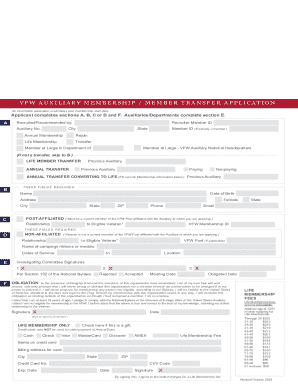

Get the free Form 50-212

Get, Create, Make and Sign form 50-212

Editing form 50-212 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 50-212

How to fill out form 50-212

Who needs form 50-212?

How to Fill Out Form 50-212

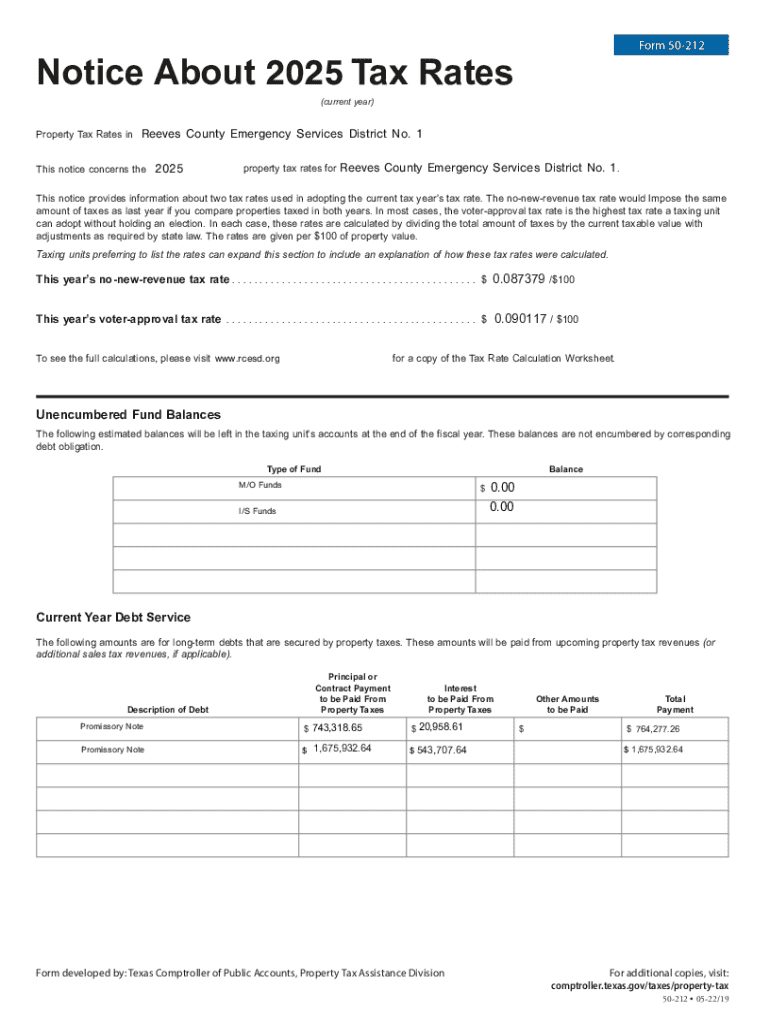

Overview of Form 50-212

Form 50-212 is a critical document used specifically in the context of [insert context such as tax or healthcare]. This form serves to [define purpose, e.g., report income, apply for benefits], making it essential for compliance and record-keeping. By understanding and accurately completing Form 50-212, users can ensure they fulfill their legal obligations while accessing necessary services.

The importance of Form 50-212 cannot be overstated; it plays a vital role in various administrative processes, especially for [target users]. This guide addresses the ins and outs of completing this form, empowering you to navigate your responsibilities with confidence.

Who needs to use Form 50-212?

Form 50-212 is primarily utilized by individuals, businesses, and organizations that find themselves in scenarios requiring [specific obligations met by the form]. For instance, freelancers reporting self-employment income or small business owners claiming deductions may need to complete this form to stay compliant.

Understanding whether you need to use Form 50-212 hinges on your unique situation. If you fall into one of the categories outlined or face situations such as [list common scenarios], taking the time to fill out this form correctly is crucial.

Accessing Form 50-212

Accessing Form 50-212 is straightforward, as it can typically be downloaded from official government sources. The website of the IRS or relevant state tax authority provides direct links for acquiring this form. Additionally, you can visit pdfFiller for an easy download experience.

There are additional options for accessing Form 50-212 via pdfFiller, which facilitates cloud-based document management. This platform not only allows you to fill out the form but also provides various interactive features for editing and sharing.

Advantages of using pdfFiller for Form 50-212

Using pdfFiller to access and complete Form 50-212 offers numerous advantages. A few key features include:

Step-by-step instructions for completing Form 50-212

Filling out Form 50-212 involves providing specific information in designated sections. The following sections outline how to navigate this process effectively.

Section 1: Personal information

Begin with your personal information, including your full name, address, and contact number. Ensuring this information is accurate helps avoid delays in processing your form.

Use clear and legible handwriting if completing the form by hand, or ensure your entries are easy to read when using a digital format. Double-check for spelling errors.

Section 2: Financial information

The financial information section typically requires relevant data such as income details, deductions, or benefits applicable to your situation. Be sure to include complete figures to avoid discrepancies.

Common pitfalls include miscalculating totals or omitting necessary fields. Utilize calculators or financial tools to verify entries.

Section 3: Additional information

Certain additional information may be specific to your case, such as notes on previous filings or required attachments. Familiarize yourself with what is essential and differentiate between optional and mandatory sections.

Use this section to provide any necessary background that may be valuable for those reviewing your form.

Using pdfFiller to edit and enhance your form

pdfFiller empowers you to edit your Form 50-212 flexibly. You can insert additional text or fields easily, add annotations, and even highlight important sections. All these interactive tools help streamline the completion of the form while ensuring you don’t miss any vital entries.

Reviewing and submitting Form 50-212

Before submitting Form 50-212, it's imperative to double-check all entered information. Review your form section by section, looking for common errors such as incorrect calculations, missing signatures, or incomplete sections.

Establishing a checklist for this purpose can be very helpful, helping to ensure that no detail is overlooked and your form can be processed without delays.

Submitting your form: Options and procedures

Once you’ve completed your review, it’s time to submit Form 50-212. There are generally two options available:

Managing Form 50-212 after submission

After submitting Form 50-212, keeping track of your submission status is crucial. Most tax authorities provide a means of confirming receipt, such as an online tracker or by phone.

If you encounter any issues—like delays—it is advisable to follow up promptly to resolve any complications. This approach can save you from penalties or complications down the line.

Keeping copies and managing documentation

Always keep copies of your submitted Form 50-212. Using pdfFiller, you can store and organize your documents digitally, ensuring easy access for future reference necessary for audits or revisions.

Maintaining clear records helps substantiate the data reported and may come in handy during interactions with tax authorities or other agencies.

Frequently asked questions (FAQs)

Many users encounter common questions regarding Form 50-212 that can lead to confusion. Frequently asked questions include how to correct errors post-submission, understanding deadlines and extensions, and the best practices for documenting supporting information.

Addressing these FAQs ensures that users feel confident proceeding through the process without unnecessary concerns or setbacks.

Tools and features of pdfFiller for document management

pdfFiller offers several interactive features that enhance the filling experience of Form 50-212. These tools allow for real-time collaboration, which is especially useful in team settings. Users can work together on document creation or filling out the necessary forms simultaneously.

Incorporating digital signatures and approvals throughout your document management process is another essential feature, ensuring form integrity and speeding up collaboration.

Learning resources to optimize your usage of pdfFiller

pdfFiller provides a wealth of learning resources, including tutorials, webinars, and user support materials. These resources help users maximize their experience and effectively utilize the full suite of tools available, ensuring a smooth document creation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 50-212 without leaving Google Drive?

How do I make changes in form 50-212?

How can I fill out form 50-212 on an iOS device?

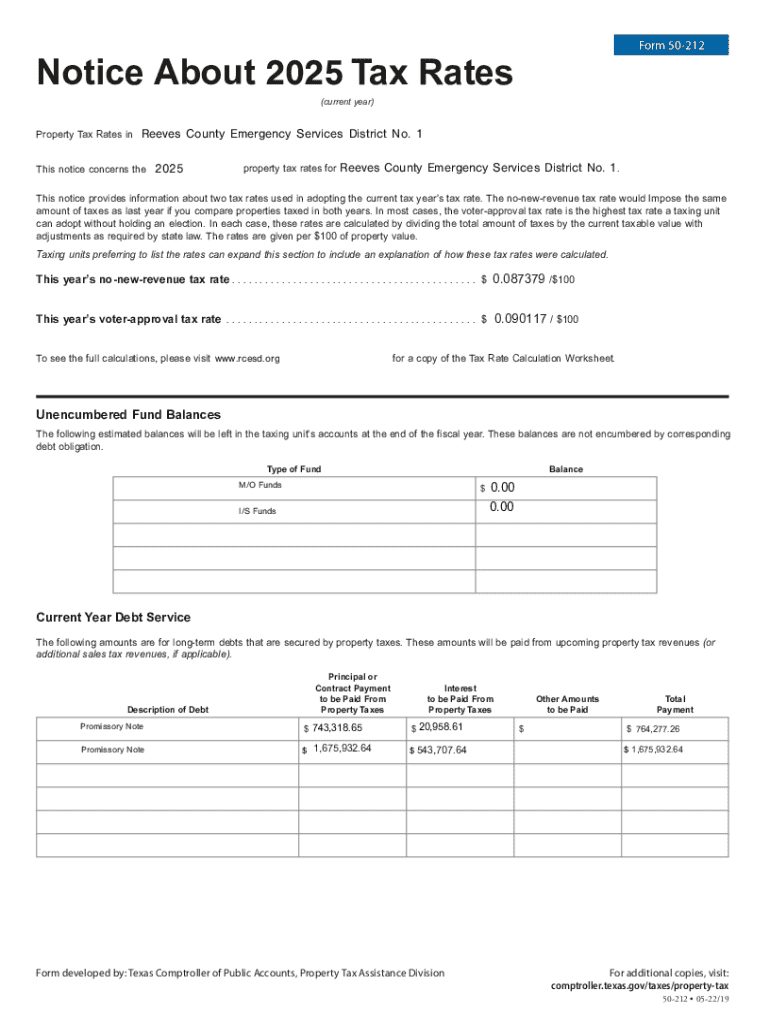

What is form 50-212?

Who is required to file form 50-212?

How to fill out form 50-212?

What is the purpose of form 50-212?

What information must be reported on form 50-212?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.