Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form: A Comprehensive How-to Guide

Understanding Form 990-EZ

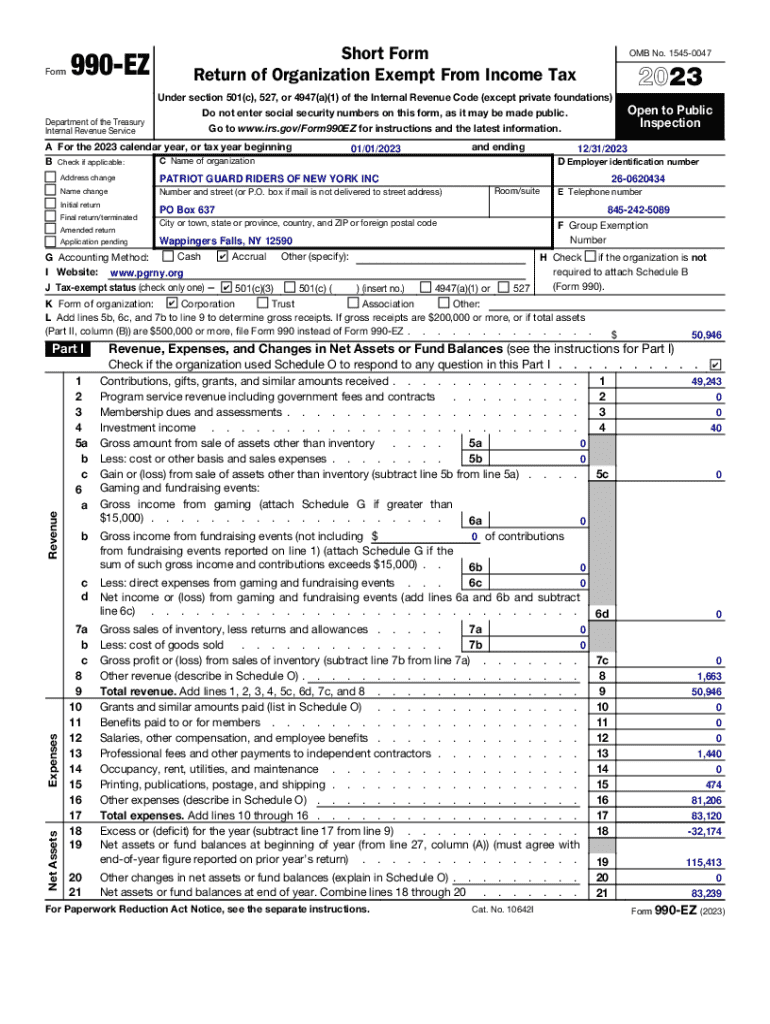

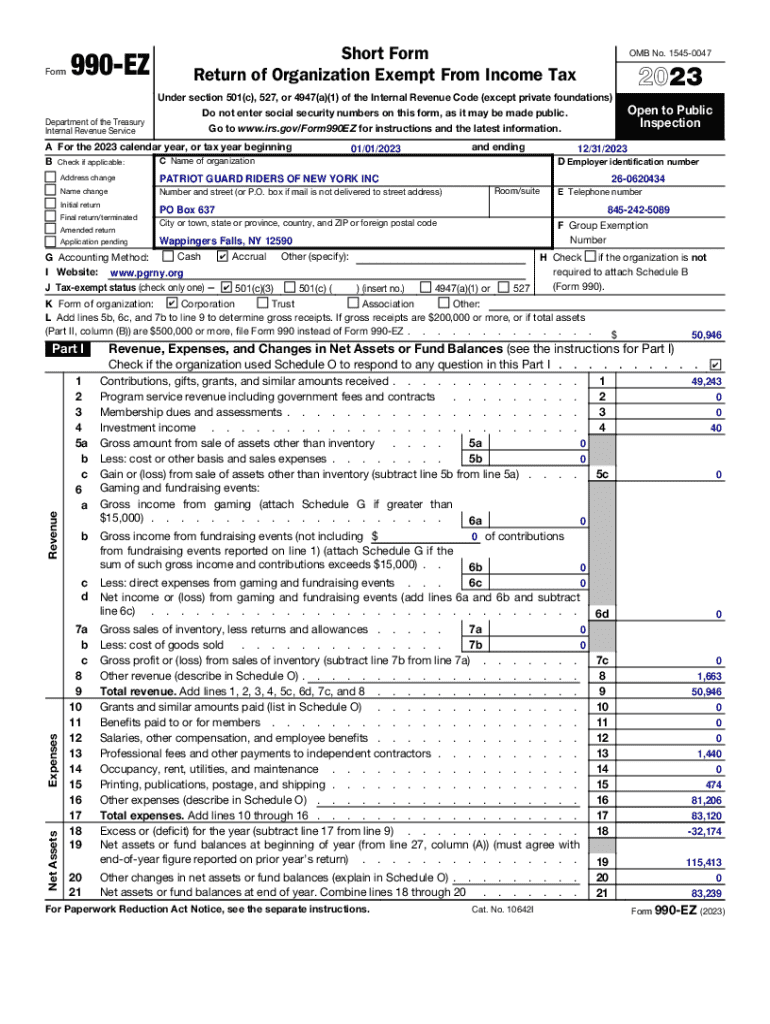

Form 990-EZ is a streamlined version of the IRS Form 990, used by many tax-exempt organizations to report their financial information. This form is specifically designed for organizations with annual gross receipts between $200,000 and $500,000 and total assets under $500,000 at the end of the tax year. A diverse range of nonprofits, including charities and social welfare organizations, falls under this category, thus making Form 990-EZ a crucial document for their compliance and transparency.

Unlike Form 990, which is significantly more detailed and requires more comprehensive reporting, Form 990-EZ presents a simpler alternative for smaller organizations. Those eligible for Form 990-EZ often choose it to reduce the burden of documentation, allowing them to focus more on their missions rather than on extensive paperwork.

Preparing to file Form 990-EZ

Prior to filing Form 990-EZ, organizations must gather all necessary documentation and financial records to ensure accurate reporting. Key documents include financial statements such as balance sheets, income statements, and records of receipts. It's essential to compile this information before the filing deadline to guarantee timely submission and compliance.

Understanding the eligibility requirements for filing Form 990-EZ is also crucial. Organizations must confirm that they meet the threshold of annual gross receipts and overall assets. Common misconceptions include the belief that all nonprofits can use this form or that no financial records are needed, which can lead to complications during the filing process.

Step-by-step guide to completing Form 990-EZ

Filling out Form 990-EZ requires a meticulous approach. Each section of the form is designed to capture specific financial data, starting from income details to governance practices. It’s essential to understand each section to ensure a comprehensive representation of your organization’s financial standing.

When filling out each part of Form 990-EZ, be aware of potential pitfalls, such as omitting crucial financial data or incorrectly categorizing expenses. Best practices include double-checking all entries and utilizing accounting software or consulting with a tax professional to minimize errors.

Editing and reviewing your form

Utilizing pdfFiller, organizations can streamline the editing and review process of Form 990-EZ. Uploading the form to a cloud-based platform allows for easy editing, comment facilitation, and real-time collaboration amongst team members.

Collaboration is a key feature within pdfFiller, allowing multiple users to access and edit the document simultaneously. This can lead to a more thorough review process, reducing the risk of mistakes. Team members can set permissions to determine who can view, edit, or finalize the document, ensuring that sensitive information remains secure.

eSigning and submitting your Form 990-EZ

eSigning has become a pivotal part of the document submission process. The legal implications of electronic signatures are the same as traditional handwritten signatures, making eSigning through pdfFiller a practical choice for organizations looking to comply efficiently with IRS requirements.

When it comes to submitting Form 990-EZ, organizations have the option of electronic submission via the IRS e-file system or mailing a hard copy. If choosing to eFile, ensure that all information is accurate before hitting 'send' as electronic submissions cannot be corrected easily afterward. For those opting to mail in their form, ensure it’s postmarked by the deadline to avoid penalties.

Post-filing considerations

After submitting Form 990-EZ, keeping accurate records is crucial. The IRS generally requires organizations to maintain their tax documents for at least three years after filing. Proper documentation ensures that organizations can respond to any inquiries or audits that may arise regarding their financial activities.

Understanding your organization’s post-filing obligations includes being aware of audit triggers and maintaining open lines of communication with board members about governance and compliance. Should your organization be selected for an audit, having all supporting documents readily available can facilitate the process significantly.

Common questions and issues

Many organizations encounter questions and concerns regarding the nuances of Form 990-EZ, especially surrounding eligibility and submission processes. A common question is about the specific income ranges qualifying an organization for this form. It's essential for organizations to understand these thresholds and prepare accordingly to avoid last-minute filing errors or omissions.

In instances where mistakes arise after submission, organizations can file an amended Form 990-EZ to correct any errors. It’s also helpful to have a clear point of contact for tax-related support within the organization to ensure that all inquiries and issues can be addressed swiftly.

Conclusion

The Form 990-EZ serves as an essential tool for smaller tax-exempt organizations to fulfill their filing obligations, providing a simplified yet comprehensive means of reporting financial activities. By following the step-by-step guide outlined, organizations can navigate the preparation and submission of this form with confidence.

Moreover, leveraging solutions like pdfFiller empowers organizations to streamline their documentation process, ensuring that Form 990-EZ is completed accurately and submitted timely, thereby allowing nonprofit leaders to focus on their mission rather than paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 990-ez electronically in Chrome?

Can I edit form 990-ez on an iOS device?

How can I fill out form 990-ez on an iOS device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.