Get the free Form 8453-te

Get, Create, Make and Sign form 8453-te

Editing form 8453-te online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8453-te

How to fill out form 8453-te

Who needs form 8453-te?

A comprehensive guide to form 8453-TE

Understanding the 8453-TE form

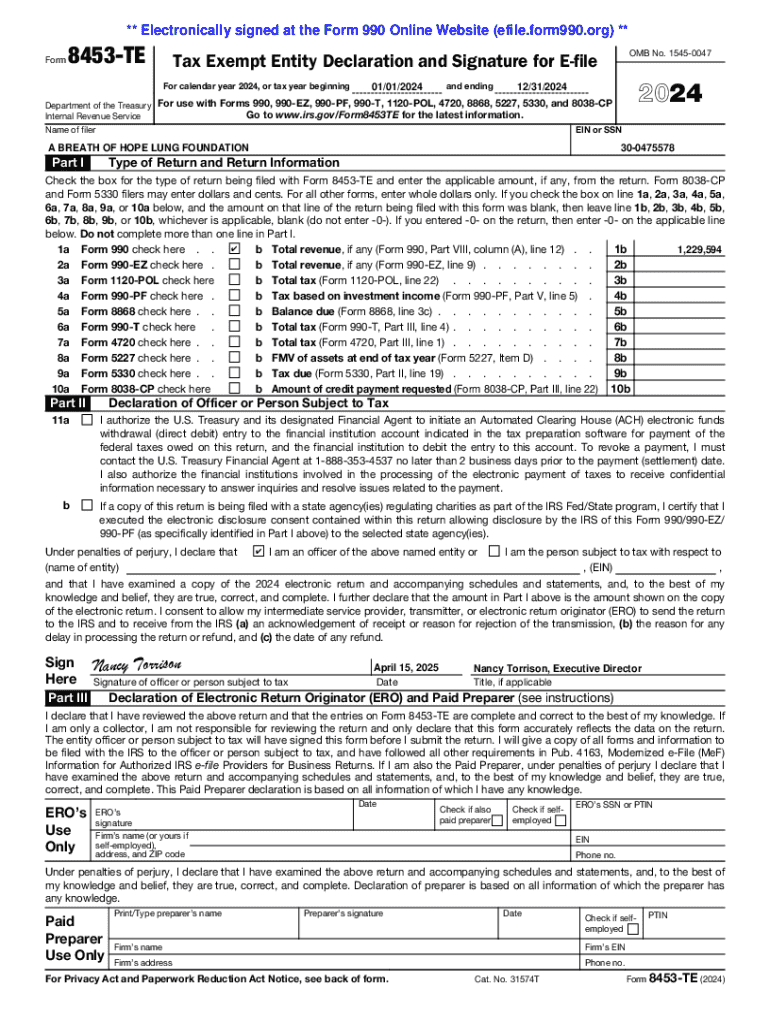

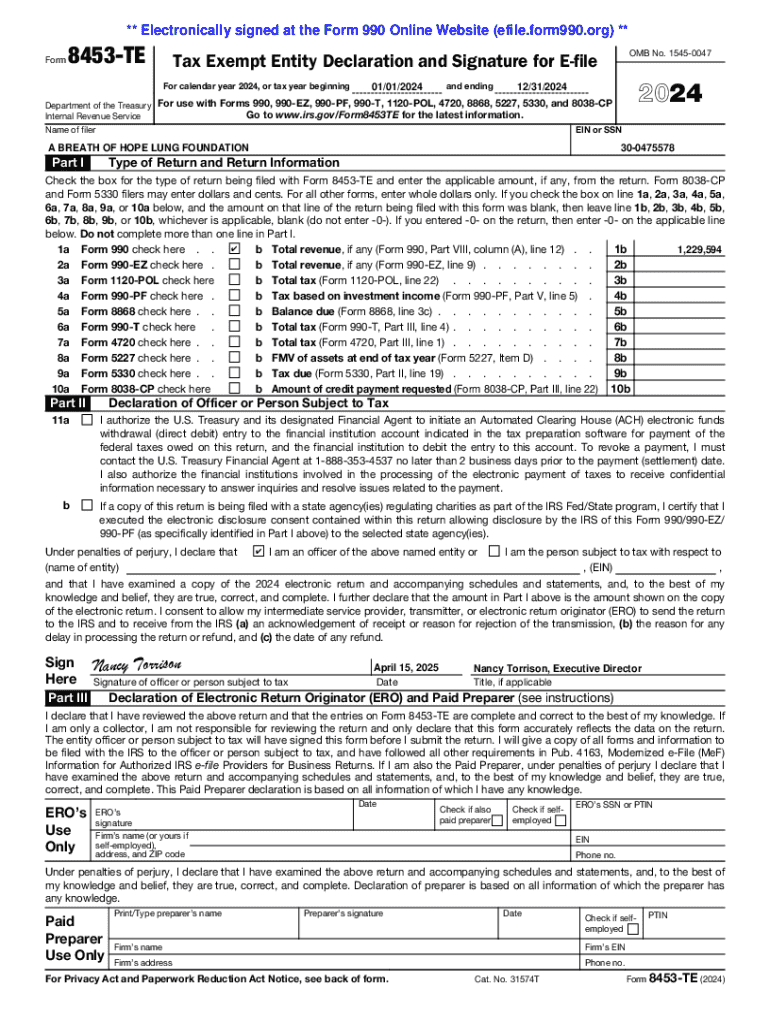

The 8453-TE form is a crucial document used in the process of submitting certain tax-related information online. Specifically, this form is designed for electronic submissions by entities that are not allowed to e-file without attaching the necessary paper documents. It helps ensure that the submission adheres to IRS standards while protecting sensitive information.

The form is often required for organizations like trusts and estates, which must report specific items such as their income and deductions. If you are involved in preparing tax returns for any of these entities, understanding when to utilize the form 8453-TE is vital for compliance and accuracy.

Detailed instructions for completing the form 8453-TE

Completing the form 8453-TE involves several essential steps that must be executed carefully to ensure accuracy. Here's a step-by-step guide to help you through the process.

Step 1: Gathering required information

Before filling out the form, gather all necessary personal and business information. This includes your entity's name, address, Employer Identification Number (EIN), and any other relevant tax identification numbers. It's also crucial to have tax documents such as previous filings and any supporting statements ready.

Step 2: Filling out personal information

Begin by entering your organization's name and address at the top of the form. Follow this by providing your EIN. Accuracy is key here, as errors can create complications in processing your submission.

Step 3: Documenting tax information

This section requires specific data related to your entity's taxes. You will need to include details such as gross income, deductions, and credits. Be sure to format this data clearly to avoid confusion.

Step 4: Reviewing your entries

After completing the entries, take the time to review your form thoroughly. Common mistakes to watch out for include incorrect amounts, misspellings, or providing the wrong EIN. Double-checking these details can save you from unnecessary follow-ups later.

Step 5: Finalizing your form

Once you're satisfied with the information provided, sign and date the form. Ensure that the signatures are from individuals authorized to represent your organization.

How to edit and modify the form 8453-TE using pdfFiller

Your 8453-TE form doesn't have to be a static document. With pdfFiller, editing and modifying your form becomes a straightforward process. Here's how to get started.

Accessing the form on pdfFiller

First, log into your pdfFiller account and use the search feature to locate the 8453-TE form. Once found, select it to begin editing. The intuitive interface allows you to work seamlessly, whether you're updating information or making adjustments.

Editing features overview

pdfFiller provides a range of editing tools at your disposal. You can add text, images, and annotations easily. You can modify existing text to ensure it accurately reflects the latest tax data.

Using the cloud-based tools

One major advantage of pdfFiller is the cloud-based infrastructure that allows you to edit your documents from anywhere. This flexibility means you can access and modify your 8453-TE form regardless of your location, ensuring you have the most up-to-date information on hand.

eSigning and collaborating on the form

In today’s digital age, eSigning has become an essential component of document management. With pdfFiller, signing your 8453-TE form becomes hassle-free.

How to eSign the 8453-TE form with pdfFiller

To apply a digital signature, navigate to the eSigning section once your document is ready. You’ll need to follow a few straightforward steps to create a digital signature. This signature is equally valid and legally binding as a physical signature.

Collaborative options

pdfFiller also offers collaborative tools. You can invite team members or tax advisors to review and provide feedback on the document. The platform allows you to track edits and maintain version control, ensuring that everyone involved in the process is on the same page.

Managing and storing your form 8453-TE

Proper management of your 8453-TE form is crucial for ease of retrieval during audit or compliance checks. With pdfFiller, managing your document is built into its features.

Saving options available in pdfFiller

Save the completed form in various file formats, including PDF, DOCX, or others depending on your needs. Choose cloud storage options for easy access from any device, ensuring that you can retrieve the document whenever required.

Best practices for document management

Organize your forms systematically to enhance retrieval efficiency. Consider using folders tagged with dates or years, and set reminders for related tax deadlines. This method helps prevent last-minute rushes when filings are due.

Frequently asked questions (FAQs) about the 8453-TE form

Tax-related queries often arise, and understanding the nuances of the 8453-TE form can alleviate many concerns.

Common concerns and their solutions

If you make a mistake on the form, the initial step is to determine if it's a minor or substantial error. Minor errors can sometimes be corrected on the fly, but substantial errors might require re-filing. Additionally, checking the status of your submission involves contacting the IRS or using the online tools they provide.

Clarifying misunderstandings

Many misconceptions surround the requirements of the form. For instance, some believe that additional paper documents are unnecessary after e-filing, but that is not always the case. Make sure to stay updated with the latest IRS guidelines to avoid misunderstandings.

Expert tips for efficient tax filing

Maximizing the capabilities of pdfFiller can significantly enhance your document management process.

Unique features to enhance your workflow

Utilize the platform's tools, such as the PDF merge and pdf unlock functions, to combine documents or unlock restricted forms when needed. This makes your overall document handling more flexible and efficient.

Effortless tax filing strategies

A well-organized approach, including automated workflows and setting up specific conditions for document handling, can lead to time-saving techniques that streamline tax filing processes. Consider using an agreement generator to automate standard agreements you may require.

Conclusion: Mastering the 8453-TE form with pdfFiller

The journey of mastering the form 8453-TE becomes manageable when armed with knowledge and the right tools. pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. By understanding the significance of the 8453-TE form and utilizing pdfFiller's features, users can streamline their tax processes and ensure compliance, ultimately reducing the burden during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 8453-te online?

How do I edit form 8453-te in Chrome?

How do I fill out the form 8453-te form on my smartphone?

What is form 8453-te?

Who is required to file form 8453-te?

How to fill out form 8453-te?

What is the purpose of form 8453-te?

What information must be reported on form 8453-te?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.