long they need to keep different forms based on industry standards and legal requirements. Having a clear understanding of these policies not only aids in compliance but also in maximizing the efficiency of document management.

Troubleshooting common issues with employer forms

Despite best efforts, common issues with employer forms can arise. Identifying these errors quickly is essential to maintaining workflow and compliance. Frequent problems include missing information, incorrect formats, or failure to obtain necessary signatures. Establishing a clear protocol for addressing these concerns can mitigate disruptions.

Accessing support resources through pdfFiller can significantly ease troubleshooting. The platform offers customer service and help guides specifically designed to address these common issues. Engaging with these resources can provide clarity and guidance when faced with obstacles in form management.

Streamlining future form processes

Analyzing completed forms can vastly improve the efficiency of future processes. By leveraging data from previous forms, employers can identify recurring information needs and streamline their operations. This analysis also supports the development of improved templates and forms.

Additionally, pdfFiller's analytics tools can provide valuable insights into form performance. Tracking completion times and gauging user engagement helps pinpoint areas for optimization. With these insights, employers can refine their form processes to save time and enhance efficiency, ensuring that the management of documents is as effective as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send an employer039s guide to to be eSigned by others?

How do I execute an employer039s guide to online?

How do I edit an employer039s guide to on an iOS device?

What is an employer039s guide to?

Who is required to file an employer039s guide to?

How to fill out an employer039s guide to?

What is the purpose of an employer039s guide to?

What information must be reported on an employer039s guide to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.