Get the free CIBC Payment Protector Insurance for Credit Cards

Get, Create, Make and Sign cibc payment protector insurance

How to edit cibc payment protector insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cibc payment protector insurance

How to fill out cibc payment protector insurance

Who needs cibc payment protector insurance?

Understanding the CIBC Payment Protector Insurance Form

Overview of CIBC Payment Protector Insurance

CIBC Payment Protector Insurance offers a safety net for individuals holding CIBC credit products. This insurance helps ensure that your loan or credit card payments are covered in cases of unforeseen circumstances. Its primary objective is to alleviate financial stress by protecting borrowers from the impact of events such as job loss or critical illness.

The significant benefits of CIBC Payment Protector Insurance include peace of mind, as it potentially protects you from missed payments that could negatively impact your credit rating. Additionally, it encompasses a wide range of life events, ensuring that policyholders feel secure no matter what challenges arise.

Eligibility for this insurance predominantly includes CIBC credit cardholders and personal loan customers. It can be a critical support during tough times, as it covers several scenarios that can impact an individual's ability to make payments, such as layoffs, injuries, or diagnosis of severe health issues.

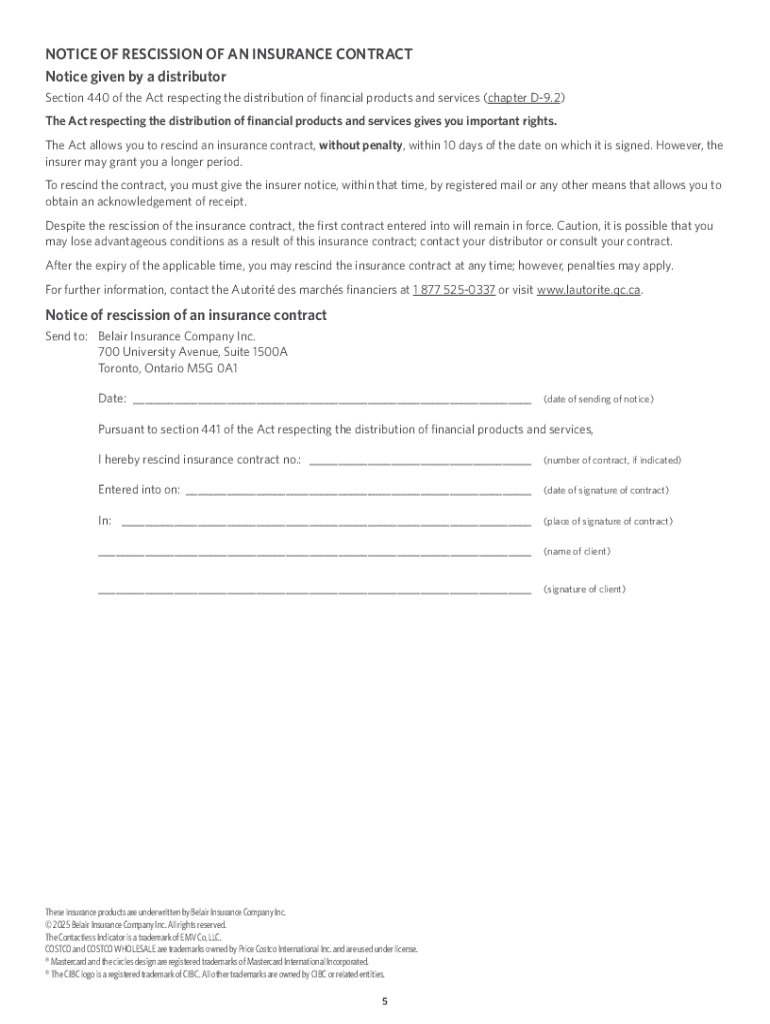

Understanding the CIBC Payment Protector Insurance Form

The CIBC Payment Protector Insurance Form is essential for securing your coverage. This form collects necessary information that CIBC needs to assess your eligibility and determine your appropriate coverage. Completing this form accurately is critical, as any mistakes may delay processing or result in denial of coverage.

The key sections of the form include Personal Information, where you provide identifying details; Coverage Options, where you specify the type and extent of coverage desired; Payment Details, outlining your payment methods; and a Signature and Declaration section, which confirms your understanding and acceptance of the policy terms.

Step-by-step guide to completing the CIBC Payment Protector Insurance Form

Completing the CIBC Payment Protector Insurance Form involves several organized steps to ensure thoroughness. Start by gathering all necessary information which typically includes identification documents such as a driver's license or passport, alongside your financial information like income sources and expenses.

Next, you will fill out the form systematically. First, input your personal information accurately to avoid any identification issues. Move on to select the appropriate coverage options that meet your needs. Be cautious here—common mistakes include selecting incorrect coverage levels or omitting required fields. After filling out, take the time to review your form; missing a detail may cause significant delays in processing.

Once the review is complete, sign the form confirming your agreement and submit it through your preferred method—electronic or paper. Electronic submission may speed up processing times significantly.

Editing the CIBC Payment Protector Insurance Form using pdfFiller

Many users opt for pdfFiller to edit documents like the CIBC Payment Protector Insurance Form due to its simplicity and functionality. To begin, access the form directly on pdfFiller. The platform allows you to import your document quickly, ensuring you have the latest version.

The editing features on pdfFiller are user-friendly and enhance your experience significantly. You can add text to fill in required sections conveniently. If your insurance application requires a signature or a photo, pdfFiller also allows you to insert images. In addition, templates are readily available for quicker edits, making the whole process more efficient.

eSigning the CIBC Payment Protector Insurance Form

The adoption of electronic signatures in insurance processes has made things more convenient for consumers. eSigning the CIBC Payment Protector Insurance Form using pdfFiller secures your identity and ensures your consent is valid. This modern method not only speeds up the signing process but typically offers enhanced security benefits.

To eSign your form through pdfFiller, simply follow the prompts on the platform. It guides you through selecting the location for your signature and completing any additional required fields. Notably, pdfFiller incorporates industry-standard security features, including encryption, which keeps your signature and document secure throughout the process.

Managing your CIBC Payment Protector Insurance documentation

Once you've completed your application using the CIBC Payment Protector Insurance Form, managing your documents efficiently is crucial. pdfFiller provides various tools to keep your records secure and accessible. You can store your filled form securely within your pdfFiller account, ensuring that you have it on hand whenever needed.

Furthermore, the platform makes it easy to share your documents. Whether you need to send your application to a spouse or a financial advisor, pdfFiller allows for smooth sharing options. Additionally, you can keep track of policy updates and renewal notifications, ensuring that you are always informed about the terms and status of your coverage.

FAQs about CIBC Payment Protector Insurance Form

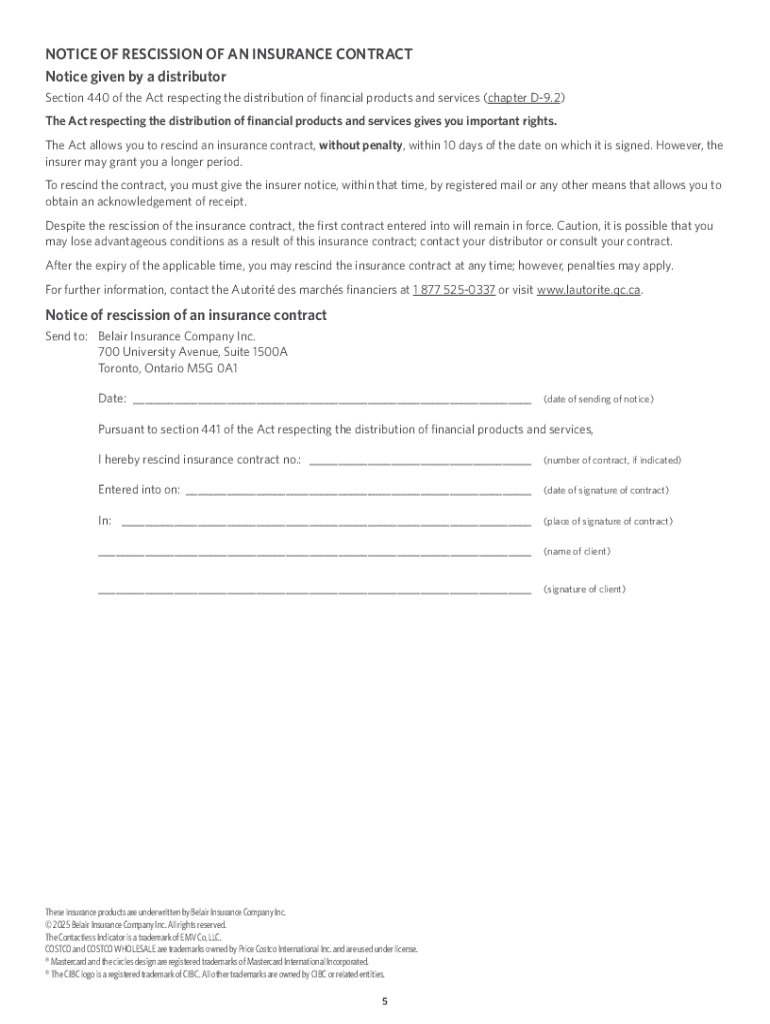

Understanding details about your insurance application is essential, and it's common for questions to arise. If you discover an error after submitting your CIBC Payment Protector Insurance Form, you should promptly contact CIBC customer service to resolve it. They can guide you through any necessary adjustments.

Similarly, if you want to change your coverage options after submission, it is typically possible but may require another form or adjustments to your current policy. Processing times for the insurance application can vary; usually, you can expect a few business days, but it’s always best to confirm with CIBC directly.

Troubleshooting common issues with the CIBC Payment Protector Insurance Form

Like any process, issues can arise when submitting your CIBC Payment Protector Insurance Form. Common submission errors may include missing information or incorrect data entry. To address these issues, always double-check the information on your form and utilize resource tools, such as checklists, to ensure completeness.

If your application is denied, review the communication you receive from CIBC. It typically contains reasons for denial and instructions on how to rectify the situation. For further assistance, you can contact CIBC's customer service department, who can help guide you through the reapplication process if necessary.

Benefits of using pdfFiller for your insurance needs

pdfFiller stands out as a comprehensive document management solution tailored to insurance needs, including the CIBC Payment Protector Insurance Form. Its robust features empower users to navigate complex forms with ease. The access-from-anywhere capabilities ensure that you can fill, edit, and manage your forms from any location, whether at home or on the go.

Additionally, collaboration and sharing tools streamline teamwork, making it easier for individuals or teams working together on insurance applications. Users have reported successful navigation of their insurance forms using pdfFiller, highlighting its intuitive interface and the efficiency it brings to managing important documents.

Interactive tools to assess your coverage needs

To make the most informed decisions about your insurance coverage, interactive tools can be incredibly beneficial. Several calculators available on pdfFiller can help you determine the necessary coverage limits based on your financial circumstances and needs. These tools ensure that you won't be under or over-insured.

Moreover, comparison tools allow you to evaluate different insurance products, enabling you to choose a plan that best aligns with your financial and personal situations. The resources on pdfFiller will assist you to navigate the costs associated with Payment Protector Insurance, highlighting what factors might influence premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cibc payment protector insurance directly from Gmail?

How can I get cibc payment protector insurance?

Can I create an electronic signature for the cibc payment protector insurance in Chrome?

What is cibc payment protector insurance?

Who is required to file cibc payment protector insurance?

How to fill out cibc payment protector insurance?

What is the purpose of cibc payment protector insurance?

What information must be reported on cibc payment protector insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.