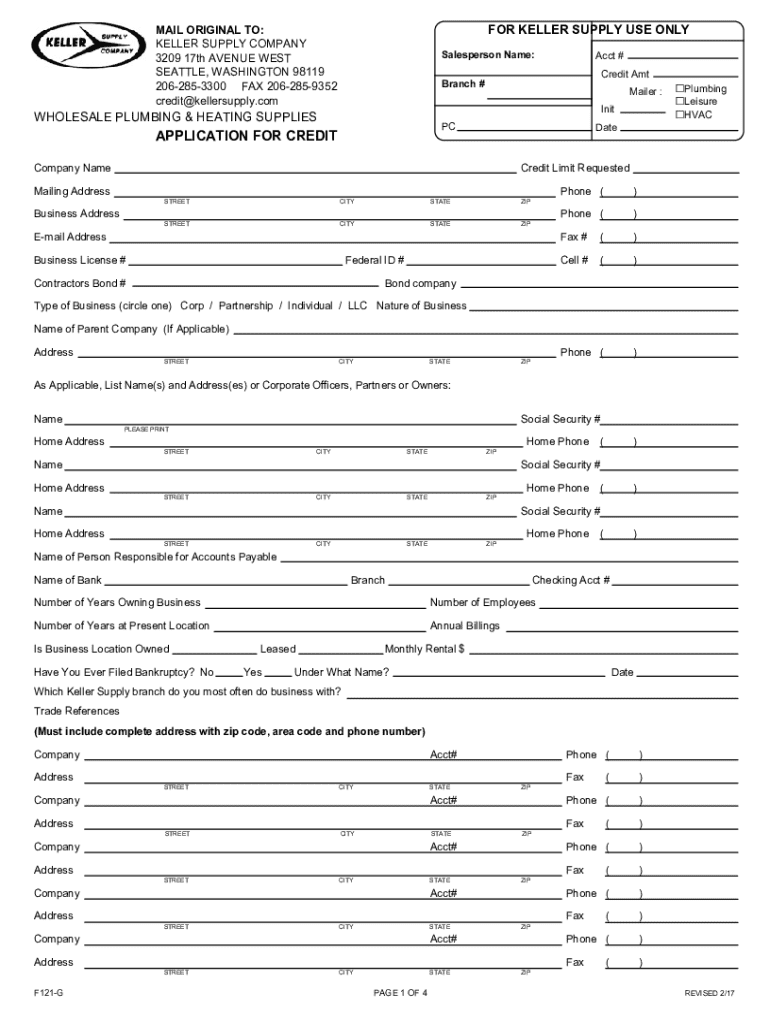

Get the free Application for Credit

Get, Create, Make and Sign application for credit

Editing application for credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for credit

How to fill out application for credit

Who needs application for credit?

Application for Credit Form - How-to Guide

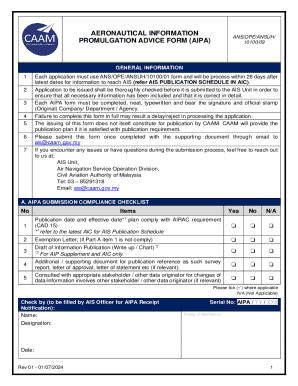

Understanding the application for credit form

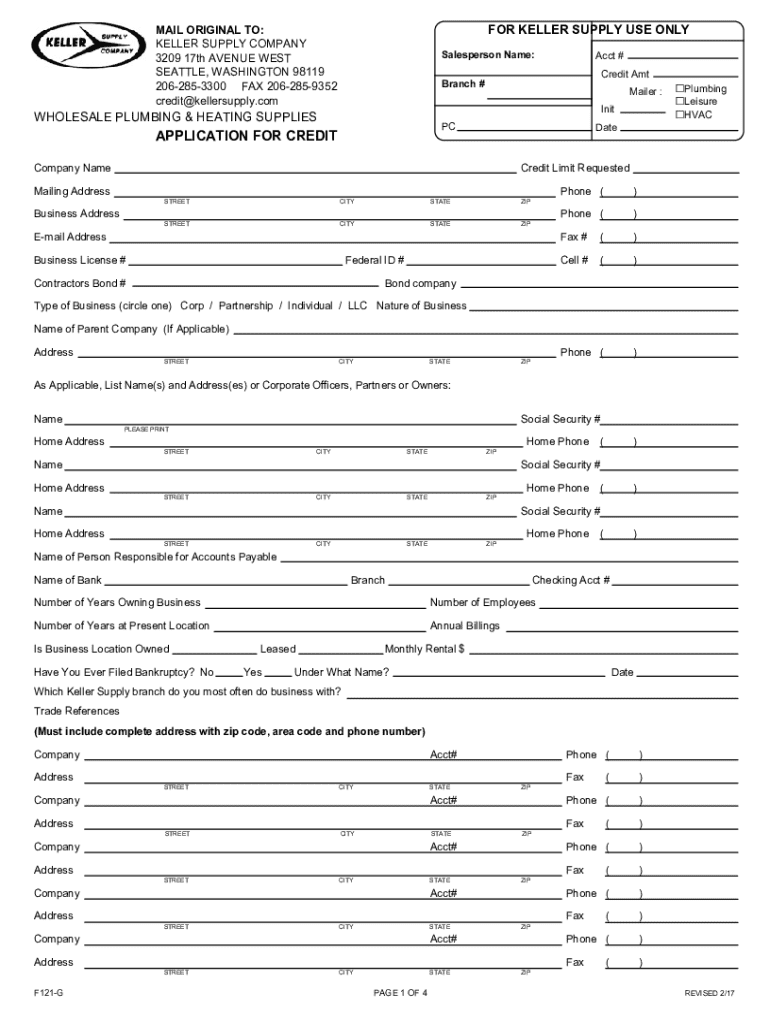

An application for credit form is a document submitted to lenders by individuals or businesses seeking credit, such as loans or credit cards. It serves to disclose important personal and financial information necessary for the lender to make informed decisions. By understanding this form and its importance, applicants can facilitate a smoother lending process.

Key components typically include personal identification, financial details such as income, assets, liabilities, employment history, and a credit history overview. Each section is vital in forming a complete picture of the applicant's financial health.

Preparing to complete your application for credit

Before filling out your application for credit form, gather the necessary documents. This preparation step ensures accuracy and expedites the review process, increasing your chances of securing credit.

Organize these documents efficiently to avoid delays. Additionally, assess your creditworthiness by checking your credit score and reports through agencies like Credit Karma or Experian. A good score can significantly improve your application’s success.

Step-by-step guide to filling out the application for credit form

When you're ready to fill out the application, take it step-by-step. Begin with the personal information section.

Editing and customizing your application for credit form

Utilizing tools like pdfFiller can streamline the process of editing your application. With seamless editing capabilities, users can customize PDF forms to fit their needs.

Additionally, you can add comments and notes to clarify your intent or provide context, which is especially useful for team submissions.

eSigning your application for credit form

Understanding the eSignature process is essential for the submission of your application for credit form. Electronic signatures have become legally valid in many jurisdictions, simplifying the signing process.

Security measures such as encryption and authentication protect your information during the signing process, giving you peace of mind.

Submitting your application for credit form

After completing and signing your application for credit form, the next step is submission. Understanding how and where to submit is crucial.

Be prepared for follow-up. Regularly check the status of your application and understand the timelines for processing to manage your expectations.

Common mistakes to avoid on your application for credit form

Inaccuracies can derail your application for credit form. Here are some common pitfalls to avoid.

Accurate and complete information improves your chances of a quick approval, so take care when filling out your form.

Troubleshooting post-submission issues

If your application for credit form is denied, it’s important to understand common reasons for denial and how to address them.

Contacting the lender is paramount for clarifications regarding your application status. Effective communication can help resolve ambiguities that may arise post-submission.

Leveraging pdfFiller's tools for future forms

Beyond just credit applications, pdfFiller offers the ability to create and manage various essential documents. Leveraging these tools can streamline your overall document management process.

The cloud feature promotes seamless collaboration with teams on different document projects, enhancing productivity.

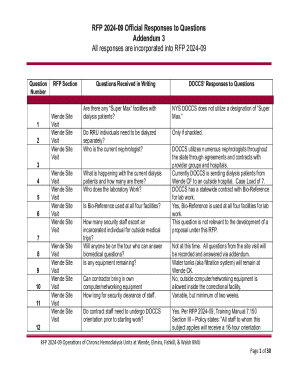

Enhancing your knowledge of credit applications

Understanding different types of credit can further inform your applications. Distinctions between personal and business credit applications can significantly affect eligibility and approval.

Gaining insights from community discussions can provide various perspectives and strategies that improve your application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute application for credit online?

How do I edit application for credit online?

How can I edit application for credit on a smartphone?

What is application for credit?

Who is required to file application for credit?

How to fill out application for credit?

What is the purpose of application for credit?

What information must be reported on application for credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.