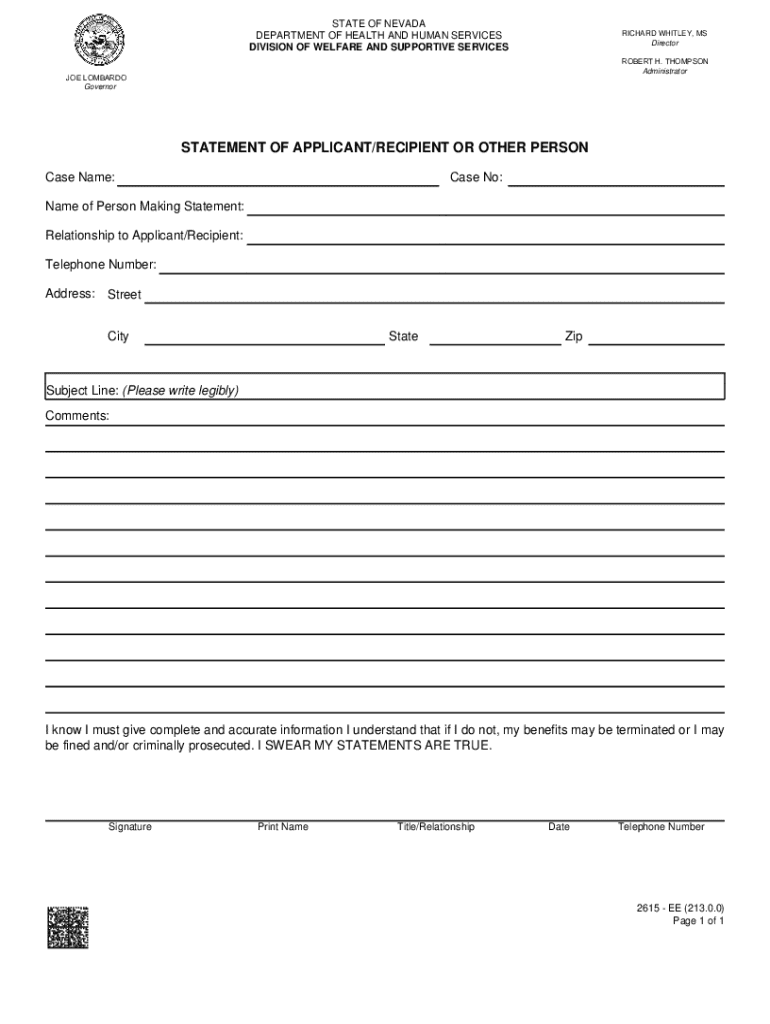

Get the free 2615 - EE STATEMENT OF APPLICANT/RECIPIENT OR OTHER PERSON

Get, Create, Make and Sign 2615 - ee statement

Editing 2615 - ee statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2615 - ee statement

How to fill out 2615 - ee statement

Who needs 2615 - ee statement?

A Comprehensive Guide to the 2615 - EE Statement Form

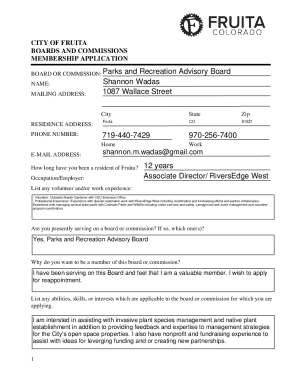

Overview of Form 2615 - EE

The 2615 - EE Statement Form is an essential document used in specific financial or legal matters. Its primary purpose is to provide a structured method for individuals and organizations to report certain information, which may include income, expenditures, or other pertinent data. The accurate completion of this form is crucial as it helps ensure compliance with regulatory requirements and facilitates better decision-making processes.

Utilizing the 2615 - EE Statement Form is important in various contexts, including legal determinations, financial analyses, and tax filings. Mismanagement of this document can lead to severe consequences, such as penalties or delays in decision-making.

Who needs to use the 2615 - EE Statement Form?

Individuals and entities involved in financial reporting typically need to use the 2615 - EE Statement Form. This includes business owners, accountants, and tax professionals who require a reliable method for documenting financial data. Additionally, non-profits and governmental entities may also find themselves needing to complete and submit this form for transparency and compliance.

Typical scenarios for usage of the 2615 - EE Statement Form include annual financial audits, compliance reviews, and any situation where financial data must be officially documented. Its importance spans across industries and business sizes, emphasizing the necessity of maintaining accurate and detailed records.

Detailed insights into the 2615 - EE Statement Form

Understanding the key features of the 2615 - EE Statement Form is crucial for accurate completion. The form typically includes several sections that guide users in providing the necessary information. Important fields include specific income sources, expenses, and any deductions that need to be reported.

Each section of the form is designed to capture precise information, ensuring that all data is relevant and useful. For instance, income sources may require detailed breakdowns, while expenses must be categorized effectively. This breakdown not only aids in completing the form but also in analyzing financial health.

Common mistakes to avoid

Common mistakes while filling out the 2615 - EE Statement Form can lead to invalid submissions and increased scrutiny. One frequent error is neglecting to provide complete and supporting documentation. Failing to attach receipts or documentation for reported expenses can result in significant issues.

Another mistake involves miscalculating totals in the financial summaries. It's crucial to double-check figures and calculations before submission. To ensure accuracy, you can use tools like pdfFiller, which allow for easy validation and correction of data.

Step-by-step instructions for completing the 2615 - EE Statement Form

Step 1: Gathering necessary information

Before diving into the completion of the 2615 - EE Statement Form, gather all necessary documents. This preparation will streamline the process and reduce errors. Required documents typically include recent financial statements, receipts for all claimable expenses, and previous statements if available.

Step 2: Filling out the form

When filling out the 2615 - EE Statement Form, start by entering your identification information. Next, proceed with documenting income from various sources, taking care to note all amounts accurately. For each expense, ensure you categorize it properly, providing detailed explanations where necessary.

Step 3: Review and edit your form

Post completion, thoroughly review the entire document. Ensure that all entered information aligns with your supporting documents. Utilize pdfFiller’s editing tools to make corrections easily. This platform allows for interactive edits and encourages users to validate information before final submission.

Step 4: Signing the form

Once you are satisfied with your form, it must be signed. You can opt for an electronic signature through pdfFiller, which is legally valid. Electronic signatures eliminate the need for printing and scanning, making the submission process more efficient.

Step 5: Submitting the form

Finally, submit the completed 2615 - EE Statement Form. Depending on the requirements, forms can be submitted electronically via pdfFiller or by mail. Always retain a copy for your records and securely store any confirmation of submission to handle follow-ups smoothly.

Interactive tools and capabilities

pdfFiller provides an array of interactive features that can significantly enhance the way you manage the 2615 - EE Statement Form. Users can take advantage of tools that allow for real-time editing, collaboration, and secure storage of documents. This cloud-based platform enables you to access your documents from anywhere, facilitating remote work and collective problem-solving.

Collaborating with team members is more straightforward, as documents can be effortlessly shared for feedback and approval. With version control in place, tracking changes becomes easy, allowing teams to maintain oversight of edits and contributions.

FAQs about the 2615 - EE Statement Form

Here are common questions users often have regarding the 2615 - EE Statement Form. One frequent concern pertains to whether an electronic signature is valid for submission. The answer is yes; as long as the electronic signature complies with the legal standards set forth, it holds the same weight as a handwritten signature.

Another common question is about correcting mistakes after submission. If you discover an error post-submission, you may need to file an amended form or reach out to the submission agency for guidance, depending on the nature of the issue.

Related topics for further understanding

In conjunction with the 2615 - EE Statement Form, understanding other similar forms can be beneficial. For instance, accompanying forms often include detailed tax returns and specialized expenditure reports used for grant applications. Gaining familiarity with these related forms can provide a more comprehensive view of financial responsibilities.

Moreover, being aware of the legal implications after submission is essential. Ensuring accuracy prevents potential complications, such as audits or penalties due to incorrect information. Understanding the ramifications of submitting inaccurate data can motivate users to take the submission process seriously.

Documents and links: A to Z

Navigating regulatory guidelines can feel overwhelming, but several resources can streamline this process. A well-curated list of related documentation should be maintained to access forms and resources easily. Consider including links to the official websites that provide necessary regulatory information regarding the 2615 - EE Statement Form.

Additionally, providing access to instructional guides, FAQs related to common submission issues, and any amendments relevant to the form can assist users in remaining compliant and informed.

Quick links

To facilitate ease of use, access essential tools related to managing the 2615 - EE Statement Form. Users can find direct links to pdfFiller's features for editing, signing, and submitting this document. Also available are shortcuts to account settings and useful support forums designed to assist users every step of the way.

Advanced tips for efficient document management

Maximizing pdfFiller for document strategy involves using the plethora of features available to streamline workflow. Organizing documents into folders and maintaining clarity regarding versions can prevent confusion and enhance efficiency during collaborative efforts.

Best practices for archiving and retrieving documents include regularly backing up files and using clear naming conventions for easy retrieval. Maintaining the integrity of documents over time can significantly reduce future complications when referring back to previous filings or forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2615 - ee statement in Chrome?

Can I create an eSignature for the 2615 - ee statement in Gmail?

How do I fill out 2615 - ee statement on an Android device?

What is 2615 - ee statement?

Who is required to file 2615 - ee statement?

How to fill out 2615 - ee statement?

What is the purpose of 2615 - ee statement?

What information must be reported on 2615 - ee statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.