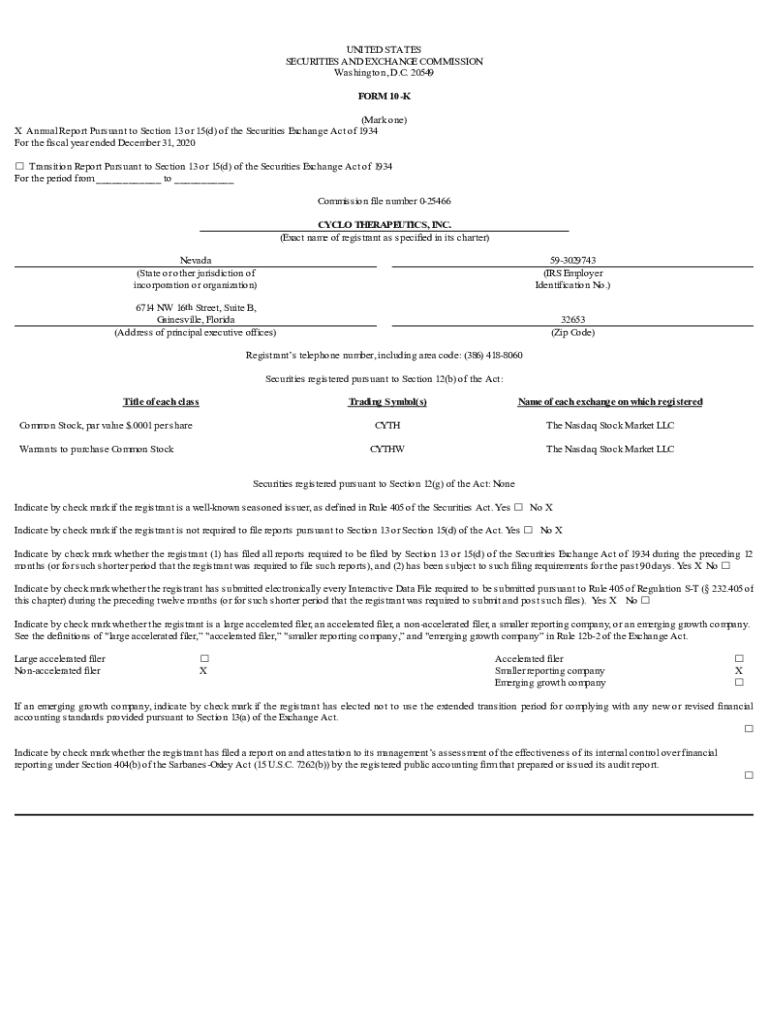

Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

10-K Form: Your Comprehensive Guide to the Filing Process

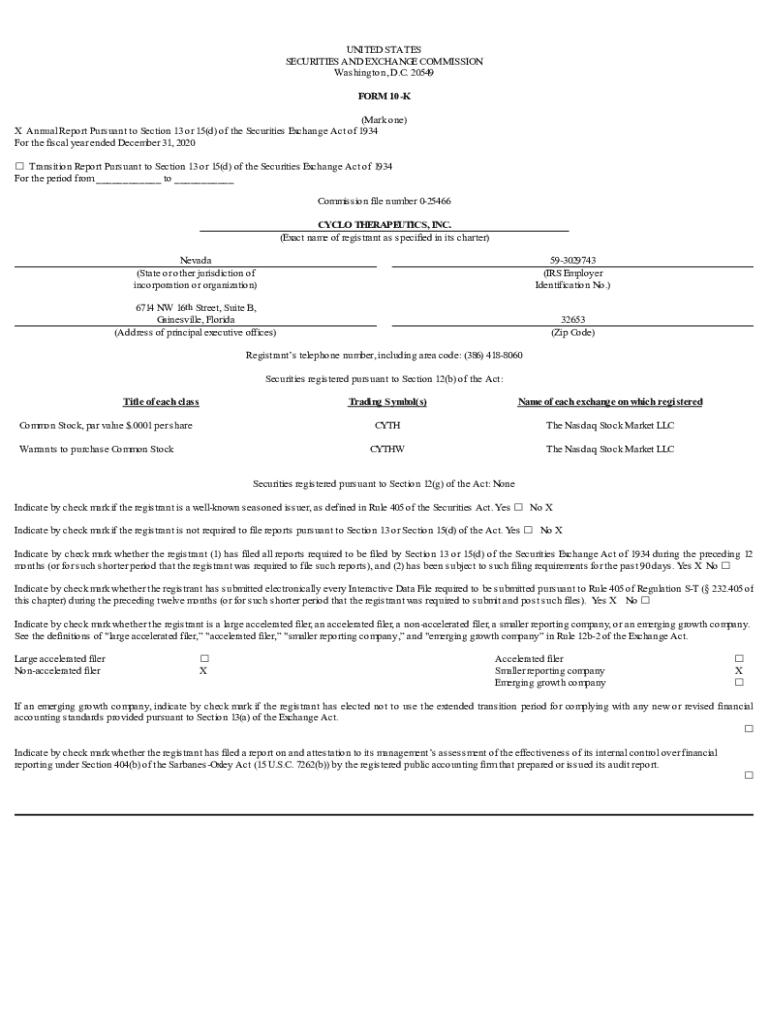

Understanding the 10-K Form

The 10-K form is a comprehensive report that publicly traded companies must file annually with the Securities and Exchange Commission (SEC). It’s a crucial document that provides key insights into a company's financial performance and overall business health. Unlike a standard annual report, the 10-K is a more detailed document and is designed to give investors an in-depth look at the company’s operations, financial conditions, risks, and management strategies.

Essentially, the 10-K form serves not just as a regulatory requirement but as a vital tool for stakeholders to assess the viability and future prospects of a company. Veterans in the investment community recognize its importance in supporting informed decision-making.

Key components of a 10-K report

A 10-K report is structured into several sections that each serve a specific purpose in delivering comprehensive information. This structured approach not only aids in compliance but facilitates easier navigation for analysts and investors. The primary sections include:

Financial statements included in a 10-K are prepared according to Generally Accepted Accounting Principles (GAAP), ensuring consistency and comparability across different reporting periods.

Who must file a 10-K and why?

The obligation to file a 10-K primarily falls on public companies, which include any business that publicly traded its securities, whether equity or debt securities. Furthermore, foreign companies traded on U.S. exchanges must also comply by filing a Form 20-F, analogous to the 10-K. Compliance is mandatory for entities that exceed specific market capitalization and shareholder thresholds, ensuring adequate transparency and investor protection.

Failure to file a 10-K can have significant implications for a company, including fines, potential delisting from exchanges, and a damaged reputation amongst investors. Consequently, consistent and timely reporting underscores a company’s commitment to regulatory compliance and transparent operations.

The 10-K submission process

Preparing a 10-K filing involves a multi-step process that requires meticulous attention to detail and collaboration across different departments, including finance, legal, and operations. Start by gathering required information from financial statements, audits, and risk assessments. Consider establishing a timeline that accommodates document collection from various teams. Key deadlines often follow the close of the company’s fiscal year.

Once the necessary information is compiled, the next step is to file with the SEC via the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR). The EDGAR system allows for electronic submissions of all required documents, including the 10-K.

Addressing financial reporting requirements

Compliance with GAAP is crucial in the preparation of the 10-K form since it fosters trust in reported numbers. Understanding GAAP ensures that financial reports are accurate and reflect the company’s financial position accurately. Companies often face the potential pitfall of overlooking the necessity of detailed notes accompanying financial statements, which can lead to misinterpretations of financial health.

Moreover, a significant aspect of the filing process is the role of independent auditors. These auditors review financial statements to ensure that the reports reflect a fair and accurate representation of the company’s financial health. Preparing for an audit can be intricate; companies should aim to have their records in order well before the audit begins, ensuring a smooth process.

Frequently asked questions about 10-K filings

Understanding the nuances of the 10-K form often leads to various questions from individuals and smaller companies exploring filing techniques. One common query is how the 10-K differs from an annual report. While both provide insights into a company’s financial standing, the 10-K is far more detailed and is submitted to regulatory bodies. In contrast, annual reports may present a summarised version of information, focusing instead on marketing and outreach.

Another significant question arises from private companies regarding the necessity of filing a 10-K. The answer is simply no; private companies do not need to file a 10-K, but many may opt for similar reporting strategies for potential investors or partners.

Tips for effective 10-K management

Managing the 10-K process smoothly demands organized collaboration and consistent communication. Utilizing tools that enhance document collaboration can vastly improve the efficiency of preparation. One of these tools is pdfFiller, which allows users to create, edit, and manage documents with ease. With features like electronic signature integration and seamless editing capabilities, teams can work collectively in the cloud, distilling the time and effort needed to compile and submit the 10-K.

Effective collaboration practices are beneficial when working on the 10-K. Assign specific responsibilities to team members, establish clear deadlines, and utilize tools that facilitate the sharing of documents. eSigning capabilities can streamline approval processes and eliminate some of the logistical burdens typically associated with document management.

Keeping your 10-K updated

Regularly updating the 10-K is critical for ensuring that the information remains accurate and reflective of the company’s operational landscape. Annual reviews facilitate this, allowing companies to reassess their financial standing and address changes in business strategy or market conditions. Maintaining historical records and documenting amendments can also aid stakeholders in understanding the evolution of a company over time.

In today’s fast-paced environment, leveraging technology for future filings enhances transparency and efficiency. Cloud-based platforms offer robust solutions for document storage and sharing, simplifying compliance tracking and data retrieval for audit purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 10-k online?

How do I edit form 10-k on an iOS device?

How do I fill out form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.