Get the free Consumer Credit Application

Get, Create, Make and Sign consumer credit application

How to edit consumer credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit application

How to fill out consumer credit application

Who needs consumer credit application?

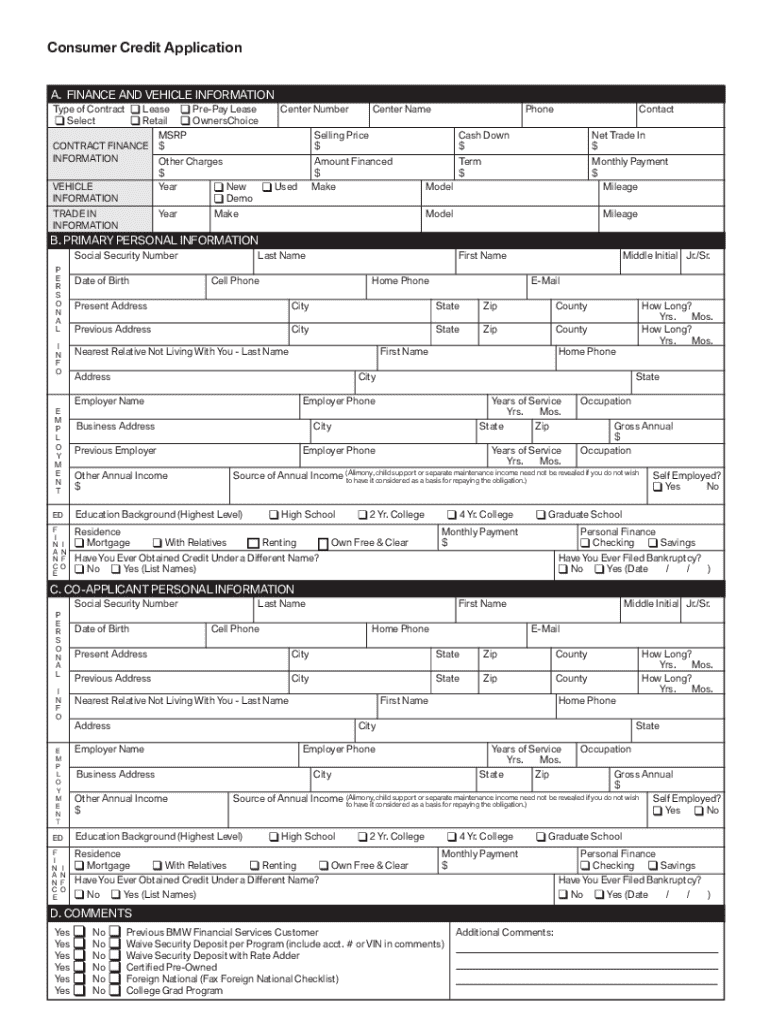

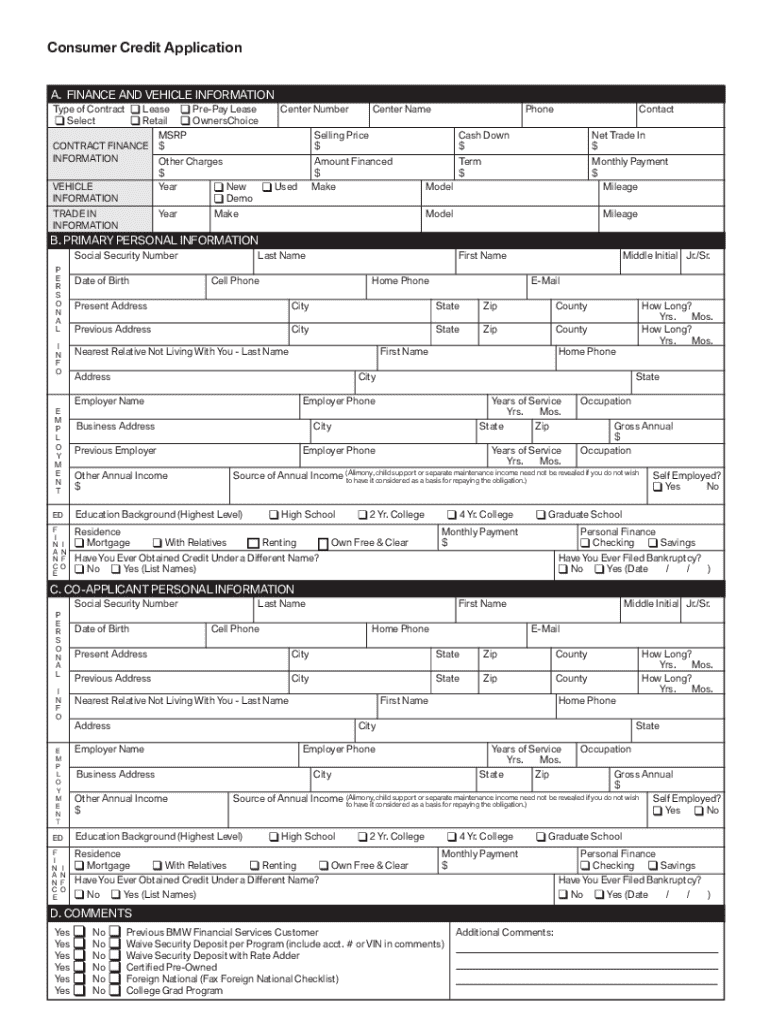

Comprehensive Guide to the Consumer Credit Application Form

Overview of consumer credit applications

Consumer credit refers to the type of credit that allows individuals to borrow money or access services with the promise of repayment over time. This form of credit is essential for making significant purchases, such as homes, cars, or funding education. A standardized consumer credit application form is crucial as it ensures that lenders receive consistent and comprehensive information necessary for making informed lending decisions. It also helps protect both the consumer and lender by standardizing the credit evaluation process.

Understanding the consumer credit application form

The consumer credit application form comprises several key components that provide lenders with a complete picture of the applicant's financial responsibility. These components typically include:

Additional information required includes identification documents and proofs of income, which are necessary for verification. Accuracy in filling out each section cannot be overstated, as even small errors can lead to delays or denials.

Step-by-step instructions for filling out the form

Filling out a consumer credit application form can seem daunting, but following a structured approach can simplify the process. Here’s how to complete each section:

Personal Information Section

In this section, include your full name, current address, and date of birth. Ensure that the details match those on your identification documents. Common mistakes include typos or providing outdated addresses. Double-check your entries for accuracy.

Financial Information Section

In detail your income sources, such as wages, freelance payments, or alimony. Listing your monthly expenses, including rent, utilities, and other necessary costs, will help establish your financial picture. It’s crucial to outline your assets and liabilities clearly, allowing lenders to calculate your debt-to-income ratio effectively.

Employment History Section

Report your employment information accurately, including your current and past employers, job titles, and duration of employment. Job stability is a significant factor that lenders consider, so be transparent about your work history.

Additional Information Section (if applicable)

This section may allow for further personal insights, such as mentioning any pets or additional liabilities. Check whether your application requires this section to be filled.

Interactive tools available

pdfFiller provides robust tools for completing consumer credit application forms efficiently. Their template library contains various versions of the form, making it easy to find the right fit. Essential features include interactive fields that allow users to fill out the form seamlessly and ensure no information is missed.

Utilizing eSignature tools

pdfFiller's eSignature tools enable users to sign forms electronically, which streamlines the submission process and eliminates the need for printing. The benefits include legal compliance, security, and saving time, creating a more efficient path to completing your credit application.

Collaborating with others on your application

If you're working in a team or requiring co-signers for your consumer credit application, pdfFiller offers collaboration features that allow sharing of the application for input or approval. This feature is particularly useful in complex financial situations where multiple inputs are beneficial.

Tips for team collaboration through pdfFiller

You can assign tasks and set notifications for team members to review specific sections of the application, making the process efficient. Collaborative editing ensures that everyone has input, which can lead to a more successful application.

Common pitfalls and how to avoid them

Filling out a consumer credit application form may present several common pitfalls that can hinder your approval. Missing information is a frequent issue, where applicants overlook required sections, leading to delays. Providing inaccurate data is another major pitfall, whether from typos or outdated financial figures.

The importance of reviewing each section before submission cannot be overstated. You might consider having a trusted friend or family member proofread your completed form to catch errors you might have overlooked.

Submitting your application

Once your consumer credit application form is completed, submitting it electronically through pdfFiller is simple and straightforward. After submission, it’s crucial to track your application status to stay informed.

What to do after submission: follow-up tips

Upon submission, if you haven’t heard back within the expected timeframe, consider following up with the lender. Also, prepare for a potential interview or further inquiry if the lender seeks additional information.

Frequently asked questions

After submitting your consumer credit application, several questions might arise. Understanding what happens during the review process can alleviate concerns. Typically, the lender will conduct a credit check and evaluate your financial history.

How to handle rejections?

If your application is rejected, don’t lose heart. Many lenders provide reasons for denial, which can serve as constructive feedback. Analyze the information, improve your credit situation, and consider reapplying.

Can changes be made post-submission?

If you realize an error after submitting your consumer credit application form, promptly contact the lender. In some instances, they may allow you to amend the application without negatively impacting your potential approval.

Appendix

To aid in your application process, below are additional resources to refer to.

Transitioning to loan management tools

After successfully completing your consumer credit application and potentially receiving a loan, utilizing tools to manage these documents becomes essential. pdfFiller allows you to manage loan documents efficiently and keep track of payment due dates.

Setting reminders for payments ensures you never miss a due date, bolstering your financial reputation. Additionally, the role of pdfFiller in maintaining organized financial records cannot be undervalued as it leads to better financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete consumer credit application online?

How do I fill out the consumer credit application form on my smartphone?

Can I edit consumer credit application on an Android device?

What is consumer credit application?

Who is required to file consumer credit application?

How to fill out consumer credit application?

What is the purpose of consumer credit application?

What information must be reported on consumer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.