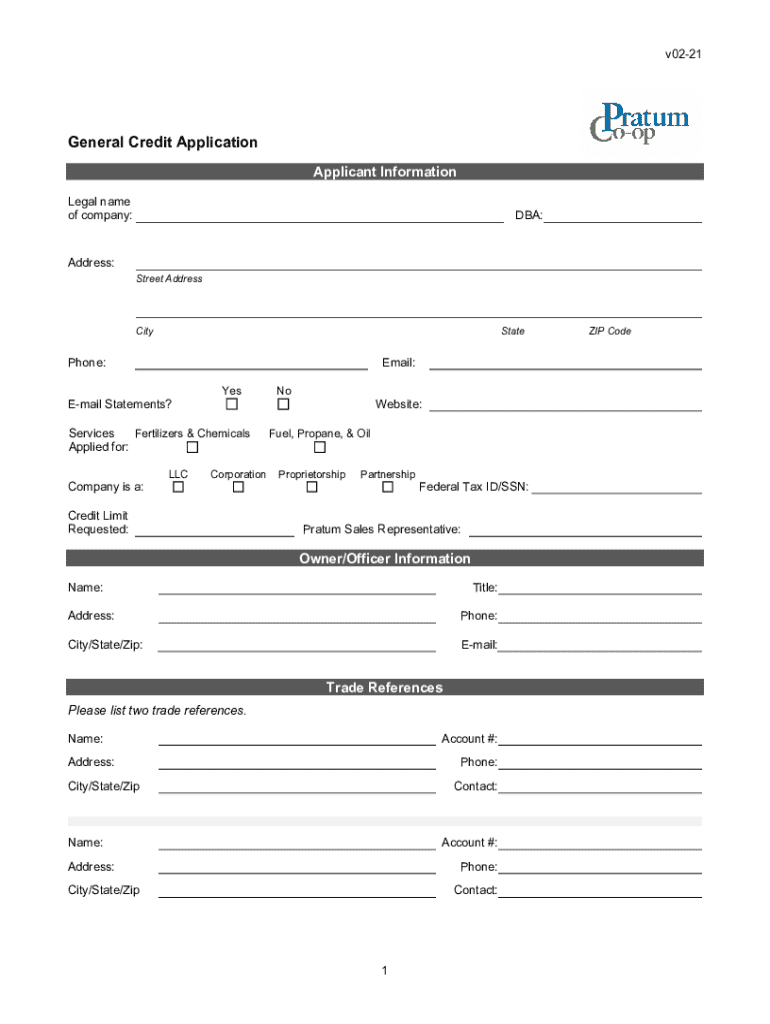

Get the free General Credit Application

Get, Create, Make and Sign general credit application

Editing general credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out general credit application

How to fill out general credit application

Who needs general credit application?

A comprehensive guide to the general credit application form

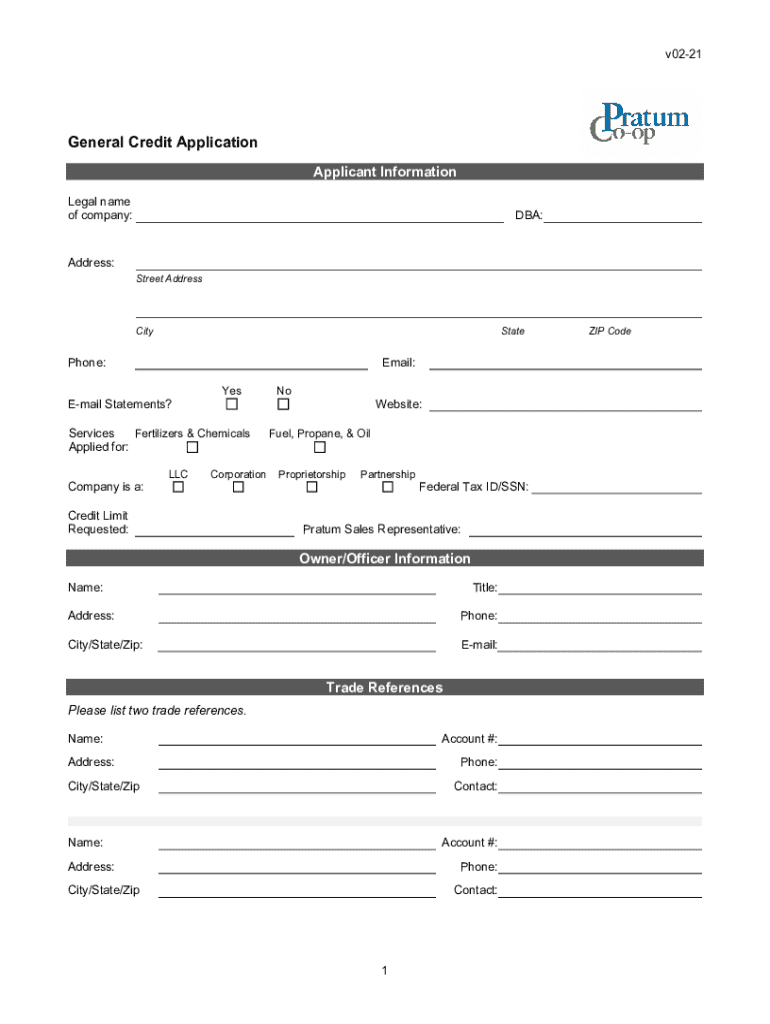

Overview of the general credit application form

A general credit application form serves as the primary document utilized by lenders to assess an individual's or entity's eligibility for credit. The purpose of this form is straightforward: it collects essential information that lenders require to evaluate the creditworthiness of the applicant. In today's competitive financial environment, providing precise and comprehensive information can significantly enhance the likelihood of approval.

Accurate data enables lenders to make informed decisions about risk and repayment capability. Conversely, errors or omissions can lead to delays or outright rejections of loan applications. Therefore, constructing a detailed and well-structured general credit application form is critical, as it helps streamline the approval process and fosters trust between the applicant and lender.

Key components of a general credit application form

Understanding the layout of the general credit application form is vital for successful completion. Here are the primary components:

Each section is crucial in presenting a complete financial picture, allowing lenders to assess your request more effectively.

Best practices for completing the general credit application form

Preparing to complete your general credit application form involves more than just filling in blank spaces. It's essential to gather all necessary documents before you begin. This includes recent pay stubs, tax returns, and identification to support the information you provide.

Avoiding common mistakes is also critical. Double-check your information for accuracy and consistency, particularly numerical values and dates. Moreover, it's a good idea to present your financial status clearly and accurately, using straightforward language and organized information. A well-completed application reflects your professionalism and increases your chances of approval.

Step-by-step instructions for filling out the application

Filling out the general credit application form can feel overwhelming, but following a structured approach can simplify the process:

Interactive tools for simplifying your application process

pdfFiller offers a dynamic suite of document creation features aimed at simplifying the credit application process. One key advantage is the availability of templates specifically designed for general credit applications. These templates provide a structured format that aids users in gathering and presenting their information effectively.

Additionally, pdfFiller's electronic signature capabilities allow applicants to sign documents digitally, helping to expedite approvals. This feature is increasingly valuable in an era where efficiency and speed are paramount. Overall, utilizing these interactive tools can make the daunting task of filling out a credit application form much less intimidating.

Understanding the review process after submission

After submission of the general credit application form, applicants can expect a systematic review process. Lenders typically reach out to confirm receipt of the application and might request additional documentation if needed. Understanding this phase is crucial; it can clarify what to anticipate while awaiting approval.

Communication from lenders may vary by institution, but generally, a timeframe for a decision is provided. Following up effectively is also important. If you haven't heard back within the timeframe given, it's appropriate to reach out for a status update. This shows your continued interest in securing the credit and keeps lines of communication open.

Managing your credit application documents with pdfFiller

Once you've submitted your general credit application form, managing your documents effectively is essential. pdfFiller enables users to organize and store forms in a digital workspace, providing secure access from anywhere. This digital convenience is particularly valuable for documenting your credit journey.

You can easily access, edit, and share your application documents within the platform. This feature allows for collaboration with team members or financial advisors who may help in reviewing the information provided or offer guidance. With pdfFiller, document management becomes a stress-free process, whether you're applying for a closed-end loan or pursuing other credit options.

Sample forms and templates for reference

Having access to reference materials can improve the quality of your application. A strong general credit application form typically includes well-organized sections, clear headings, and complete information detailing your financial history. To assist you in crafting your application, pdfFiller offers example forms and customizable templates.

These resources help to illustrate what components should be included and how to present them effectively. Utilizing these samples can ease the process, allowing you to adapt them to your particular needs and financial context.

Troubleshooting common issues during the application process

While completing the general credit application form might seem straightforward, applicants can encounter various common issues. These may include unclear instructions, difficulties in gathering necessary documentation, or unintentional omissions. It’s vital to identify these problems early to ensure a smooth application process.

If difficulties arise, reaching out to support for assistance can be beneficial. PdfFiller's customer service is available to help with specific questions about the platform, as well as resolving issues tied to the use of credit forms. Enhancing your application's chances of approval requires awareness of potential pitfalls and addressing them proactively.

FAQs about the general credit application form

Many applicants have questions regarding the general credit application form, especially concerning essential definitions and processes. Common queries revolve around best practices for filling out the form, what specific information is mandatory, and how data security measures are applied. Understanding these aspects can help alleviate concerns and ensure that applicants feel confident in submitting their forms.

Additionally, familiarity with legal terminology and procedures can help shed light on what to expect throughout the approval process. Credit applications can frequently involve detailed language, so it is essential to seek clarifications as needed. Engaging with FAQs is a proactive way to educate yourself and dispel any uncertainties you might have as you navigate the credit application landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send general credit application to be eSigned by others?

How do I make edits in general credit application without leaving Chrome?

How do I fill out the general credit application form on my smartphone?

What is general credit application?

Who is required to file general credit application?

How to fill out general credit application?

What is the purpose of general credit application?

What information must be reported on general credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.