Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

Editing form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

How to Fill Out the Form 990-EZ

Understanding the Form 990-EZ

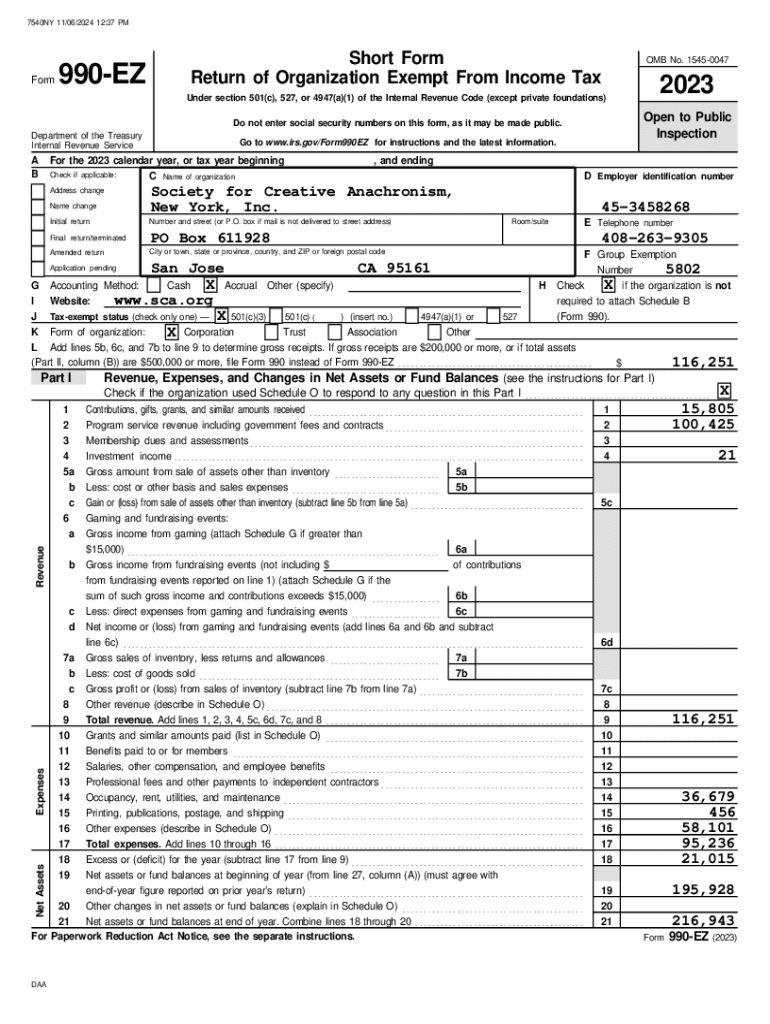

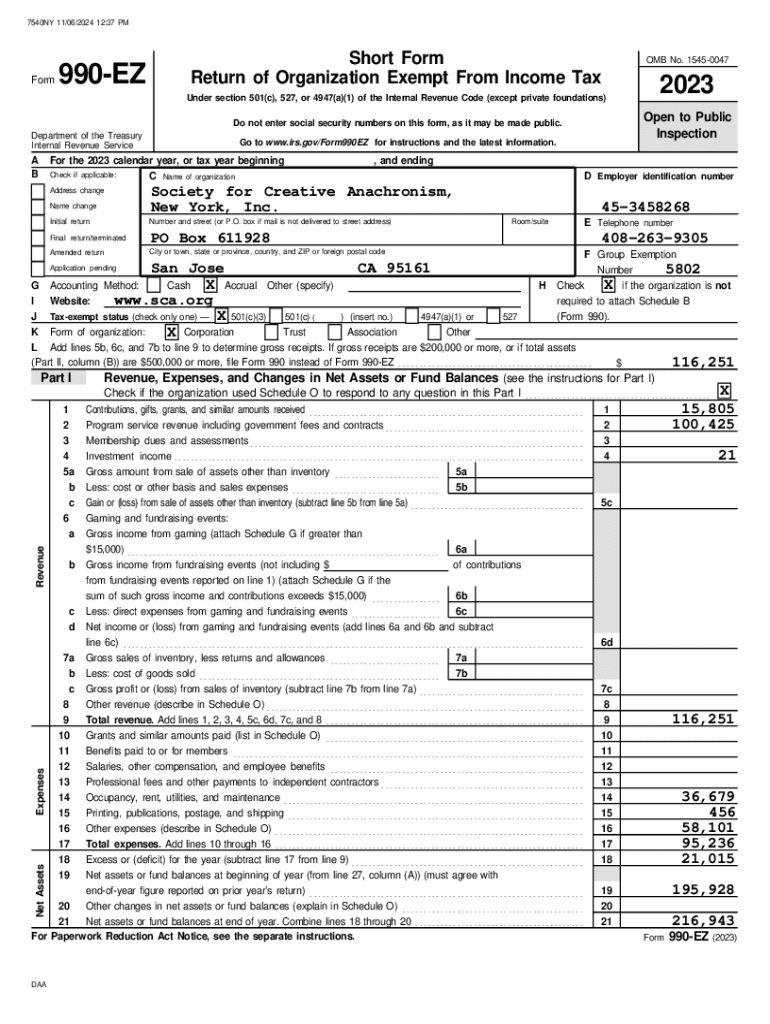

Form 990-EZ is a critical compliance document that nonprofit organizations use to report their financial information to the IRS. This form serves a dual purpose: it ensures tax-exempt organizations maintain transparency by providing essential financial data while enabling the IRS to monitor compliance with federal tax regulations. Nonprofits that fall under specific revenue thresholds often benefit from using Form 990-EZ as it simplifies reporting requirements compared to the full Form 990.

The primary aim of Form 990-EZ is to facilitate a straightforward reporting mechanism for smaller nonprofits that generate under $200,000 in gross receipts and have total assets below $500,000. Utilizing this form instead of the more extensive Form 990 can mitigate administrative burdens, particularly for smaller entities that lack extensive resources to devote to complex tax filing.

Key differences between Form 990 and Form 990-EZ

The main distinctions between Form 990 and Form 990-EZ revolve around the size and complexity of the nonprofit organization. Form 990 is intended for larger organizations with more complex reporting obligations, while Form 990-EZ is designed for smaller entities. The revenue threshold for Form 990-EZ is fixed at $200,000 of gross receipts, and total assets must not exceed $500,000. Larger organizations exceeding these limits must file Form 990, which includes far more comprehensive disclosures, detailed financial statements, and supporting schedules.

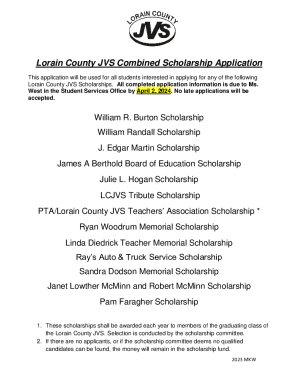

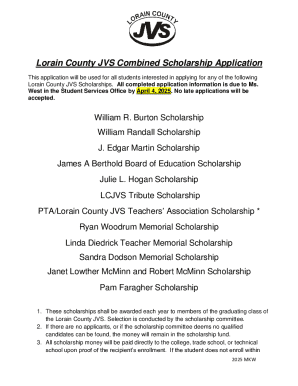

Who needs to file Form 990-EZ?

Eligible organizations that can use Form 990-EZ include small charities, community organizations, and educational institutions with limited revenue and asset levels. Generally, any nonprofit whose gross receipts exceed $200,000 or whose total assets surpass $500,000 will be automatically required to file Form 990 instead. Certain religious organizations may also qualify for exemption from both forms under specific IRS guidelines.

Common use cases for Form 990-EZ encompass a spectrum of smaller nonprofits, such as youth groups, local art organizations, and neighborhood improvement associations. Each of these organizations usually provides valuable services to the community while operating within modest financial parameters, thus aligning perfectly with the Form 990-EZ requirements.

Preparing to complete Form 990-EZ

Before diving into filling out Form 990-EZ, organizations need to gather required documentation and information. This includes comprehensive financial records, such as income statements, balance sheets, and cash flow statements reflecting all income and expenses incurred during the fiscal year. Additionally, prior Form 990 submissions and board meeting minutes may be necessary to ensure accurate and consistent reporting.

Utilizing tools available on pdfFiller can greatly streamline the preparation process. With its interactive features, pdfFiller allows organizations to manage their documents efficiently. Users can fill out Form 990-EZ digitally, ensuring clarity and accuracy while allowing easy edits and adjustments before final submission.

Step-by-step guide to filling out Form 990-EZ

Filling out Form 990-EZ involves several pivotal sections, each requiring careful attention to detail.

Part : Revenue

In Part I, organizations must list specific types of revenue, which include contributions, grants, program service revenue, and investment income. Accurate reporting here is essential, as misreporting could lead to penalties or loss of tax-exempt status.

Part : Expenses

Part II requires detailing specific line items for all expenses incurred by the organization. This includes operating expenses such as salaries, rent, utilities, and program costs. Being precise in this section not only reflects financial responsibility but also aids in understanding the operation’s sustainability.

Part : Balance Sheet

In Part III, organizations will report their assets and liabilities. This includes cash, property, and overdue obligations, giving a snapshot of the organization’s financial health to any observer. Transparency here is crucial for maintaining trust with stakeholders.

Part : Financial Statements

Part IV requires summarizing key financial data to provide a holistic view of the organization’s performance. Here, organizations may choose to attach additional financial statements if necessary, which can enhance clarity and comprehensiveness.

It’s paramount for organizations to pay attention to key sections that could significantly affect their tax status or reporting obligations. Ensuring all information is accurately recorded will mitigate potential challenges when facing IRS scrutiny.

Common mistakes to avoid when completing Form 990-EZ

Common errors can arise when completing Form 990-EZ, particularly misreporting revenue or expenses. An organization must avoid underreporting income or misclassifying expenses, as this can lead to severe repercussions, including penalties or audits. Additionally, failing to sign or date forms before submission can incur delays and headaches.

To ensure accuracy, organizations should double-check all figures and calculations. It's beneficial to consult with a tax professional who specializes in nonprofit filings to ensure compliance and further minimize the risk of errors. Engaging these practices can render a smoother filing experience.

Submitting Form 990-EZ

Organizations have various options for submitting Form 990-EZ. Electronic filing is available through platforms like pdfFiller and the IRS e-File system, allowing for quicker processing and confirmation of submission. For those choosing to submit via postal mail, ensuring the correct address is utilized and timelines adhered to is crucial.

Understanding deadlines is equally important in nonprofit tax filings. The IRS mandates that Form 990-EZ be filed on or before the 15th day of the fifth month after the end of the organization's accounting year, which means careful coordination is necessary to avoid unnecessary penalties.

After filing: what to expect

Once Form 990-EZ has been submitted, organizations should monitor any follow-up communications from the IRS. Understanding what notifications mean, such as requests for additional information or clarifications, can significantly aid an organization in maintaining compliance. Proactivity in addressing IRS queries remains paramount.

The importance of recordkeeping post-submission cannot be overemphasized. Organizations should retain all documents related to Form 990-EZ for at least three years after filing, especially in the event of an audit. Creating a systematic approach to documentation can safeguard against future issues and ensure ongoing adherence to regulatory requirements.

Using pdfFiller tools for continued document management

As organizations continue their document management journey, securing e-signatures is a critical element in keeping records compliant and the process efficient. pdfFiller facilitates obtaining e-signatures, helping organizations streamline their submission processes while maintaining authenticity.

Additionally, pdfFiller offers features for collaborating with team members, allowing multiple stakeholders to review and edit forms collaboratively. This type of functionality simplifies the oversight process and ensures that all necessary checks are in place before finalizing submissions. The cloud-based access further provides the capability to manage and reference documents conveniently for future filings, enhancing organizational productivity.

Conclusion

Filing Form 990-EZ is a fundamental responsibility for eligible nonprofit organizations that strive to maintain tax-exempt status while promoting transparency and accountability. Understanding the nuances of completing this form is crucial in avoiding common pitfalls associated with errors and omissions. By leveraging tools like pdfFiller, organizations can benefit from a more efficient filing process and enhanced document management.

Integrating pdfFiller into your document management strategy empowers your nonprofit to adhere to compliance requirements seamlessly. With the right practices and tools, organizations can streamline their filing and allow them to focus on fulfilling their missions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990-ez?

How can I edit form 990-ez on a smartphone?

Can I edit form 990-ez on an iOS device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.