Get the free Lb56f

Get, Create, Make and Sign lb56f

Editing lb56f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lb56f

How to fill out lb56f

Who needs lb56f?

Understanding the LB56F Form for Minnesota Farmers

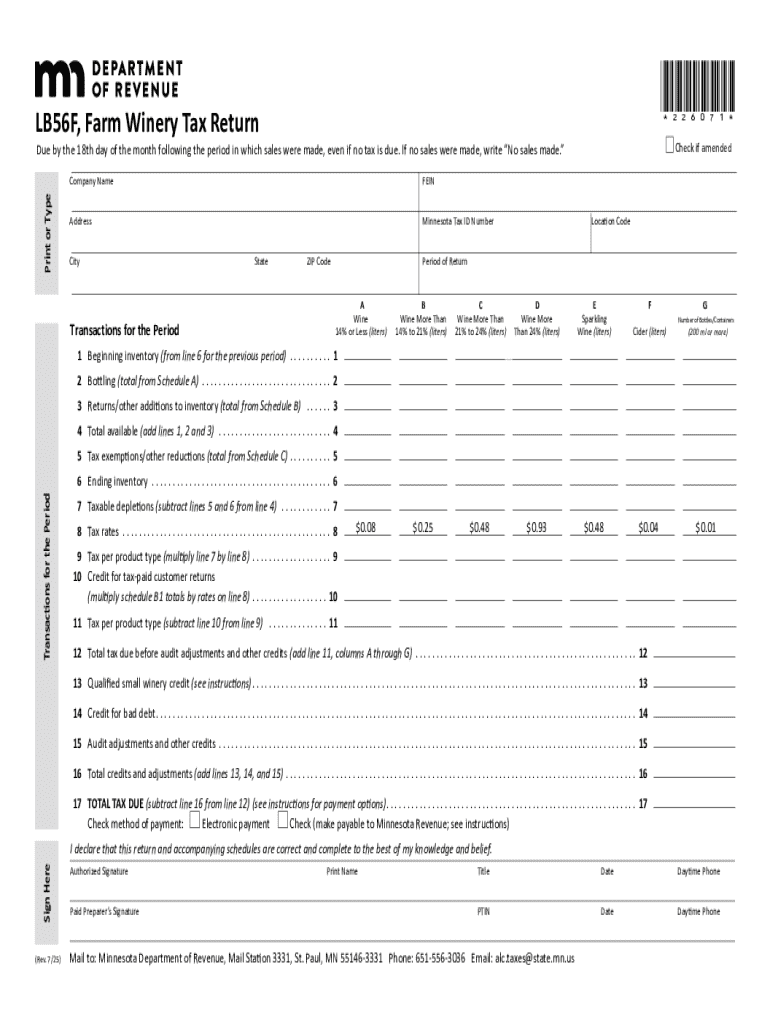

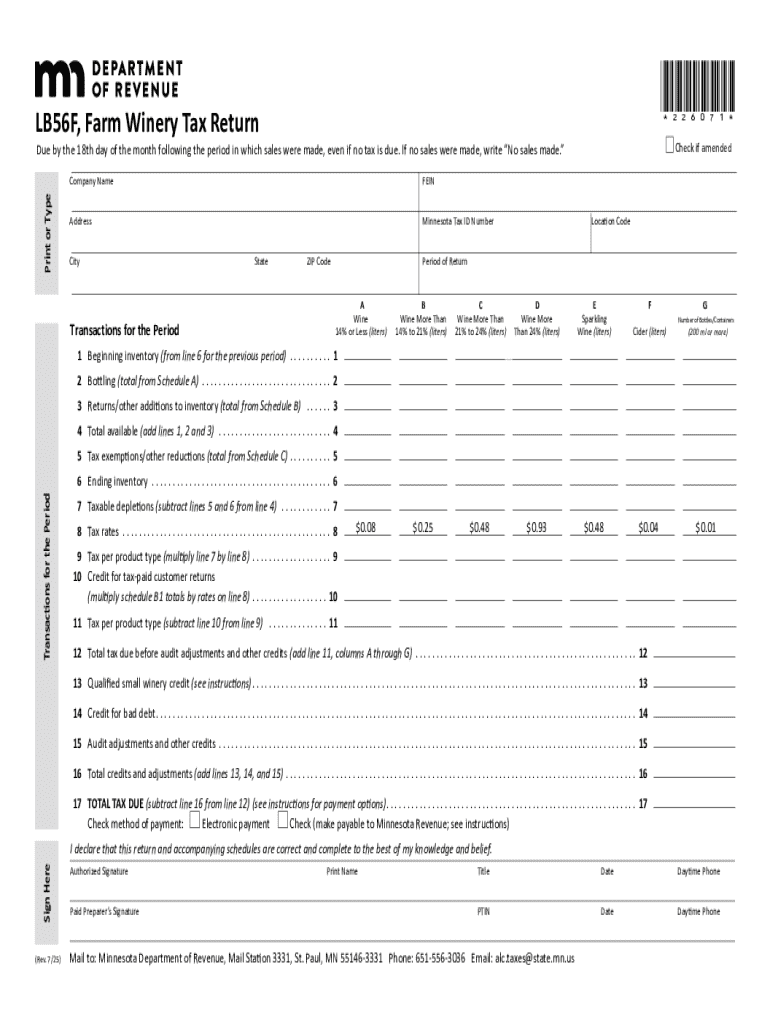

Overview of LB56F form

The LB56F form is a vital document for farmers in Minnesota. It serves as a specific tax return form designed to report agricultural income and expenses to the Minnesota Department of Revenue. The form's importance lies in its capacity to accurately reflect a farm's financial situation, ensuring compliance with state tax regulations and enabling potential deductions that are crucial for farm sustainability.

Farmers must utilize the LB56F form to report their operations effectively. This includes detailing income earned from crops and livestock, as well as any associated costs incurred throughout the farming season. By accurately filing this form, farmers not only clarify their financial status but also harness the deductions available to them, which can significantly alleviate tax burdens.

Who needs to use the LB56F form?

The LB56F form targets several key groups within the agricultural sector in Minnesota. Firstly, individual farm owners who operate independently should embrace this form to accurately depict their income and expenses related to agricultural activities. Secondly, agricultural businesses, which may involve partnerships or corporations, are required to submit the LB56F form to maintain compliance with state tax obligations.

Moreover, tax professionals assisting farm clients must be familiar with the LB56F form to provide accurate guidance and support in the tax filing process. It's essential that anyone filing the LB56F meets specific eligibility criteria, such as generating farm income or operating as a recognized agricultural entity.

Key features of the LB56F form

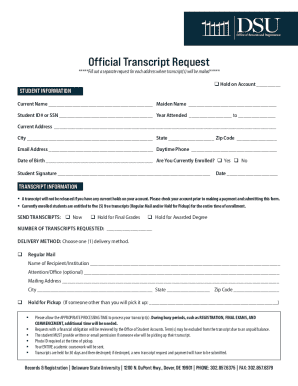

The LB56F form consists of essential sections that facilitate proper reporting. The Personal Information section gathers vital details about the farmer or business entity, ensuring clear identification. The Income Details section requires farmers to specify various income sources such as crop sales, livestock sales, and any other agriculture-related revenue.

Moreover, the Expense Reporting section allows for the inclusion of deductible costs, which could encompass equipment purchases, seed costs, and feed expenses. Finally, the Tax Computation area enables farmers to summarize their total income and deductions, leading to the final tax obligation. This structure differentiates the LB56F from other common tax forms by focusing specifically on agricultural income and expenses.

Step-by-step guide to completing the LB56F form

Completing the LB56F form requires dedication and attention to detail. Begin by gathering all necessary information. A checklist of documents should include receipts, previous tax returns, and records of income and expenses related to farming activities.

Once you have the required documentation, proceed to fill out the Personal Information section. Here, you'll enter your name, business name (if applicable), address, and contact information. After that, report all sources of income, ensuring to include diverse types such as revenue from crop sales and livestock sales.

Next, document your expenses by itemizing deductible costs that help reduce your taxable income. Common deductible expenses include seed purchases, fertilizer, equipment maintenance, and worker wages. Then, review the Tax Computation section, which will help you summarize your financials and determine your tax obligation before finalizing the form for submission.

Editing and managing your LB56F form with pdfFiller

Using pdfFiller simplifies the process of managing your LB56F form. This platform offers features for easy editing, allowing users to input necessary details accurately and seamlessly. It also provides options for cloud storage, enabling farmers and tax professionals to access documents from anywhere, ensuring that your important files are never out of reach.

In addition to editing, pdfFiller includes interactive tools for annotating and commenting directly on the form, which is particularly helpful for tax professionals collaborating with clients. Features such as these allow for collaborative editing, ensuring all stakeholders are on the same page and minimizing errors during the filing process.

Signing and submitting the LB56F form

For efficiency, electronic signatures are becoming increasingly important as they streamline the submission process. Using pdfFiller, you can easily eSign your LB56F form, enhancing security and reducing the time spent on traditional paper processes. This integration of technology into tax filing not only speeds up the process but also increases accuracy.

After signing the document, you have several submission options available. You can directly submit the completed form to the Minnesota Department of Revenue electronically, through mailing it, or even by visiting a local tax office. Each method ensures that your documents reach the correct authorities in a timely manner.

Common FAQs about the LB56F form

A common question surrounding the LB56F form is what to do if a mistake is made while filling it out. It’s crucial to rectify any errors as quickly as possible to avoid potential issues with the Minnesota Department of Revenue. In such cases, farmers should contact the department for guidance on how to amend their filing.

Another prevalent concern is discrepancies in reported income. If there’s a significant difference from what was filed previously or expected, it should be clarified promptly to prevent penalties. Lastly, the consequences of not submitting the LB56F form can range from fines to increased scrutiny from tax authorities, making it essential for farmers to adhere to filing deadlines and requirements.

Related tax forms and documents

In addition to the LB56F form, there are several other tax forms that farm operators should be aware of. One essential document is the Form 1040 Schedule F, which reports profit or loss from farming activities. This form complements the LB56F by providing broader financial context for the farmer's overall tax return.

Additionally, farm inventory forms assist operators in tracking the status and value of their agricultural products throughout the year. Understanding these related documents can provide valuable insights into tax obligations and help maximize available deductions.

Additional resources for farm taxes

Farmers can benefit from various IRS publications that provide detailed guidance on agricultural tax reporting, including IRS Publication 225, which specifically addresses farmers and their unique tax considerations. These resources can help demystify the filing process and clarify eligibility requirements.

Utilizing professional tools and guides for farm financial management is crucial for optimizing tax filings. Moreover, accessing state-specific tax assistance programs can further enhance compliance and potentially uncover new deductions and credits available for farmers operating within Minnesota.

Tips for maximizing your tax deductions

Practicing diligent record-keeping is vital for farmers looking to maximize tax deductions through the LB56F form. Retaining receipts and documenting transactions throughout the year not only facilitates an accurate representation of income and expenses but also supports claims for deductions during audits.

It's advisable to utilize professional tax assistance, especially for complex farming operations, to uncover all available deductions and ensure compliance with state regulations. Engaging a tax professional with experience in agricultural tax law can yield significant benefits by identifying tax strategies that align with farm operations.

Real-life case studies of successful LB56F form filings

Numerous farm owners have experienced the benefits of accurate LB56F form filings. For instance, a local dairy farm reported substantial savings by correctly documenting expenses that fell under deductible categories. This strategic approach not only minimized tax liability but also provided a clearer overview of the farm's financial health.

Another case involved a family-run vegetable farm that utilized the LB56F form to identify inefficiencies in expense reporting. Post-filing, they restructured their financial practices, leading to enhanced profitability and more informed decision-making. Such examples underscore the importance of meticulous preparation and understanding tax filing requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit lb56f from Google Drive?

How can I send lb56f for eSignature?

How do I complete lb56f online?

What is lb56f?

Who is required to file lb56f?

How to fill out lb56f?

What is the purpose of lb56f?

What information must be reported on lb56f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.