Get the free Financial Application

Get, Create, Make and Sign financial application

Editing financial application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial application

How to fill out financial application

Who needs financial application?

The comprehensive guide to financial application forms

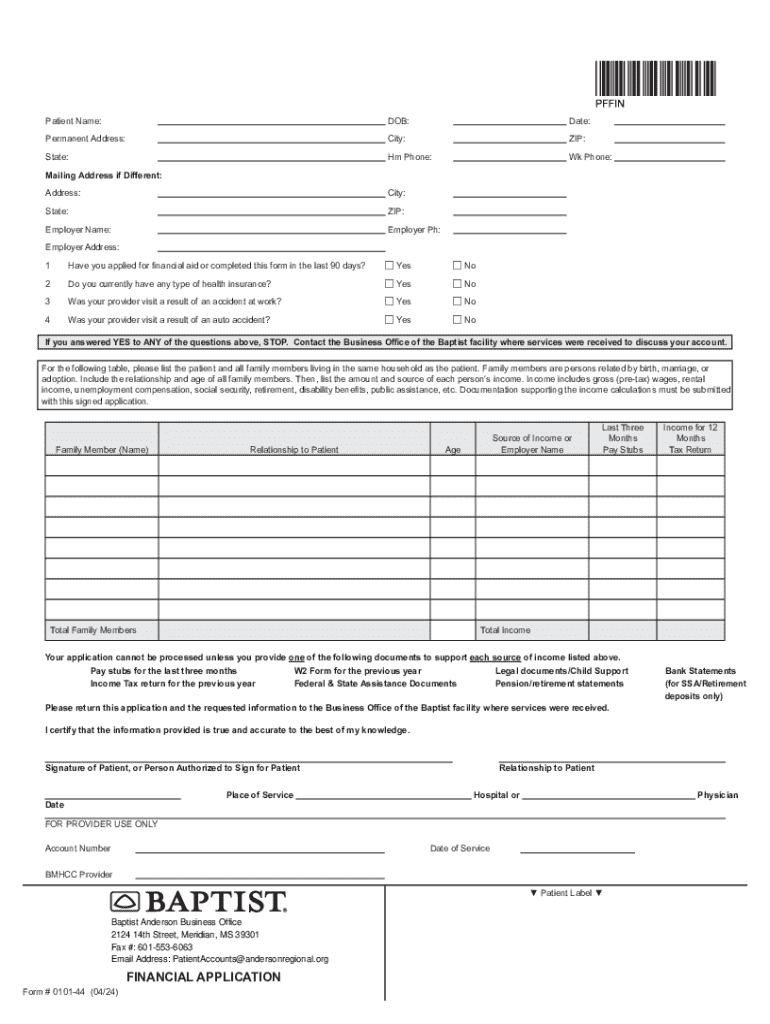

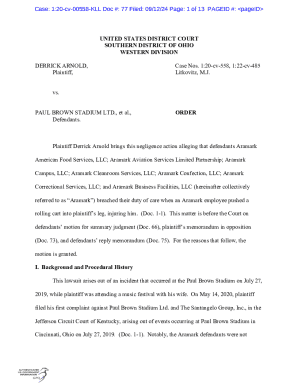

Understanding the financial application form

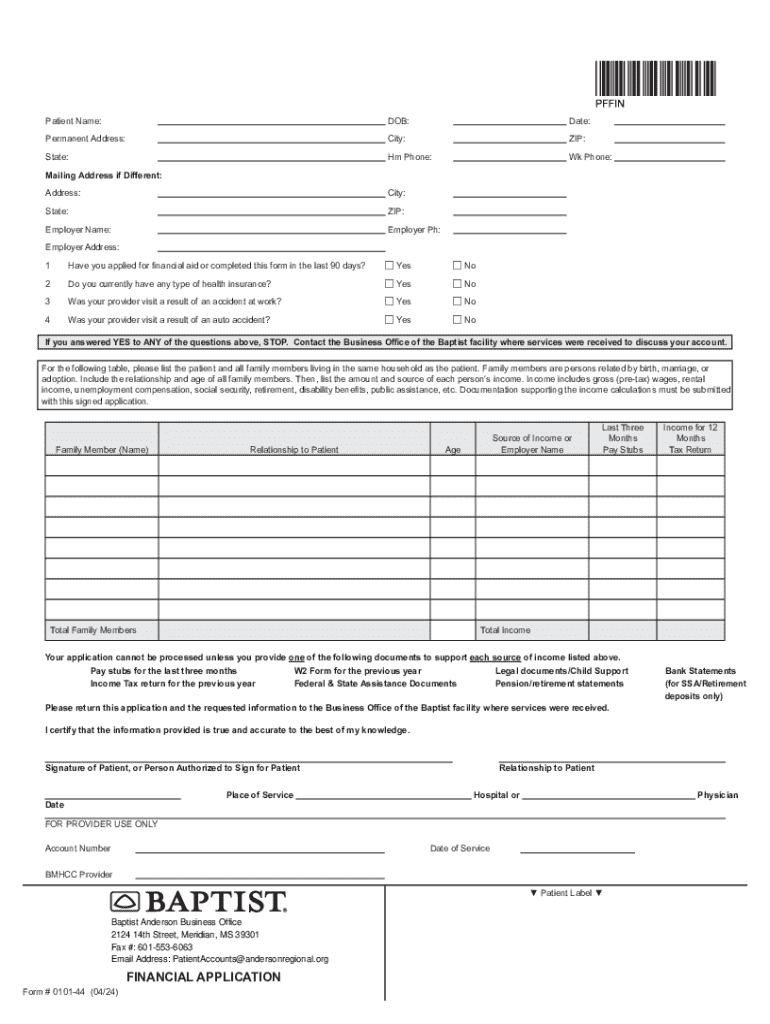

A financial application form is a formal document that collects information about an individual's or organization's financial situation. Its primary purpose is to assess eligibility for financial assistance, loans, or government programs. Understanding the components and types of these forms is essential for anyone seeking financial support.

The importance of a financial application form cannot be overstated. It serves as the gateway to obtaining necessary funding, whether for educational purposes, personal loans, or government assistance programs. Accurate completion of this document plays a crucial role in determining both approval and the amount of aid available.

Who should fill out a financial application form?

Financial application forms are not limited to individuals; organizations and businesses also need to fill them out. Eligibility criteria vary significantly for individuals seeking financial aid or loans compared to businesses applying for assistance, such as startup funding or grants.

Different audiences will benefit from these forms, including students seeking educational aid, low-income families applying for government support, and entrepreneurs looking for startup loans. Each group has unique requirements and motivations that shape how they complete their applications.

Key components of financial application forms

When filling out a financial application form, it's crucial to include essential information that accurately reflects your financial status. This typically involves filling in personal identification details such as your name, address, and social security number, as well as providing a comprehensive overview of your finances.

Understanding what supporting documentation is required is equally important. A common list of required documents may include tax returns, pay stubs, and bank statements. Accurate and complete information helps expedite the review process, thus increasing your chances of approval.

How to complete a financial application form

Completing a financial application form can seem daunting, but by following a step-by-step approach, it becomes manageable. Start by gathering all the necessary documents related to your finances and personal details.

Next, fill out the personal information fields accurately. It's essential to detail your financial information comprehensively, including income sources and liabilities. Once completed, review the form thoroughly to confirm accuracy, correcting any unintended errors.

Should you use a template for your financial application form?

Using a template for your financial application form can be highly beneficial. Templates not only save time but also enhance efficiency by ensuring that all necessary components are included. This removed much of the guesswork involved in formatting and structuring your application.

Quality templates provide a solid foundation for your application and can be easily customized to suit your specific needs. Platforms like pdfFiller offer a variety of templates for different applications, which can be a great resource for anyone looking to optimize their application process.

Frequently asked questions

Many individuals have queries regarding financial application forms, including what happens if a mistake is made on the form or how long the processing takes. It's important to clarify these points upfront to ensure a smooth application process.

Common questions include whether online applications are accepted, which many institutions now allow for enhanced accessibility. After submission, following up to check on the status of your application is a good practice, providing peace of mind as you await a decision.

Related financial templates

Exploring other financial templates can be beneficial as well. Various forms complement the financial application form, each designed for specific purposes. Utilizing these templates can streamline your financial management.

Loan application templates, grants, and scholarships applications, as well as expense report templates, can assist in fulfilling a wide array of financial needs. Leveraging these documents effectively can optimize your financial planning processes.

Saving time with online financial application forms

In an era where speed and efficiency are paramount, opting for online financial application forms provides numerous benefits. Digital submissions enhance accessibility, allowing you to complete forms anywhere with internet access. This flexibility is particularly valuable for busy individuals or teams.

Furthermore, online platforms, such as pdfFiller, streamline the application process through interactive tools for editing and signing. A user-friendly interface simplifies document management, making it easier than ever to track your application and ensure that all necessary steps are completed.

Sample letters for financial assistance requests

Knowing when to use a request letter for financial assistance can greatly impact your chances of receiving help. These letters can be effective in various scenarios, whether you’re seeking additional funding for education or outlining a financial need due to unforeseen circumstances.

Crafting an effective request letter involves structured communication. Key components include a clear introduction stating your purpose, the body detailing your specific needs and circumstances, and a conclusion that respectfully requests assistance. Having templates for these letters can streamline the writing process and enhance efficacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial application without leaving Google Drive?

How can I fill out financial application on an iOS device?

How do I complete financial application on an Android device?

What is financial application?

Who is required to file financial application?

How to fill out financial application?

What is the purpose of financial application?

What information must be reported on financial application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.