Get the free Chronicle of Central Bank Policy 1972 - 2004

Get, Create, Make and Sign chronicle of central bank

How to edit chronicle of central bank online

Uncompromising security for your PDF editing and eSignature needs

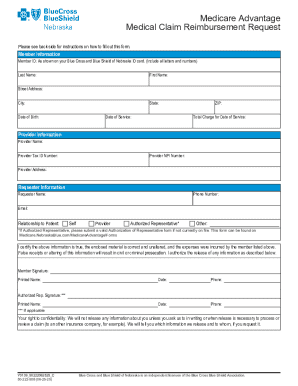

How to fill out chronicle of central bank

How to fill out chronicle of central bank

Who needs chronicle of central bank?

Chronicle of Central Bank Form - A How-to Guide

Overview of central bank forms

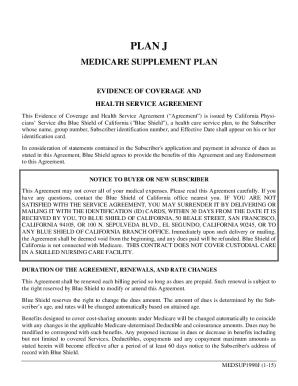

Central bank forms are crucial documents employed by monetary authorities and financial institutions to ensure effective economic management and regulatory compliance. These forms serve multiple purposes, including tracking monetary policy implementations, reporting financial stability metrics, and detailing foreign exchange operations. Understanding these forms is not just important for regulatory entities but also beneficial for banks and the general public, as transparency in financial regulation is paramount.

Key stakeholders include central banks, which implement monetary policy; governments, which depend on stable financial systems; and the public, whose economic well-being relies on sound financial practices. In this ecosystem, central bank forms act as vital links, ensuring that all parties maintain clear communication and that regulatory requirements are met.

Types of central bank forms

Central bank forms fall into several categories, each serving a distinct purpose in the financial framework. Understanding the various types helps organizations navigate the regulatory landscape effectively.

Key components of a central bank form

When dealing with central bank forms, understanding their structure is essential to ensure accurate compilation and compliance. Each form typically consists of several key components that facilitate thorough submission.

Step-by-step instructions for completing central bank forms

Completing central bank forms can be a meticulous process, but a systematic approach can simplify it tremendously. Here’s a step-by-step guide to help you navigate this task efficiently.

Interactive tools for form management

Utilizing digital tools like pdfFiller can significantly enhance your experience when dealing with central bank forms. pdfFiller offers a range of functionalities designed to optimize document management.

Navigating common challenges in form submission

Despite preparations, challenges may arise during form submissions that necessitate effective management. Being aware of these hurdles can save valuable time.

Case studies and best practices

Learning from others’ experiences can greatly inform how we manage central bank forms. Here, we explore successful submissions and the lessons learned from common pitfalls.

Future trends in central bank documentation

The role of technology in document management is expanding, and central banks are no exception. Observing the direction of these trends can help stakeholders prepare effectively.

Additional support and services for document management

To further ease the complexities associated with central bank forms, pdfFiller provides comprehensive support services tailored to different organizational needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify chronicle of central bank without leaving Google Drive?

How do I fill out the chronicle of central bank form on my smartphone?

How can I fill out chronicle of central bank on an iOS device?

What is chronicle of central bank?

Who is required to file chronicle of central bank?

How to fill out chronicle of central bank?

What is the purpose of chronicle of central bank?

What information must be reported on chronicle of central bank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.