Get the free 10-k

Get, Create, Make and Sign 10-k

How to edit 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-k

How to fill out 10-k

Who needs 10-k?

10-K Form How-to Guide

Understanding the purpose and importance of the 10-K form

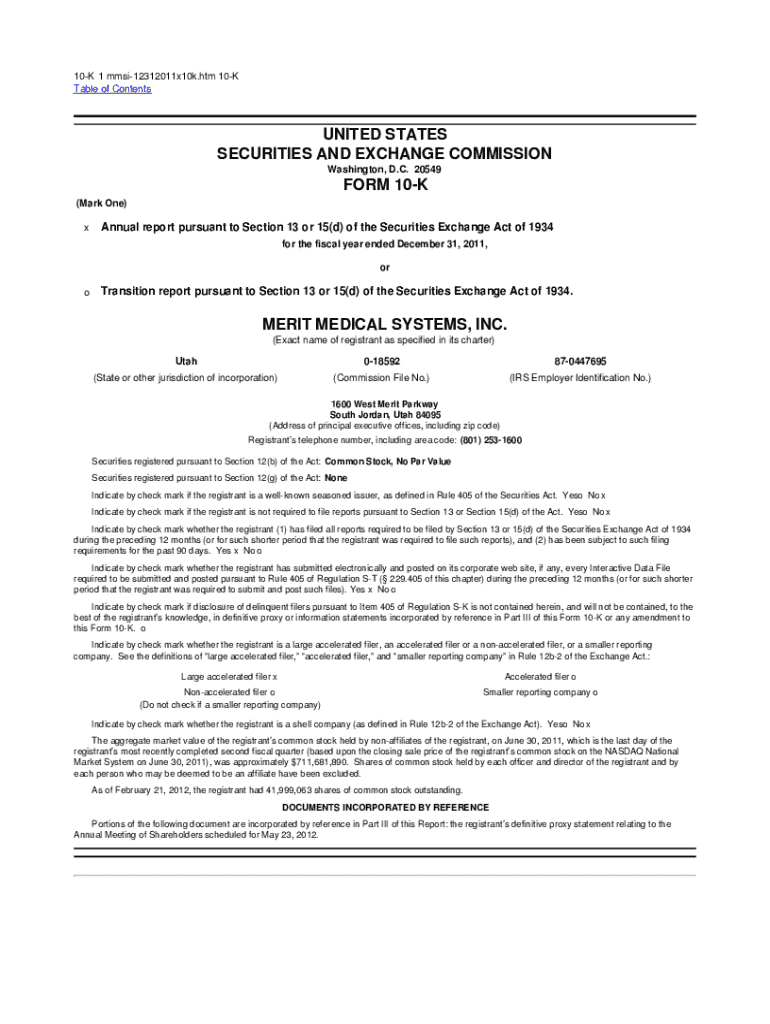

The 10-K form is a comprehensive report filed annually by publicly traded companies to the Securities and Exchange Commission (SEC). It provides a detailed overview of a company's financial performance, risks, and operations over the past year, serving as a vital source of information for investors and stakeholders. The depth of information contained within a 10-K is far superior to other reports, such as the quarterly 10-Q reports, giving a clearer picture of a company's health and future.

For investors, understanding the intricacies of the 10-K is crucial when making informed decisions about where to allocate capital. The form is not just a regulatory requirement; it is a tool that can reveal a company’s strengths and vulnerabilities. Moreover, it can serve as a benchmark to compare the financial standing and management effectiveness against peers in the same sector.

Detailed breakdown of the 10-K structure

The 10-K is divided into several key sections, each serving a specific purpose that collectively paints a detailed picture of a company's performance. The primary sections include:

Understanding each section is essential for stakeholders. For instance, the Risk Factors section informs investors about the vulnerabilities a company may face, while the Financial Statements provide quantitative evidence of the company’s health and historical performance.

Navigating the 10-K filing process

Filing a 10-K involves several steps and adherence to specific regulatory timelines. Companies must ensure that their report is accurate and complete before submission to avoid penalties. The first step involves gathering necessary financial data and completing the required forms.

Common filing methods include electronic submission through the SEC's EDGAR system, which allows for timely updates and makes the information accessible to investors and analysts. It's crucial to pay close attention to deadlines; missing them can result in significant penalties or even legal repercussions.

How to interpret the information in a 10-K

Interpreting a 10-K requires analytical skills to assess quantitative data and qualitative insights. Investors should learn to analyze key performance metrics such as revenue growth, profit margins, and earnings per share. Understanding the Management’s Discussion and Analysis (MD&A) is equally important, as this section outlines management’s perspective on performance and future outlook.

Furthermore, identifying risks within the Risk Factors section allows investors to gauge the potential challenges that may impact the company’s future earnings. It’s also critical to understand how these risks are managed. A well-rounded understanding can lead to more informed decisions based on both numbers and management strategies.

Tips for finding and accessing 10-K forms

Locating a company’s 10-K forms is primarily done through the SEC’s EDGAR database, where all public filings are archived. Investors and analysts should familiarize themselves with effective search techniques to navigate this large repository successfully. Company investor relations websites also house their respective 10-K forms, providing a user-friendly option for accessing the information.

Leveraging search tools effectively can save time and enhance your research efficiency. By knowing specific keywords and understanding the filing dates can also streamline the search process.

Key highlights and takeaways from recent 10-K filings

Recent 10-K filings have shown noteworthy trends in financial reporting practices. Companies are increasingly focused on sustainability and environmental disclosures due to rising regulatory requirements and investor interest in corporate social responsibility. This shift is adding new dimensions to how companies present their financial data and operational strategies.

Significant changes in regulations, particularly regarding the disclosures of risk factors associated with climate change and corporate governance, have also emerged. For instance, organizations listed on major exchanges are now held to higher standards of transparency, particularly concerning executive compensation and environmental impact.

Making use of the 10-K for business decisions

The information included in a 10-K can play a pivotal role in shaping investment strategies. For investors, utilizing 10-K data helps identify undervalued stocks or companies poised for long-term growth. Understanding financial performance metrics enables investors to craft tailored investment strategies based on empirical data.

Additionally, businesses can leverage insights from 10-K forms to foster stronger relationships with stakeholders. By engaging in thorough due diligence, companies can make informed decisions about potential partnerships or acquisitions. Integrating insights from 10-Ks into broader market analysis can provide a competitive edge.

Engaging with 10-K data through interactive tools

pdfFiller offers solutions that allow users to seamlessly edit, manage, and collaborate on 10-K forms. Using cloud-based platforms can significantly enhance the management of these documents, providing a space for e-signatures and collaborative discussions between teams. This innovative approach ensures that everyone involved can contribute easily, while also maintaining the integrity and security of sensitive information.

The benefits of using a cloud-based document management solution like pdfFiller include enhanced accessibility, security, and efficiency, ultimately empowering users to manage forms on-the-go.

Common pitfalls and FAQs related to 10-K forms

Navigating the complexities of the 10-K form can lead to common pitfalls, such as misunderstanding required disclosures or failing to meet deadlines. Companies should ensure all sections are complete to avoid regulatory penalties. A frequently asked question among investors is: What happens if a company fails to file a 10-K? In such cases, companies may face severe fines and legal repercussions, which can significantly affect their public image.

Another common concern deals with verifying the accuracy of the information within a 10-K. Investors should cross-reference data with other reports or independent sources to confirm accuracy. Avoiding common mistakes, such as neglecting updates to risk factors or management discussions, is crucial for firms preparing these documents.

Continuous learning: Staying updated on 10-K filings

Staying informed about changes in the regulatory landscape concerning 10-K filings is essential for all stakeholders. Numerous resources exist to help individuals and businesses keep abreast of new regulations and best practices concerning 10-K forms. Regularly engaging with newsletters, financial media, and educational platforms can enhance understanding.

Networking with financial analysts and industry experts can also provide insights into the latest trends and changes affecting company disclosures. Participating in forums and discussions can enhance your knowledge of regulatory updates and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 10-k without leaving Google Drive?

How do I make changes in 10-k?

How do I complete 10-k on an Android device?

What is 10-k?

Who is required to file 10-k?

How to fill out 10-k?

What is the purpose of 10-k?

What information must be reported on 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.