Get the free Indigo Paints Limited Tds Intimation

Get, Create, Make and Sign indigo paints limited tds

Editing indigo paints limited tds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indigo paints limited tds

How to fill out indigo paints limited tds

Who needs indigo paints limited tds?

How-to Guide: Indigo Paints Limited TDS Form

Overview of the Indigo Paints Limited TDS Form

The Indigo Paints Limited TDS form is a critical document in the financial landscape for businesses operating within India. TDS stands for Tax Deducted at Source, which is an income tax collected at its source rather than at a later stage. The purpose of this form is to detail the deductions made on various payments, including salaries, commissions, or professional fees, ensuring that the correct tax is withheld and remitted to the government. Ensuring the accuracy and timeliness of the TDS process is essential for compliance with the Income Tax Act.

TDS is significant for payment processes in business as it facilitates a smooth channel for tax collection, preventing tax evasion and ensuring the government receives its dues promptly. It also builds trust with clients and partners, as it demonstrates adherence to fiscal responsibilities, further enhancing business credibility.

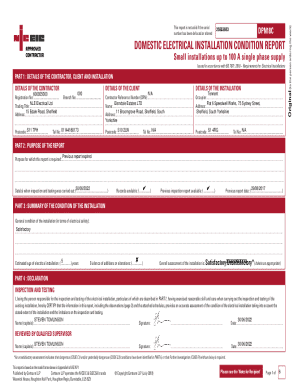

Understanding the structure of the TDS form

The Indigo Paints TDS form is structured to collect vital information that serves tax compliance needs. It typically has several key sections:

Common terms and abbreviations typically include TDS rate (the percentage to be deducted), PAN (personal identification number in tax matters), and deductor, which refers to the person or entity responsible for making the deduction.

Preparing to fill out the Indigo Paints TDS form

Before filling out the Indigo Paints Limited TDS form, it’s necessary to gather all required documents and information. This typically includes:

Common mistakes to avoid include failing to double-check PAN details, misunderstanding TDS rates applicable, and neglecting to sign the declaration, which can lead to legal repercussions.

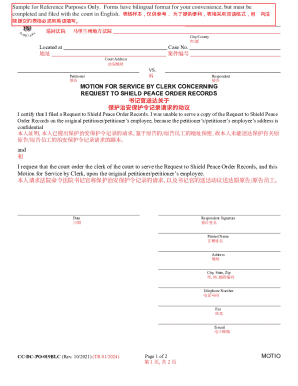

Step-by-step instructions to fill out the TDS form

Filling out the Indigo Paints Limited TDS form involves several steps. Here’s a straightforward approach:

Interactive tools for filling out the TDS form

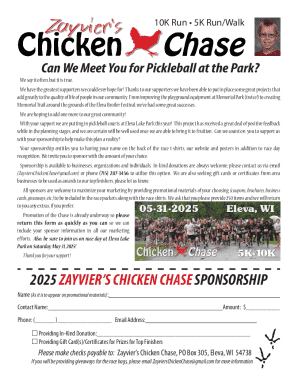

Utilizing the right tools can significantly ease the process of filling out the Indigo Paints Limited TDS form. One such feature is the eFill tool available on pdfFiller.

This interactive feature allows users to fill out the form electronically, editing and saving their entries in real time. It also supports collaboration, enabling team members to provide input and ensure that the information submitted is accurate.

Editing and reviewing your completed TDS form

Once you've filled out the Indigo Paints Limited TDS form, it’s advisable to review it meticulously. Here are some tips for an efficient review:

Thorough review ensures compliance and can prevent potential future legal issues related to tax errors.

Signing the Indigo Paints TDS form

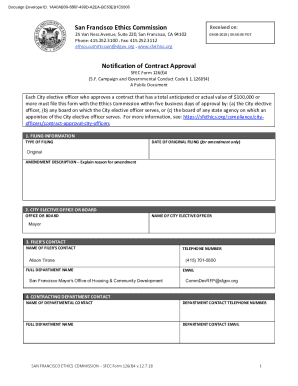

To make the Indigo Paints Limited TDS form valid, it must be signed appropriately. Electronic signatures are increasingly accepted and can simplify this process.

Signing the form not only acts as a legal affirmation but also secures the document against unauthorized changes, ensuring that your compliance is well documented.

Submitting the TDS form

After filling out and signing the Indigo Paints Limited TDS form, the next step is submission. There are various methods to do this, each with its own advantages.

To ensure your submission is received successfully, always verify the submission receipt and keep a copy of the completed form and evidence of submission for your records.

Managing your TDS forms and documentation

An efficient approach to documentation entails smart management of completed TDS forms. Using tools like pdfFiller can transform how you maintain and track your documents.

Having a system in place not only simplifies audit responses but ensures continual compliance with changing regulations.

Troubleshooting common issues

Filling out the Indigo Paints Limited TDS form may present several challenges. Here are some frequently asked questions and common hurdles faced by users:

Resources within pdfFiller include support articles and FAQs that can provide additional guidance when filling the TDS form.

Additional tips for efficient document management

To maintain compliance with TDS regulations and ensure that your documentation remains in excellent shape, consider implementing best practices. This can include regular audits of your paperwork, training team members on TDS processes, and ensuring software is up to date.

Leveraging cloud-based capabilities allows immediate access and enhances collaboration within teams, making document management an ongoing endeavor.

User testimonials and experiences

Testimonials from individuals and teams who have utilized pdfFiller for their Indigo Paints Limited TDS form processes can provide insight into the practical benefits of this platform.

Users report a noticeable increase in efficiency and accuracy when filling out tax forms through pdfFiller due to its interactive tools, collaboration options, and accessible guidelines. Many appreciate the reduction of paperwork stress and the easy tracking of submissions.

Being part of a community that values efficient document management can foster a collaborative spirit among users, sharing tips and strategies to navigate tax compliance successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indigo paints limited tds in Gmail?

How can I get indigo paints limited tds?

How do I edit indigo paints limited tds online?

What is indigo paints limited tds?

Who is required to file indigo paints limited tds?

How to fill out indigo paints limited tds?

What is the purpose of indigo paints limited tds?

What information must be reported on indigo paints limited tds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.