Get the free 2025-2026 Verification Worksheet

Get, Create, Make and Sign 2025-2026 verification worksheet

How to edit 2025-2026 verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 verification worksheet

How to fill out 2025-2026 verification worksheet

Who needs 2025-2026 verification worksheet?

2 Verification Worksheet Form: A Comprehensive How-to Guide

Understanding the 2 verification worksheet form

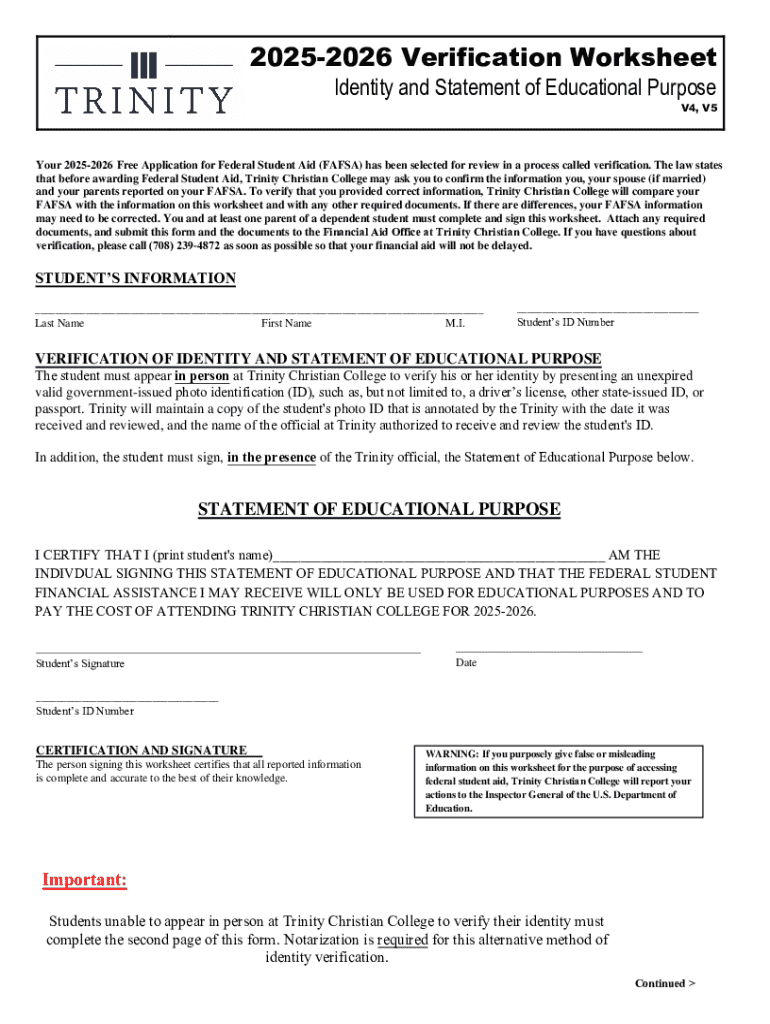

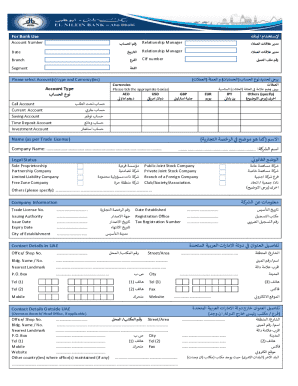

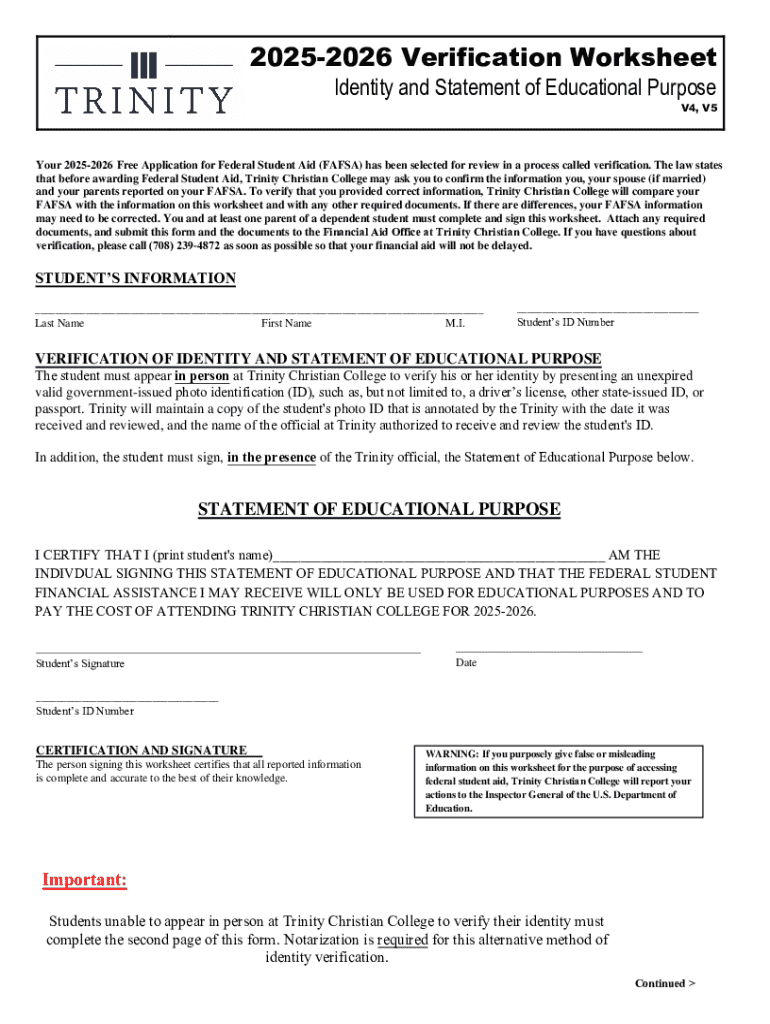

The 2 verification worksheet form is a crucial document used in the financial aid process for students seeking access to federal student aid. This form is designed to verify the accuracy of information reported on the Free Application for Federal Student Aid (FAFSA) and ensures that students receive financial support they qualify for. By understanding its definition and purpose, students and parents can navigate the financial aid landscape more effectively.

The importance of the verification worksheet cannot be understated. Without it, applicants may face delays in the processing of their financial aid, potentially jeopardizing their ability to attend college. Consequently, it is vital for applicants to understand who needs to complete this form, which typically includes students whose FAFSA is selected for verification by the U.S. Department of Education.

Key updates for the 2 academic year

The 2 academic year brings with it several critical updates to the verification process. Firstly, there have been changes in verification requirements, reflecting ongoing efforts to streamline and enhance the accuracy of determined eligibility for financial assistance. New regulations may dictate the type of documentation required, altering what students previously needed to submit.

Moreover, additional documentation may be necessary, depending on individual financial circumstances. Applicants must stay informed of important deadlines, as not adhering to them could lead to delays or complications in the financial aid review process.

Step-by-step guide to filling out the verification worksheet

Filling out the 2 verification worksheet requires attention to detail and organization. Here's a comprehensive guide on how to navigate this process efficiently.

Common corrections to avoid in the verification worksheet

Many applicants encounter errors when completing the verification worksheet. Common mistakes include failing to report household members accurately, miscalculating income information, or omitting required signatures. To prevent these issues, it’s helpful to double-check entries carefully before submission.

If errors are discovered after submission, applicants can usually address them by contacting the financial aid office at their institution, which may guide them through the correction process.

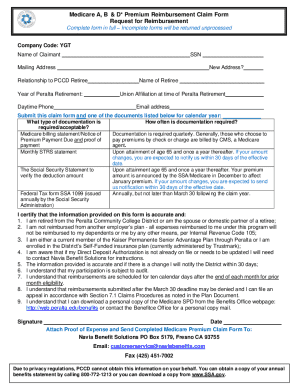

Subsidized and unsubsidized financial assistance programs

Understanding the differences between subsidized and unsubsidized financial assistance programs is pivotal for applicants. Subsidized loans are based on financial need, meaning the interest does not accumulate while the student is enrolled at least half-time. In contrast, unsubsidized loans accumulate interest from the time they are disbursed.

Verification plays a critical role in determining eligibility for these financial aid types. The verification process ensures that accurate financial data is presented, directly impacting the kind of financial awards a student may receive.

Policies and procedures related to verification

Each institution has its policies regarding verification, which can vary significantly from one school to another. Familiarizing oneself with these policies aides students in understanding the expectations set forth by their specific institution. Additionally, federal guidelines establish a baseline for compliance.

Failing to adhere to institutional verification requirements can result in consequences, such as a lack of financial aid or delays in processing, underscoring the importance of thoroughness in completing the worksheet.

Professional judgment (PJ) and its role in verification

Professional judgment is a special provision within the financial aid system that allows financial aid administrators to make adjustments to a student’s financial aid package based on unique circumstances. Situations such as significant variation in income or unforeseen family hardships may warrant a PJ review.

To request a PJ review, students are generally required to submit additional documentation demonstrating their circumstances, thus enhancing their eligibility for financial assistance.

Acceptable documentation for verification

Documenting income accurately is essential during the verification process. Acceptable documentation includes Adjusted Gross Income (AGI) figures from tax returns and W-2 forms from employers. Furthermore, family size must be substantiated with sufficient proof of household members.

In certain special circumstances, additional documentation may be required. This could encompass medical expenses or unusual family situations that impact financial standing.

Verification exclusions

Certain situations may lead to a waiver of verification requirements. Students with specific statuses, such as those who are military veterans or who receive certain types of assistance, may find themselves exempt.

To claim exclusions, students should converse with their financial aid office, which can provide guidance on the documentation required to verify their unique circumstances.

Frequently asked questions (FAQs)

Once the 2 verification worksheet form is submitted, students often want to know what to expect next. Typically, financial aid offices will review submitted documents, and students will receive updates on the status of their application. The timeframe for verification can vary, and students should manage their expectations accordingly.

For those with unique financial circumstances, reaching out to the financial aid office as early as possible is advisable, allowing for individual consideration.

Using pdfFiller to streamline the verification process

pdfFiller simplifies the process of managing the 2 verification worksheet. From document editing to eSign capabilities, pdfFiller offers robust tools that help students create, manage, and submit their forms without hassle. The cloud-based platform enables easy collaboration between families and financial advisors, facilitating necessary discussions and document sharing.

Features like customizable templates streamline the filling process while ensuring accuracy. Users can upload documents, add signatures, and keep everything organized from one platform, reducing stress and enhancing efficiency.

Final checklist before submitting your verification worksheet

Before pressing the submit button on the verification worksheet, students should ensure that all parts of the document are filled out completely. It's essential to confirm that all supporting documents are accurate and submitted alongside the worksheet.

Keeping copies of everything submitted is also vital for future reference. This not only aids in tracking the progress of financial aid applications but also serves as a safeguard should any issues arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025-2026 verification worksheet directly from Gmail?

Can I create an electronic signature for the 2025-2026 verification worksheet in Chrome?

Can I create an electronic signature for signing my 2025-2026 verification worksheet in Gmail?

What is 2026 verification worksheet?

Who is required to file 2026 verification worksheet?

How to fill out 2026 verification worksheet?

What is the purpose of 2026 verification worksheet?

What information must be reported on 2026 verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.