Get the free Tax File Number (tfn) Notification

Get, Create, Make and Sign tax file number tfn

How to edit tax file number tfn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax file number tfn

How to fill out tax file number tfn

Who needs tax file number tfn?

Tax File Number (TFN) Form: A How-to Guide

Understanding the Tax File Number (TFN)

A Tax File Number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to individuals and businesses for tax purposes. The significance of the TFN is paramount, as it streamlines tax administration by linking taxpayers with their tax records, ensuring that taxes are accurately assessed and collected. In a system where compliance is key, the TFN is a vital cog that facilitates the smooth processing of tax returns and payment of benefits.

Every taxpayer, whether an individual or a business entity, must understand how the TFN operates. For individuals, it is mandatory for tax returns, while businesses leverage their TFN for various regulatory requirements. Essentially, the TFN acts as a gateway to all tax-related activities, reinforcing the need to possess one as part of fulfilling tax obligations.

Who needs a TFN?

In Australia, various groups require a TFN. Primarily, individuals—including both residents and non-residents—need a TFN to lodge their tax returns and access government services such as welfare payments. Additionally, businesses, including sole traders, partnerships, and companies, also require a TFN for tax reporting and compliance purposes. There are exceptions, notably certain payments and income activities that may not necessitate a TFN, though having one generally simplifies dealings with the ATO.

The importance of the TFN form

The purpose of the TFN form is critical. It serves as the official registration mechanism that allows individuals and businesses to meet their tax obligations. By completing this form, applicants can secure their TFN, which in turn unlocks various benefits, such as seamless tax return filing and eligibility for specific government services. Moreover, being registered allows taxpayers to receive tax returns promptly, avoiding delays that can arise from not having a TFN.

On the contrary, failing to obtain a TFN can lead to severe implications. Without a TFN, individuals may face higher tax rates, delayed refunds, or outright ineligibility for certain tax rebates. Additionally, businesses lacking a TFN may encounter administrative headaches and potential fines due to non-compliance with reporting requirements. Therefore, acquiring a TFN through the appropriate form is not only beneficial but also essential for all taxpayers.

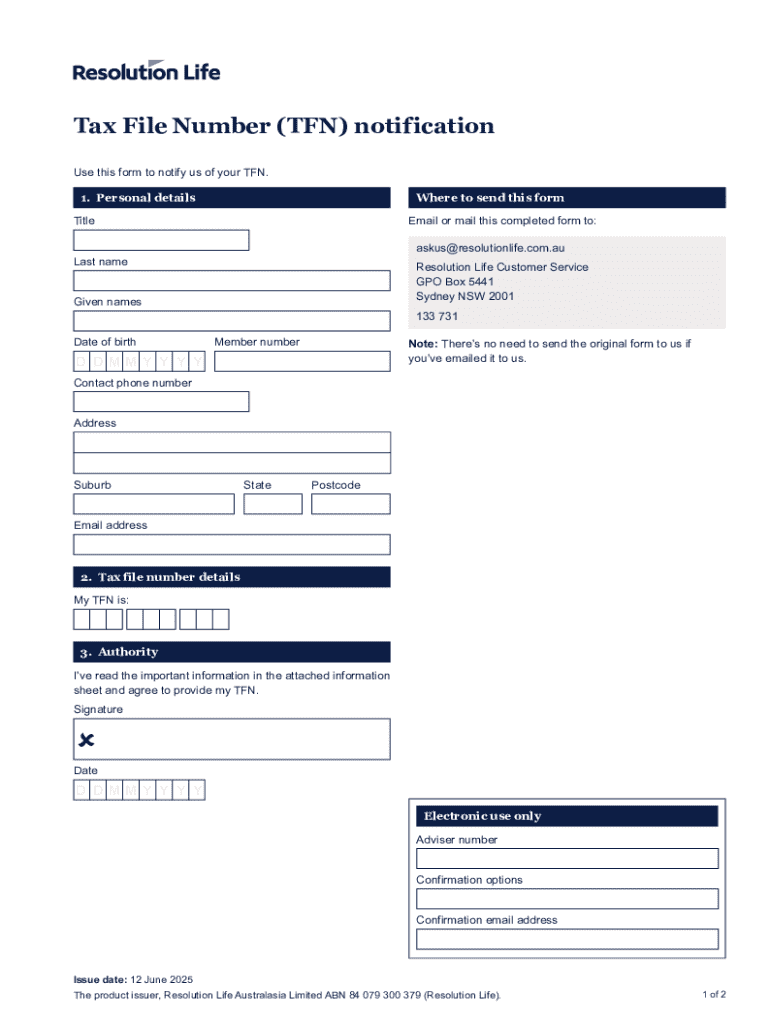

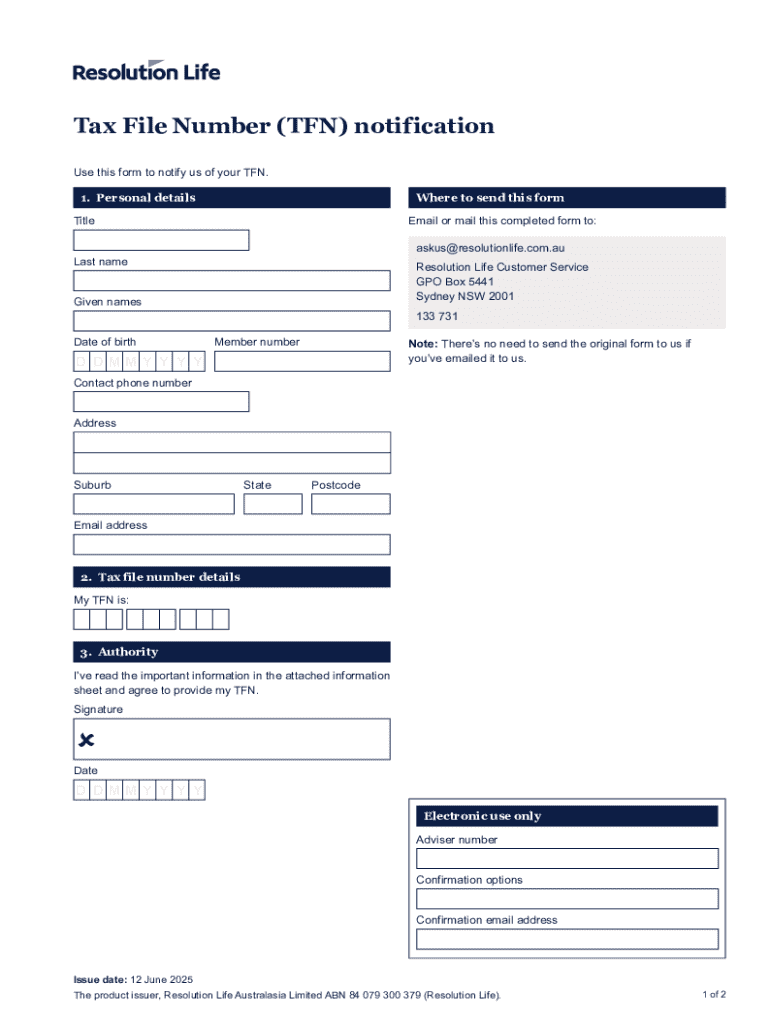

Step-by-step guide to completing the TFN form

Success in completing the TFN form starts with gathering necessary information. Before filling out the form, ensure you have the appropriate identification documents, such as a Driver's License or Passport, ready. Additionally, personal details, including your full name, address, and date of birth, are essential. The accurate representation of these details is crucial for the ATO to process your application without issues.

Next, you will access the TFN form. The ATO website provides the form, which can be conveniently downloaded. For an enhanced filling experience, pdfFiller allows you to access the TFN form in PDF format, making it easy to fill out electronically or print if needed. This platform also caters to mobile devices, ensuring necessary accessibility.

Completing the TFN form involves filling in several sections, including personal details and residency questions. Pay special attention to your answers regarding residency status, as it influences tax liabilities and obligations. For businesses, additional information about the type of business structure is required. Common pitfalls include errors in personal details and missing out on residency confirmations, which can delay processing.

Furthermore, using pdfFiller can optimize your filling experience. You can upload the TFN form directly to the platform, allowing you to edit and make necessary amendments on the go. This tool supports eSignatures, enabling quick submissions once the form is complete, and also facilitates collaboration if you're working in teams.

Submitting your TFN form

Once the TFN form is completed, the next step is submission. There are multiple methods to submit your form to the ATO. Online submission is the most efficient method, available through the ATO's official website. Ensure you follow any guidance provided on the site to make sure your application is correctly lodged. If you prefer traditional methods, mailing the form is straightforward as well; simply print the completed form and send it to the address provided by the ATO.

After submission, applicants can expect different processing times. While many TFN applications are processed quickly, some may take several weeks, particularly during peak tax periods. To check the status of your application, you can contact the ATO directly or follow any online guidelines available on their portal.

Managing your TFN information

After acquiring your TFN, managing it responsibly is essential. There may be instances when you need to update your TFN details, especially if your personal circumstances change, such as a name change due to marriage or relocation. Updating your information can be done by revisiting the TFN form and providing the new details. Utilizing pdfFiller can make this process smoother; you can easily modify and resubmit your updated form directly through the platform.

Moreover, safeguarding your TFN is crucial. Given the sensitive nature of the information, best practices include keeping digital records secure with password protection and avoiding sharing your TFN unnecessarily. If you suspect misuse or identity theft involving your TFN, report it immediately to the ATO and consider safeguarding strategies to mitigate any potential damage.

Common questions about the TFN form

Several inquiries commonly arise concerning the TFN form. A frequent question is whether you can apply for a TFN while overseas. The answer is yes; the ATO allows overseas applications, but you'll need to provide specific documentation regarding your identity and residency. Another common question involves the loss of a TFN; in such cases, you can retrieve your TFN by providing your personal details to the ATO. Notably, your TFN does not expire, so you do not need to renew it; once issued, it remains valid throughout your taxpayer life unless revoked.

If you require additional help regarding your TFN or the application process, contacting the ATO is advisable. Have your personal details and any correspondence related to your TFN at the ready to streamline your conversation.

Enhancing your document management with pdfFiller

Utilizing pdfFiller not only facilitates the completion of the TFN form but also enhances overall document management. It offers numerous features, including the ability to create, edit, and store documents in the cloud, which makes accessing important forms, like the TFN application, easy from any device and location. This centralized management of documents ensures that your crucial files are organized and accessible when needed.

In addition, pdfFiller includes tools for collaboration, allowing users to share documents with teams or with professionals who can assist in the completion or verification of forms. This flexibility extends to editing PDFs on the go or integrating with other platforms for a more efficient workflow, ensuring you stay organized in all your document dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax file number tfn?

Can I edit tax file number tfn on an iOS device?

Can I edit tax file number tfn on an Android device?

What is tax file number tfn?

Who is required to file tax file number tfn?

How to fill out tax file number tfn?

What is the purpose of tax file number tfn?

What information must be reported on tax file number tfn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.