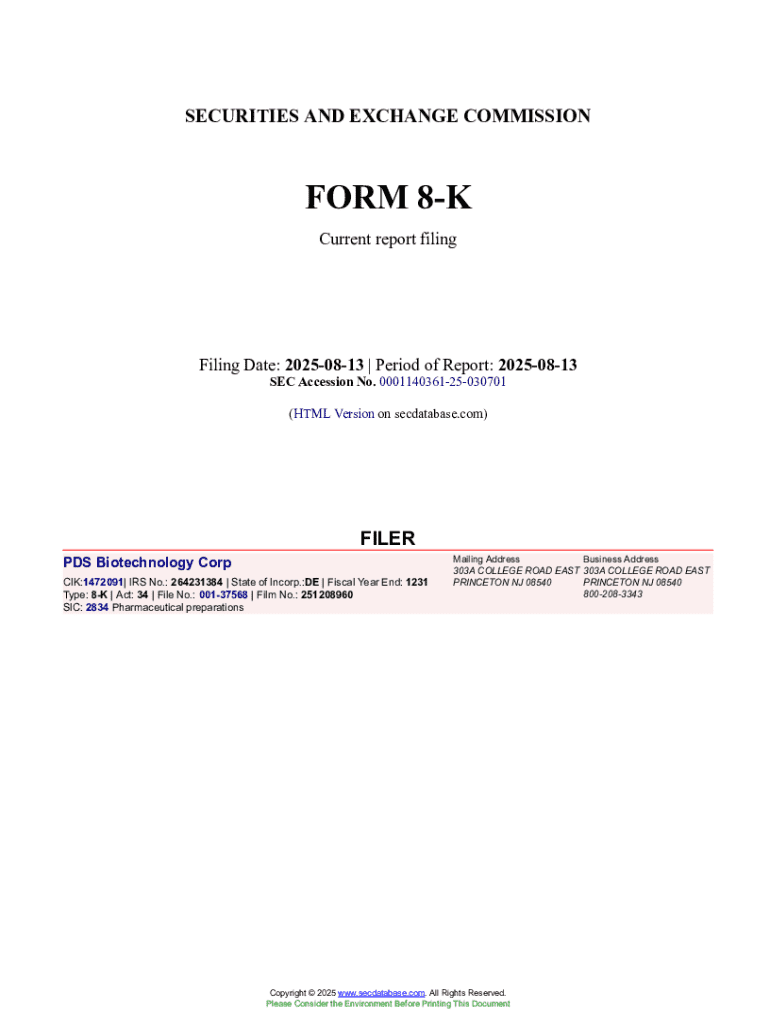

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Complete and Understand Form 8-K

Understanding Form 8-K: What You Need to Know

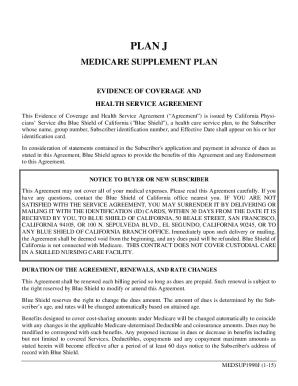

Form 8-K is an essential report that publicly traded companies must file with the Securities and Exchange Commission (SEC) to announce major events that shareholders should know about. Unlike annual reports or quarterly filings, which are scheduled at specific times, the Form 8-K must be submitted in a timely manner whenever certain significant events occur, ensuring that the public is kept informed of any material changes.

The significance of Form 8-K lies in its role as a communication tool that promotes transparency within the financial markets. It informs investors, analysts, and the general public about a company's operational or financial conditions and governance. Key components of this form can include information on mergers and acquisitions, bankruptcy, changes in executive leadership, and significant asset purchases.

When is Form 8-K Required?

Filing Form 8-K is generally triggered by specific events categorized as 'reportable' under SEC regulations. Companies must determine whether an incident is significant, which could include but is not limited to changes in control, bankruptcy, or amendments to the company’s articles of incorporation. Regulatory obligations require companies to file Form 8-K within four business days of the occurrence of the event.

The SEC mandates strict compliance with these filing timelines to preserve transparency in the financial markets. Late filings can potentially result in penalties, including fines, which highlight the importance of timely compliance.

Benefits of Using Form 8-K

The benefits of using Form 8-K extend beyond mere compliance. For publicly traded companies, filing a 8-K fosters a culture of transparency that helps build trust with investors. As stakeholders become more informed about company developments, they can evaluate their investment decisions with the most current information available.

Additionally, timely disclosures can influence market perception favorably. When investors perceive a company as transparent, they are more likely to invest, promoting a stable stock price. Moreover, ethical corporate governance practices significantly enhance a company's reputation, which can attract not only investors but also potential business partners.

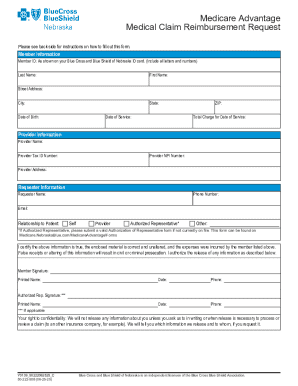

How to fill out a Form 8-K effectively

Completing Form 8-K requires careful attention to detail to ensure that all necessary information is appropriately reported. Follow this step-by-step guide to fill out Form 8-K effectively.

How to read and interpret a Form 8-K

Understanding how to read and interpret a Form 8-K is vital for investors and stakeholders. First, familiarize yourself with the structure of the form. Each section provides important disclosures relevant to your investment decisions. Language used in the filings may include specific jargon, so it's essential to grasp terminology such as 'material adverse effect' or 'control change.'

Identifying key disclosures, especially positive or negative changes within a company's operations or financials is crucial. Understanding the implications of these disclosures helps in making informed decisions. Market analysts often monitor Form 8-K filings for clues about future performance, making it an indispensable resource for serious investors.

Common challenges and tips for filing Form 8-K

Filing Form 8-K is not without challenges. Common mistakes include forgetting key disclosures, filing under the wrong item, or failing to meet the four-business-day deadline. Each of these can lead to penalties or scrutiny from regulators, which can harm a company's reputation.

To help navigate this complex process, companies should maintain clear communication among departments and have a dedicated compliance team to manage filings. Utilizing checklist resources and template forms can streamline preparation and reduce errors.

Frequently asked questions about Form 8-K

Filing Form 8-K timely is vital, but companies occasionally file late. What happens in these situations? A late Form 8-K can lead to a range of consequences including potential fines and inquiries from the SEC. If the event is indeed material, the filing should still be made to provide as much disclosure as possible to investors. Companies can also amend a Form 8-K after submission if new information necessitates adjustments or corrections.

Moreover, understanding how Form 8-K affects investor decision-making is essential. Investors often use disclosures to react to market movements, assess risk, and reevaluate their trades. Not only do late filings create a sense of mistrust, but they undermine the entire principle of timely market information.

Keeping up with updates and changes

Staying informed of SEC regulations regarding Form 8-K is crucial for corporate compliance. Regularly reviewing changes in filing requirements and updating internal processes is essential for maintaining transparency with investors. Companies can subscribe to the SEC’s notifications for any updates affecting their filings, which is vital for proactive engagement in compliance.

Additionally, utilizing technology tools such as document management systems can streamline the filing process and enhance tracking compliance. Form management software, like that offered by pdfFiller, allows users to maintain organization and assurance in their documentation, ensuring that every submission is timely and accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k to be eSigned by others?

Can I create an electronic signature for signing my form 8-k in Gmail?

How do I fill out form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.