Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Comprehensive Guide to Form 10-Q: Understanding and Managing Your Filings

Understanding Form 10-Q

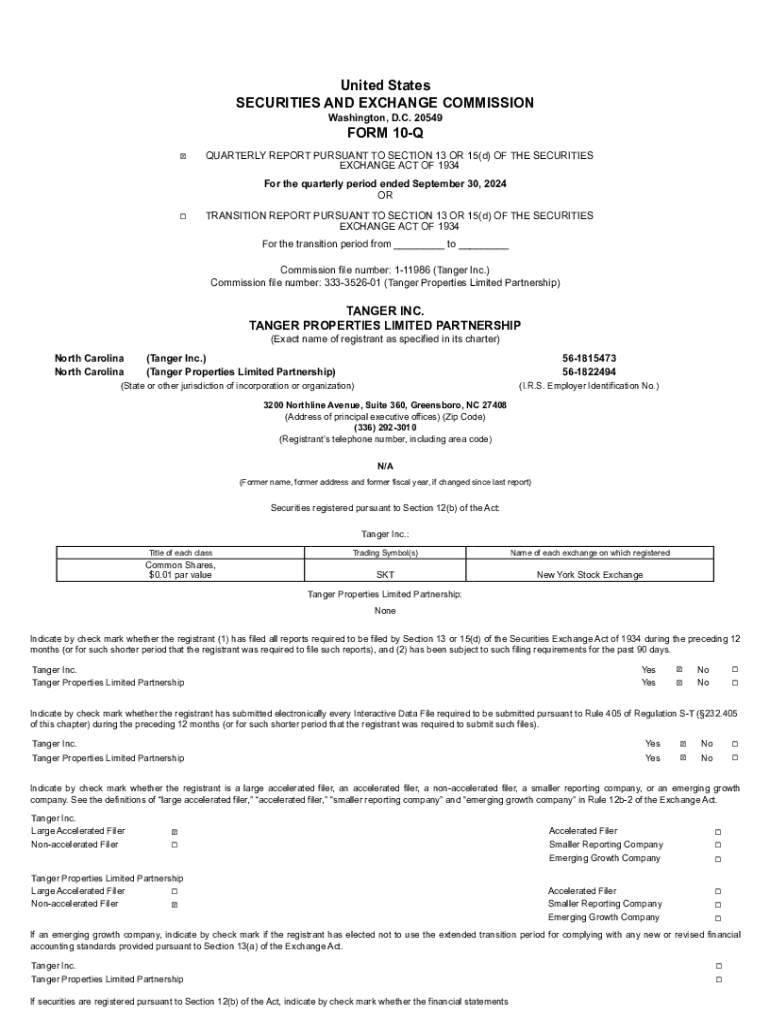

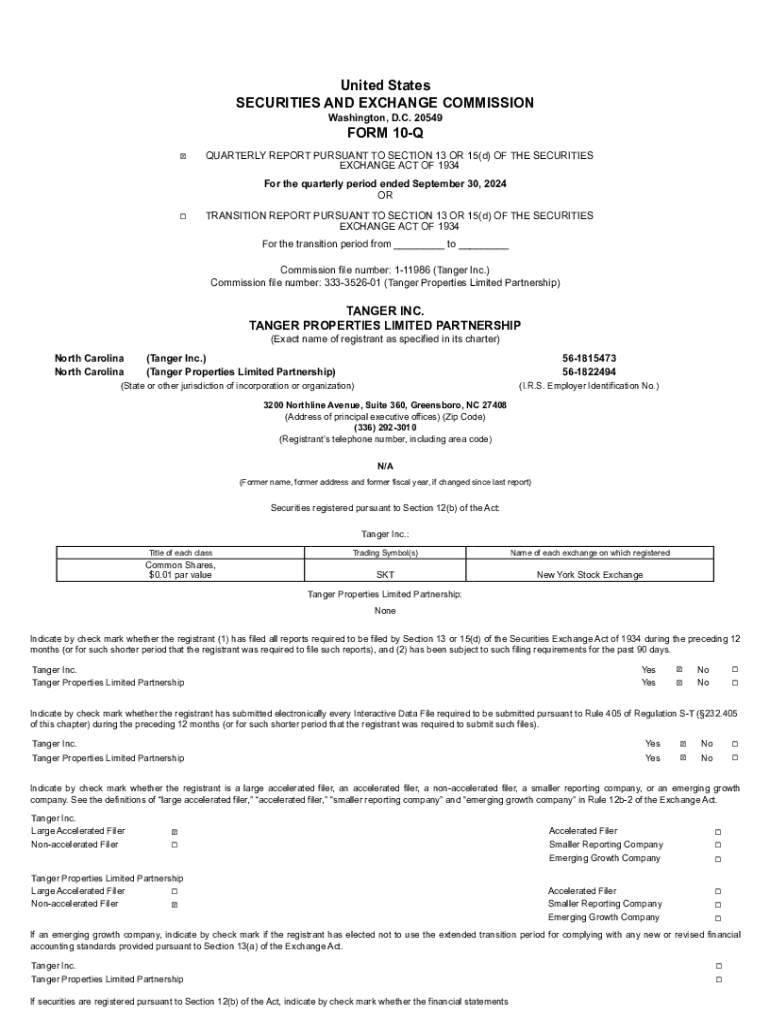

Form 10-Q is a comprehensive report that publicly traded companies in the United States must file quarterly with the Securities and Exchange Commission (SEC). This document provides a detailed look into the company’s financial condition and operational performance over the preceding quarter, making it crucial for investors and analysts. Unlike Form 10-K, which offers an annual summary, the 10-Q provides more frequent updates to keep stakeholders informed of significant shifts in the company’s performance.

The importance of Form 10-Q cannot be overstated as it fosters transparency in financial reporting, allowing investors a timely view of the company’s financial health. By comparing quarterly data, stakeholders can better gauge a company’s trajectory and make more informed investment decisions.

Key components of Form 10-Q

Form 10-Q includes several key components essential for providing a thorough understanding of a company's current status. These components consistently appear in each filing and are pivotal in financial analysis.

The document typically contains:

Each of these components plays a significant role. The financial statements deliver the raw data, while MD&A contextualizes it within the company's operational narrative, highlighting challenges and factors influencing performance.

Filing requirements for Form 10-Q

The SEC mandates that all publicly traded companies file a Form 10-Q following the end of each fiscal quarter, except for the fourth quarter, which is covered in the annual Form 10-K. Therefore, companies are required to file this form on a quarterly basis, providing investors with a regular update on their performance. Failure to comply with these regulations can lead to penalties and reputational damage.

If a company misses the filing deadline for their Form 10-Q, it faces various consequences including potential fines and the risk of being delisted from stock exchanges. Companies might also face scrutiny from regulators, which can foster a lack of confidence among investors.

Navigating the Form 10-Q structure

Understanding the structured format prescribed by the SEC is crucial for effectively navigating Form 10-Q. It adheres to specific guidelines outlining how information should be presented, which includes mandatory disclosures about financial performance and optional sections that management may choose to include.

The distinction between mandatory and optional disclosures is significant; mandatory disclosures are legally required, while optional ones may provide added insights into management strategies or future outlooks. When interpreting the data, stakeholders need to consider both types of disclosures to gain a full understanding of the company's situation.

Step-by-step instructions for filing Form 10-Q

Filing Form 10-Q requires careful preparation. The process begins with compiling financial data—this includes gathering numbers from accounting records and preparing preliminary drafts of the financial statements. An organized approach is essential to ensure that all relevant data is accounted for.

Utilizing software tools can aid in data compilation significantly. Many accounting platforms can provide accurate financial data and automate calculations, facilitating faster preparation. Before finalizing the document, it’s vital to conduct several review checkpoints to ensure accuracy, compliance, and that all applicable sections have been accurately documented.

Editing and signing Form 10-Q

Editing digital documents can be straightforward with the right tools. When it comes to Form 10-Q, it is essential to ensure that all information is current and accurate. pdfFiller offers powerful PDF editing features, allowing users to fine-tune their documents for clarity and compliance. When editing, focus on clarity, ensuring that financial data is easy to read and free of clutter.

Adding electronic signatures is a necessary step in finalizing Form 10-Q. It confirms that the management is accountable for the information presented in the document. The use of secure electronic signatures not only expedites the filing process but also maintains the integrity of the document.

Managing your 10-Q filings

Keeping track of Form 10-Q filings can be a daunting task, especially for larger companies. Establishing a systematic approach to organizing past filings, amendments, and revisions can streamline the process significantly. Solutions like pdfFiller can aid in managing these documents effectively.

Using collaborative tools within pdfFiller allows teams to efficiently work together on submissions and reviews. Such tools can improve communication among team members, ensuring that reviews are conducted promptly and revisions are implemented appropriately.

Common pitfalls and challenges

Filing Form 10-Q is not without its challenges. Common pitfalls include missing deadlines, failing to comply with SEC requirements, and discrepancies in financial reporting. Each of these issues can lead to penalties or even a loss of investor confidence.

To avoid these issues, companies should implement a timeline for their quarterly filings and adhere to strict internal reviews to ensure accuracy. Regular training for staff involved in the filing process can also enhance compliance and avoid costly mistakes.

Tools and resources for Form 10-Q preparation

Successful filing of Form 10-Q often relies on utilizing the best tools available. Recommended software can range from accounting platforms that facilitate financial reporting to specialized templates found in resources like pdfFiller. Utilizing interactive templates can greatly reduce the manual labor involved in data entry.

Beyond software, online resources provide essential guidance. Many organizations offer webinars and articles that detail the nuances of SEC regulations, ensuring that filers can maintain compliance while optimizing their reporting.

Real-world examples and case studies

Analyzing successful Form 10-Q submissions from well-known companies can offer valuable insights for your own filings. For instance, companies like Apple Inc. and Microsoft have set benchmarks with their transparent and informative filings, consistently providing detailed updates about their financial standing, market risks, and strategic pivots.

Key takeaways from these case studies include emphasizing clarity in financial data organization and the importance of thorough MD&A sections that address not only past performance but future outlooks as well.

Frequently asked questions about Form 10-Q

Questions surrounding Form 10-Q are common, particularly regarding the filing process and regulatory obligations. Stakeholders often inquire about deadlines and what corrective measures to take if discrepancies occur. To ensure an efficient quarterly reporting cycle, clarity on these questions is essential.

Final thoughts on the importance of accurate 10-Q reporting

Transparency in financial markets is crucial, and accurate reporting through Form 10-Q plays a vital role in achieving that goal. Stakeholders depend on the information provided in these forms to make informed risk assessments and investment choices. Future trends point towards increased scrutiny and expectations for reporting accuracy, making it essential for companies to adopt best practices in their filing processes.

Utilizing platforms like pdfFiller can support ongoing compliance and ease of use when managing these complex documents. With robust editing, signing, and collaborative features, it empowers users to stay ahead of their reporting obligations and maintain transparency in the marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-q to be eSigned by others?

How do I edit form 10-q on an iOS device?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.