Get the free Credit Audit Report Format

Get, Create, Make and Sign credit audit report format

Editing credit audit report format online

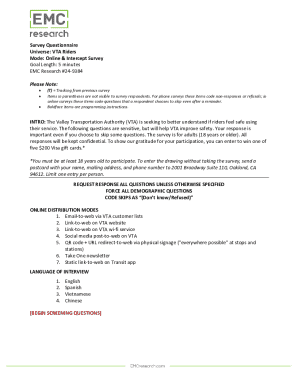

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit audit report format

How to fill out credit audit report format

Who needs credit audit report format?

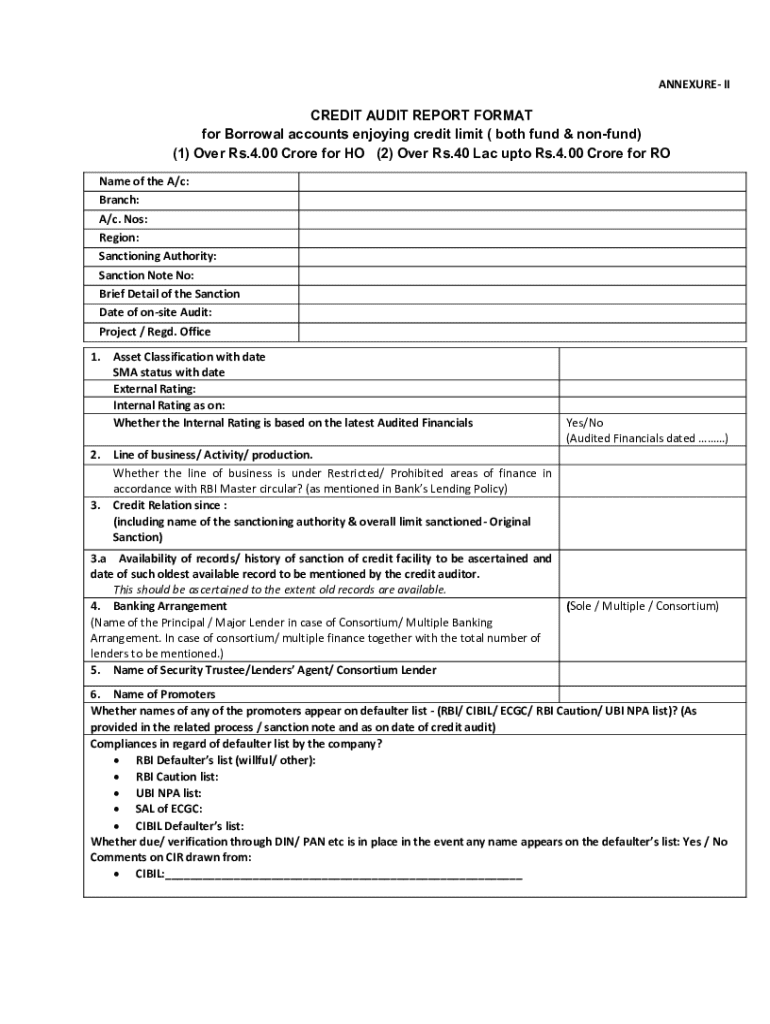

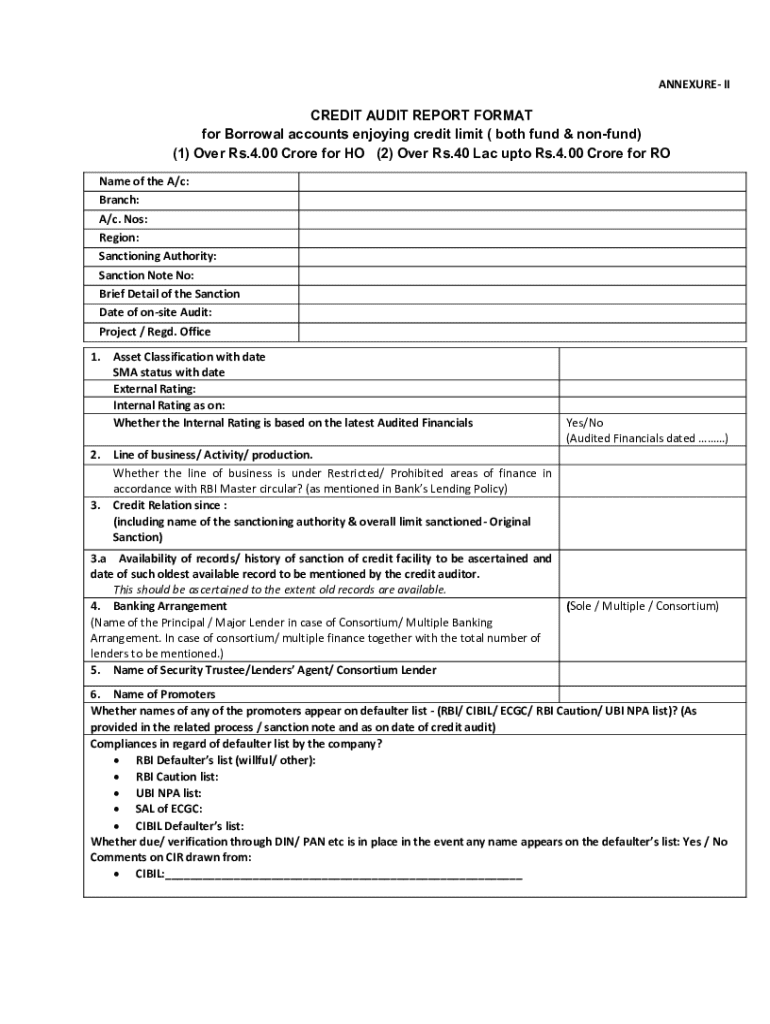

Comprehensive Guide to the Credit Audit Report Format Form

Understanding the credit audit report

A credit audit report serves as a detailed examination of an individual's or organization's credit status. It compiles and analyzes credit data, providing insights into financial health and revealing any discrepancies or issues in credit records that may affect creditworthiness.

The purpose of a credit audit report is multifaceted. Firstly, it helps in identifying areas of improvement for credit scores, which are crucial for obtaining favorable loan terms or insurance rates. Secondly, it can uncover errors in credit reports that, if corrected, can positively impact an individual's financial standing. For companies, a thorough credit audit can also ensure compliance with regulations and prepare them for potential financial assessments.

Components of a credit audit report

A well-structured credit audit report includes several essential sections that provide a holistic view of credit health and management strategies. The first part is an overview of financial health which summarizes the individual's or organization’s current financial status, including total debts and available credit.

Following this, a detailed credit score analysis provides insights into the factors influencing the credit score, such as payment history and debt utilization. A comprehensive account review outlines all credit accounts, noting any late payments, defaults, or discrepancies. Finally, the report should describe actionable debt management strategies tailored to the individual's or company's specific situation, highlighting paths toward improved credit health.

Recommended formats for presentation

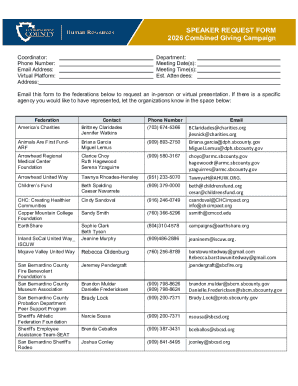

When it comes to presenting credit audit reports, standardized formats provide clarity and consistency. These can be Microsoft Word or Excel documents, which offer flexibility in formatting and data entry. Alternatively, using customizable templates, especially those available through innovative platforms like pdfFiller, can streamline the process tremendously.

pdfFiller offers a range of templates that allow users to create professional-looking credit audit reports swiftly. Users can customize fields, add comments, and incorporate interactive features, making it easier to tailor reports to specific requirements.

Step-by-step guide to filling out the credit audit report form

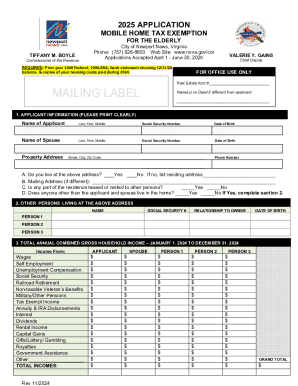

Filling out a credit audit report effectively begins with gathering the necessary information. Users need to compile personal financial data, including income statements, existing debts, and payment histories. Additionally, it is crucial to collect pertinent credit history documents, such as credit reports from major bureaus.

Once this data is organized, using pdfFiller for creating the report is straightforward. Start by accessing the designated template, then edit fields to input your information. The platform allows for the integration of electronic signatures and enables easy sharing capabilities for collaborative review.

Interactive tools for enhanced reporting

Incorporating interactive tools enhances the quality and usability of the credit audit report. pdfFiller provides several features, including real-time collaboration tools that enable multiple users to work on the report simultaneously. This functionality is invaluable for teams that require input from various stakeholders.

Moreover, the commenting and feedback options allow users to discuss specific elements of the report, ensuring comprehensive coverage of all facets of the credit audit. Integration with financial data analysis tools also adds value, as users can create visual representations such as graphs and charts to depict trends, thus enhancing understanding.

Collaborating effectively with teams

Sharing credit audit reports securely and effectively is essential for teamwork. pdfFiller allows users to set specific user permissions, determining who can view or edit the documents. Such control is crucial in maintaining the integrity of sensitive financial information.

Further enhancing collaboration, pdfFiller enables real-time collaborative editing, which means that team members can make changes and see responses instantly. Assigning roles for review and approval also streamlines the auditing process, as contributors can be tasked with examining specific sections of the report, improving overall efficiency.

Common challenges in creating credit audit reports

Creating credit audit reports can present several challenges, especially for those unfamiliar with financial assessments. One significant hurdle is navigating complex financial data, which often requires a keen understanding of credit terminology and figures. Users may struggle to interpret data accurately, which can lead to reporting errors.

Additionally, addressing poor credit ratings can be daunting, as it necessitates a proactive approach to rectifying any issues highlighted in the report. Ensuring accuracy in reporting figures is crucial; thus, consistent double-checking of all entries and calculations helps to mitigate potential problems.

Real-world applications of credit audit reports

Credit audit reports serve a variety of real-world applications that extend beyond simple assessments of creditworthiness. For instance, businesses often utilize these reports to make informed financial decisions regarding loan applications, particularly when securing favorable rates and terms. A solid credit audit can provide lenders with confidence in the organization's financial health.

Additionally, case studies indicate that individuals regularly benefit from credit audit reports by identifying actionable steps for financial improvement. These findings could involve paying down specific debts ahead of time or disputing inaccuracies in credit reports, both of which play critical roles in enhancing overall credit scores.

Best practices for maintaining financial records

To create effective credit audit reports, maintaining up-to-date financial records is essential. This includes regularly updating audit reports to reflect current financial conditions and modifying strategies as necessary. Consistent revisions ensure that all data remains relevant and accurate over time.

Moreover, establishing document retention policies can help in organizing financial records efficiently. Utilizing a cloud-based solution such as pdfFiller allows for the secure storage of financial documents, enabling easy access and ensuring that vital materials are not misplaced.

Advanced strategies for credit improvement

Taking actionable steps based on audit findings can significantly improve credit scores. Developing clear action plans that address identified weaknesses helps users systematically enhance their credit profiles. This may involve negotiating with creditors for better terms, consolidating debts, or establishing consistent payment schedules.

Furthermore, leveraging resources for financial consultation can provide additional guidance; professional advice can pinpoint strategies that may not be immediately obvious. Lastly, tracking progress over time using update features in platforms like pdfFiller ensures that steps taken lead to meaningful changes.

FAQs about credit audit reports

Understanding the common questions surrounding credit audit reports can clear up uncertainties and promote confidence in utilizing these tools effectively. One frequent inquiry pertains to the turnaround time for completing a credit audit report, which largely depends on the complexity of the financial data involved; however, utilizing streamlined processes through tools like pdfFiller can considerably reduce this timeframe.

Security is another primary concern when sharing credit audit reports, and pdfFiller offers robust options to ensure sensitive data remains protected, enabling secure sharing options. It is also essential to note the differences between personal and business credit audits; while both serve to assess creditworthiness, the metrics and data analyzed can differ substantially, necessitating tailored approaches for each.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit audit report format from Google Drive?

How do I execute credit audit report format online?

How do I fill out credit audit report format using my mobile device?

What is credit audit report format?

Who is required to file credit audit report format?

How to fill out credit audit report format?

What is the purpose of credit audit report format?

What information must be reported on credit audit report format?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.