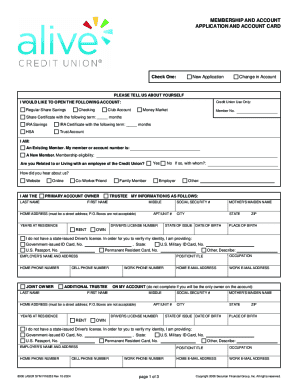

Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to the Form 990 Form

Understanding the Form 990: Overview and Purpose

Form 990 is an essential tool for nonprofit organizations in the United States, serving as the main reporting and disclosure document required by the Internal Revenue Service (IRS). This form enables nonprofits to provide detailed information about their financial status, governance, and activities, essential for transparency.

The importance of Form 990 cannot be overstated, as it not only contributes to the accountability of nonprofits to their stakeholders—including donors, grantmakers, and the public—but also helps the IRS ensure tax compliance. Nonprofit organizations with gross receipts over $200,000 or total assets over $500,000 are required to file Form 990 annually.

Deep dive into Form 990 components

Breaking down Form 990 reveals multiple critical sections, each designed to capture specific types of information necessary for comprehensive reporting. Understanding these components is vital to properly filling out the form.

Part : Summary

This section serves as an overview of the organization’s activities, finances, and governance. It summarizes key information such as revenue, expenses, and net assets. Stakeholders often focus on this part first, making it essential for nonprofits to present accurate and compelling data here.

Part : Signature Block

The signature block is crucial as it legitimizes the filed information. A designated official like the Executive Director or the board chairperson must sign it, affirming the organization’s commitment to the data's accuracy.

Part : Statement of Program Service Accomplishments

Here, nonprofits need to articulate the programs they operate, including their impact and accomplishments. This section is not merely a statement of activities, but a narrative that conveys the essence and effectiveness of the organization's work.

Part : Checklist of Required Schedules

This checklist helps organizations identify additional schedules that may be required based on their activities and finances. Completing this part accurately is crucial to avoid incomplete submissions that could invite scrutiny from government organizations.

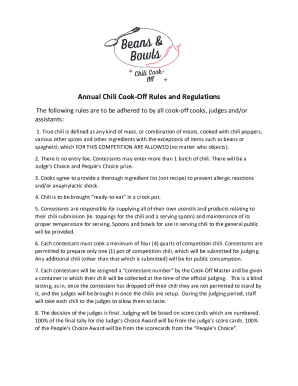

Step-by-step instructions for filling out Form 990

Before starting to fill out Form 990, gather all necessary documents. This will typically include financial records, program descriptions, and internal policies to ensure all information is accurate and comprehensive.

When filling out each section, adhere to best practices for data accuracy. Double-check figures, and ensure consistency across all parts. Special attention should be given to complex areas such as fundraising expenses, governance practices, and financial disclosures to avoid common pitfalls such as omissions or discrepancies.

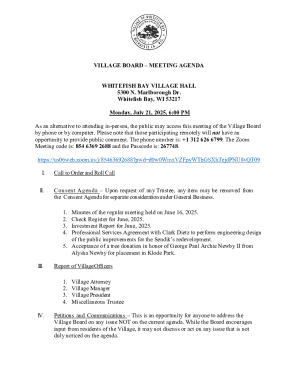

How to submit Form 990 electronically

The IRS encourages electronic submissions of Form 990. E-filing is efficient and helps ensure that your form is completed accurately with fewer errors. Various e-filing methods are available, including third-party software designed for nonprofit organizations.

To use the IRS e-File system, prepare your files according to the software's requirements. Follow these steps: access an approved e-filing service, input your data following the prompts, review for accuracy, and submit your Form 990 electronically before the deadline.

Interactive tools for managing Form 990

Modern tools can greatly assist in managing and filing Form 990. Online calculators for financial reporting can help nonprofits estimate their gross receipts and total assets, ensuring they know whether they meet the thresholds for filing.

Additionally, utilizing templates and examples of successful submissions can guide organizations in crafting their own forms. Collaboration features allow team members to work together seamlessly on document preparation, promoting accuracy and efficiency.

Addressing common questions about Form 990

Many questions arise in relation to Form 990, particularly around submission requirements and deadlines. For instance, organizations not meeting the revenue threshold might still benefit from filing Form 990-N (e-Postcard), which aids in maintaining their tax-exempt status.

Moreover, if errors are found in a filed form, organizations can amend their submissions by filing Form 990-X. Missing submission deadlines can lead to penalties and loss of tax-exempt status, hence addressing these queries is crucial for compliance.

Strengthening compliance and transparency

Keeping accurate records goes beyond merely fulfilling IRS requirements; it also fosters trust with stakeholders. A well-prepared Form 990 reflects a commitment to transparency that resonates with donors and the public.

Organizations can leverage the information from their Form 990 not only for regulatory compliance but also for grant applications and fundraising campaigns. Many grantmakers require Form 990 for their assessment, making it essential for nonprofits to maintain clarity and accuracy.

Resources for assistance and further learning

Numerous resources are available for organizations seeking guidance on Form 990. Professional associations dedicated to nonprofit support often provide specialized training and webinars that cover filling the form, compliance tips, and staying updated with IRS changes.

Accessing IRS resources and publications can also enhance an organization’s understanding of the requirements surrounding Form 990, providing impactful insights that lead to better practices.

Real-life case studies: Success stories using Form 990

Examining successful Form 990 submissions can provide invaluable lessons. Organizations that excel in their reporting often cite thorough documentation practices, collaboration, and a proactive approach to IRS guidelines as keys to their audit success.

Learning from these successes can guide other nonprofits in managing their own submissions effectively, reinforcing the practices of transparency and accuracy vital for positive stakeholder relations.

Collaboration and document management with pdfFiller

pdfFiller stands out as a versatile platform for nonprofits needing to complete, eSign, and manage their Form 990. It offers an intuitive interface that simplifies the editing and completion process, allowing organizations to focus on the content of their submissions.

The cloud-based features not only promote efficient collaboration among teams but also ensure that documents are secure and accessible. By utilizing pdfFiller's tools, organizations can streamline their Form 990 reporting and enhance their overall document management efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990?

How do I edit form 990 in Chrome?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.