Get the free Agricultural Employer Wage Statement

Get, Create, Make and Sign agricultural employer wage statement

How to edit agricultural employer wage statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out agricultural employer wage statement

How to fill out agricultural employer wage statement

Who needs agricultural employer wage statement?

Comprehensive Guide to the Agricultural Employer Wage Statement Form

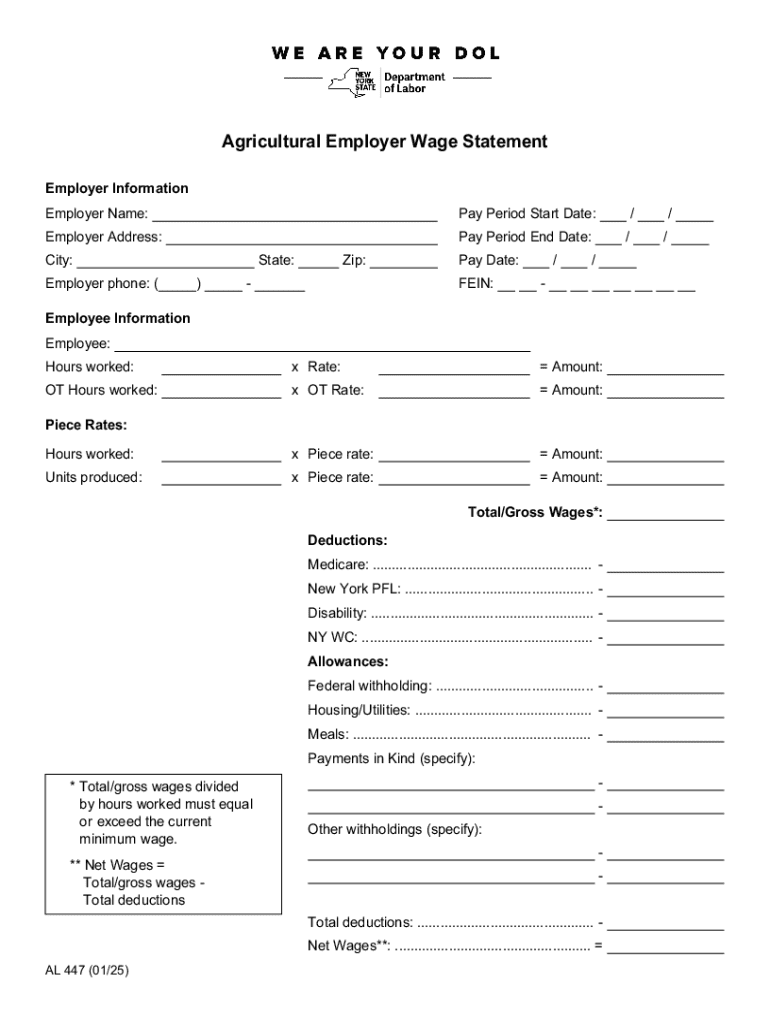

Overview of agricultural employer wage statement form

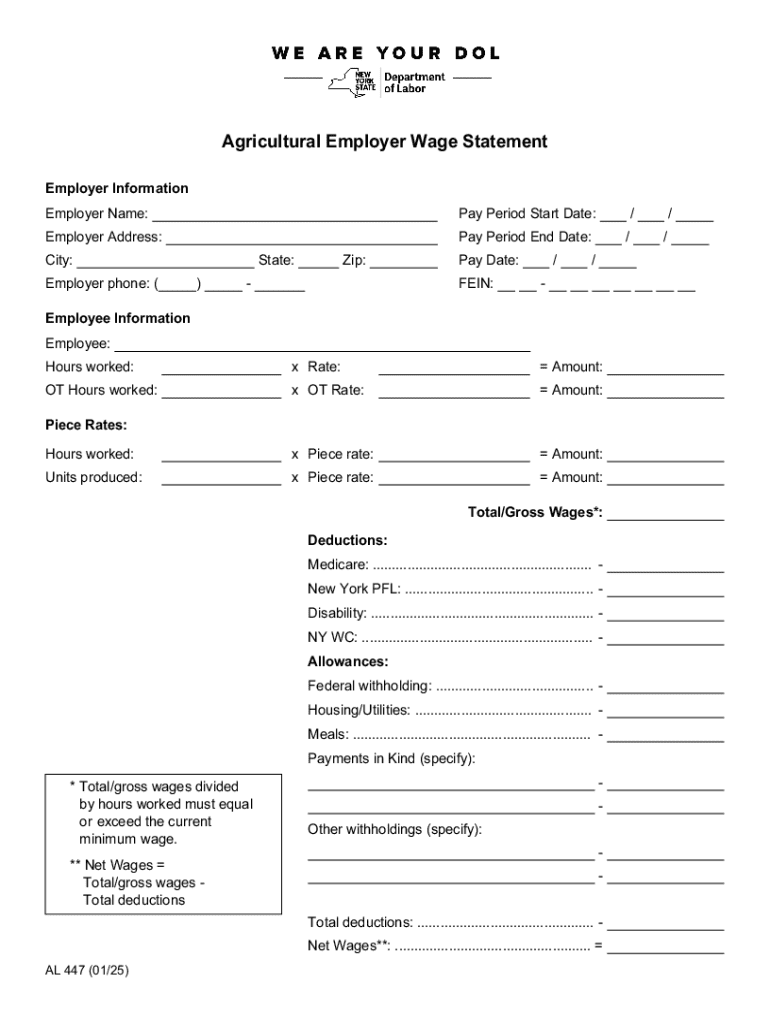

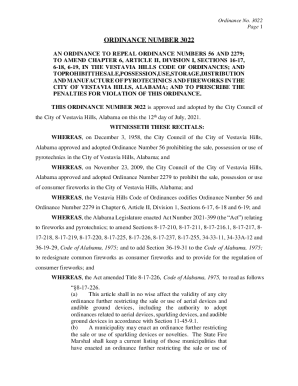

The agricultural employer wage statement form is a critical document designed to provide an official account of wages paid to employees within the agricultural sector. This form serves multiple purposes, primarily ensuring transparency between employers and employees regarding remuneration and benefits.

In the context of agricultural employment, this wage statement is essential for record-keeping, tax reporting, and compliance with labor laws. Employers are legally obligated to present accurate and timely wage information to their workers, fostering a trustworthy relationship and meeting statutory requirements.

Who should use the agricultural employer wage statement form?

The agricultural employer wage statement form is primarily utilized by agricultural employers who need to provide detailed wage information to their employees. This includes individual farms, agricultural companies, and cooperative associations that employ laborers for various agricultural tasks.

Employees in the agricultural sector also benefit from this form, as it outlines essential details about their earnings and deductions. Moreover, government agencies and labor organizations rely on these statements for monitoring compliance with employment standards, ensuring farmers adhere to wage laws, and resolving disputes related to pay.

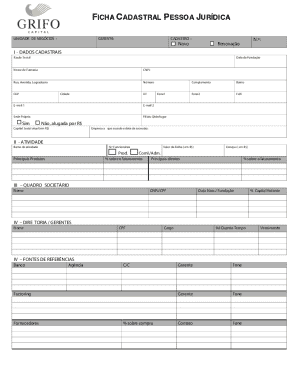

Key components of the agricultural employer wage statement form

Understanding the key components of the agricultural employer wage statement form is crucial for both employers and employees. The form typically consists of several sections that capture essential information regarding employer and employee details, wage specifics, and deductions.

Each part of the form plays a vital role in presenting a comprehensive overview of an individual's earnings and the circumstances surrounding payment.

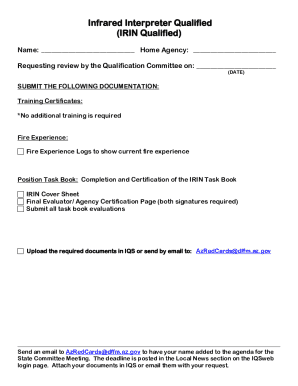

How to fill out the agricultural employer wage statement form

Filling out the agricultural employer wage statement form accurately is essential for effective communication between employers and employees. To ensure clarity and compliance, a step-by-step approach can be beneficial.

Begin by gathering all necessary information related to the employee’s wages and hours worked, along with the employer’s details. Each section needs to be completed meticulously to avoid errors which could lead to misunderstandings or compliance issues.

Editing and formatting your agricultural employer wage statement

Using tools such as pdfFiller significantly enhances the process of editing and formatting your agricultural employer wage statement form. Users can take advantage of various features while ensuring the document meets their specific brand guidelines.

Adding branding elements such as company logos and contact information can personalize the document, improving its professionalism. Formatting is also crucial: clarity in presentation can help avoid confusion over wage information.

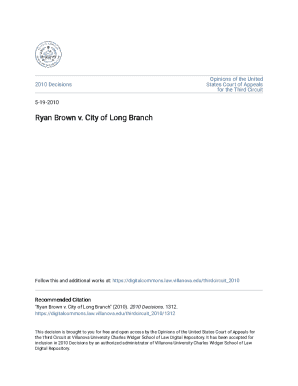

Signing the agricultural employer wage statement form

Once the agricultural employer wage statement form is complete, obtaining signatures is the next critical step. With the rise of digital solutions, electronic signatures have become a popular method for finalizing documents.

These electronic signatures are not only convenient but also legally valid, provided they meet specific guidelines. Understanding how to implement eSigning effectively can streamline your payroll processes.

Submitting and distributing the form

After completion and signing, it's essential to understand best practices for submitting and distributing the agricultural employer wage statement form. Employers typically have specific obligations regarding the timely submission of wage statements to government agencies.

Equally important is providing copies to employees, which reflects good practice and compliance. Keeping accurate records of submitted forms is also critical for potential audits and future reference.

Managing agricultural employer wage statements effectively

Effective management of agricultural employer wage statements is critical in today's digital age. Utilizing document management systems like pdfFiller not only streamlines the process but also enhances efficiency.

Employers can track changes, manage revisions, and ensure data security within the platform. This not only saves time but also fosters compliance and minimizes the risk of errors in wage documentation.

FAQs about the agricultural employer wage statement form

Employers and employees often have questions regarding the agricultural employer wage statement form. Understanding these queries can enhance the relationship between them by clarifying obligations and entitlements.

Common issues may revolve around legal obligations, the interpretation of wage details, or resolving disputes over payments. Addressing these frequently asked questions can provide both parties with peace of mind regarding their rights and responsibilities.

Enhancing your document management experience with pdfFiller

pdfFiller is at the forefront of providing tools that simplify the process of completing agricultural employer wage statements and other forms. Its features encompass seamless editing, eSigning capabilities, and collaborative tools that are beneficial for teams working in the agricultural sector.

Using this cloud-based solution allows users to access their documents from anywhere, ensuring flexibility and real-time collaboration. Several success stories have illustrated how agricultural businesses have optimized their document management processes using pdfFiller.

Troubleshooting common issues with the agricultural employer wage statement form

Navigating the challenges associated with the agricultural employer wage statement form is essential to maintaining smooth payroll processes. Common filing errors can lead to significant issues if not addressed promptly.

Employers should be aware of steps to correct submitted forms and know where to find resources for further assistance. Taking proactive measures can help avoid complications during audits or disputes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send agricultural employer wage statement for eSignature?

Can I create an electronic signature for signing my agricultural employer wage statement in Gmail?

How do I edit agricultural employer wage statement on an iOS device?

What is agricultural employer wage statement?

Who is required to file agricultural employer wage statement?

How to fill out agricultural employer wage statement?

What is the purpose of agricultural employer wage statement?

What information must be reported on agricultural employer wage statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.