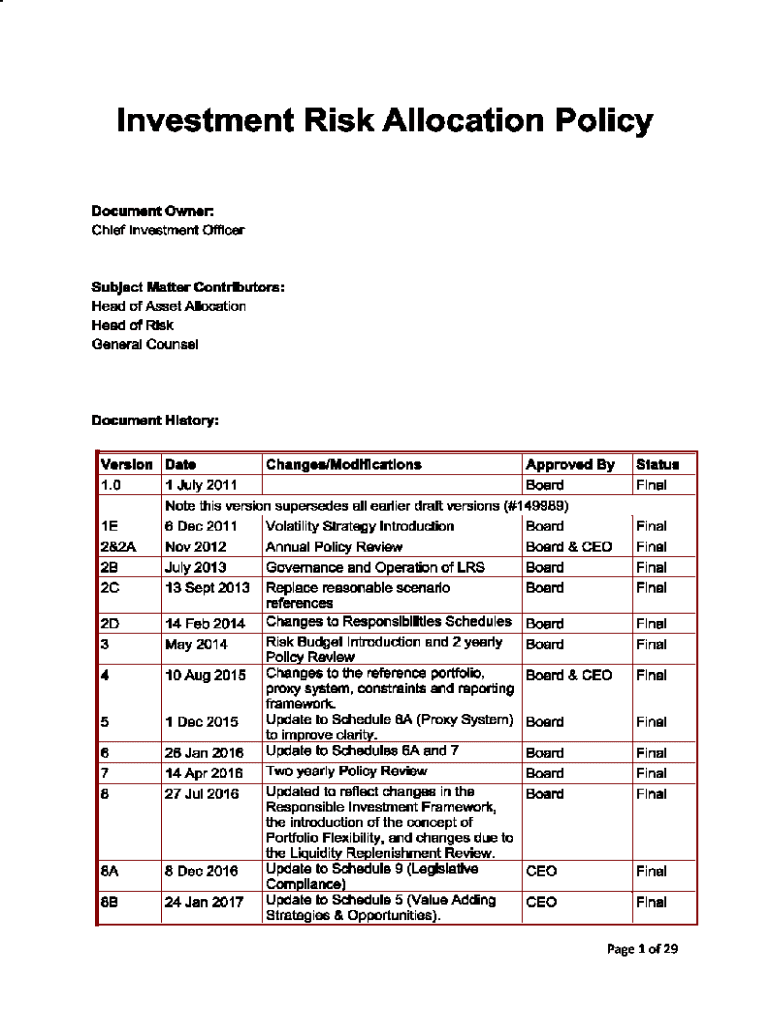

Get the free Investment Risk Allocation Policy

Get, Create, Make and Sign investment risk allocation policy

Editing investment risk allocation policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment risk allocation policy

How to fill out investment risk allocation policy

Who needs investment risk allocation policy?

Investment Risk Allocation Policy Form - A Comprehensive Guide

Overview of investment risk allocation policies

Investment risk allocation policies play a pivotal role in defining how investment risks are distributed across various asset classes within a portfolio. These policies are crucial because they ensure that investment strategies align with an individual or organization's financial goals and risk tolerances. A well-structured investment risk allocation policy not only enhances potential returns but also minimizes exposure to risks by diversifying investments.

Key components of a risk allocation policy include risk tolerance levels, asset class diversification, and investment time horizons. It is essential that these components are tailored to meet the unique financial objectives and needs of the investor or organization in question. Aligning these policies with specific investment goals enhances financial decision-making and reduces the potential for emotional decisions driven by market volatility.

Understanding the investment risk allocation policy form

The investment risk allocation policy form serves as a systematic outline for documenting an investor's approach to risk management within their portfolio. Its primary purpose is to maintain organization and clarity, ensuring that all stakeholders understand the investment strategy and risk philosophy.

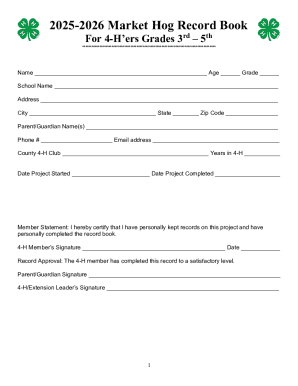

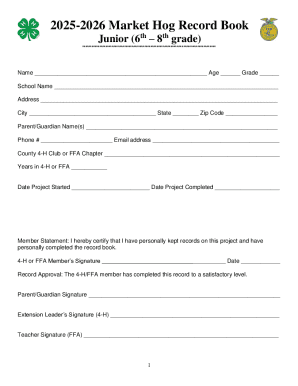

Required information typically includes personal details, financial objectives, risk tolerance assessments, and proposed asset allocation percentages. The accuracy of this information is critical — any errors can lead to misguided investment decisions that could adversely affect portfolio performance.

Step-by-step guide to filling out the investment risk allocation policy form

Successfully completing the investment risk allocation policy form requires careful preparation and thought. Here’s a breakdown of the necessary steps:

Step 1: Gathering required information

Begin by collecting all pertinent personal and investment information. Document your financial background, assets, income sources, and any existing investment portfolios. Equally important is performing a risk tolerance assessment to measure how much volatility you can endure. Various online tools and questionnaires can assist in determining this.

Step 2: Analyzing investment goals

Next, analyze your investment goals by distinguishing between short-term and long-term objectives. Short-term could entail saving for a purchase, while long-term might focus on retirement savings. Additionally, consider how inflation could impact the real value of your investments over time.

Step 3: Defining risk allocation strategies

Decide on the risk allocation strategy by considering different asset classes such as equities, bonds, and alternative investments. Each asset class carries different levels of risk and return profiles. Utilize diversification principles to spread risk, ensuring that not all investments are correlated to mitigate potential losses.

Step 4: Documenting decisions in the form

Finally, document your decisions accurately in the investment risk allocation policy form. Pay close attention to properly populating risk precursors and ensure compliance with pertinent regulations. This thorough documentation provides transparent guidance for anyone managing your investments.

Interactive tools for evaluating risk allocation

Utilizing interactive tools can significantly enhance your understanding of risk allocation strategies and the potential impacts of various market scenarios. Here are some tools to consider:

Best practices for completing your investment risk allocation policy form

Once you have a foundational understanding of how to complete the investment risk allocation policy form, it's beneficial to follow best practices to enhance clarity and effectiveness. Effective communication of investment goals is paramount; articulate them in clear, measurable terms for easy understanding.

Regularly review and update your policy to adapt to changing financial circumstances or market dynamics. Engaging with financial advisors provides expert insights, which can ensure that your investment strategy remains robust and aligned with market conditions.

Collaborative features of pdfFiller

pdfFiller allows teams to work together seamlessly on the investment risk allocation policy form, enhancing collaboration and communication among stakeholders. Users can share forms with team members for input and feedback; this collaborative approach not only improves the quality of the final document but also ensures all perspectives are considered.

Utilizing comment and suggestion features enables constructive discussions around investment strategies. Moreover, real-time collaboration capabilities streamline document finalization, ensuring that all changes are instantly saved and ready for review.

Managing your investment risk allocation policy form

After customizing your investment risk allocation policy form, effective management is essential. Keeping your documents secure should be a top priority; utilizing cloud storage solutions ensures accessibility from anywhere while maintaining safety.

Tracking changes and employing version control mitigates confusion and enhances clarity regarding document modifications. Moreover, the incorporation of eSignature technology allows for official approval processes, making it easier to implement your policy across stakeholders.

Advanced strategies in investment risk allocation

For investors looking to enhance their risk allocation strategies, advanced techniques such as integrating environmental, social, and governance (ESG) factors can add significant value. These approaches align with ethical investing principles while potentially providing competitive returns.

Adapting your policy to evolving market conditions is equally important. Continuous monitoring of performance metrics and economic indicators allows for timely adjustments to optimize portfolio performance. Reviewing case studies of successful risk allocation strategies can provide insights and inspiration for developing your unique approach.

Additional insights on risk management in investment

Effective risk management is vital for investment success, influencing both growth potential and the ability to withstand market downturns. Identifying and avoiding common mistakes, such as failing to diversify or overextending risk exposure, can safeguard investments.

As the investment landscape evolves, staying informed about future trends in risk management — including the adoption of technology and data analytics — can equip investors with the insights needed to make well-informed decisions in a dynamic marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit investment risk allocation policy online?

How do I edit investment risk allocation policy on an iOS device?

How do I fill out investment risk allocation policy on an Android device?

What is investment risk allocation policy?

Who is required to file investment risk allocation policy?

How to fill out investment risk allocation policy?

What is the purpose of investment risk allocation policy?

What information must be reported on investment risk allocation policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.