Get the free Pers-bsd-241

Get, Create, Make and Sign pers-bsd-241

How to edit pers-bsd-241 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pers-bsd-241

How to fill out pers-bsd-241

Who needs pers-bsd-241?

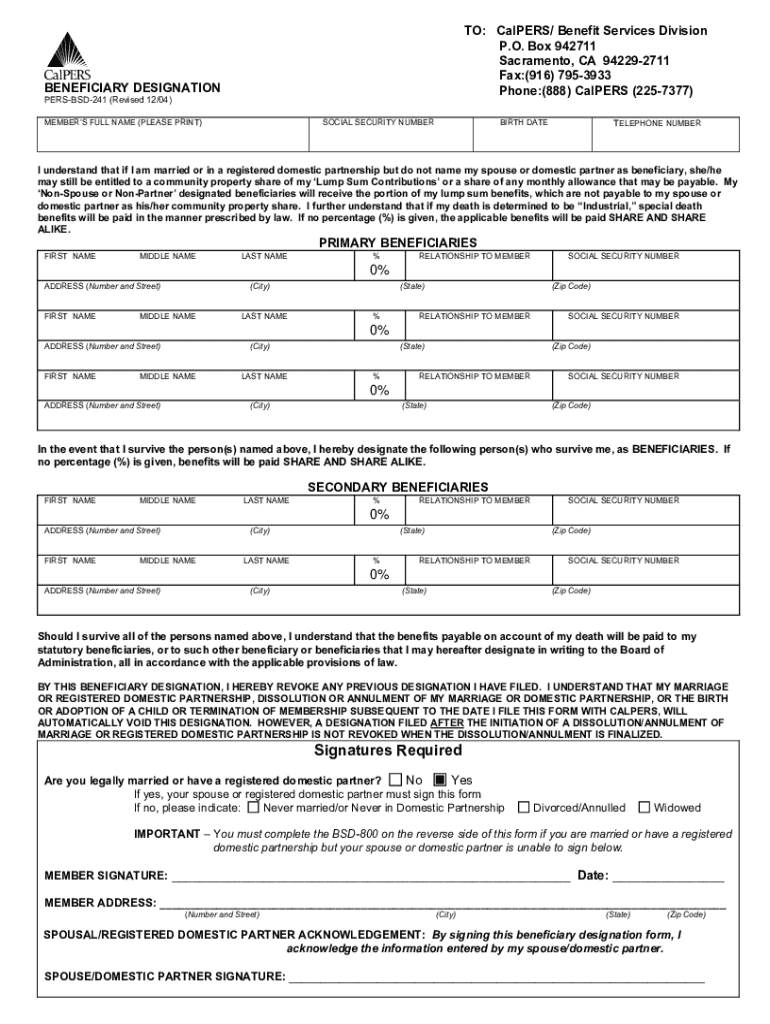

Your Comprehensive Guide to the pers-bsd-241 Form

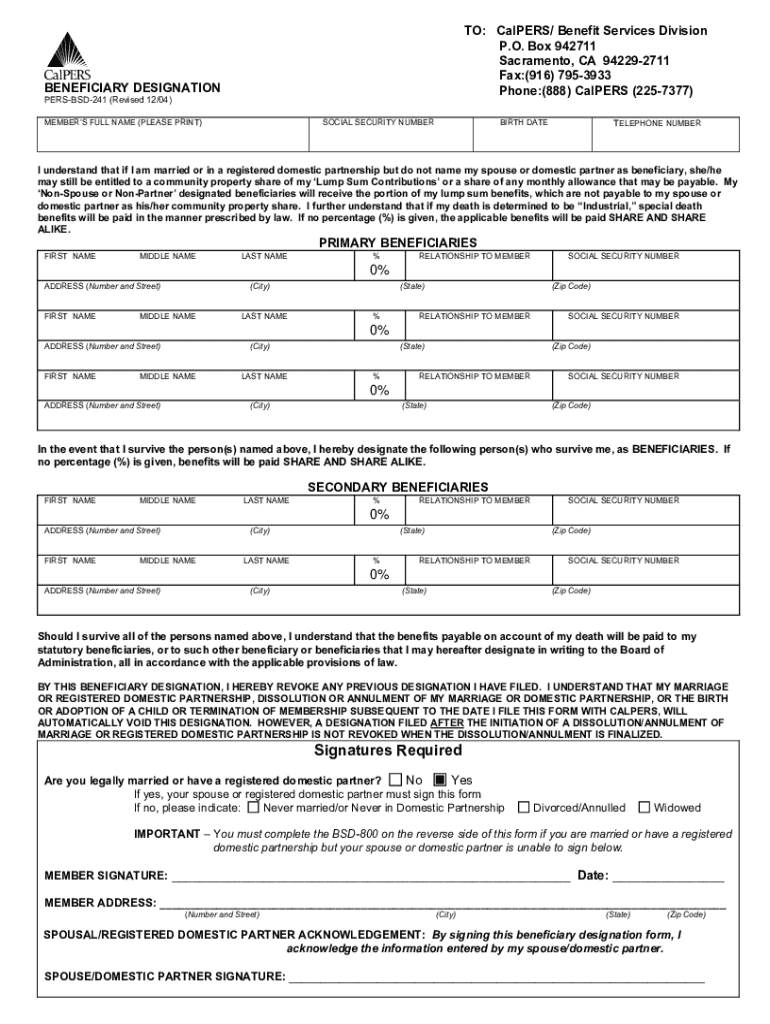

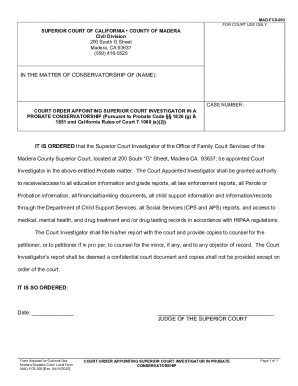

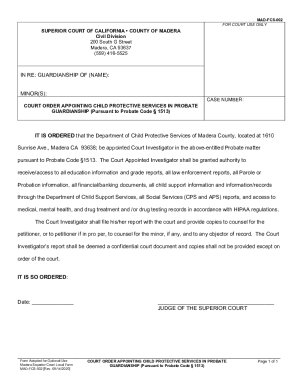

Understanding the pers-bsd-241 form

The pers-bsd-241 form is a crucial document tailored for individuals accessing various state benefits, such as retirement plans and health coverage. Understanding its significance is key to ensuring compliance and facilitating benefits management. This form is generally used to provide necessary information that determines eligibility for benefits, making it essential for both applicants and administrators.

Individuals required to use the pers-bsd-241 form include employees in public sectors, retirees, and beneficiaries who must declare or update their information. Moreover, its utilization transcends just being a mandatory document; it is a valuable tool for maintaining accurate records and ensuring that benefits are allocated efficiently.

Key terms and definitions

Familiarity with key terms on the pers-bsd-241 form is essential for accurate completion. For instance, understanding terms like 'beneficiary designation,' 'eligible benefits,' and 'income verification' can enhance clarity while filling out the form. Terms must be navigated carefully to avoid any ambiguities that might lead to processing delays.

Defining these terms upfront also assists in ensuring that users comprehend the implications of what they are filling out, reigning in confusion and misinterpretation while working within pdfFiller’s user-friendly interface. Knowledge of terminology is not just about correctness; it's about empowerment and confidence in the entire submission process.

Preparing to fill out the pers-bsd-241 form

Before diving into the completion of the pers-bsd-241 form, gathering all necessary information is a crucial first step. This includes personal identification details, employment verification documents, and any pertinent financial information that corroborates your eligibility for benefits. Having these documents at hand streamlines the process significantly and minimizes the chances of submitting incomplete information.

To be well-prepared, consider organizing your data in a methodical manner. Create a checklist with all required documents to ensure nothing is overlooked. For instance, maintain a file or folder labeled specifically for the pers-bsd-241 form. Having this streamlined organization can save time and frustration during completion.

Common mistakes to avoid

While filling out the pers-bsd-241 form, several common mistakes can surface that may lead to delays or rejections. One notable error is providing incorrect or mismatched personal information, which can lead to verification issues. Additionally, neglecting to sign the form or misaligning details can create hurdles during submission.

Double-checking your entries is an effective strategy to minimize mistakes. It’s advisable that users develop a habit of reviewing each section carefully—twice if necessary—before finalized submission. Utilizing pdfFiller’s interactive features will also help in identifying any discrepancies before submission.

Step-by-step instructions for completing the pers-bsd-241 form

Completing the pers-bsd-241 form requires a systematic approach. Here’s a section-by-section breakdown to ensure you accurately fill out the required information:

Using interactive tools

pdfFiller offers an array of interactive tools specifically designed for efficiently filling out the pers-bsd-241 form. Users can leverage features like auto-fill, which streamlines repetitive information entry, saving time and errors. The platform also provides real-time feedback on field completion, indicating where adjustments may be needed.

Additionally, users can easily switch between desktop and mobile, ensuring access to the pers-bsd-241 form whenever necessary. With these innovative tools, you can complete the form without the hassle of traditional paper documents, making it easier than ever to manage benefits.

Editing and modifying the pers-bsd-241 form

Once the pers-bsd-241 form is filled out, it’s common to find areas that require adjustments. Using pdfFiller’s editing options, users can easily navigate through the form to implement changes quickly. This includes correcting typos, adding or removing beneficiaries, or updating personal information.

Comparing original versus edited versions is facilitated by pdfFiller’s tracking features, allowing you to see the history of changes made. Regularly saving versions of your document can protect against data loss and simplify the final review process before submission.

Saving and managing your document

It is important to save the completed pers-bsd-241 form meticulously. Use clear, descriptive names for your files, like 'pers-bsd-241_YourName_Date', to easily locate them later. pdfFiller allows users to save documents directly in a cloud platform, ensuring they are accessible from any device.

Organizing your forms within folders on the pdfFiller platform can further simplify access to your documents, especially if you manage multiple forms. It makes tracking necessary updates or submitting recurring forms a seamless experience.

eSigning the pers-bsd-241 form

Understanding the implications of eSignatures is critical when submitting the pers-bsd-241 form. An eSignature holds legal validity, allowing documents to be signed electronically in a way that complies with regulations while reducing the turnaround time for submissions.

To ensure the transaction is secure, pdfFiller implements various security measures—in ensuring that all signatures are traceable and verified. This gives users peace of mind that their eSigned documents are protected against potential fraud or dispute.

Step-by-step eSigning guide

Signing the pers-bsd-241 form using pdfFiller is straightforward:

Once signed, users can share the completed form effortlessly with relevant parties via secure email or download options, making the submission process far more efficient.

Submitting the pers-bsd-241 form

Submitting the completed pers-bsd-241 form can be accomplished through various methods. Beneficiaries can opt for online submission, which is often faster, versus traditional mail methods which can add days to processing times. When submitting online, be sure to follow any specific protocols or checklists provided by the relevant authority to ensure your submission is complete and accepted.

To mitigate the risk of rejection or loss of the form, always confirm receipt once submitted. Many online submission platforms provide notifications or confirmation emails, which serve as proof of submission.

Tracking submission status

Tracking the status of your submission can be vital for users of the pers-bsd-241 form. pdfFiller offers various tracking tools to monitor your form’s progress through the system. Expect to receive updates that will alert you of the current state of your submission and any necessary next steps.

In cases of loss or rejection, it is important to know the steps needed to resolve the issue. Contacting the relevant authority promptly and having your submission confirmation ready can facilitate a faster resolution.

Frequently asked questions about the pers-bsd-241 form

Navigating through the process of completing the pers-bsd-241 form often raises common queries. For instance, one may ask: 'What should I do if I realize I made a mistake after submission?' Generally, the guidance here involves contacting the processing entity to correct the error, as many organizations have protocols for amended submissions.

Also, understanding where to access the pers-bsd-241 form and any variations that might exist across jurisdictions can be crucial. Ensure to refer to official sources or the pdfFiller platform for the appropriate version that complies with your state’s regulations.

Troubleshooting tips

Technical issues can surface when using pdfFiller or filling out the pers-bsd-241 form. Common concerns include accessing saved documents or printing errors. If you encounter these problems, first check your internet connection and refresh the platform. Should issues persist, engage pdfFiller’s customer support for immediate assistance.

Additional support for using the pers-bsd-241 form

If you have specific questions when utilizing the pers-bsd-241 form, accessing customer support through pdfFiller is a straightforward process. Utilization of support options, such as live chat or email inquiry, offers users the immediate help they may need.

Moreover, connecting with community resources through forums or user groups can provide additional insights. Sharing experiences with others who regularly use the pers-bsd-241 form can bolster your understanding and make the navigation process less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pers-bsd-241?

How do I edit pers-bsd-241 on an iOS device?

How do I edit pers-bsd-241 on an Android device?

What is pers-bsd-241?

Who is required to file pers-bsd-241?

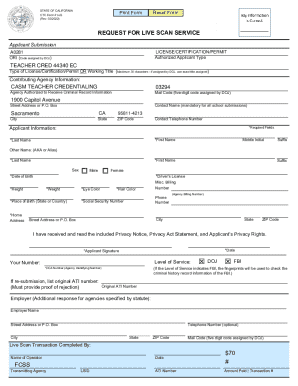

How to fill out pers-bsd-241?

What is the purpose of pers-bsd-241?

What information must be reported on pers-bsd-241?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.