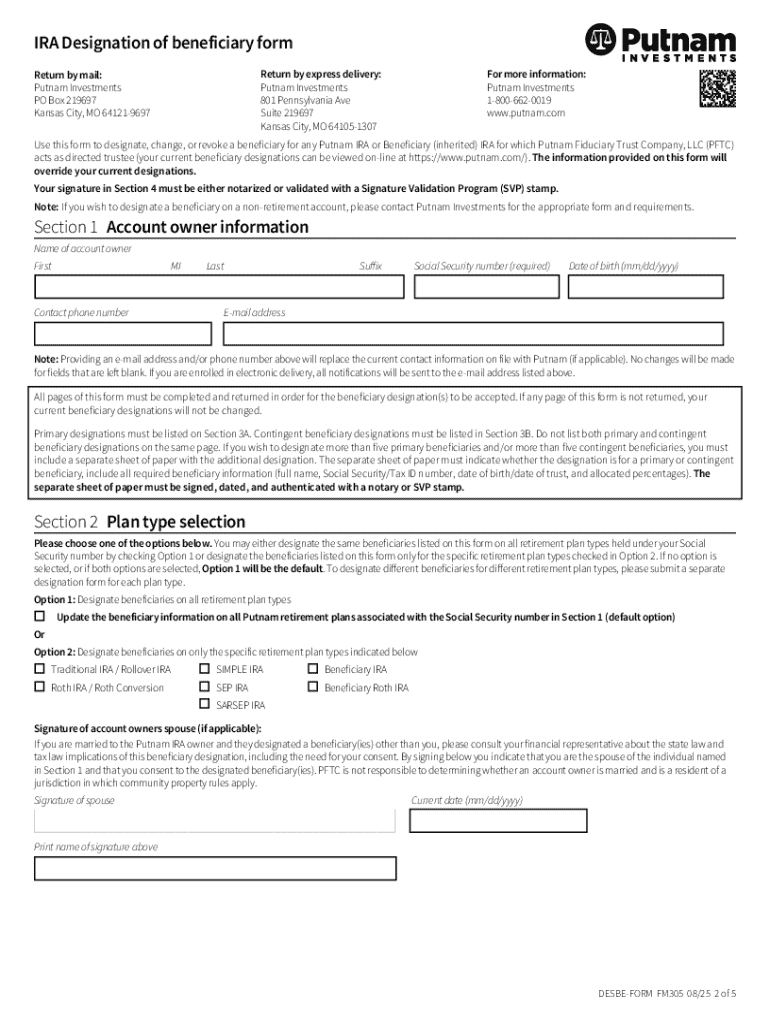

Get the free Ira Designation of Beneficiary Form

Get, Create, Make and Sign ira designation of beneficiary

Editing ira designation of beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira designation of beneficiary

How to fill out ira designation of beneficiary

Who needs ira designation of beneficiary?

IRA Designation of Beneficiary Form: How-to Guide

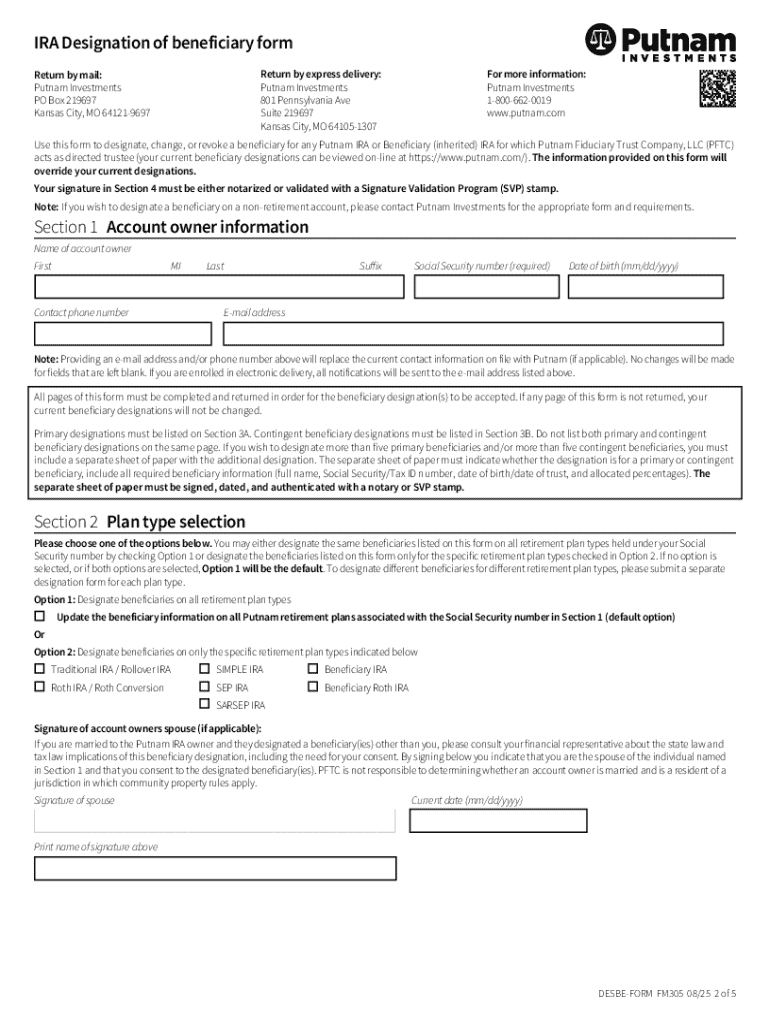

Understanding the IRA designation of beneficiary form

The IRA Designation of Beneficiary Form is a crucial document that allows you to specify who will inherit the assets in your Individual Retirement Account (IRA) after your passing. This form serves the purpose of ensuring that your retirement savings are allocated according to your wishes, eliminating any ambiguity that can arise in asset distribution.

Designating beneficiaries for your IRA is vital because it not only helps streamline the transfer of assets but also avoids the probate process, which can be time-consuming and costly. Furthermore, keeping your beneficiary designations updated ensures that your intentions are honored, especially during major life changes.

Types of beneficiaries

In the context of the IRA designation of beneficiary form, there are primarily two types of beneficiaries: primary and contingent. Primary beneficiaries are the first in line to inherit the IRA assets upon your death. Contingent beneficiaries serve as backup options who will inherit the assets if the primary beneficiaries are unable to do so.

You can designate individual beneficiaries—such as family members or friends—or entity beneficiaries, which can include trusts, charities, or estates. Choosing the right type of beneficiary is essential as it can influence everything from how assets are taxed to the handling of your estate’s financial obligations.

Reasons to use the IRA designation of beneficiary form

Using the IRA designation of beneficiary form allows for a seamless transition of assets without the delays associated with probate. When beneficiaries are clearly defined, they can access these funds quickly and without court intervention. This efficiency is particularly beneficial during emotionally difficult times, allowing loved ones to focus on healing rather than legal processes.

Life changes, such as divorce or the birth of a child, may necessitate updates to your original designations. Regularly reviewing your beneficiaries ensures that your assets go to those you intend to support. Additionally, tax implications can vary depending on the type of beneficiary, making it essential to consider how each designation could impact their financial situation.

Step-by-step instructions for completing the form

To properly complete your IRA designation of beneficiary form, follow these step-by-step instructions. First, gather the required information, including your personal details, account information, and specifics about your chosen beneficiaries such as their Social Security numbers and contact information. Having these details at hand will facilitate the process.

Next, fill out the form carefully. Make sure to accurately complete each section. Clearly specify your primary and contingent beneficiaries, indicating their relationship to you. After filling out the form, it is crucial to sign and date it to validate your intentions.

Submitting the form

Once your IRA designation of beneficiary form is completed, you must submit it according to your IRA custodian's guidelines. Some custodians may accept digital submissions while others may require paper forms to be sent via mail. To avoid any confusion, it is highly advisable to contact your IRA custodian to confirm the submission process and verify that your form has been processed correctly.

Best practices for managing beneficiary designations

Managing your IRA designation of beneficiary status should be an ongoing task rather than a one-time occurrence. Life changes demand that you regularly review and update your beneficiary designations, especially after significant events such as marriage, divorce, or the death of a designated beneficiary. Setting reminders for periodic reviews can prevent outdated information from causing complications in the future.

Additionally, it's important to communicate with your beneficiaries about their status. Discussing your decisions can help them understand their rights, obligations, and any potential tax implications related to inheriting your IRA assets.

Common questions and answers about the IRA designation of beneficiary form

One significant question individuals often ask is, 'What happens if I don’t designate a beneficiary?' In many states, the default rules will apply, which typically allows the estate to inherit the IRA. This can lead to additional complexities, including probate, delays, and potentially increased taxes.

Another common inquiry is, 'Can I change my beneficiary after submitting the form?' Yes, you can amend your beneficiary designations by completing a new IRA designation of beneficiary form. Ensure that you document these changes properly for future reference.

Utilizing pdfFiller for your IRA designation of beneficiary form

For an efficient and user-friendly approach to managing your IRA designation of beneficiary form, consider utilizing pdfFiller. This cloud-based platform allows you to edit PDFs seamlessly, which is particularly helpful when updating your forms. With its editing tools, you can customize sections to fit your specific needs.

Beyond editing, pdfFiller provides digital signing capabilities, ensuring your document complies with legal requirements. The platform also offers secure storage and sharing options, allowing you to keep your important documents organized and accessible.

Additional considerations when using the IRA designation of beneficiary form

When considering your IRA designation of beneficiary form, it's crucial to seek legal and financial advice, particularly if your situation involves complex family dynamics or substantial assets. Consulting professionals can provide tailored guidance that aligns with your specific circumstances, ensuring your designations fulfill your wishes effectively.

Additionally, state-specific regulations may impact how your designations are treated under the law. Therefore, it's advisable to familiarize yourself with local rules regarding beneficiary designations to ensure your documents adhere to these stipulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the ira designation of beneficiary in Gmail?

How do I edit ira designation of beneficiary on an iOS device?

Can I edit ira designation of beneficiary on an Android device?

What is ira designation of beneficiary?

Who is required to file ira designation of beneficiary?

How to fill out ira designation of beneficiary?

What is the purpose of ira designation of beneficiary?

What information must be reported on ira designation of beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.