Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

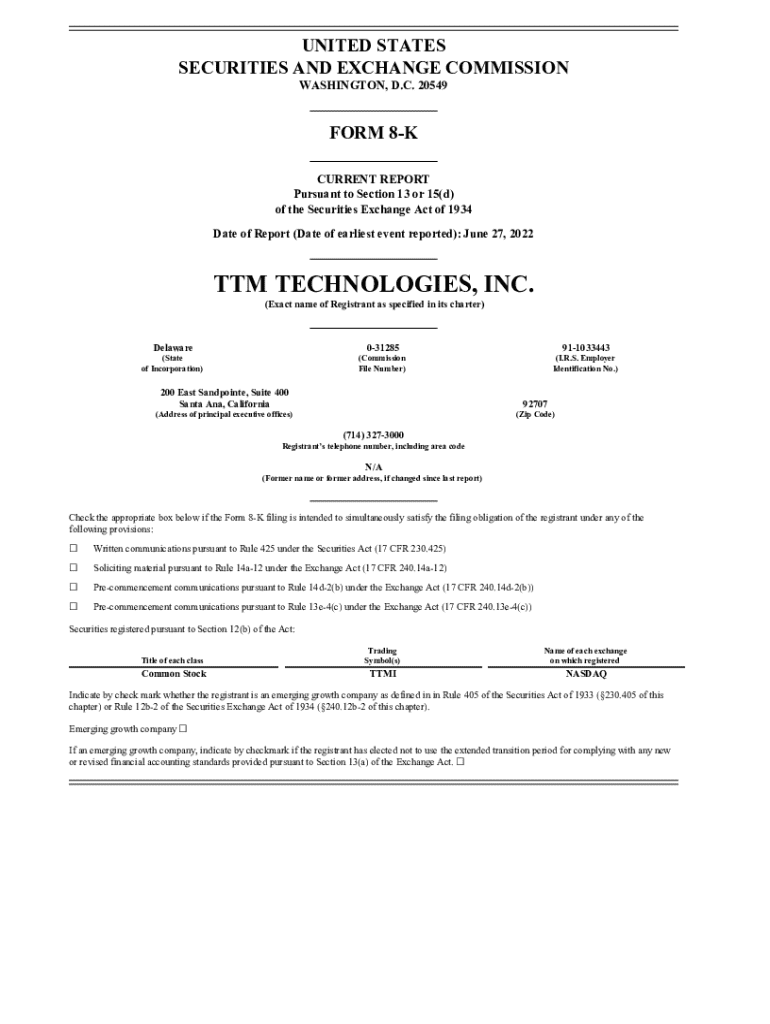

Understanding Form 8-K: An Essential Disclosure Tool

What is an 8-K?

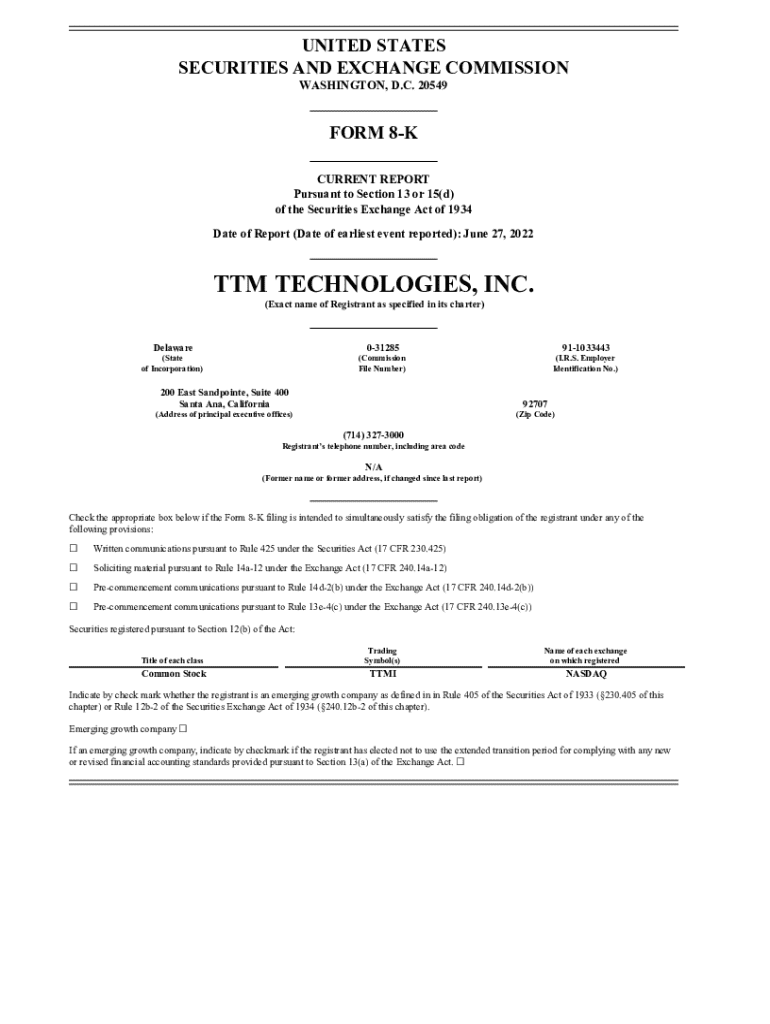

Form 8-K is a crucial regulatory filing adopted by the U.S. Securities and Exchange Commission (SEC) that public companies must submit to disclose significant events that shareholders should know about. Unlike more comprehensive reports such as 10-K and 10-Q, which cover quarterly and annual performance, the 8-K focuses on specific occurrences that may affect a company's financial standing or the decisions of investors. By mandating timely disclosures of important developments, Form 8-K serves to promote transparency and protect investors.

This form plays a pivotal role in the financial ecosystem, ensuring that stakeholders are kept informed about critical company developments, be they operational changes, financial performance updates, or legal issues. Its importance cannot be overstated, as timely and accurate disclosures can have far-reaching implications for stock prices and investor trust.

Components of an 8-K filing

An 8-K filing comprises several key sections, each addressing different types of reportable events. These elements may include:

Each section of the 8-K is designed to provide a clear understanding of the event, its implications, and any potential risks involved, thus ensuring that investors have the information necessary to make informed decisions.

Triggering events for 8-K filings

Several common situations necessitate the filing of an 8-K. Typically, the following events trigger an obligation to file immediately:

The urgency in filing an 8-K differentiates it from regular reporting requirements, which occur quarterly and annually. Unlike 10-Q and 10-K reports, which summarize ongoing financial performance over broader periods, 8-K forms must be filed within four business days of the triggering event.

Legal and regulatory framework

The SEC plays a central role in enforcing Form 8-K filings, establishing the obligations for public companies to disclose material events promptly. Failure to comply with these requirements can lead to severe consequences, including potential fines or sanctions.

Furthermore, inadequate reporting can diminish investor trust and may lead to negative public perception. Companies that overlook Form 8-K obligations may face increased scrutiny from regulators and may suffer from a decline in stock prices as investors react to perceived risks.

Transparency and investor trust

Timely 8-K filings are essential for maintaining transparency and building trust among investors and stakeholders. These disclosures allow investors to stay updated about significant events that could impact their investment decisions. This proactive communication demonstrates a company's commitment to openness and accountability, fostering stronger investor relations.

Moreover, 8-K disclosures play a critical role in a company's reputation management. Prompt notifications of both positive and negative events can mitigate misinformation, helping to maintain investor confidence even in turbulent times.

Market reactions and implications

The market often reacts strongly to 8-K announcements, especially regarding significant events such as mergers, acquisitions, or unexpected financial results. Investors typically analyze these disclosures closely, resulting in rapid shifts in stock prices based on the perceived impact of the news.

For instance, when a company announces an unexpected change in leadership via Form 8-K, shares may experience volatility as investors reassess future prospects. Conversely, a successful merger announcement can lead to increased investor enthusiasm and higher stock prices, as evidenced in several case studies highlighting the market’s response to 8-K disclosures.

Step-by-step guide to analyzing an 8-K

Reading an 8-K form requires a systematic approach. Start by focusing on the headers, which indicate the nature of the disclosure. This will help identify which specific event is being reported. Key items to check include titles and effective dates of changes, as well as explanations provided by the company’s management.

Next, decode the financial information included in the filing. Look for any changes in financial metrics or operational strategies that could indicate future performance. Additionally, pay careful attention to management's narrative commentary, as this section often highlights risks, future directions, and opportunities that may not be immediately obvious.

Keys to understanding narrative context

Understanding the narrative context of an 8-K is vital. The management commentary often fills gaps left by raw data, explaining not just what has happened, but also why it matters. Look for discussions around strategic shifts, risk factors, and responses to market conditions.

This context is important in painting a full picture of the company's situation, helping investors aggregate both the factual data provided and the management's strategic outlook. Recognizing the interplay between reported events and the commentary can provide deeper insights into potential future actions.

Utilizing pdfFiller for Form 8-K management

pdfFiller is an excellent tool for managing Form 8-K filings. With its cloud-based platform, users can streamline the creation, editing, and submission of 8-K forms. The platform allows companies to maintain a secure repository of their submissions, making it easy to access and organize important documents.

Incorporating features like document collaboration, eSigning, and real-time editing, pdfFiller facilitates teamwork during the preparation of disclosures, ensuring accuracy and compliance with regulatory requirements. This integrated approach to Form 8-K management saves time and enhances the overall filing process.

Best practices for form management

To effectively track 8-K filings with pdfFiller, consider implementing the following best practices:

These strategies can enhance the efficiency of document management and ensure that regulatory obligations are consistently met, lessening the risk of potential penalties.

Industry-specific considerations

Different sectors may have specific nuances when it comes to Form 8-K requirements. For example, technology companies may frequently file 8-Ks due to rapid changes in operational scope or mergers and acquisitions, while companies in regulated industries may have stricter guidelines around disclosures.

Staying informed about sector-specific reporting trends can help companies navigate the 8-K filing landscape. Engaging with sector-specific advisory services can offer additional insights into compliance expectations unique to each industry, ensuring timely and accurate filings.

Role of legal and financial advisors

Legal and financial advisors play a crucial role in assisting companies with Form 8-K filing obligations. They offer guidance on compliance issues and help tailor disclosures to capture the true implications of reported events.

Consulting with experts during the preparation of disclosures ensures that companies navigate complex regulations correctly and can highlight relevant information while complying with SEC rules.

Common queries addressed

Understanding the nuances of filing Form 8-K can be complex. Here are some common questions addressed:

These inquiries highlight the significance of staying informed about regulatory timelines and obligations while also shedding light on the importance of timely and accurate disclosure.

Resources for further understanding

For those seeking comprehensive knowledge regarding Form 8-K, the SEC's official website offers a wealth of resources, including information on filing procedures, timelines, and penalties for non-compliance. Various educational materials and community forums also provide avenues for further discussion and expert insights on navigating Form 8-K effectively.

pdfFiller's advantages for Form 8-K management

Utilizing pdfFiller provides distinct advantages for managing Form 8-K filings. The platform’s comprehensive cloud-based document management solutions allow companies to edit PDFs, eSign, and collaborate seamlessly—all from a single, secure environment. Enhanced security features protect sensitive information, ensuring compliance with regulatory demands.

Additionally, collaboration tools facilitate teamwork during shared filings, enabling companies to leverage collective expertise while navigating the complexities of regulatory requirements. This integrated approach not only streamlines the filing process but also fosters an environment of trust and transparency among stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8-k from Google Drive?

How do I execute form 8-k online?

Can I create an eSignature for the form 8-k in Gmail?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.