Get the free List of Creditors

Get, Create, Make and Sign list of creditors

How to edit list of creditors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out list of creditors

How to fill out list of creditors

Who needs list of creditors?

Understanding and Utilizing the List of Creditors Form: A Comprehensive Guide

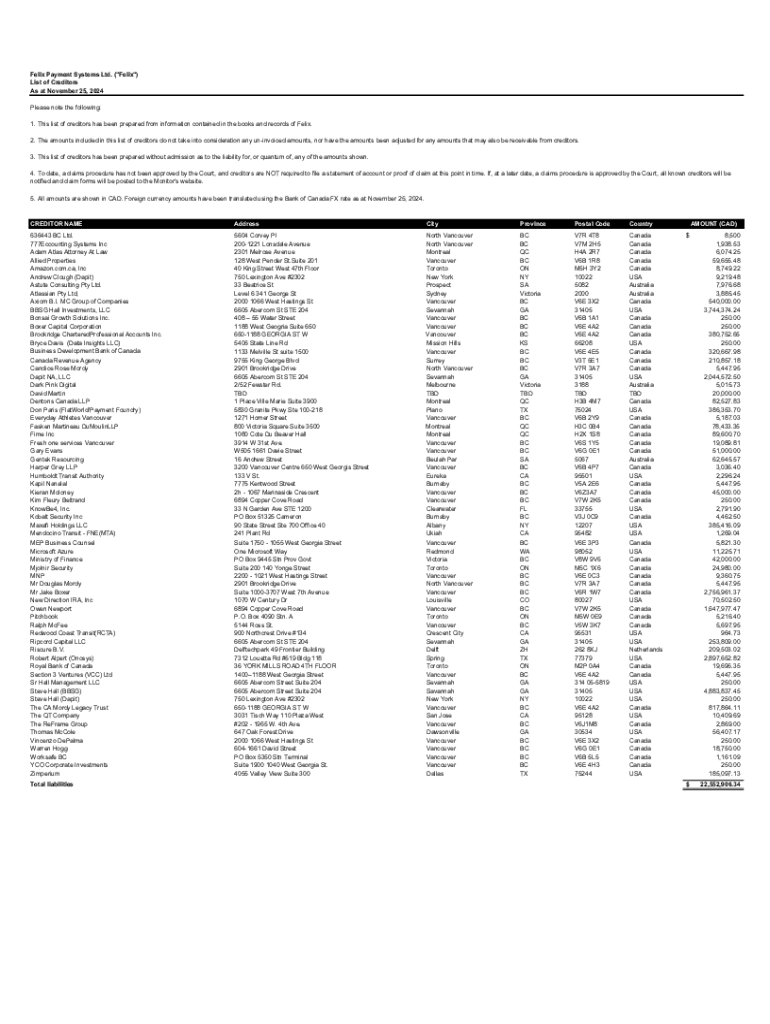

Understanding the list of creditors form

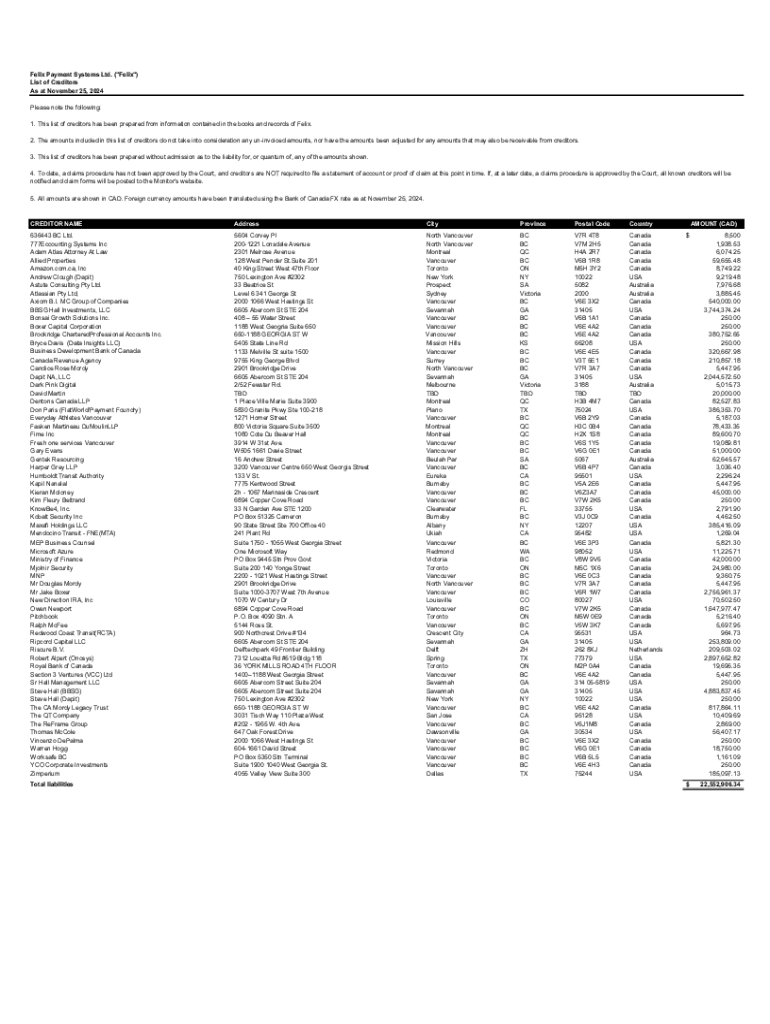

The list of creditors form is a vital document often encountered when individuals or businesses face financial challenges, particularly during bankruptcy proceedings. This form serves a dual purpose: it consolidates information about all creditors a debtor owes money to and ensures transparency in the financial landscape. By accurately detailing these entities, individuals and businesses can effectively manage their financial obligations and facilitate necessary legal processes.

For both individuals and businesses, the importance of maintaining a comprehensive list of creditors cannot be overstated. It acts as a key tool for financial management and may influence how debtors negotiate repayment terms or handle legal disputes. Moreover, this list is not just a mere formality; it's a critical component in legal proceedings, ensuring that all parties involved are informed and considered.

Who needs to fill out the list of creditors form?

Various individuals and entities may find themselves needing to fill out the list of creditors form. Primarily, those undergoing bankruptcy proceedings, whether personal or corporate, must disclose their creditors. This includes individuals facing overwhelming personal debts, small business owners struggling to stay afloat, or corporate professionals aiming to overcome financial hurdles.

What information is required?

Filling out the list of creditors form requires specific information that is crucial for effective financial management. To provide a clearer view of one's financial obligations, users must compile basic details about each creditor. This typically includes the creditor's name, address, and contact information. Additionally, it is essential to categorize types of debts being incurred, distinguishing between secured and unsecured debts since this classification can significantly impact financial strategy.

Documentation supporting the claims listed in the form is also critical. Having accurate records can simplify future negotiations with creditors and expedite legal processes. Common mistakes often arise during the completion of this form, leading to incomplete entries or misclassification of creditors, both of which can lead to complications in managing debts.

Step-by-step guide to filling out the list of creditors form

Filling out the list of creditors form can be a straightforward process when approached with organization and preparedness. Here’s a step-by-step guide to help streamline the completion of this form.

Step 1: Gather necessary documentation

Before accessing the form, gather all relevant documentation. This includes bills, outstanding loan agreements, and any legal notices from creditors. Having this information on hand will facilitate accurate entries and prevent common mistakes.

Step 2: Access the form on pdfFiller

Navigate to the pdfFiller website and access the list of creditors form. Utilizing pdfFiller's intuitive interface, you can easily find the template needed. The platform allows for efficient navigation and retrieval of your forms from anywhere.

Step 3: Input your creditor information

Begin entering your creditor details as required. It often helps to use templates provided by pdfFiller for accuracy and efficiency. Fill in all sections carefully, ensuring that no creditors are overlooked.

Step 4: Review and edit your entries

After entering the data, take time to review each entry. Accurate proofreading is pivotal as errors may lead to delays or legal issues. pdfFiller provides tools for easy editing, allowing you to tweak any mistakes before finalizing the document.

Step 5: Finalize and save your form

Complete the filling process by ensuring all details are correctly inputted. When you are satisfied, choose the appropriate saving options provided by pdfFiller, allowing for easy access later on.

Tools and features of pdfFiller for document management

pdfFiller offers various tools and features that simplify managing the list of creditors form. The cloud-based nature of pdfFiller allows you to access your documents anytime, anywhere, making it convenient for working professionals and individuals alike.

Collaboration features are particularly useful for teams that may be working on financial management together. The platform encourages teamwork by enabling multiple users to contribute and edit the document simultaneously.

eSignature integration

Many legal documents require signatures, and pdfFiller's eSignature integration allows users to electronically sign the form with ease. This eliminates the need for printing and scanning, thus streamlining the process further.

Document sharing options

Once your List of Creditors Form is complete, sharing it becomes a breeze with pdfFiller. Whether you need to send it to a lawyer, a financial advisor, or creditors themselves, the platform provides multiple sharing options for your convenience.

Frequently asked questions (FAQs)

Navigating the waters of creditor management can raise several questions. Here’s a breakdown of common inquiries regarding the list of creditors form.

What if 've forgotten a creditor?

Forgetting a creditor can have serious repercussions. If you realize you've neglected to list one, it's essential to amend the form as soon as possible. Ensuring that all creditors are accurately recorded helps maintain transparency with the court and can prevent future disputes.

How to handle disputes with creditors?

Disputes with creditors can arise for various reasons, such as incorrect amounts owed or misunderstanding of terms. It’s important to communicate openly with creditors, present your records, and if necessary, seek mediation. Utilizing the list of creditors form as a foundation can help facilitate these discussions.

Use cases for the list of creditors form beyond bankruptcy

Beyond bankruptcy, the list of creditors form can serve as a resource for individuals and businesses assessing their financial health. For example, during a business acquisition, potential buyers must understand the liabilities involved. Similarly, individuals setting personal finance goals can benefit from knowing their total debts listed clearly.

Best practices for managing your creditors

Effectively managing creditors goes beyond creating the list of creditors form. Best practices involve consistent tracking and updating of creditor information as situations evolve. This proactive approach not only aids in financial clarity but also empowers individuals and businesses to address issues before they escalate.

Maintaining updated records

Keeping current records of all creditor information is vital. Leverage digital tools, such as pdfFiller, to manage these records, ensuring easy access and adjustments when necessary. Scheduled reviews of your list can provide insights into your financial situation and readiness to take control.

Understanding your rights as a debtor

Every debtor possesses rights protected by law. Familiarizing oneself with these rights is instrumental in negotiating with creditors. Legal protections against harassment or undue pressure should be well understood by anyone managing debts.

How to avoid common pitfalls in creditor management

To sidestep pitfalls, it's critical to address outstanding debts promptly, communicate openly with creditors, and maintain an organized documentation system. Proactive debt management can alleviate anxiety and pave the way for financial recovery. Individuals should also consider utilizing tools such as pdfFiller for centralizing their financial documentation, further supporting a comprehensive understanding of their obligations.

Utilizing pdfFiller for future document needs

pdfFiller exists not only for the list of creditors form but offers various templates that can be indispensable for financial management. This platform provides resources such as loan agreements, termination letters, and other essential documents that users can easily adapt.

Beyond the list of creditors form: Other useful templates

Users can leverage pdfFiller for forms spanning multiple purposes. From civil litigation templates to employment contracts, having a diverse range of document templates helps individuals manage legal documentation effectively.

Leveraging interactive tools on pdfFiller

The interactive tools available on pdfFiller, such as form analytics and document tracking, empower users to analyze their document management workflows. These features can assist users in determining how and where to allocate their resources effectively.

The importance of digital solutions in document management

In an age where efficient document management solutions are imperative, pdfFiller stands out as a responsive platform that adapts to user needs. The shift toward digital documents offers enhanced security, improved collaboration, and increased accessibility, thereby simplifying users' lives and enhancing productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify list of creditors without leaving Google Drive?

Can I create an electronic signature for the list of creditors in Chrome?

How do I fill out list of creditors using my mobile device?

What is list of creditors?

Who is required to file list of creditors?

How to fill out list of creditors?

What is the purpose of list of creditors?

What information must be reported on list of creditors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.