Get the free Cscl/cd 530

Get, Create, Make and Sign csclcd 530

Editing csclcd 530 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csclcd 530

How to fill out csclcd 530

Who needs csclcd 530?

A comprehensive guide to the CSCL/-530 form for Michigan corporations

Understanding the CSCL/-530 form

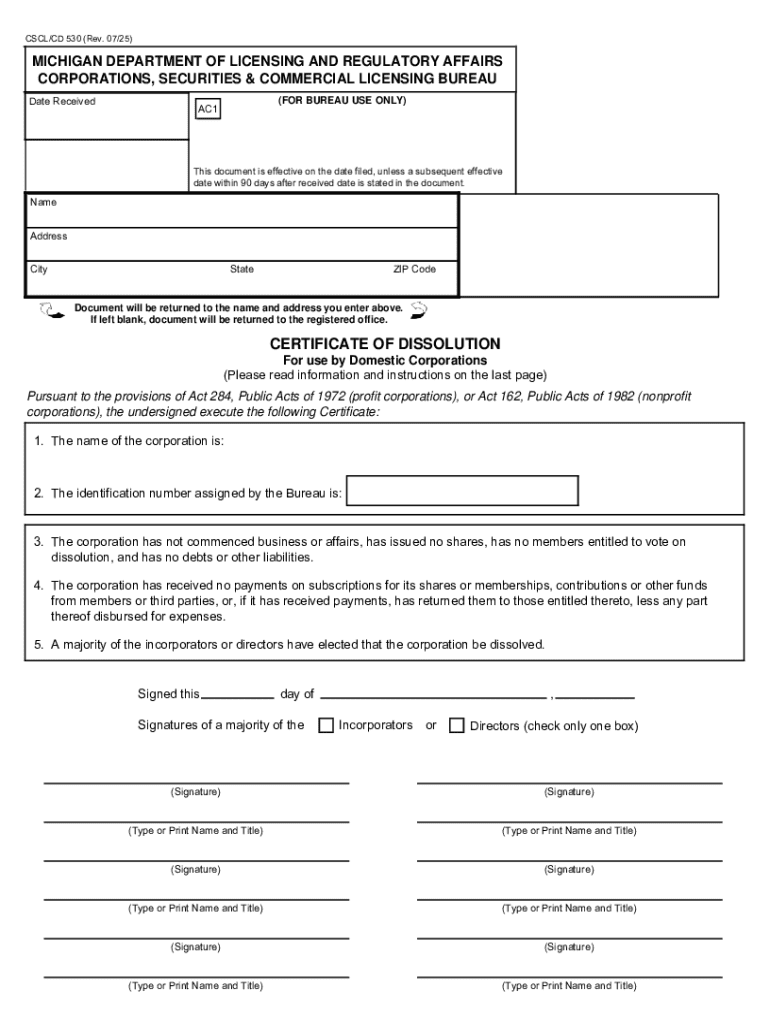

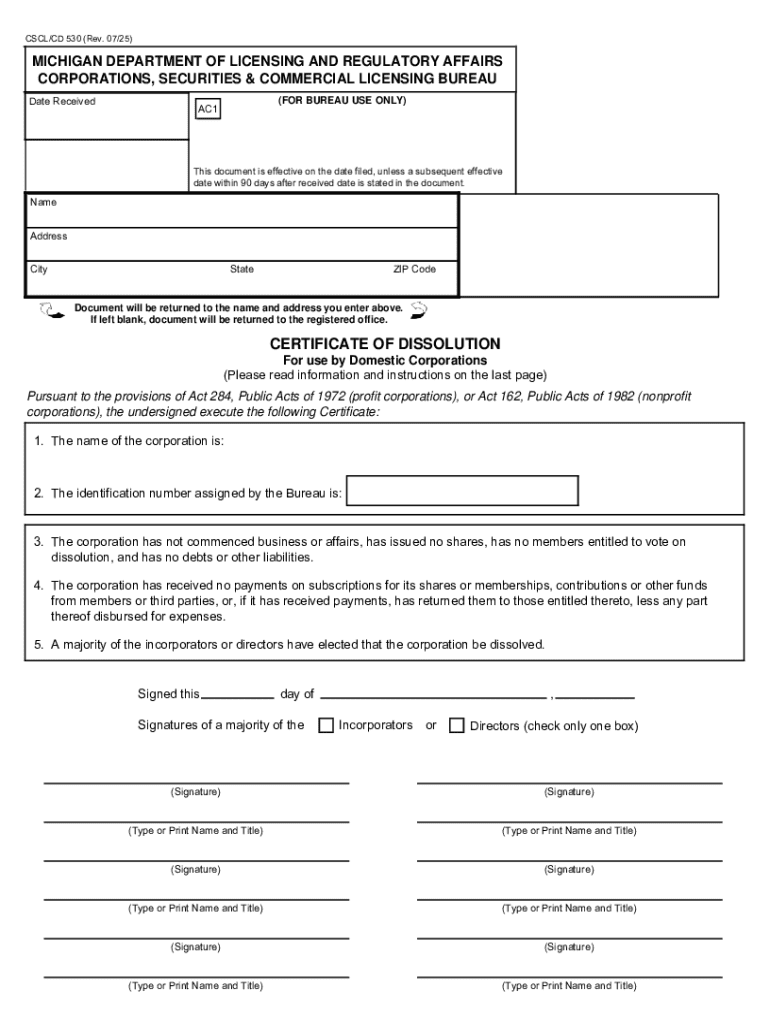

The CSCL/CD-530 form is a crucial document for corporations in Michigan, specifically serving the purpose of notifying the Michigan Department of Licensing and Regulatory Affairs (LARA) about the establishment of a domestic corporation. This form is instrumental in ensuring that your corporation is legally recognized and compliant with state regulations. The importance of the CSCL/CD-530 cannot be overstated, as it lays the groundwork for all subsequent corporate activities, from licensing to taxation.

Filing the CSCL/CD-530 form is the first step toward achieving the legal status needed for business operation. Without proper submission, your corporation may risk penalties or even the inability to operate. The filing process, while straightforward, requires attention to detail and adherence to specific guidelines set forth by the state. Proper understanding of this form is essential for anyone looking to start a corporation in Michigan.

Key features of the CSCL/-530 form

Delving deeper into the CSCL/CD-530 form reveals several essential sections that must be completed correctly to avoid delays in processing. The primary sections include the corporate name, which must be unique and not deceptively similar to existing businesses. This section ensures that each corporation has its distinct legal identity.

Another critical element is the registered agent information. A registered agent is required by law to receive legal documents on behalf of the corporation. Their address must be a physical location in Michigan. It's also vital to clearly state the business purpose of the corporation, which should outline the fundamental operations and goals of the business.

Additional requirements include signatures and verification by the incorporators. This section authenticates the document, confirming that all information provided is accurate. It's also crucial to adhere to standard formatting and submission guidelines to ensure seamless processing.

How to fill out the CSCL/-530 form step-by-step

Filling out the CSCL/CD-530 form can seem daunting at first, but by breaking it down into manageable steps, the process becomes straightforward. The first step is to gather the required information, which includes legal documents indicating the corporation's structure, names of incorporators, and other relevant paperwork needed before you complete the form.

Once you've gathered all necessary documents, proceed to fill out the form. Pay close attention to each section, ensuring that no areas are left blank unless specified. Each section has critical importance; for example, double-check the spelling of names and addresses to prevent errors. A helpful tip is to use templates or digital platforms like pdfFiller, which may offer pre-filled sections and suggestions based on your inputs.

After filling out the form, take time to review it meticulously. Ensure that all information is accurate and complete to avoid unnecessary processing delays. Clarity in your submissions aids in quick approval and compliance with Michigan's corporate regulations.

Submitting the CSCL/-530 form

Submitting the CSCL/CD-530 form can be done via various methods, primarily online or through traditional mail. The online filing process through the Michigan Secretary of State's website is often the preferred choice, allowing for quick submission and immediate confirmation of receipt. If opting for mail-in submission, ensure that the form is sent to the correct address as specified by LARA and consider using certified mail for tracking purposes.

Processing time can vary; typically, online submissions are processed faster than mailed ones. Expect confirmations regarding the status of your submission within a few weeks. After submission, the corporation is officially registered, but further steps, such as applying for necessary licenses or permits, would be needed to commence business operations fully.

Managing your corporation post-submission

Post-submission, maintaining accurate records is essential for the sustainability of your corporation. This includes retaining copies of the CSCL/CD-530 form and any other documents related to corporate formation. Keep track of shareholder meetings, business transactions, and financial statements; this information is critical for annual reports and compliance with state requirements.

Compliance is a crucial aspect of running a domestic corporation in Michigan. This means adhering to annual report requirements, which require timely submissions to avoid penalties. Additionally, ensure that all licenses and permits specific to your business function are up to date. Utilizing digital tools like pdfFiller can greatly enhance your document management experience. This platform allows users to edit, eSign, and collaborate on corporate documents, streamlining the management process significantly.

Common challenges and solutions

While filing the CSCL/CD-530 form may seem straightforward, several challenges often arise. Common mistakes include incomplete information, such as missing required fields or incorrect corporate names. Oversights like these can lead to rejected submissions, causing frustrating delays. To mitigate these issues, take the time to understand every field in the form fully.

Resources for troubleshooting can be found through LARA’s website or through legal advisors who specialize in corporate formation. Engaging with experienced professionals can clarify complexities that arise during the filing process and help ensure that all documentation submitted meets the state's legal expectations.

Related forms and documents

Navigating corporate forms can be overwhelming, but understanding related documents like the CSCL/CD-550 for Articles of Organization or the CSCL/CD-580 for profit corporation filing is vital. These forms serve specific purposes in the corporate lifecycle, and knowing when to use them is essential for effective management of your corporation.

Accessing these documents is usually straightforward, with most available through the Michigan Department of Licensing and Regulatory Affairs website. Having all relevant forms at hand allows for better planning and ensures compliance with all necessary regulations.

Real-life applications and case studies

Several successful businesses in Michigan began with the completion of the CSCL/CD-530 form. One noteworthy example is a local tech startup that navigated the complexities of the filing process and encountered challenges due to unclear business purposes initially stated. After reevaluating their filings and updating their business description, they were able to establish compliance and focus on their core business operations.

These case studies highlight the importance of accurately stating information during the filing process. Businesses that take the time to understand and correctly complete their CSCL/CD-530 form often find themselves on a more secure footing for future growth and development.

Expert tips for a successful filing experience

Industry professionals recommend being organized and thorough when tackling the CSCL/CD-530 form. Utilize cloud-based platforms like pdfFiller, which provide templates that can streamline the process. These tools often come equipped with features that facilitate editing and collaboration, ensuring that all necessary parties can contribute their insights efficiently.

Additionally, taking the time to read all filing guidelines provided by LARA can prevent unintended mistakes. Each aspect of the filing procedure is designed to ensure the legality and compliance of your corporation, which can positively impact your business operations for years to come.

Exploring linked topics

Understanding how to start a corporation in Michigan involves more than just filing the CSCL/CD-530 form. Key on topics like taxes associated with corporate operations, annual report requirements, and the importance of necessary licenses and permits to keep your corporation compliant and functional. Exploring these areas provides a comprehensive view of corporate management.

Utilizing a cloud-based document management system, such as pdfFiller, can also simplify these processes further. It helps in organizing forms, tracking submissions, and ensuring that all required documentation is continuously updated, which is essential for any corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the csclcd 530 in Chrome?

How do I fill out csclcd 530 using my mobile device?

Can I edit csclcd 530 on an Android device?

What is csclcd 530?

Who is required to file csclcd 530?

How to fill out csclcd 530?

What is the purpose of csclcd 530?

What information must be reported on csclcd 530?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.