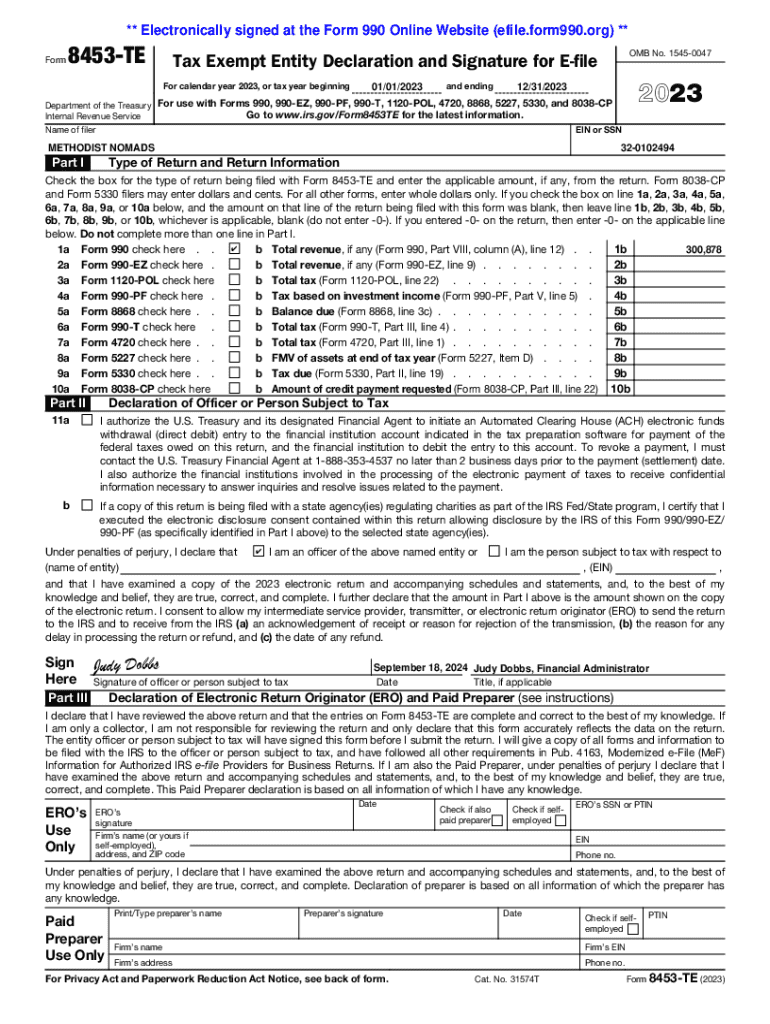

Get the free Form 8453-te

Get, Create, Make and Sign form 8453-te

Editing form 8453-te online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8453-te

How to fill out form 8453-te

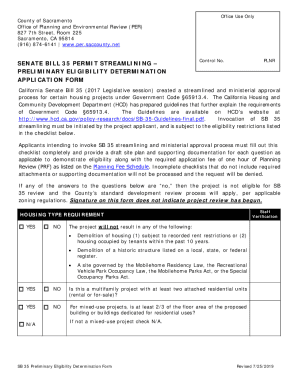

Who needs form 8453-te?

Form 8453-TE: A Comprehensive Guide

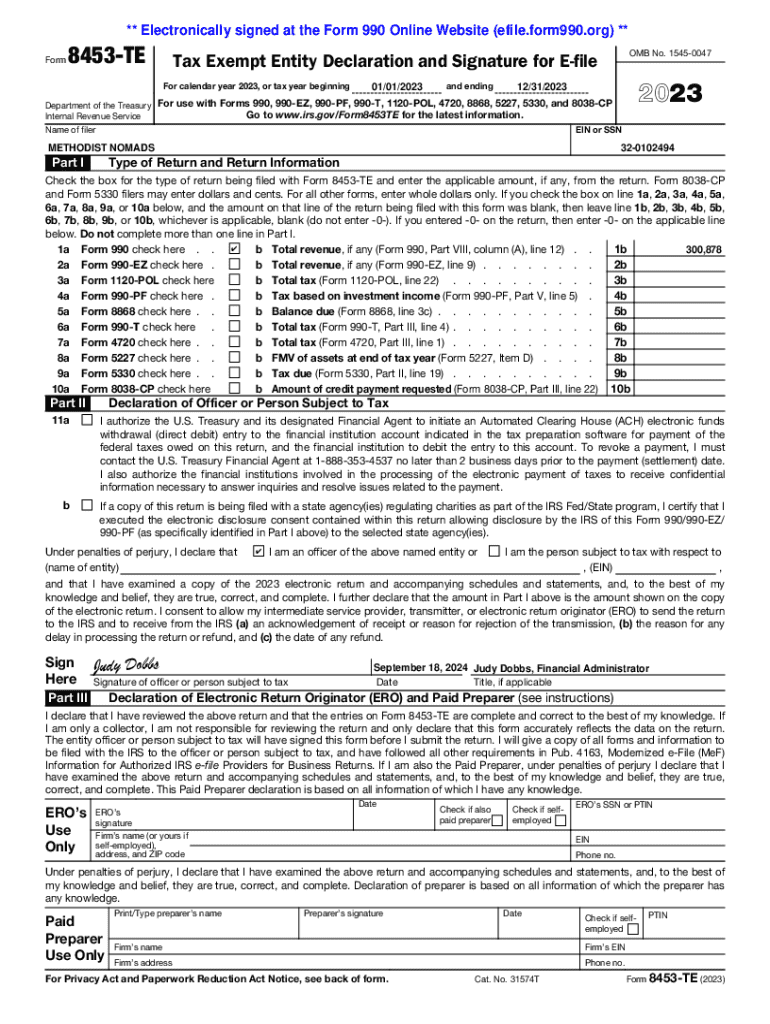

Understanding Form 8453-TE

Form 8453-TE is a crucial document for tax-exempt organizations. Its primary purpose is to serve as a declaration for e-filed returns, allowing these organizations to submit certain tax forms electronically while maintaining the required signed copies. By facilitating electronic filing, Form 8453-TE helps streamline the tax submission process for organizations that qualify under the tax-exempt status.

Understanding the importance of Form 8453-TE is essential. This form not only aids tax-exempt organizations in complying with federal regulations but also ensures that their submitted documents are considered valid. For tax-exempt organizations, ensuring timely and accurate return submissions is vital to maintaining their tax-exempt status.

When to use Form 8453-TE

You'll need to use Form 8453-TE in specific situations, typically when electronically filing Forms 990, 990-EZ, or 990-PF. These forms are integral for tax-exempt organizations, and using Form 8453-TE is necessary for confirming that the organization has the requisite information and documentation attached.

Key deadlines must be noted to ensure compliance. For most tax-exempt organizations, the deadline for submitting Form 8453-TE coincides with the due date of your organization's return, typically the 15th day of the 5th month after the end of your organization's tax year.

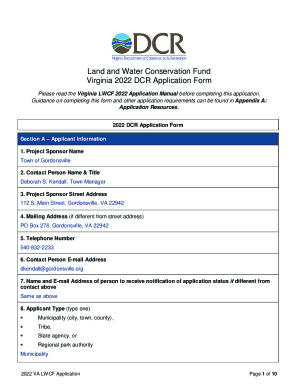

Preparing to fill out Form 8453-TE

Before diving into the details of Form 8453-TE, gather all necessary information and documentation. You will need various pieces of data, including your organization’s name, address, Employer Identification Number (EIN), and the specific tax forms you are filing. Collecting these details ahead of time can help streamline the process.

Familiarizing yourself with common terminology used in this form can also be beneficial. Terms like 'tax-exempt', 'e-file', and 'IRS guidelines' are frequently encountered. Understanding these concepts removes ambiguity and aids greatly during the preparation of Form 8453-TE.

Common terminology and FAQs

Many people frequently ask about the necessity of Form 8453-TE. Simply put, it is required if you are filing specific forms electronically. Additionally, it is common to wonder about retaining copies; organizations must maintain the signed Form 8453-TE and any attached documents for their records.

Step-by-step instructions for completing Form 8453-TE

Completing Form 8453-TE does not have to be daunting. Each section is designed to capture vital information about your tax-exempt organization. Begin by filling in the organization's name and EIN, which are prominently featured at the top. After that, provide details regarding the forms being filed and include any attachments necessary to support your submission.

Ensure you double-check all information entered on the form. Common mistakes to avoid include typos in the EIN, incorrect filing dates, and omission of required signatures. Verification not only boosts compliance but also minimizes the risk of processing delays, ensuring a smooth submission.

Tips for ensuring accuracy

To enhance the accuracy of your Form 8453-TE submission, consider employing a verification process. After completing the form, have a secondary individual review the entries. Mistakes may seem trivial, but they can lead to significant delays or complications down the road.

Tools and resources for editing and managing Form 8453-TE

One powerful tool for managing Form 8453-TE and other essential documents is pdfFiller. This platform allows users to edit PDFs, ensuring that entries can be corrected and updated easily. To use pdfFiller effectively, simply upload your Form 8453-TE to the platform, where you can make necessary changes without the hassle of reprinting.

Additionally, pdfFiller provides robust eSignature solutions, enabling users to sign documents electronically. This feature is particularly useful for organizations needing to have multiple stakeholders involved in approving the form. Collaborating securely with team members on pdfFiller enhances productivity and ensures that the form can be finalized from anywhere.

Post-submission steps for Form 8453-TE

After submitting Form 8453-TE, organizations can expect a processing timeline that typically varies based on the volume of submissions received by the IRS. Understanding this timeline is crucial, as it can dictate further necessary actions. If issues arise, organizations may need to provide follow-up documentation or clarify details regarding their filing.

Once submitted, proper record-keeping becomes paramount. Organizations should adopt best practices for storing their submitted forms alongside supporting documentation, as these records might be needed in the case of audits or inquiries from the IRS.

Best practices for storing your submitted forms

Utilizing pdfFiller’s document management features can aid in archiving and retrieving documents efficiently. Having a designated cloud storage system ensures that your organization can access crucial information whenever it is needed, contributing to streamlined operations.

Troubleshooting common issues with Form 8453-TE

Identifying processing errors with Form 8453-TE is essential for timely resolutions. Common indicators of mistakes include notifications from the IRS or unexpected delays in processing times. Regularly following up on your submission can help pinpoint any such issues.

If problems arise, having a clear action plan is crucial. Contacting the IRS for assistance can expedite the resolution process. Additionally, utilizing pdfFiller’s support tools can provide guidance on document management and ensure seamless eSignature implementation.

Case studies: Successful use of Form 8453-TE

Real-world examples significantly illustrate the successful utilization of Form 8453-TE. Organizations that have embraced electronic filing and the use of this form have reported not only efficiency in their tax processes but enhanced compliance through reduced errors and quicker submission times. They have achieved these improvements by leveraging tools such as pdfFiller for document management and collaboration.

Key takeaways from these examples highlight the importance of accurate record-keeping, timely submissions, and utilizing modern tools like pdfFiller for optimal management and compliance.

Enhancing your document management strategy with pdfFiller

Beyond handling Form 8453-TE, pdfFiller offers a wide array of solutions for managing other forms and agreements, streamlining your organization’s document workflow. Utilizing an agreement generator or employment contract creator is seamless on this platform, helping organizations draft, edit, and eSign critical documents with ease.

Integrating pdfFiller into your workflow benefits individuals and teams alike by automating various document tasks, potentially reducing the burden of paperwork. With a focus on productivity, pdfFiller empowers users to effortlessly navigate their documentation needs from a single, cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 8453-te?

Can I create an electronic signature for the form 8453-te in Chrome?

How do I complete form 8453-te on an Android device?

What is form 8453-te?

Who is required to file form 8453-te?

How to fill out form 8453-te?

What is the purpose of form 8453-te?

What information must be reported on form 8453-te?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.