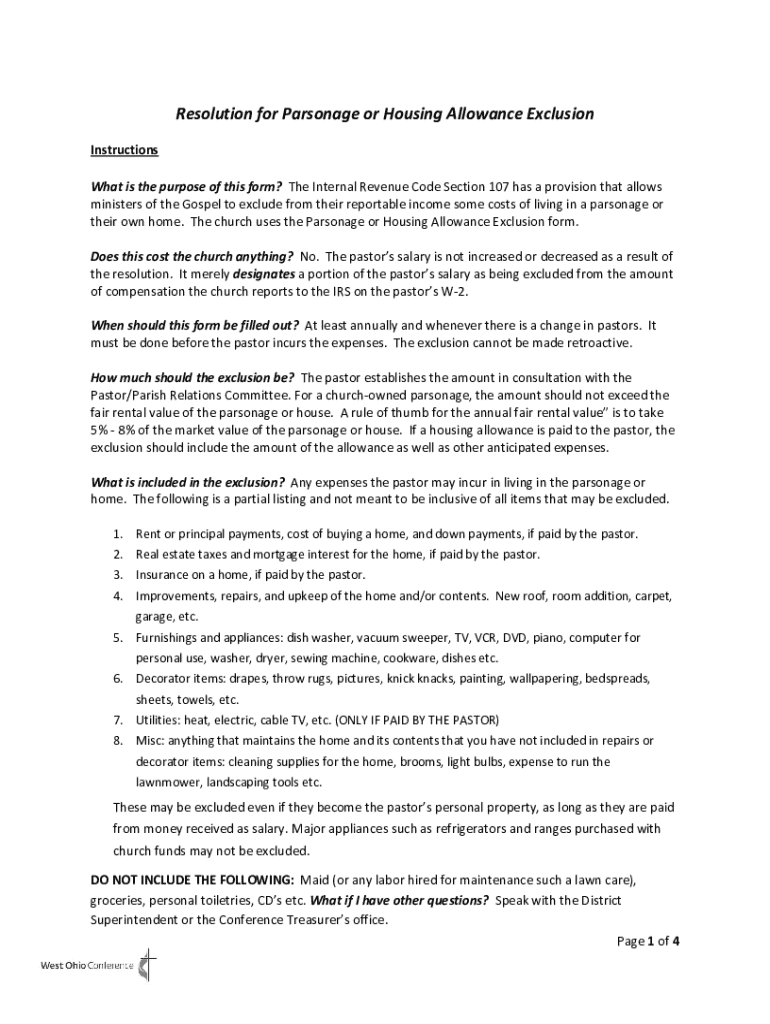

Get the free Resolution for Parsonage or Housing Allowance Exclusion

Get, Create, Make and Sign resolution for parsonage or

How to edit resolution for parsonage or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resolution for parsonage or

How to fill out resolution for parsonage or

Who needs resolution for parsonage or?

Resolution for Parsonage or Form: A Comprehensive Guide

Understanding parsonage allowance resolutions

A parsonage allowance, often referred to as a housing allowance, is a financial benefit provided to ministers and pastors by their churches. This allowance is designated to cover housing expenses, which may include rent or mortgage payments, property taxes, utilities, and home maintenance. The parsonage allowance resolution is crucial as it formalizes this benefit through church board approval, ensuring that funds are allocated correctly and that the minister can utilize the allowance for tax benefits.

The importance of the parsonage allowance resolution cannot be overstated. This resolution outlines the specific dollar amount allocated to the pastor or minister, offering legal protection and tax advantages. By having an official document, both the church and the minister can prevent potential disputes related to compensation and tax deductions. Furthermore, understanding how to draft and implement this resolution is essential for adherence to IRS guidelines, which can significantly affect the financial health of church staff.

Key components of a parsonage resolution

A well-structured parsonage resolution should encompass the essential elements that define the agreement between the church and the minister. Key components of the resolution document typically include the name of the church or organization, the designation of the minister or recipient of the allowance, and the precise amount allocated for the parsonage allowance. These details are not merely formalities but serve to establish the purpose and limit of the financial support provided.

Additionally, tax considerations must be a focal point in any parsonage resolution. The IRS has established guidelines that dictate how housing allowances should be documented and utilized by ministers. Failure to comply with these guidelines can lead to unwanted tax ramifications for both the church and the minister. Ministers are generally able to exclude their parsonage allowance from their taxable income, making it financially advantageous, provided the resolution is correctly formatted and adhered to.

Steps to create a housing allowance resolution

Creating a housing allowance resolution can be a structured process. Start by identifying the needs and requirements of your church and minister. Assess the housing costs and the financial position of your church to determine a reasonable allowance. Next, draft the resolution document using clear and concise language that aligns with IRS regulations.

Utilizing interactive templates available on pdfFiller can streamline the drafting process. These templates make it easy for users to input relevant information and adjust the document accordingly. Once the initial draft is completed, it is crucial to review and amend to ensure accuracy and compliance. After the document is finalized, move it through the approval process, where church boards may need to vote or reach a consensus on the terms outlined in the resolution.

Lastly, maintain proper documentation and record-keeping to serve as a reference for future audits and evaluations. Keeping an organized structure will not only facilitate renewal of the resolution but also prepare for any inquiries regarding the allowance.

Sample housing allowance resolution template

A practical approach to understanding the housing allowance resolution is through a sample template. For instance, a completed resolution might state, 'The [name of church] hereby establishes a housing allowance of $[amount] for [minister's name] for the fiscal year of [year]. This allowance is in accordance with IRS guidelines and is intended to cover housing-related expenses.'

There are ample customization options available in pdfFiller. Users can easily edit, sign, and adapt the template, ensuring that it meets the specific needs of their church and aligns with any updated regulations. This level of customization is vital for maintaining relevance as housing and financial circumstances change.

Common mistakes to avoid in creating a parsonage resolution

Creating a parsonage resolution is straightforward, yet certain pitfalls should be avoided to ensure its effectiveness. One common mistake is incomplete documentation; failing to include all necessary details can lead to disputes or tax complications down the line. Understanding IRS requirements is paramount—mistakenly believing that verbal agreements suffice can jeopardize the allowance's tax exemption.

Another significant error is failing to communicate with stakeholders, such as church boards and the minister. Regular updates and discussions can prevent misunderstandings and ensure everyone is on the same page regarding the allowance. Lastly, neglecting regular reviews can render a parsonage resolution obsolete as tax laws and church needs evolve. Maintaining an active dialogue about the resolution can aid in timely adjustments and future-proof the document.

Utilizing pdfFiller for effective document management

pdfFiller offers robust features that make the management of parsonage resolutions efficient and accessible. Its interactive editing tools allow users to modify documents seamlessly, ensuring that resolutions remain current and compliant. The eSigning capabilities provide a legal layer to the resolution, simplifying the approval process and enhancing security.

The cloud-based collaboration features of pdfFiller further boosts its usability, allowing multiple users to access and update documents from anywhere. This is particularly beneficial for church boards who may be working in different locations or those needing to verify the resolution's details in real-time. Accessing parsonage resolutions through pdfFiller not only aids in secure storage but also facilitates easy sharing for collaborative efforts and quick resolution updates.

Best practices for maintaining parsonage resolutions

Maintaining a parsonage resolution requires diligence and proactive management. One of the best practices is to conduct regular reviews and updates to ensure compliance with tax laws and that it meets the current needs of the church and the minister. By involving ministers in this process, churches can also gather valuable feedback, ensuring that the allowance remains fair and relevant.

Additionally, staying informed about any changes in tax law is crucial. As regulations evolve, so too should the parsonage resolution. Ensuring that the allowance reflects current legal frameworks can protect both the church and the minister from potential legal and financial ramifications.

Related resources for churches and ministries

In addition to understanding parsonage allowances, churches and ministries can benefit from several related resources. A sample compensation report for clergy can provide insights into what is commonly offered within the industry. Similarly, a guide to church compensation laws helps navigate the various legal stipulations that reduce the chances of disputes.

Furthermore, an overview of public accommodations laws relevant to religious organizations is essential for ensuring compliance and prudent management of church operations. These resources can empower church boards to make informed decisions regarding compensation and provide clarity for ministers.

Frequently asked questions (FAQs)

What is the process for a church to establish a parsonage allowance? The process typically begins with the church board assessing housing needs and budget capabilities. They then draft a resolution, consider feedback, and vote for approval. How often should a housing allowance resolution be reviewed? It is advisable to review this resolution annually or whenever there are significant changes in housing expenses or tax legislation. Can a parsonage allowance resolution be modified? Yes, a resolution can be modified; however, it generally requires a new vote from the church board to ensure all stakeholders are in agreement.

Contact information for additional support

For further assistance regarding document management, pdfFiller offers dedicated support services to help with any inquiries related to creating or managing your parsonage resolutions. Additionally, church advocacy groups and legal advisors are available to provide further guidance on best practices and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get resolution for parsonage or?

How do I execute resolution for parsonage or online?

How do I complete resolution for parsonage or on an iOS device?

What is resolution for parsonage or?

Who is required to file resolution for parsonage or?

How to fill out resolution for parsonage or?

What is the purpose of resolution for parsonage or?

What information must be reported on resolution for parsonage or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.