Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

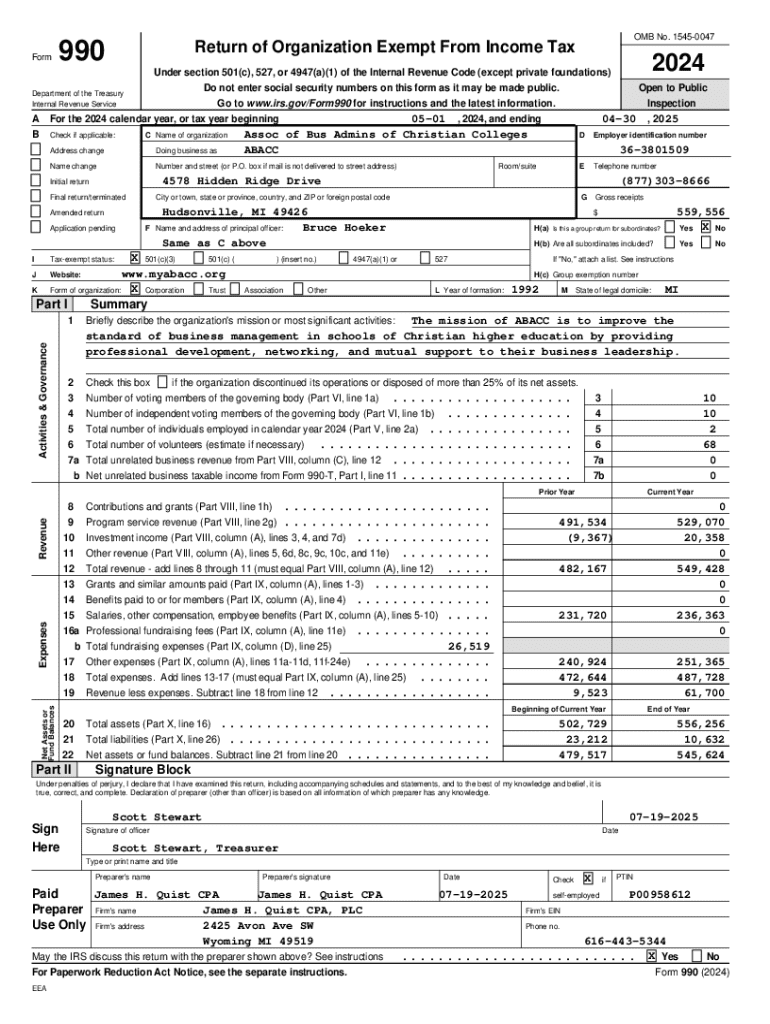

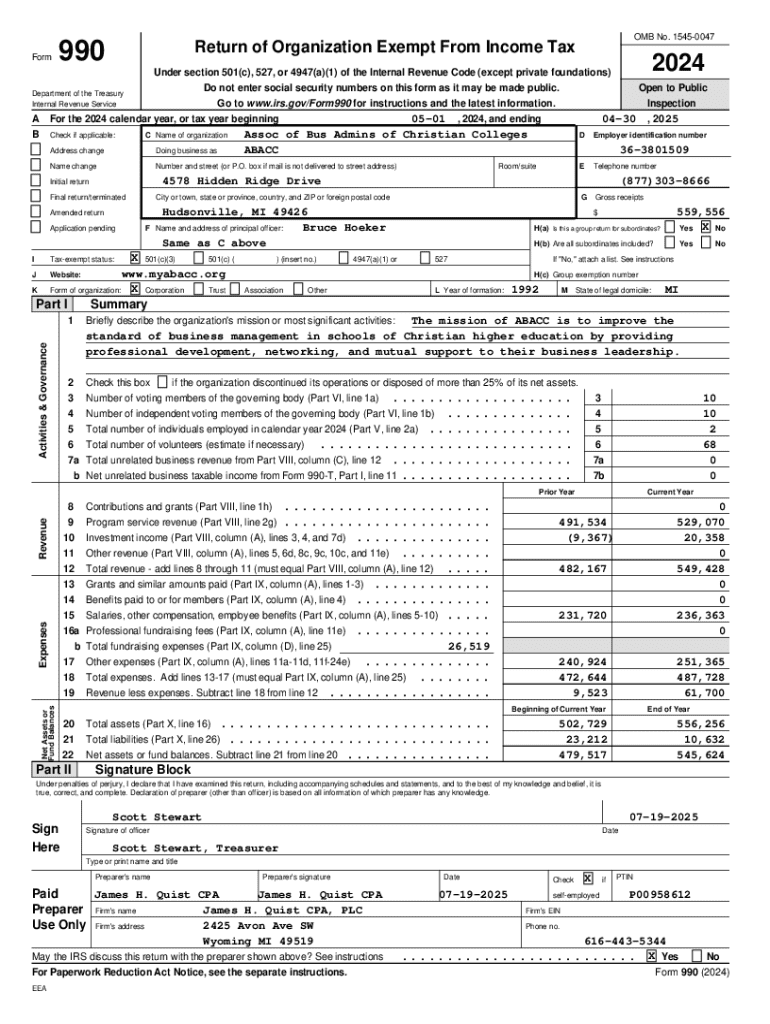

Understanding the Form 990

Form 990 serves as a critical instrument for tax-exempt organizations in the United States, primarily nonprofits. It is designed to provide transparency into the financial activities, operations, and governance of these organizations. The purpose of Form 990 is not only to comply with IRS requirements but also to offer a comprehensive overview for donors, stakeholders, and the public regarding an organization’s fiscal health and mission effectiveness.

The importance of Form 990 cannot be understated. For nonprofits, filing Form 990 is crucial as it helps to maintain their tax-exempt status while informing stakeholders about their operational activities. Additionally, the form contributes to public trust and transparency, which are essential for fundraising and donor engagement.

Who needs to file Form 990?

Not every entity is obligated to file Form 990. Generally, organizations recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code need to submit this form annually. Key eligibility criteria include size and type of organization; typically, organizations with gross receipts over $200,000 or total assets exceeding $500,000 must file the comprehensive Form 990, while smaller organizations may use Form 990-EZ or Form 990-N (e-Postcard).

Different entities, such as charitable organizations, private foundations, and social clubs, also have unique requirements for filing. It’s essential for organizations to identify their specific classification to ensure compliance and avoid penalties due to misinformation.

When is Form 990 due?

Form 990 is typically due on the 15th day of the fifth month following the close of an organization's fiscal year. For most nonprofits that operate on a calendar year, this translates to a due date of May 15. However, organizations can request an automatic six-month extension by filing Form 8868, extending the due date to November 15. Organizations that fail to meet these deadlines may incur late filing penalties, which can accumulate to $20 per day, capping at $10,000, or 5% of the organization’s gross receipts for the tax year.

Awareness of due dates is vital not only to avoid penalties but also to maintain good standing with the IRS, which can impact funding and donor relationships.

Navigating the structure of Form 990

Understanding the structure of Form 990 is essential for accurate completion. The form consists of multiple parts that break down financial and operational information. Notably, Part I serves as a summary, presenting a snapshot of the organization’s mission, programs, and financial status. In addition, Part II contains the signature block, certifying the accuracy of the form, while Part III shares the organization’s program accomplishments that reflect its mission in action.

Other significant sections include Part IV, which outlines the organization’s revenue and expenditures, and Part V, which covers governance practices. Accurately navigating these sections can lead to clearer insights into the organization's structure and financial management.

Understanding key terms and information on Form 990

A crucial aspect of completing Form 990 is understanding the terminology used throughout the document. Terms such as 'contributions' generally refer to donations received and can include cash, property, or services. Likewise, 'expenditures' pertain to expenses related to various activities, including program services, administrative costs, or fundraising efforts. Grasping these definitions allows organizations to accurately report their financial activities.

Furthermore, organizations should familiarize themselves with other financial jargon found in the form, such as 'assets,' 'liabilities,' and 'net assets'. This knowledge equips nonprofit leaders with the critical understanding required for effective financial reporting and compliance with tax laws.

Step-by-step instructions for filling out Form 990

The first step before filling out Form 990 is gathering necessary information. Essential documents include prior year tax returns, financial statements, board meeting minutes, and a record of contributions and expenses. Ensuring that this data is well-organized can significantly reduce errors during completion. It’s crucial for organizations to have their financial records in a systematic manner, as this can streamline the filing process.

Once the information is gathered, organizations can start filling out each section of Form 990. Careful attention should be paid to input accurate data, particularly in financial sections, to avoid discrepancies. Utilizing checkboxes and clear labeling will aid in navigation. Common pitfalls while filling the form may include misunderstanding or misinterpreting sections; thus, it helps to refer back to IRS instructions or consult a tax advisor for clarification.

Checklist before submitting Form 990

Before submitting Form 990, organizations should conduct a thorough review of the completed form. A pre-filing checklist can ensure accuracy and completeness. Essential items include confirming that all necessary sections are completed, ensuring the signature block is filled out, and verifying that required schedules are attached.

It’s also advisable to review financial figures against source documents to catch any discrepancies. Organizations should also ensure that the form is submitted to the correct IRS address based on their location and that they maintain copies of submitted forms for their records. An organized filing system can help track submissions and prepare for future audits.

Editing and managing your Form 990

Managing Form 990 efficiently can be facilitated by digital tools like pdfFiller. This platform offers a seamless experience for PDF editing, allowing users to upload, fill, and save Form 990 effortlessly. Organizations can benefit from features such as real-time collaboration, version control, and easy access to completed documents, which simplifies the often tedious process of document management.

Using pdfFiller allows organizations to focus on the substance of their form rather than getting bogged down in paperwork. The platform ensures that all data remains secure while still allowing easy access for all users involved in the form preparation process.

eSigning your Form 990

In today’s digital environment, eSigning forms has become increasingly popular. The benefits of electronic signatures include faster turnaround times and increased convenience, particularly for organizations with multiple stakeholders involved in the approval process. For organizations using pdfFiller, the process to eSign Form 990 is straightforward. Users can simply click the 'eSign' option and follow prompts to authenticate and sign the document electronically.

Moreover, eSigning through pdfFiller ensures the security and legal validity of the signed document, making it a reliable choice for sensitive forms like Form 990. This not only speeds up the process but also enhances overall compliance and operational efficiency.

Tracking and storing your Form 990

Proper document tracking and storage practices can mitigate chaos during audits or inquiries. When using pdfFiller, organizations can easily store their completed Form 990s in a cloud-based system, accessible from anywhere. This allows authorized personnel to track changes and updates made to the form over time, while ensuring compliance with documentation requirements.

It’s essential for organizations to maintain an organized digital filing system, categorizing documents by year and type. Documentation history can then be reviewed to ensure all appropriate forms are submitted timely and to prepare for eventual IRS reviews.

Common questions about Form 990

Despite its importance, many organizations have questions about Form 990 and its requirements. Common inquiries revolve around eligibility, the processing timeline, and understanding penalties for late filing. For instance, many smaller organizations mistakenly assume they can skip filing if their revenues are below certain thresholds, only to find out they’re required to file Form 990-N (e-Postcard).

Clarifying misconceptions about Form 990 can mitigate filing errors. Engaging with a community of nonprofit leaders or seeking guidance from tax advisors can provide valuable insights and shared experiences, often resulting in a more accurate reporting process.

Contextual case studies

Examining real-world examples of Form 990 mishaps and successes can be enlightening. Some organizations face significant penalties for late filings, while others have succeeded in improving transparency and funding through accurate reporting. One notable case is that of a nonprofit that, due to inaccurate data reporting, lost its tax-exempt status, highlighting the importance of diligence in completing Form 990.

Conversely, several nonprofits have demonstrated growth in donor trust and funding after implementing best practices in their reporting. Learning from these examples fosters a proactive approach to completing Form 990 accurately and on time.

Additional tools and resources for nonprofits

In addition to utilizing pdfFiller, nonprofits can benefit from various interactive tools designed to assist with Form 990 filing. These include calculators to estimate filing requirements, document templates for related nonprofit documentation, and extensive resource libraries offering guidelines and tax compliance updates.

Engaging with these tools empowers organizations to ensure all filing deadlines are met and can significantly improve their operational efficiency. Many organizations also take advantage of community forums where they can share experiences, challenges, and strategies in managing Form 990 and nonprofit compliance more generally.

Conclusion

Form 990 is more than just a tax document; it serves as a vital narrative of an organization’s financial activities and commitment to public accountability. By leveraging resources such as pdfFiller, nonprofits can simplify the process of filing, editing, and managing this crucial form. Understanding and utilizing Form 990 effectively is essential for maintaining tax-exempt status and enhancing transparency, thereby fostering trust and engagement within the community served.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 online?

How do I edit form 990 on an Android device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.