Get the free 576 (a)

Get, Create, Make and Sign 576 a

How to edit 576 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 576 a

How to fill out 576 a

Who needs 576 a?

A comprehensive guide to the 576 a form

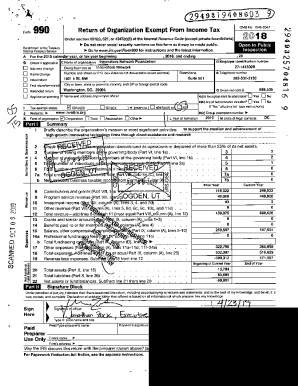

Overview of the 576 form

The 576 form serves a critical function across various sectors by collecting specific information needed for operational and regulatory requirements. It is often employed in scenarios such as financial disclosures, regulatory compliance, and tax filings, ensuring that necessary data is reported in a standardized manner. This form helps maintain transparency and accountability, which are crucial in professional environments.

In many industries, the 576 form streamlines processes by allowing organizations to present data consistently. This uniformity reduces confusion among stakeholders, including clients, regulators, and internal teams. The importance of using the 576 a form cannot be understated, as errors or delays in submission can lead to penalties or operational setbacks for businesses.

Getting started with the 576 form

Before diving into the filling process, having the right tools and resources is paramount. pdfFiller’s cloud-based solution allows you to easily edit, manage, and submit your 576 form from anywhere, making it a perfect choice for both individuals and teams needing flexible access. Familiarizing yourself with its features can significantly enhance your efficiency.

Gathering the necessary information and documentation before starting is essential to ensure a seamless experience. You’ll need identification details, financial documents, or any specific inputs related to the purpose behind filing the form. Understanding your end goal will help you fill out the 576 form accurately and comprehensively.

Step-by-step guide to filling out the 576 form

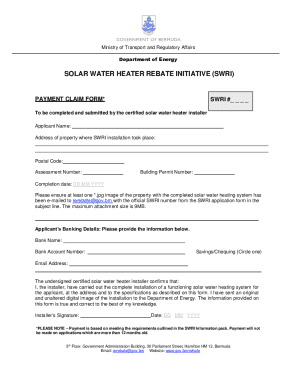

Section 1 of the 576 form requires you to enter your personal information. This includes your name, address, phone number, and email. Ensure all details are entered accurately and spell names correctly to avoid issues. For individuals filling out this form, accurate contact information is essential for follow-ups and correspondence.

In Section 2, clarify the purpose of your submission. This section typically entails fields like why you are submitting the form, what it’s concerning, and other specific details that matter. Tailor your responses based on the scenario you're filling the form for, whether it’s for tax reasons, regulatory compliance, or another purpose.

Section 3 may require you to attach supporting documentation. This could include financial records, identification proofs, or statements corroborating the information provided in the form. Align your documents accurately with the form’s objectives to facilitate processing.

Finally, in Section 4, before submitting, it’s crucial to review and verify your entries. Double-check every detail, as common mistakes include incorrect personal details or missing signatures. A thorough review minimizes correction requests and delays.

Editing the 576 form

After filling out the 576 form, leveraging pdfFiller’s features allows for effective edits. The platform provides various editing tools including text boxes and annotations to clarify or modify any part of your form easily. With the user-friendly interface, changes can be made quickly and intuitively without needing complicated software.

Additionally, collaboration among team members is facilitated through pdfFiller. You can invite colleagues to review the form, offer feedback, and suggest necessary changes. This interactive approach ensures that everyone involved is on the same page, and it increases the likelihood of submitting a well-prepared form.

Signing the 576 form

Understanding the legal standing of electronic signatures is crucial when it comes to the 576 form. Many organizations and institutions accept eSignatures as valid for most documents. By using pdfFiller, you can simply add your eSignature, ensuring your submission complies with legal standards.

However, if an electronic signature is not suitable for your situation, there are alternative signing methods available. This includes handwritten signatures, which may require a witness depending on the legal context. Ensure you follow applicable laws when determining the method of signature.

Submitting the 576 form

Submitting the 576 form can be straightforward with proper guidance. Choose the submission method that fits best; you can submit it online through pdfFiller or send a physical copy via mail, depending on the requirements set forth by the recipient. Online submission is generally quicker and provides confirmation of receipt.

Tracking your submission is an essential step many overlook. pdfFiller offers tools that allow you to confirm that your form has been received by your intended recipient. Utilizing these tracking features can help you stay informed about the status of your submission and mitigate any potential confusion.

Managing submitted forms

Post-submission, managing your forms efficiently is vital. Utilizing pdfFiller’s cloud storage allows you to organize your files systematically, making them easy to locate in the future. Categorizing documents by type or date can simplify your document retrieval, essential for audits or future filings.

If you receive any follow-up requests regarding your submission, it’s important to respond promptly. Maintaining clear records of all submitted forms will prepare you to address queries efficiently and professionally. Proper document management not only saves time but also enhances your credibility with stakeholders.

Common FAQs and troubleshooting

Users often encounter similar issues while dealing with the 576 form. Whether it’s confusion regarding specific sections or frustration over submission errors, addressing these common concerns is essential. A well-structured FAQ section on websites, such as pdfFiller, serves to clarify these challenges, providing concise answers that can guide users effectively.

For troubleshooting, step-by-step solutions can assist users in resolving common problems, such as misplaced information, submission delays, or technical issues with editing. By preparing for these scenarios, users can navigate the process with confidence.

Advancing your document skills

Exploring the advanced features of pdfFiller can unlock new potentials in document management beyond the 576 form. Users can delve into comprehensive tools for creating and editing PDFs, managing workflows, and improving collaboration processes. These skills not only enhance your efficiency but can also empower your teams to work smarter.

By familiarizing yourself with the wider functionalities of pdfFiller, you can become adept at navigating various forms and improving overall document handling strategies. Whether for personal projects or team-based initiatives, advancing these skills is invaluable.

Engaging with the community

Gaining insights from user stories can illuminate paths to successfully navigating the use of the 576 form. Learning from the experiences of others who have tackled similar submissions can provide practical insights to troubleshoot issues effectively or optimize the process.

Encouraging feedback within these communities fosters improvement and collective knowledge raising. Sharing personal experiences not only helps others but enhances your understanding and connection within the user community. Collectively, these insights can lead to better practices in filling and managing the 576 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 576 a without leaving Google Drive?

Where do I find 576 a?

How do I complete 576 a on an Android device?

What is 576 a?

Who is required to file 576 a?

How to fill out 576 a?

What is the purpose of 576 a?

What information must be reported on 576 a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.