Get the free Gift of Appreciated Securities Form

Get, Create, Make and Sign gift of appreciated securities

How to edit gift of appreciated securities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift of appreciated securities

How to fill out gift of appreciated securities

Who needs gift of appreciated securities?

Navigating the Gift of Appreciated Securities Form: A Comprehensive Guide

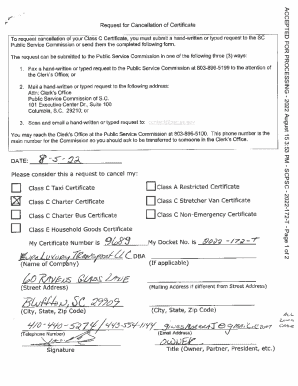

Overview of the gift of appreciated securities form

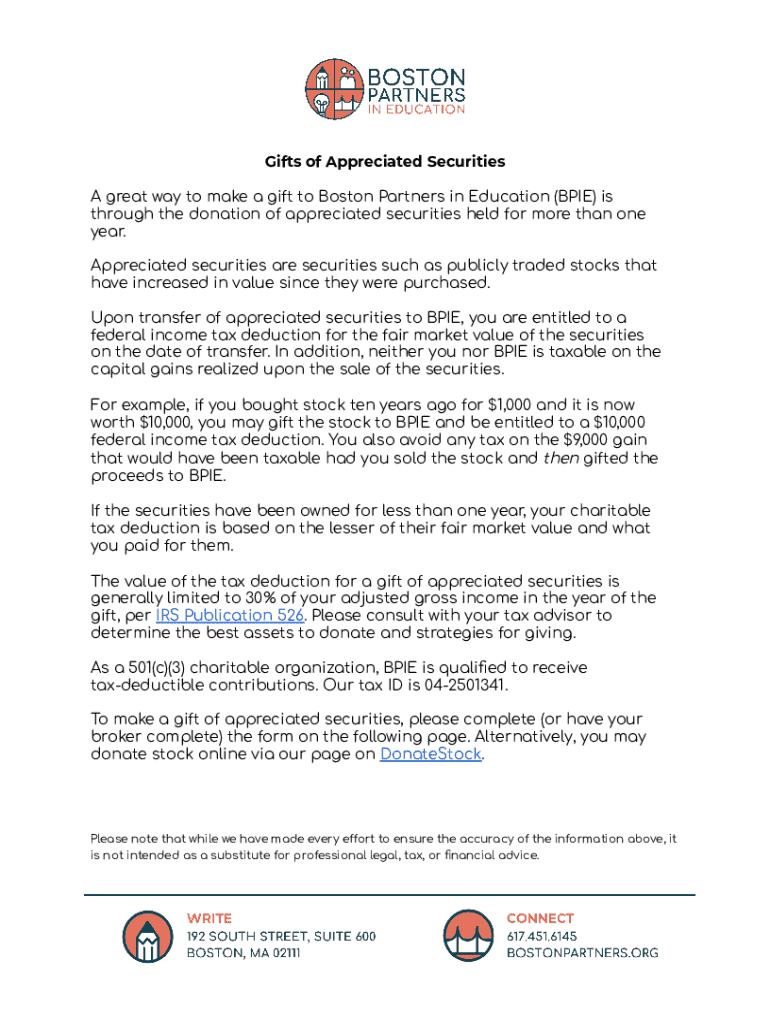

The Gift of Appreciated Securities Form is a crucial document designed for individuals who wish to donate appreciated securities—such as stocks, bonds, or mutual funds—to charitable organizations. The primary purpose of this form is to facilitate the tax-efficient transfer of ownership, enabling donors to capitalize on the benefits of their appreciated assets. By donating these securities, individuals not only contribute to worthy causes but also optimize their financial standing through potential tax deductions.

Donating appreciated securities is paramount for several reasons. Firstly, the act of giving helps sustain and grow nonprofit organizations. Secondly, from a financial perspective, when you donate the securities instead of selling them, you avoid capital gains taxes, further enhancing the tax efficiency of your charitable efforts. This form simplifies the process, ensuring that all necessary information is captured appropriately and facilitating a streamlined transaction.

It's essential to note that the tax benefits linked to the donation of appreciated securities can significantly influence the donor's tax situation. Charitable contributions often exceed the value of the securities at the time, and when handled correctly, donors can leverage these benefits effectively. Understanding the implications of this form can promote a more informed philanthropic strategy.

Key components of the gift of appreciated securities form

The Gift of Appreciated Securities Form is structured to capture specific information critical to processing the donation. It consists of four main components that ensure clarity and compliance with regulations.

Step-by-step guide to completing the gift of appreciated securities form

Completing the Gift of Appreciated Securities Form is a crucial step in executing a seamless donation. Below are the steps to ensure that you navigate the process effectively.

Reviewing and editing your gift of appreciated securities form

Once the form is completed, it’s important to review it thoroughly. pdfFiller offers editing tools that enable you to add notes and comments for clarity, ensuring that every detail is correctly captured before submission.

Utilizing these editing features not only improves understanding but also promotes collaboration. Engage with team members to discuss the details before finalizing the form. It’s crucial to adhere to IRS regulations to avoid complications. Hence, it’s advisable to ensure that all areas comply with the requirements set forth, particularly concerning tax documentation.

Common questions and answers

Understanding the nuances of gifting appreciated securities is vital for successful donations. Here are some common inquiries that may arise during the process.

How pdfFiller enhances your experience

pdfFiller enhances the process of completing and submitting the Gift of Appreciated Securities Form, making document management easier than ever. The platform's seamless eSigning functionality ensures that you can quickly sign your form electronically, eliminating the need for printing, scanning, or postage.

Additionally, pdfFiller allows you to access the form from anywhere, providing flexibility in document management. Secure cloud storage means that all your documents are safe, organized, and easily retrievable, providing peace of mind as you navigate your philanthropic efforts.

Success stories: donors making an impact

The impact of gifting appreciated securities is profound, with many donors sharing their success stories. Individual donors have recounted how this approach not only supported causes dear to them but also enhanced their financial positioning.

Testimonials underscore the emotional satisfaction and financial wisdom behind donating these types of assets. For instance, one donor shares that by gifting a portion of their stocks, they funded a scholarship that is now aiding several students, thus creating a tangible positive impact in their community. Case studies such as these highlight the importance and benefits of using the Gift of Appreciated Securities Form in philanthropic endeavors.

Contacting us for personalized support

For those seeking tailored guidance through the process of completing the Gift of Appreciated Securities Form, pdfFiller support is readily available. Whether you have tax-related queries or need assistance navigating the form, our expert team is here to help.

Reach out to our support team through our website, where you'll find various contact details. Personalized assistance ensures that all your questions are answered and that you have the support needed to optimize your donation strategy.

Conclusion: empowering your generosity

The Gift of Appreciated Securities Form is not just a piece of paper; it’s a tool that empowers your generosity and philanthropic efforts. By understanding its functionalities and implications, you can maximize both your charitable contributions and tax advantages.

Utilizing this form strategically allows donors to diversify their philanthropic efforts while focusing on their intent to create lasting change. Consider the significant impacts your contributions can make, and let pdfFiller streamline the process for a more seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift of appreciated securities in Gmail?

How can I edit gift of appreciated securities from Google Drive?

Can I create an electronic signature for signing my gift of appreciated securities in Gmail?

What is gift of appreciated securities?

Who is required to file gift of appreciated securities?

How to fill out gift of appreciated securities?

What is the purpose of gift of appreciated securities?

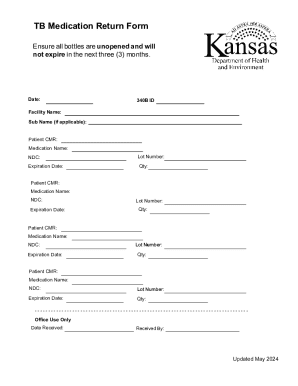

What information must be reported on gift of appreciated securities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.