Get the free Schedule 14a

Get, Create, Make and Sign schedule 14a

Editing schedule 14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a

How to fill out schedule 14a

Who needs schedule 14a?

A comprehensive guide to the Schedule 14A form

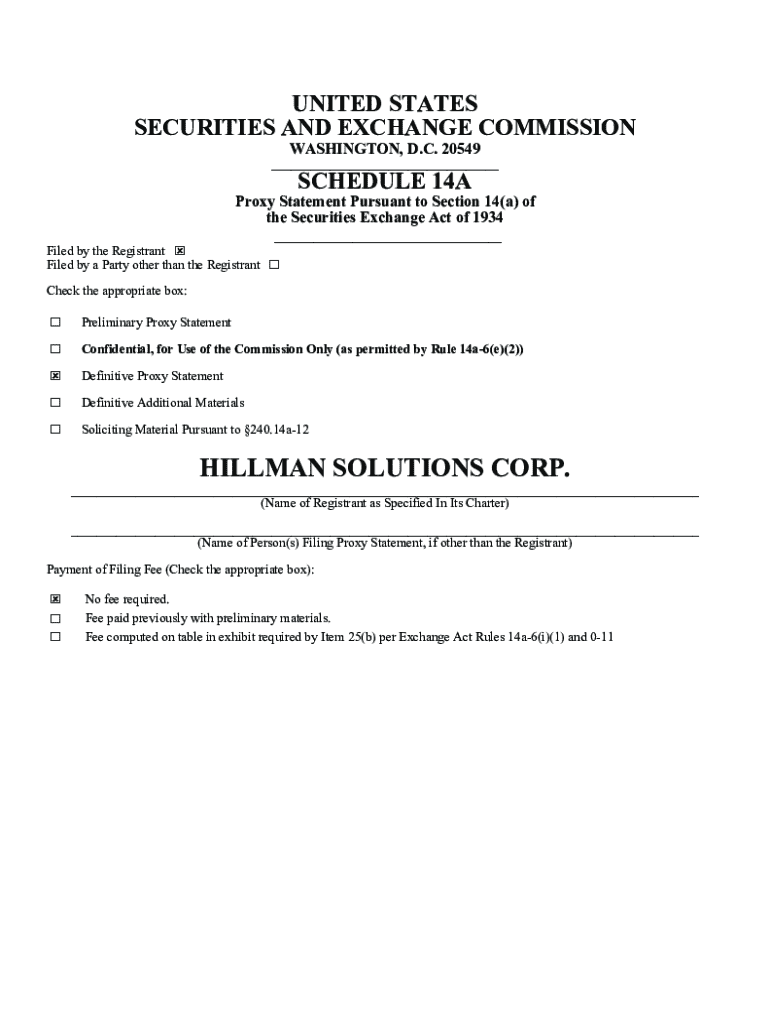

Overview of Schedule 14A Form

The Schedule 14A form, also known as the proxy statement, is an essential document required by the Securities and Exchange Commission (SEC) for publicly traded companies. Its primary purpose is to provide shareholders with the necessary information to make informed decisions regarding matters that will be voted upon at shareholder meetings. It plays a vital role in ensuring transparency in corporate governance and influencing shareholder votes.

When companies plan to solicit votes from their shareholders on important issues, such as board elections or major corporate transactions, they must file a Schedule 14A. This requirement ensures that shareholders are adequately informed about the proposals being put forth, which could significantly impact their investments. Companies that fail to comply with filing this form risk facing penalties from regulators, lack of shareholder trust, and potential disruptions in their governance processes.

Key components of Schedule 14A

Understanding the fundamental components of the Schedule 14A form is critical for companies when creating this document. The scheduled form typically includes essential background information, detailed proposals for shareholder consideration, essential financial data, and necessary disclosures regarding executive compensation.

Filing requirements and deadlines

Filing the Schedule 14A is obligatory under various conditions, notably when a company seeks to hold an annual meeting or a special meeting where shareholder votes are required. Additionally, the SEC mandates deadlines for filing this form to ensure that shareholders receive the information they need in a timely manner.

How to prepare a Schedule 14A

Preparing a Schedule 14A requires a meticulous approach to ensure all pertinent information is accurately represented. Companies must gather relevant data, draft the necessary proposals and recommendations, and confirm legal compliance before submission.

Engaging shareholders through Schedule 14A

Effective communication with shareholders is paramount for fostering engagement and ensuring that they are informed about voting matters. A well-prepared Schedule 14A acts as a central tool for this communication, inviting shareholders to understand the importance of their votes.

The SEC review process for Schedule 14A

Once submitted, the SEC reviews Schedule 14A filings to ensure compliance with federal regulations. This review process may lead to request amendments or clarifications that companies need to address before final approval.

Impact of Schedule 14A on corporate governance

The Schedule 14A form plays a pivotal role in enhancing corporate governance by ensuring transparency and accountability. By providing shareholders with comprehensive information regarding board actions and decisions, companies can establish a foundation of trust and confidence.

Best practices for managing Schedule 14A

Companies need to adopt best practices for efficiently managing the Schedule 14A preparation process. Streamlining internal review processes and using technology can lead to a smoother execution of responsibilities.

Interactive tools and resources

To assist companies in preparing their Schedule 14A, several interactive tools and resources are available. These tools streamline the preparation process and ensure compliance with regulatory requirements.

Case studies and examples

Looking at real-world examples of Schedule 14A filings can provide valuable insights into effective practices and common challenges. Case studies can reveal how certain companies have successfully navigated the preparation and review process.

Frequently asked questions (FAQs)

Addressing common queries about the Schedule 14A form can equip stakeholders with the knowledge they need. The FAQs section can highlight recurring issues and provide practical solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the schedule 14a in Gmail?

How can I edit schedule 14a on a smartphone?

How do I complete schedule 14a on an iOS device?

What is schedule 14a?

Who is required to file schedule 14a?

How to fill out schedule 14a?

What is the purpose of schedule 14a?

What information must be reported on schedule 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.