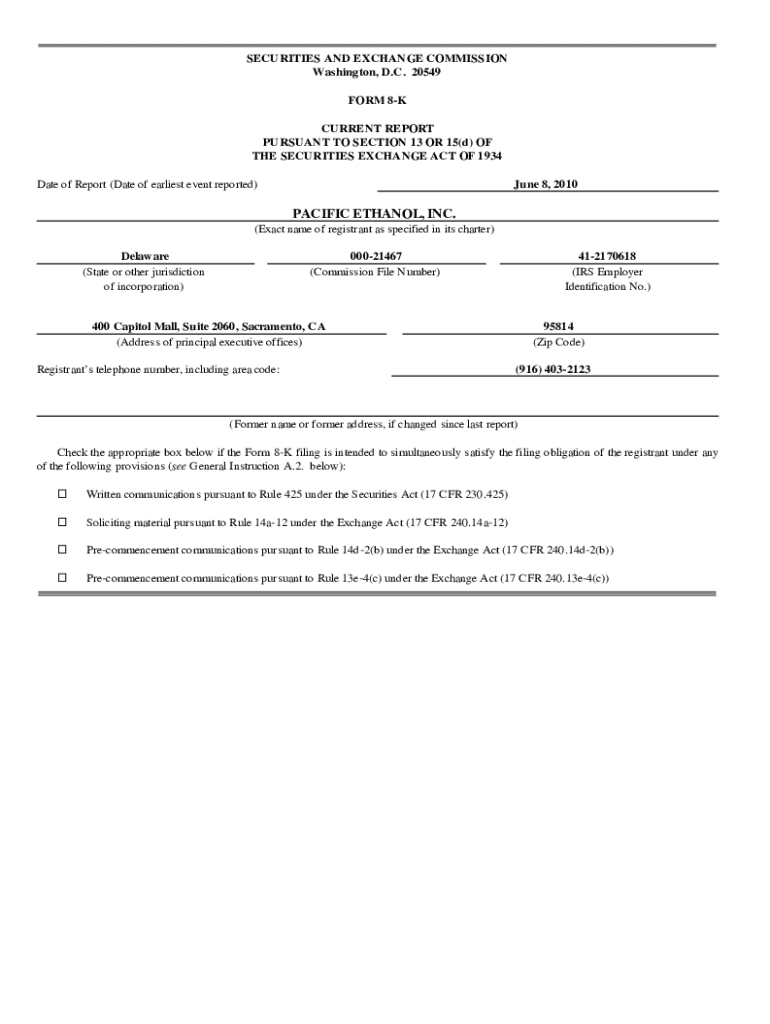

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Form: A Comprehensive How-To Guide

Understanding the 8-K form

The Form 8-K is a crucial document required by the U.S. Securities and Exchange Commission (SEC) that companies use to report major events affecting their financial condition or operations. Unlike more comprehensive filings such as the Form 10-K or Form 10-Q, which are typically submitted on a regular basis, the 8-K is triggered by specific corporate events, making it an essential tool for transparency and timely disclosure.

The significance of the Form 8-K lies in its immediacy; it provides stakeholders, including investors and analysts, with pertinent information as events unfold. By contrasting it with other SEC forms, such as Form 10-K, which encompasses an entire fiscal year's performance, and Form 10-Q, which covers quarterly updates, the 8-K distinctly thrives on urgency.

When is Form 8-K required?

A Form 8-K must be filed in circumstances that could significantly impact a company's operations or financial standing. These scenarios include, but are not limited to, major corporate events such as acquisitions, mergers, bankruptcy, the departure of key executives, and significant changes in financial condition. Each event mandates a timely response, as the SEC requires companies to file an 8-K within four business days of the triggering event.

The timeline surrounding the submission of Form 8-K is critical for compliance. Companies must stay vigilant for any occurrences that necessitate reporting and ensure their filings accurately reflect the time of the event to prevent legal complications. A robust internal mechanism for monitoring such events can streamline this process.

Structure of a Form 8-K

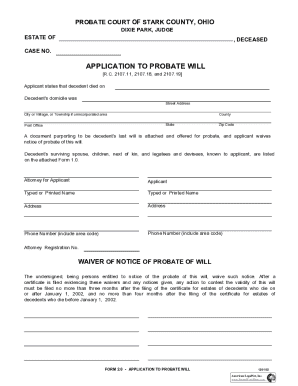

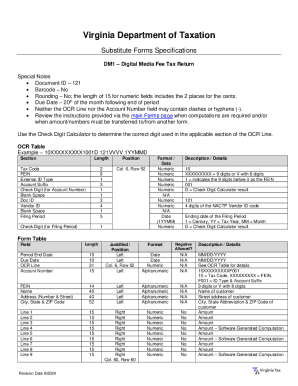

The structure of a Form 8-K is organized to facilitate straightforward reporting of specific types of information. The form includes item numbers that categorize the nature of the report. For instance, Item 1.01 covers the entry into a material agreement, while Item 2.02 pertains to the results of operations and financial condition. Each item requires distinct types of information and mandates that certain disclosures be clearly articulated.

The importance of each section cannot be overstated, as the specificity aids both the reporting company and the stakeholders in understanding the nature of the events reported. For example, Item 4.01 requires a company to disclose a change in its certifying accountant, which is vital for maintaining investor trust. Furthermore, the effective presentation of this information can enhance clarity for readers, ensuring that they can quickly grasp the implications of each reported event.

Filing an 8-K: Step-by-Step Guide

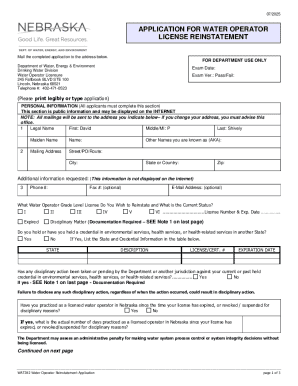

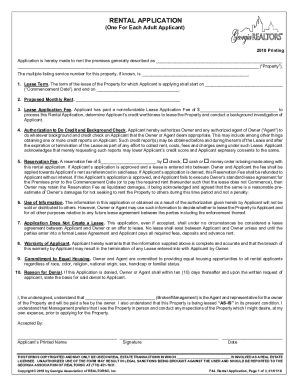

Preparing for the filing of a Form 8-K begins with understanding your company’s reporting obligations. It’s essential to gather relevant data and documentation to accurately reflect the event being reported. The process initiates with identifying the correct items that apply to the specific event, ensuring alignment with SEC requirements.

Once you’ve identified the applicable items, proceed to complete the Form 8-K online, using the SEC’s EDGAR filing system, or compile the necessary information in PDF format. Carefully include required signatures and authorizations from company officials, as these lend credibility to the submission. Additionally, be mindful to avoid common errors, such as incorrectly identifying item numbers or misrepresenting event details, which can lead to compliance issues.

Tips for efficiently completing Form 8-K

Utilizing templates when completing the Form 8-K can streamline the process, ensuring that all necessary fields are addressed. Various online resources offer standardized templates that align with SEC requirements, considerably simplifying the filing. Additionally, employing document editing and e-signature tools can aid in assembling the document efficiently.

Best practices for internal collaboration are crucial, as multiple departments may need to contribute to the information presented in the 8-K. Establishing a clear communication channel and defining roles within teams will minimize the risks of oversight or miscommunication during the preparation of the form.

Analyzing and reading the content of an 8-K form

When presented with an 8-K, investors and analysts must know how to interpret the disclosures effectively. Context plays a pivotal role; understanding the circumstances surrounding the filing helps to differentiate between significant and routine updates. Companies may frame disclosures with various intentions, and parsing through the language used can reveal their broader implications.

Additionally, stakeholders should remain vigilant for red flags within the content, such as vague statements, lack of detail, or language that might indicate underlying issues. Critical indicators may include timing, the nature of the event, and potential implications for future performance or governance.

Benefits of timely filing Form 8-K

Timely filing of Form 8-K enhances corporate transparency, a vital component in maintaining investor confidence. When companies communicate significant developments promptly, they create an environment of trust and accountability, crucial for attracting and retaining investors. Furthermore, these filings provide insights into management’s decision-making and strategies, allowing stakeholders to make informed decisions.

The impacts on investor relations are profound; proactive communication can differentiate a company in a crowded market while minimal delays can result in misinformation or speculation that could harm the company's reputation. Legal compliance with SEC reporting requirements also reduces the risk of penalties or adverse regulatory actions.

Industries most affected by 8-K filings

Certain industries may experience heightened sensitivity to 8-K filings, particularly those undergoing significant regulatory scrutiny, such as pharmaceutical, energy, and financial services sectors. For instance, a pharmaceutical company announcing a critical drug trial result may see immediate market reactions, influencing stock prices and investor sentiment.

Case studies highlight the importance of 8-K disclosures; incidents like mergers in the tech sector often trigger rapid market responses, emphasizing the need for companies to utilize 8-K filings to manage stakeholder perceptions effectively. The role of market responses to 8-K reports showcases the tension between compliance and strategic communication in corporate governance.

Frequently asked questions about Form 8-K

A common concern among companies is what happens if they miss the filing deadline for an 8-K form. Failure to file within the prescribed time frame may result in sanctions from the SEC, including fines and other legal repercussions. Hence, it is critical for companies to maintain vigilant internal procedures to monitor events that require 8-K filings.

Stakeholders interested in accessing filed 8-K forms can easily do so through the SEC’s EDGAR database. These filings are publicly available and serve as a crucial resource for investors and analysts alike. Understanding the distinction between 8-Ks and other SEC filings can also clarify how disclosures fit within the broader regulatory landscape, enhancing the interpretative capability of interested parties.

Staying updated on changes to 8-K filing requirements

Staying abreast of changes in 8-K filing requirements is essential for companies looking to maintain compliance. Recent regulatory updates may affect what events require disclosure, so it’s vital to consult reliable resources regularly. The SEC usually announces changes directly on its website, and various financial news outlets highlight these updates.

Utilizing tools or subscribing to services that offer alerts about regulatory changes provides companies with the ability to adapt quickly. Moreover, continuous education in best practices surrounding 8-K filings ensures that teams remain proficient and compliant in an ever-evolving environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 8-k online?

How do I make changes in form 8-k?

Can I create an eSignature for the form 8-k in Gmail?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.