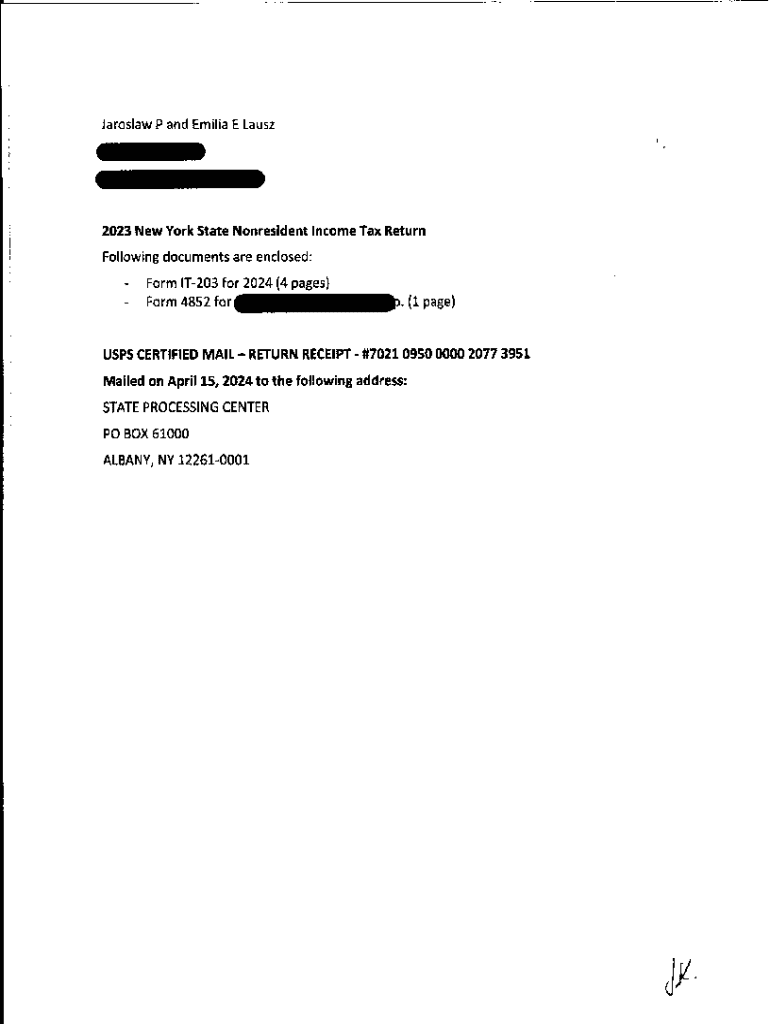

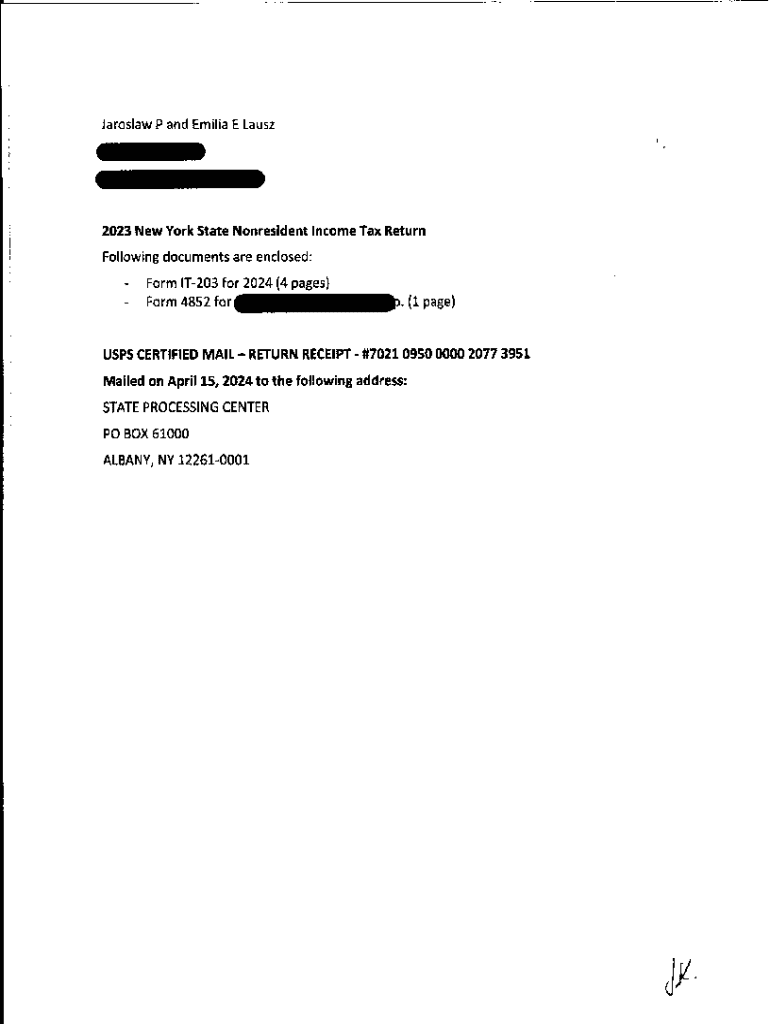

Get the free 2023 New York State Nonresident Income Tax Return

Get, Create, Make and Sign 2023 new york state

How to edit 2023 new york state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 new york state

How to fill out 2023 new york state

Who needs 2023 new york state?

Comprehensive Guide to the 2023 New York State Form

Understanding the 2023 New York State Form

New York State tax forms are crucial tools for both individuals and businesses when it comes to filing taxes and ensuring compliance with local regulations. The 2023 New York State Form, which encompasses a variety of tax-related documents, plays a significant role in this process. Understanding the nuances of these forms not only helps to streamline the filing process but also ensures accuracy and efficiency in tax obligations.

Accurate filing is essential for individuals and teams, significantly impacting tax refunds and liabilities. The 2023 tax season brings key regulatory changes that taxpayers need to be aware of, making it all the more crucial to familiarize with the correct forms. These changes may pertain to tax rates, deductions, or available credits, which could influence how you prepare and file your taxes.

Types of New York State Forms

When it comes to filing taxes in New York, different forms cater to varying needs. Here’s a breakdown of key forms you might encounter:

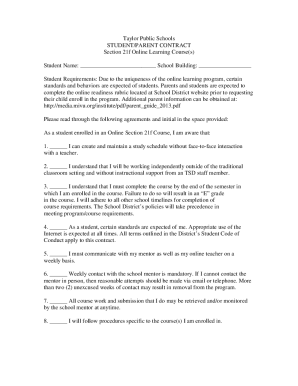

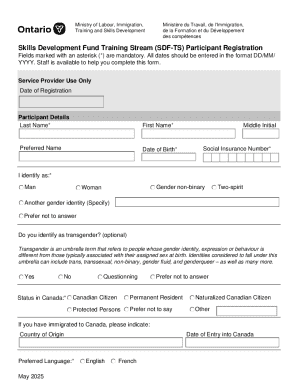

For individuals, the most common forms are Form IT-201 and Form IT-203, while businesses often utilize Form CT-3 and Form NYS-1. Additionally, miscellaneous forms such as Form IT-246 and Form IT-230 address specific tax credits and deductions relevant to individual taxpayers.

Step-by-step guide to filling out the 2023 New York State Form

Filling out your 2023 New York State Form doesn’t have to be overwhelming. Follow these steps for a seamless experience.

Interactive tools and resources

pdfFiller offers a suite of interactive tools and resources to simplify tax filings for the 2023 New York State Form.

Reviewing and submitting your 2023 New York State Form

Once you've completed your form, it's essential to conduct a final review before submission.

Frequently asked questions (FAQs)

Navigating tax forms can often lead to many questions. Here are some common inquiries regarding the 2023 New York State Form:

Additional support for your filing journey

The New York State Tax Authority offers numerous resources to assist taxpayers in navigating their filings.

Case studies and success stories

Real-life scenarios showcase how taxpayers successfully navigated the complexities of the 2023 New York State Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2023 new york state from Google Drive?

Can I sign the 2023 new york state electronically in Chrome?

Can I create an electronic signature for signing my 2023 new york state in Gmail?

What is new york state?

Who is required to file new york state?

How to fill out new york state?

What is the purpose of new york state?

What information must be reported on new york state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.