Get the free Final Notice

Get, Create, Make and Sign final notice

How to edit final notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out final notice

How to fill out final notice

Who needs final notice?

Final Notice Form: A Comprehensive Guide for Efficient Payment Collection

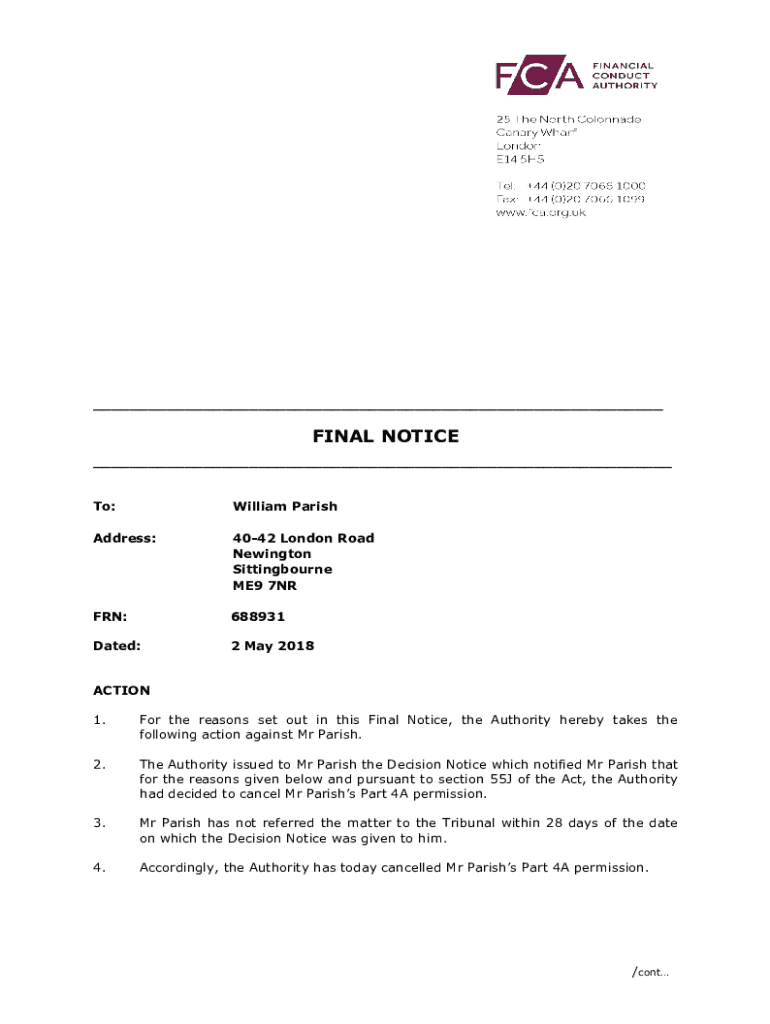

Understanding the final notice form

A final notice form is a crucial document used in the debt recovery process, informing debtors that they must settle an overdue account. It signifies the last call for payment before more severe actions are taken, such as legal proceedings or debt collections. By clearly outlining the owed amount and any potential consequences of ignoring the notice, it serves as both a reminder and a warning.

The importance of a final notice in payment collection cannot be overstated. It acts as a formal communication channel, emphasizing the seriousness of the situation. This form typically includes all necessary information related to the outstanding debt, which can aid in resolving the matter amicably before it escalates.

Common uses for final notice forms

Final notice forms are utilized across various sectors, such as retail, utilities, and healthcare. Any situation where debts are incurred may require this form as a last step in the collection process. For businesses, it's essential to know when to issue a final notice form, as it activates the next tier of collection efforts, be it legal avenues or third-party collections.

Industries such as telecommunications frequently rely on final notice forms due to the nature of recurring monthly bills. Similarly, in the rental sector, landlords find these forms invaluable when tenants fail to make timely payments. Legal implications also surface with these notices, as improper issuance may lead to complications in future collections.

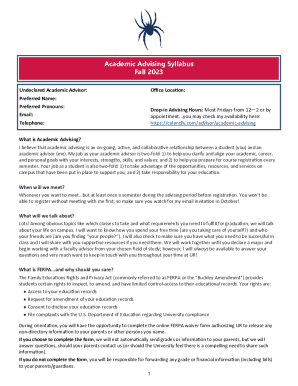

Steps to create your final notice form

Creating a final notice form starts with selecting the right template on pdfFiller. This intuitive platform offers a range of customizable options that accommodate different types of debts and industries. A well-crafted template will save you time while ensuring all necessary elements are included.

Key information to include consists of debtor details, the specifics of the payment, and a clear deadline. Personalize your form further by integrating your brand's elements, such as logos and colors, alongside any legal disclaimers that may be relevant. This not only enhances professionalism but also builds trust with your debtor.

Editing and managing your final notice form

Once your final notice form is created, utilize pdfFiller's editing features to refine your document. You can make text edits, change font styles, and adjust color schemes to match your branding seamlessly. Customization enhances the impact of your notice, making it more likely that the debtor will respond positively.

Implementing electronic signatures is another key feature of pdfFiller. This allows you to gather eSignatures from debtors efficiently, facilitating a quicker turnaround time on settlements. After your final notice form is completed and signed, ensure it is saved securely in the cloud for easy access and future reference.

Sending your final notice form

When it comes to sending your final notice form, consider the delivery method carefully. While email can provide instant delivery, physical mail may be required for legal reasons. Weight the advantages of electronic delivery, which often allows for tracking and quicker responses, against the need for more formalized communication.

To ensure your notice reaches its destination and is acknowledged, confirm the recipient's email address or mailing address is correct. If sent via email, consider requesting a read receipt. This provides additional assurance that your debtor is aware of their outstanding obligations.

What happens after sending the final notice?

After sending the final notice, anticipate various responses from the debtor. They may respond promptly with a payment, request more time, or ignore the notice altogether. Each of these outcomes requires a different strategy to manage effectively. Setting reminders for follow-up communications is essential to maintain momentum in collections.

In cases of non-response, explore further actions, such as escalating the situation to legal proceedings or involving a collections agency. Before taking further action, ensure that all communications have been documented meticulously, as this will fortify your position if legal intervention becomes necessary.

Best practices for using final notice forms effectively

To maximize the effectiveness of your final notice forms, it’s crucial to maintain a professional and respectful tone. Even though a final notice serves as a warning, how you communicate matters greatly. Ensuring legal compliance while drafting these communications can mitigate risks associated with misrepresentation or miscommunication.

Additionally, track and document all interactions and responses regarding the final notice. Keeping detailed records will help protect your interests and provide clarity in any subsequent legal actions or discussions with third-party collection agencies.

The impact of final notice forms on business relationships

Final notice forms can significantly impact business relationships, especially if the communication becomes overly aggressive. Businesses must strike a balance between firm collection efforts and the desire to maintain healthy client interactions. Demonstrating understanding and flexibility can often yield better long-term results than a rigid approach.

Starting discussions about payment terms early in the client relationship helps to clarify expectations. Emphasizing clear outlined terms can foster understanding and prevent potential disputes down the line. Consistently applying final notice procedures will also show clients the seriousness of fulfilling their obligations while maintaining the potential for ongoing collaboration.

Interactive tools for final notice forms

pdfFiller’s interactive form features greatly enhance the experience of creating and managing final notice forms. These tools allow users to seamlessly edit, customize, and specify the exact needs of their documents, ultimately improving the overall efficiency of the collection process. Additionally, the ability to collaborate with team members ensures that forms are accurate and complete prior to sending.

The user-friendly nature of these applications invites seamless navigation, allowing users to focus on crafting effective communication rather than getting bogged down by formatting issues. Case studies have demonstrated that businesses leveraging such tools have seen increased payment rates and improved client satisfaction, showcasing the real-world effectiveness of well-structured final notices.

Addressing common questions about final notice forms

Many users have questions surrounding the enforceability of final notice forms. It's critical to understand that while these documents signal the intent to collect a debt, their legal weight can vary based on jurisdiction. Thus, ensuring your form adheres to local regulations and guidelines is essential for it to be actionable.

Additionally, queries often arise regarding alternatives if a debtor fails to respond. Options may include renegotiation of terms, potential settlements, or the involvement of legal counsel for collection. Each scenario requires its approach tailored to the specific context and history of the debtor.

Success stories: How businesses improved cash flow with final notice forms

Numerous businesses have reported enhancements in cash flow after implementing effective final notice protocols. A well-known case involved a telecommunications company that adjusted their final notice strategy by adopting pdfFiller’s templates, which led to a notable increase in on-time payments. The transition illustrated the importance of clarity in communication and the impact of professional presentation.

User testimonials have echoed similar sentiments, praising the ease of creating and managing these crucial documents. Businesses have found that with interactive tools, they not only improved debt recovery rates but also enhanced their relationship management with clients, showcasing the dual benefit of effective notice issuance against the backdrop of customer service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send final notice to be eSigned by others?

Can I sign the final notice electronically in Chrome?

How can I edit final notice on a smartphone?

What is final notice?

Who is required to file final notice?

How to fill out final notice?

What is the purpose of final notice?

What information must be reported on final notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.