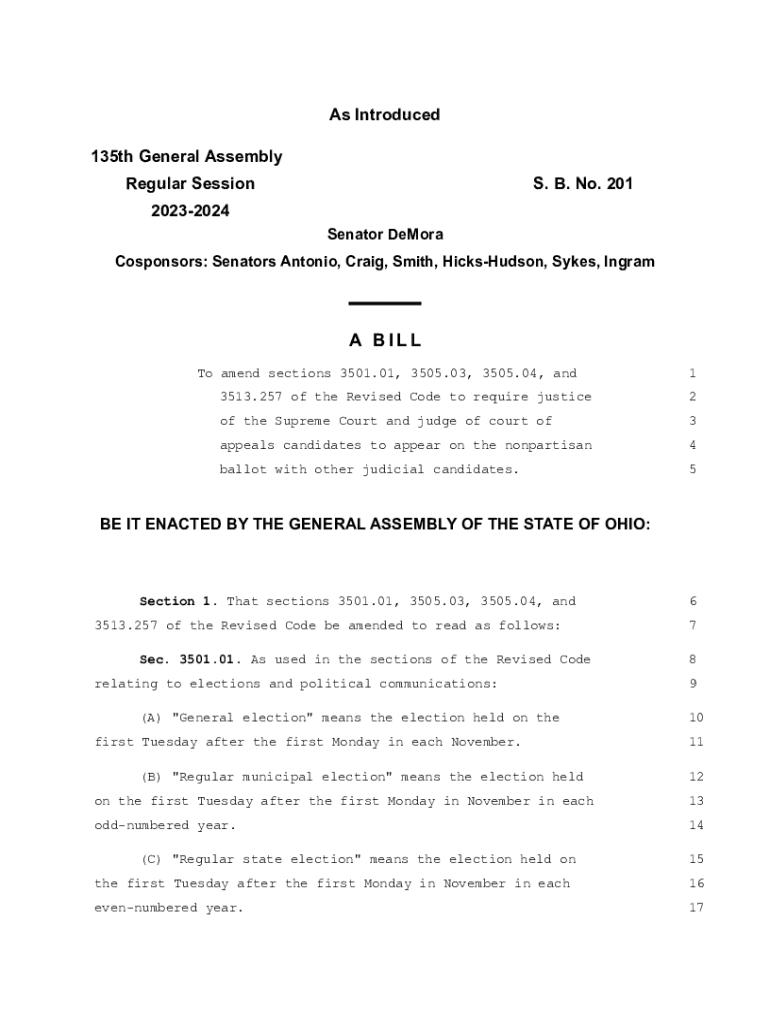

Get the free S.b. No. 201

Get, Create, Make and Sign sb no 201

Editing sb no 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sb no 201

How to fill out sb no 201

Who needs sb no 201?

Understanding the SB No 201 Form: A Comprehensive Guide

Overview of SB No 201 Form

The SB No 201 Form is a critical document used for various financial and regulatory applications. This form helps users report and document specific financial transactions or activities that might be necessary for compliance with regulatory standards. Understanding its purpose and significance is essential for individuals and businesses managing their financial commitments effectively.

Its importance lies in ensuring transparency and accountability in financial reporting, particularly for organizations required to adhere to governmental regulations. Accurate completion of the SB No 201 Form can prevent potential legal issues and facilitate smoother financial operations.

Who needs to use the SB No 201 Form?

Target users of the SB No 201 Form largely include businesses, financial institutions, and individuals who are required to report specific transactions under regulatory frameworks. This could range from small business owners to compliance officers in larger firms who manage regulatory submissions.

Common scenarios for using the SB No 201 Form include the reporting of income, expenses, or specific financial events that warrant formal documentation. Users must be aware of when this form comes into play to ensure compliance with the relevant guidelines.

Key features of the SB No 201 Form

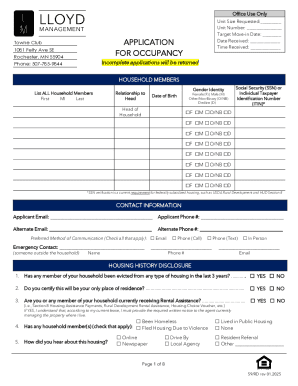

The SB No 201 Form comprises several key sections designed to capture necessary financial information accurately. These sections include personal information, financial details, and signatures to validate the documentation.

It's crucial to understand which sections are mandatory and which are optional. Mandatory sections typically require complete accuracy, while optional sections can provide additional context if needed. This distinction helps in filling the form effectively.

Understanding form terminology

Familiarizing oneself with common terminology associated with the SB No 201 Form can significantly ease the completion process. Terms like 'tax identification number' or 'net income' are examples of essential jargon that users may encounter.

Beyond basic terms, certain expressions unique to financial reporting on the SB No 201 Form are vital for comprehending the context of the information being documented. Understanding these terms minimizes mistakes and enhances clarity in submissions.

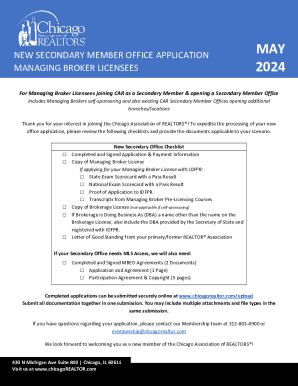

Step-by-step guide to completing the SB No 201 Form

To effectively complete the SB No 201 Form, it’s essential to gather all necessary documents beforehand. A checklist of required documents includes financial statements, previous tax returns, and any relevant identification numbers.

Having these documents organized not only speeds up the process but ensures that information entered is accurate and up-to-date. This preparatory step is crucial for a seamless form completion experience.

Filling out the form

Filling out the SB No 201 Form requires careful attention to detail. Each section should be filled out methodically, according to the instructions provided. Common areas of confusion include the reporting of income sources and deductions.

Utilizing interactive tools, such as those from pdfFiller, can greatly enhance this stage, allowing for real-time collaboration and auto-fill features that simplify the process and reduce errors.

Reviewing the form

Reviewing the completed SB No 201 Form is essential to ensure all entries truthfully reflect financial information. Setting up a checklist can help differentiate completed sections and identify the areas requiring extra attention.

An accurate review minimizes the chances of submission rejections and contributes to timely compliance with financial regulations.

Editing and modifying the SB No 201 Form

Editing the SB No 201 Form can be necessary for various reasons, including corrections or updates to financial data. Tools like pdfFiller provide user-friendly options to edit text directly or add notes, ensuring users maintain the most updated information in their documents.

Collaborative work on the SB No 201 Form enhances its accuracy. Teams can share the document with colleagues to receive feedback, fostering an environment of thorough review and cooperation.

Signing and submitting the SB No 201 Form

Electronic signatures have become integral to the submission process of the SB No 201 Form. Leveraging pdfFiller’s eSigning options simplifies this aspect, allowing users to sign the document electronically and conveniently.

Once signed, following submission guidelines is vital. Generally, forms should be submitted to the appropriate regulatory body or department responsible for overseeing compliance. Understanding submission methods helps streamline this process and avoid delays.

Troubleshooting common issues with the SB No 201 Form

Common issues with the SB No 201 Form may arise from incomplete fields or misreporting data. Identifying typical problems early on can significantly reduce frustration during the submission process.

For more complex issues, users can contact pdfFiller support for dedicated assistance. Resources are usually available for troubleshooting various challenges encountered, ensuring users can complete their forms with confidence.

Benefits of using pdfFiller for the SB No 201 Form

Utilizing pdfFiller for the SB No 201 Form offers numerous advantages, especially in document management. The platform consolidates document handling, minimizing the need for multiple tools and making it easier to organize and retrieve important files.

The enhanced collaboration features provided by pdfFiller foster teamwork, allowing for seamless input from various stakeholders involved in the form completion process. This boost in collaboration ensures that all perspectives are considered and that the form reflects a comprehensive view of the financial situation.

Moreover, the cloud-based nature of pdfFiller enables users to access and manage the SB No 201 Form anytime, anywhere. This accessibility is particularly beneficial for teams that may be working remotely or across multiple locations.

Additional content related to the SB No 201 Form

In addition to the SB No 201 Form, users may find value in exploring other related forms that cater to specific financial documentation needs. Understanding various forms can provide a more robust financial reporting strategy.

Educational resources and tools available through pdfFiller offer insights tailored to this type of form. These resources can enhance user knowledge and facilitate efficient completion of various financial reporting requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sb no 201 without leaving Google Drive?

How can I get sb no 201?

Can I create an electronic signature for signing my sb no 201 in Gmail?

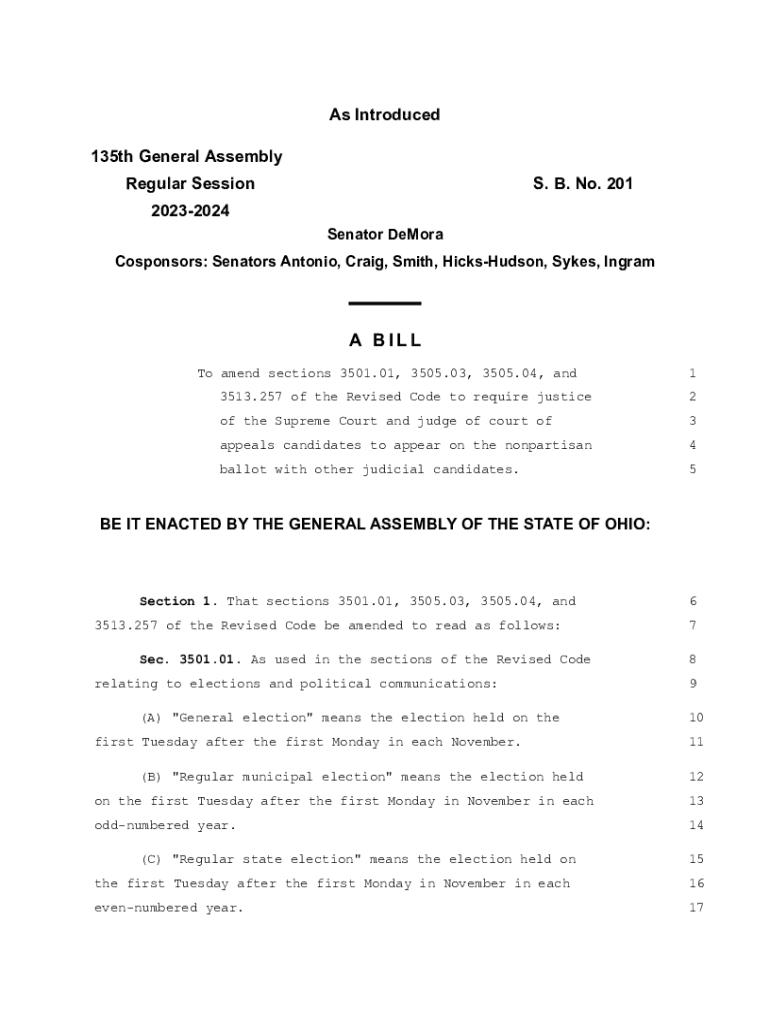

What is sb no 201?

Who is required to file sb no 201?

How to fill out sb no 201?

What is the purpose of sb no 201?

What information must be reported on sb no 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.