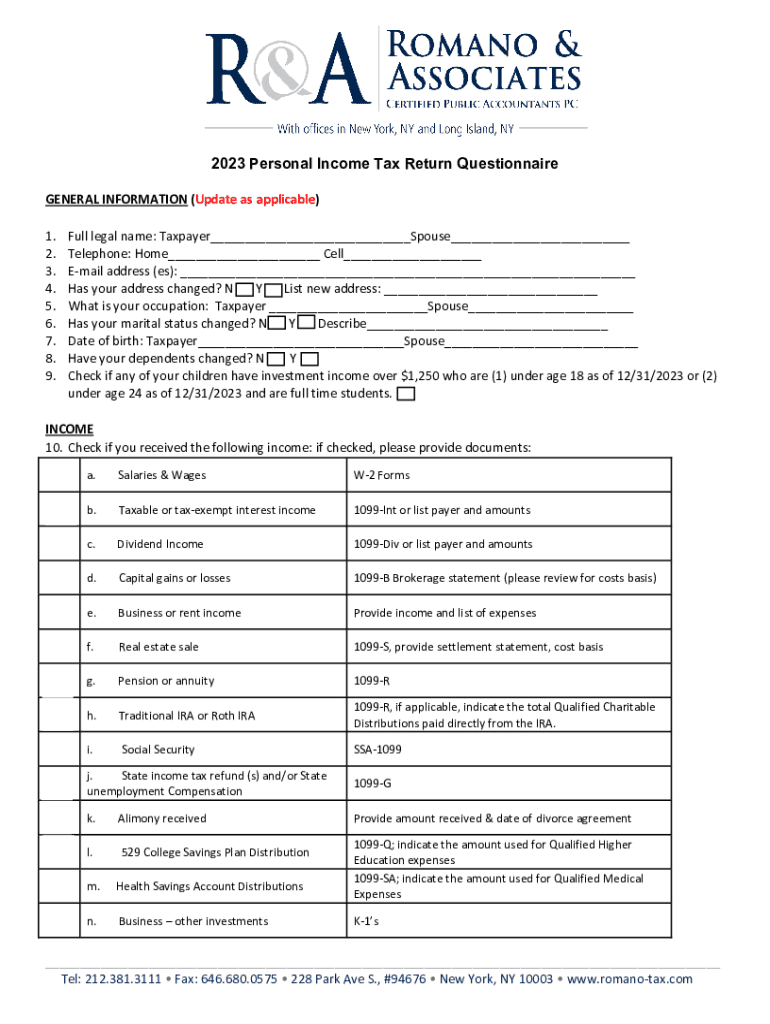

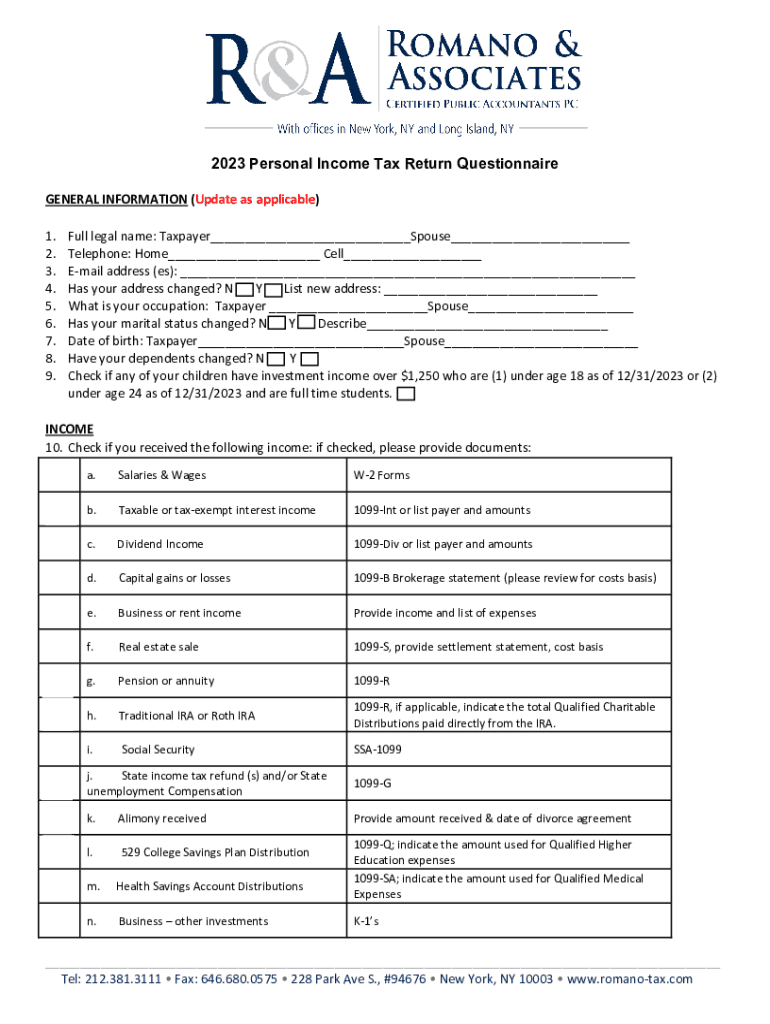

Get the free 2023 Personal Income Tax Return Questionnaire

Get, Create, Make and Sign 2023 personal income tax

Editing 2023 personal income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 personal income tax

How to fill out 2023 personal income tax

Who needs 2023 personal income tax?

Your Complete Guide to the 2023 Personal Income Tax Form

Understanding the 2023 personal income tax form

The 2023 personal income tax form is a pivotal document for taxpayers aiming to report their earnings, claim deductions, and compute their tax obligations accurately. Personal income tax forms vary based on your financial situation; hence, grasping the differences is essential. Filing becomes not just a bureaucratic task but a key responsibility that can significantly influence your financial wellness. Hence, understanding the structure of the document and how it serves your reporting requirements is crucial.

Filing accurately in 2023 is paramount, especially considering recent economic trends. With inflation affecting the cost of living, being precise in your tax filings can ensure that you benefit from available credits and deductions designed to alleviate financial strain. Taxpayers need to recognize the nuances of this year’s forms to maximize their potential refund or minimize owed taxes.

Key changes to the 2023 personal income tax obligations

This year introduces several significant changes concerning personal income tax obligations. Understanding these updates will help taxpayers optimize their returns. The IRS has adjusted tax rates and brackets, reflecting economic adjustments from the previous year. This means that categorization as a taxpayer is crucial to determining what rates apply to your income.

New deductions and credits have also been introduced for 2023. For instance, many taxpayers may qualify for extended deductions related to inflation relief checks and changes in expense claims for educational and health expenses. Furthermore, COVID-19 relief methods continue to evolve, providing potential benefits that could apply to your situation this year. Taxpayers are encouraged to review new credits available that can greatly impact their financial situation.

Step-by-step guide to completing the 2023 personal income tax form

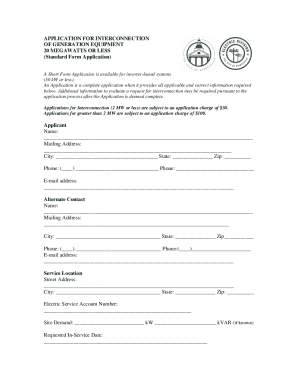

Navigating your way through the 2023 personal income tax form may seem daunting, but following a step-by-step process can simplify your experience. The first step is to gather all necessary documentation, which is crucial for an accurate filing.

Step 1: Gather your documentation

Your preparation involves collecting essential documents. The primary documents you'll need include W-2 and 1099 forms which report your income. Furthermore, gathering all receipts related to deductions is an absolute requirement; whether they relate to health expenses or education, each plays a vital role in your overall refund calculation. Don’t forget your previous year’s tax return, as it can serve as a helpful reference.

Step 2: Choose the correct form

Different personal income tax forms serve distinct needs. Generally, taxpayers may choose from Form 1040, 1040A, or the simplified 1040EZ. The complexity of your financial situation should determine your selection. If you have multiple income sources or specific deductions, the standard Form 1040 is your best bet. Simplified versions work best for straightforward scenarios without itemized deductions.

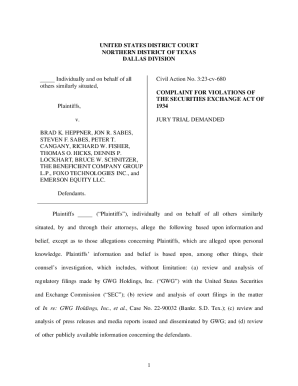

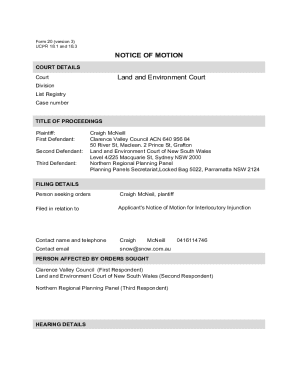

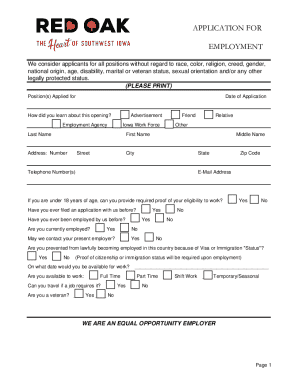

Step 3: Prepare your taxes using pdfFiller

Utilizing pdfFiller not only simplifies document management but also enhances efficiency when filing your 2023 personal income tax form. The platform offers interactive tools that make filling out your form easy and accurate. With cloud-based document management, accessing your information from anywhere means that you can manage your taxes at your convenience.

Step 4: Review and verify your entries

Mistakes can be costly. Therefore, before submission, ensure that all entries are accurate and complete. Common errors include mismatched Social Security numbers, incorrect calculations, and failure to sign your return. Conducting a thorough review process mitigates these mistakes and increases the likelihood of a smooth filing experience.

Filing options for the 2023 personal income tax form

When the form is ready, taxpayers must decide on their filing method. E-filing is becoming the preferred choice due to its speed and efficiency. However, traditional mailing is still an option for those opting for paper submissions.

E-filing: Quick and convenient

E-filing has many advantages. Submitting your 2023 personal income tax form through pdfFiller allows for quick processing. Moreover, the electronic submission means that you can receive real-time notifications from the IRS. This ensures that you will be alerted in case of any issues or necessary adjustments to your submitted form.

Mailing your tax return

When deciding to mail your tax return, print it clearly and double-check for all signatures before sealing it in an envelope. Ensure to use a USPS method that allows tracking, securing proof of your filing. This is particularly critical should someone try to claim that you failed to file.

Managing, editing, and signing your tax documents with pdfFiller

With pdfFiller, managing your tax forms becomes a straightforward task. The platform offers editing features that allow you to modify your personal income tax forms quickly and easily. It also offers the option to add digital signatures, which can streamline the process and make submissions easier for those collaborating with a tax professional.

Collaborating with tax professionals

Using pdfFiller's collaboration tools means that you can work seamlessly with tax professionals. This optimizes workflow management, ensuring that all parties involved can access and modify documents as necessary. Such collaboration is always beneficial, especially during sensitive financial discussions. The functionalities allow for structured communications, rather than emails filled with back-and-forth attachments.

Common post-filing scenarios

After filing, taxpayers might encounter several situations that require prompt attention. You might receive inquiries from the IRS regarding discrepancies or needed clarifications. Understanding how to respond to these inquiries can help mitigate further issues. Moreover, managing tax refunds effectively – knowing how to check on the status or set up payment plans for any potential dues – is essential for handling your finances responsibly.

If you need to modify your tax return post-submission, it’s crucial to know the proper steps. In most cases, filing an amended return using Form 1040X is the way to go. Staying proactive post-filing will save you time and stress.

How pdfFiller can simplify your tax filing process

pdfFiller presents users with a comprehensive document management solution tailored for seamless tax filing. With easy access from anywhere, users can ensure that they’re preparing their 2023 personal income tax form efficiently and accurately. Enhanced security features add an additional layer of protection for confidential tax information, helping you feel secure in your submissions and communications with the tax department.

FAQs about the 2023 personal income tax form

Tax season inevitably sparks questions, particularly for first-time filers. Common concerns include the types of deductions available, how to interpret recent changes, and strategies to avoid tax scams during the filing process. It’s vital to research and understand your options deeply, as being well-informed can maximize your return or minimize what you owe. For experienced taxpayers, it’s equally important to adapt to new regulations to ensure compliance.

Reviewing changes in state-specific filing requirements for 2023

Each state may have distinct regulations and requirements for filing personal income taxes, and it’s important to familiarize yourself with these when preparing your return. State income tax forms often require additional documentation or different deadlines. Utilizing resources available online for state income tax forms can provide valuable insights and help simplify the filing process.

Getting help: contact and support options

pdfFiller offers robust support options to assist users navigating the complexities of the 2023 personal income tax form. Customer service representatives are available to help with account inquiries or technical assistance, ensuring that users can file without hitches. Online resources, such as how-to guides, are immensely useful in providing step-by-step instructions for any uncertainties. Additionally, connecting with tax professionals is encouraged for personalized guidance, especially if your tax situation is complex or you’re dealing with significant changes from previous years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2023 personal income tax without leaving Chrome?

How do I edit 2023 personal income tax straight from my smartphone?

How do I edit 2023 personal income tax on an Android device?

What is personal income tax?

Who is required to file personal income tax?

How to fill out personal income tax?

What is the purpose of personal income tax?

What information must be reported on personal income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.