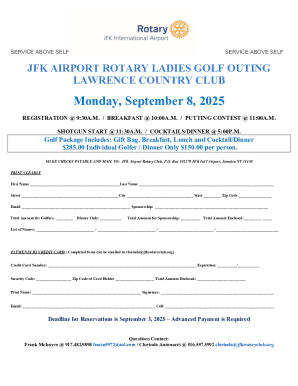

Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

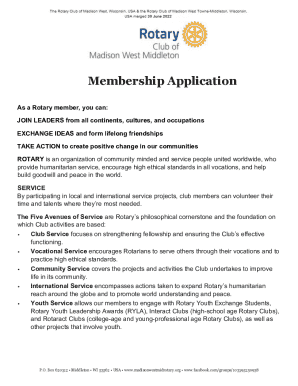

Who needs form 990?

How to Fill Out the Form 990 Form

Overview of Form 990

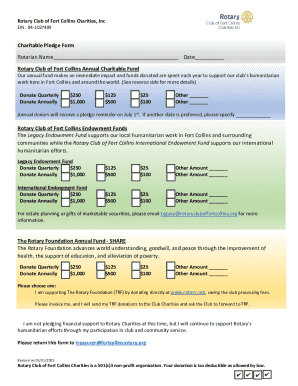

Form 990 is a vital document that nonprofits in the United States must file annually with the Internal Revenue Service (IRS). It provides essential information about the organization’s financial status, operations, and compliance with tax-exempt requirements. Nonprofits, regardless of their size, must report their revenue, expenses, and overall activities, creating transparency within the sector.

The importance of Form 990 cannot be overstated. It serves as a cornerstone for accountability, opening the financial books of nonprofits for public scrutiny and providing a means for fundraising and donor transparency. This form is also essential for maintaining tax-exempt status, crucial for nonprofit operations.

Different types of Form 990

Understanding the different types of Form 990 is crucial for organizations as they will determine which form to use based on their financial circumstances and activities. The standard Form 990 is designed for larger organizations, whereas the others cater to varying scales of nonprofit operations.

Key components of Form 990

Form 990 comprises various parts that require detailed reporting, each shedding light on different aspects of an organization’s operations and financial health. Understanding these components helps nonprofit managers and boards fulfill their reporting obligations with accuracy and transparency.

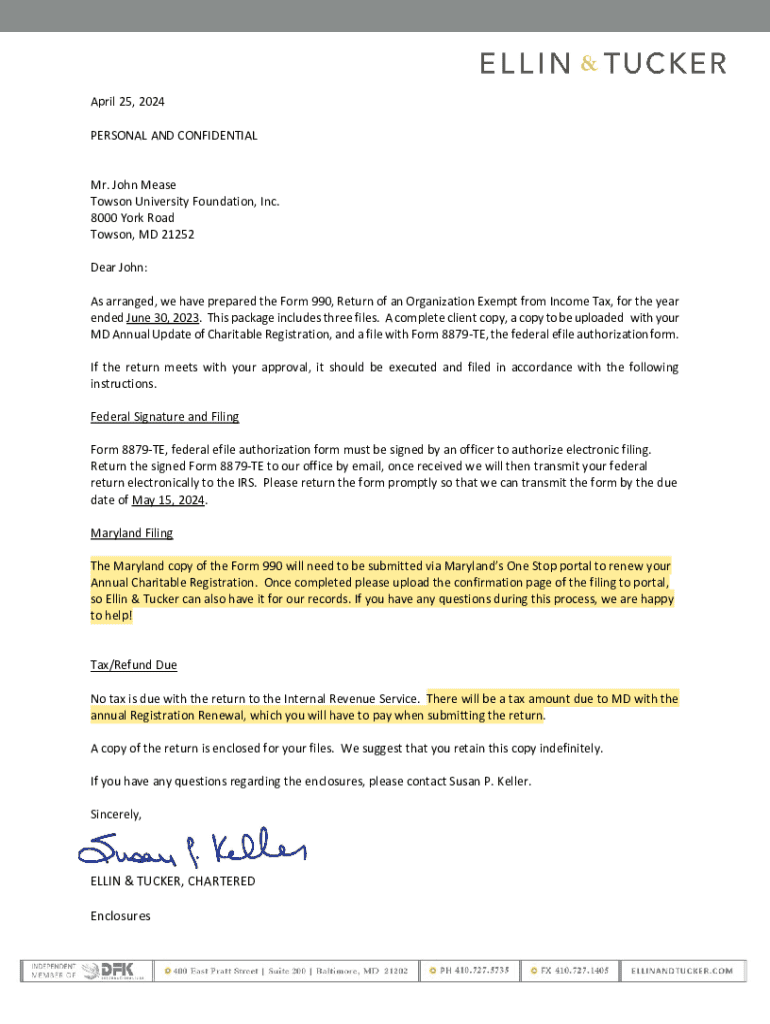

Filling out Form 990: Step-by-step guide

Filling out Form 990 involves several steps which, when followed methodically, can ensure compliance and accuracy. From gathering required documents to completing each section of the form, a structured approach is essential.

Common mistakes to avoid

Completing Form 990 can seem straightforward, but several common pitfalls can lead to delays, penalties, or compliance issues. Awareness of these mistakes will help organizations avoid unnecessary setbacks.

Tips for effective management of Form 990 filings

Effective management of Form 990 filings is crucial for nonprofits seeking to maintain transparency and compliance. Implementing best practices can streamline the process and reduce stress during the filing period.

Interactive tools and resources

Utilizing web-based tools can drastically improve the filing experience for Form 990. Platforms like pdfFiller specifically enhance your productivity with a range of interactive features.

Additionally, pdfFiller offers step-by-step video tutorials to guide users through the filing process, as well as testimonials from other users who have benefited from its solutions, providing real-world insights into its effectiveness.

Frequently asked questions (FAQs)

Understanding the complexities surrounding Form 990 can raise numerous questions for organizations new to the filing process. Addressing these FAQs can provide clarity and guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How do I edit form 990 online?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.