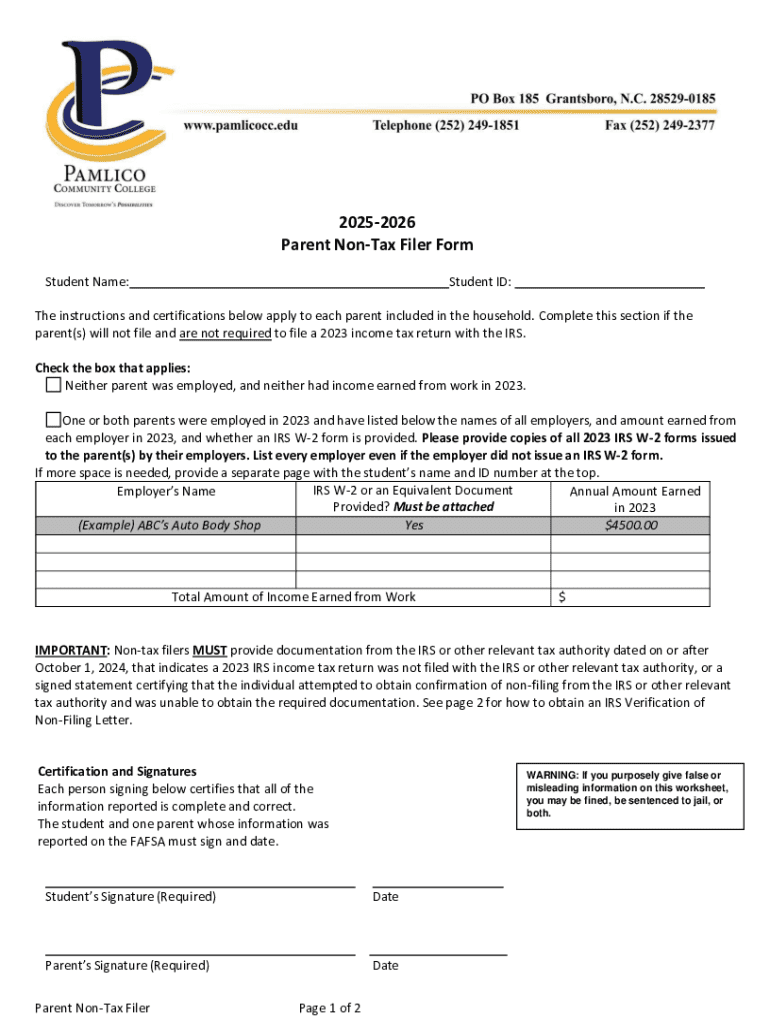

Get the free Parent Non-tax Filer Form

Get, Create, Make and Sign parent non-tax filer form

Editing parent non-tax filer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out parent non-tax filer form

How to fill out parent non-tax filer form

Who needs parent non-tax filer form?

Complete Guide to the Parent Non-Tax Filer Form

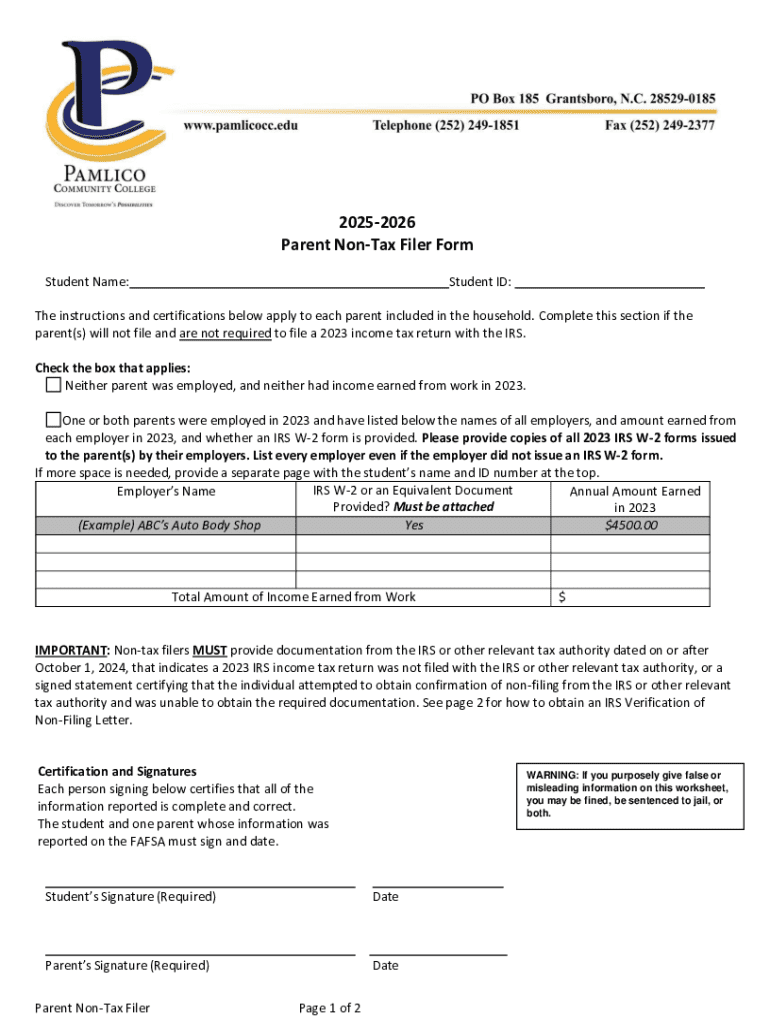

Overview of the Parent Non-Tax Filer Form

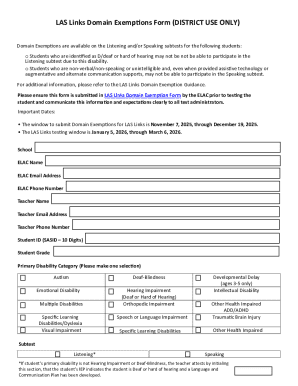

The Parent Non-Tax Filer Form is a critical document used primarily in financial contexts, especially when applying for student loans or financial aid. This form serves to verify a family’s income when one or both parents do not file taxes, thus ensuring that students have access to the financial help they need for their education.

Understanding this form’s significance is essential since many federal and state aid programs require it to assess a family's financial situation. Without this documentation, your child's financial aid application may be incomplete, potentially affecting their eligibility for necessary funding.

Who needs this form?

This form is essential for individuals or families who do not earn enough to be required to file a tax return—such as low-income households, single parents receiving assistance, or those living off non-taxed income sources. Typically, these families need to demonstrate they have a legitimate source of income to qualify for grants, scholarships, or loans.

Understanding your requirements

To be classified as a non-tax filer, specific eligibility criteria must be met. Common circumstances include earning below the IRS minimum filing threshold, relying solely on social security, or receiving assistance from welfare programs. Any of these situations may qualify parents to complete and submit the Parent Non-Tax Filer Form.

In addition, applicants must gather certain documentation to successfully fill out this form. This typically includes:

Steps to complete the Parent Non-Tax Filer Form

Completing the Parent Non-Tax Filer Form can be straightforward if you follow these steps:

Preparing your information

Before accessing the form, ensure you have all necessary financial and personal identification details ready. This preparation simplifies the subsequent steps.

Step-by-step instructions

Utilizing pdfFiller for enhanced document management

pdfFiller enhances your experience of filling out the Parent Non-Tax Filer Form by providing a range of features that streamline document management. With pdfFiller, you can edit PDF forms easily, making corrections hassle-free.

Additionally, pdfFiller’s eSigning capabilities allow you to sign documents electronically, saving time and resources. This digital process accelerates submissions, keeping your financial aid timeline on track.

Interactive tools in pdfFiller

The platform offers templates and advanced features to help you customize the Parent Non-Tax Filer Form according to your needs. You can utilize various tools that enable collaboration with family members or financial advisors for enhanced accuracy.

Addressing common questions and concerns

It’s normal to have questions regarding the Parent Non-Tax Filer Form. Here are some common inquiries many users have:

Prospective parents should familiarize themselves with troubleshooting steps and know how to reach relevant authorities for assistance if any issues arise.

Finalizing and storing your form

Once you've submitted the Parent Non-Tax Filer Form, it’s crucial to manage your documentation effectively. Securely store all completed forms and supporting documents in a safe place, whether digitally or physically.

Using pdfFiller for cloud-based storage allows you to access these forms from any device. This accessibility is especially beneficial for collaborating with team members or financial advisors, ensuring that everyone stays on the same page throughout the process.

Additional support and resources

Should you need extra help, don’t hesitate to reach out to your financial aid office or local support resources. These offices provide guidance to ensure you can navigate the financial aid process with confidence.

Moreover, there are several other essential forms related to financial aid that might be worth exploring. Understanding these additional resources can facilitate a smoother application process for your child.

User testimonials and success stories

Real accounts from individuals who successfully navigated the Parent Non-Tax Filer Form reveal the importance of careful preparation and the benefits of using pdfFiller. Users express satisfaction with the platform's ease of use and effective tools that helped them manage their documents efficiently.

These testimonials emphasize the transformative impact of effectively completing the Parent Non-Tax Filer Form, ultimately making higher education financing more achievable for families.

Taking your document management further

Exploring more tools available on pdfFiller can significantly enhance your document management experience. The platform provides additional features such as document merging or API integrations for businesses, delivering a comprehensive solution for all your form management needs.

This expansion allows families and organizations to not only manage the Parent Non-Tax Filer Form but to streamline their overall document processes, ensuring efficiency and accessibility.

Legal and compliance considerations

Completing the Parent Non-Tax Filer Form is not just a matter of filling out paperwork; it also involves understanding compliance with financial aid regulations. This form is crucial as it helps establish a family's eligibility for various forms of financial assistance, thus impacting a student’s future.

Awareness of the overarching compliance frameworks surrounding financial aid applications ensures that families not only provide the necessary documentation but maintain credibility throughout the process, safeguarding against potential issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my parent non-tax filer form in Gmail?

How can I send parent non-tax filer form for eSignature?

How do I complete parent non-tax filer form online?

What is parent non-tax filer form?

Who is required to file parent non-tax filer form?

How to fill out parent non-tax filer form?

What is the purpose of parent non-tax filer form?

What information must be reported on parent non-tax filer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.