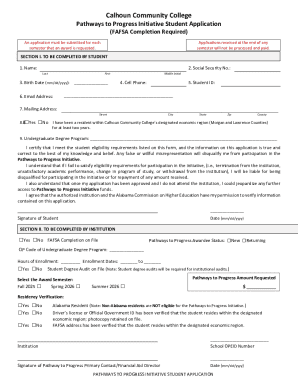

Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

How to edit form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Form 990-PF: How-to Guide Long-Read

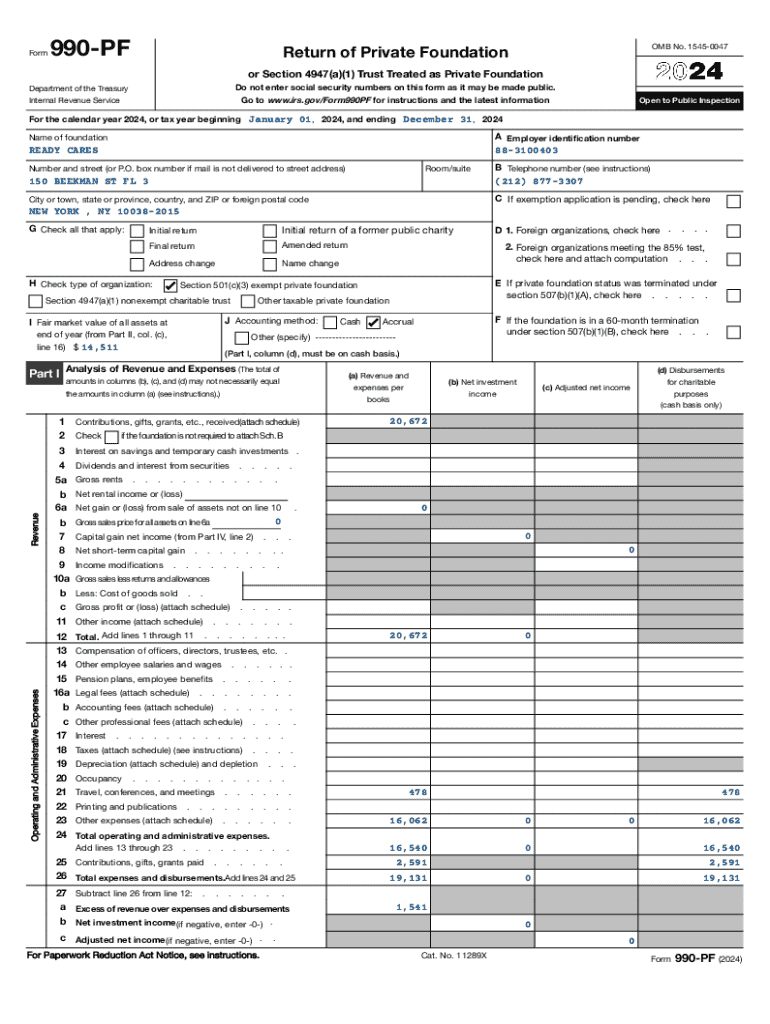

Overview of Form 990-PF

Form 990-PF is an essential document specifically designed for private foundations in the United States. This form serves as the federal income tax return for private foundations and is vital for promoting transparency and accountability within the nonprofit sector. Unlike other IRS forms, such as Form 990 or Form 990-EZ used by public charities, Form 990-PF focuses exclusively on private foundations and their unique reporting requirements.

The primary purpose of Form 990-PF is to provide the IRS and the public with detailed information regarding a foundation's financial activities, including how it allocates its funds towards charitable purposes. This transparency helps ensure that private foundations adhere to the legal obligations set forth in the Internal Revenue Code while allowing stakeholders to assess the foundation's efficiency and impact.

Who must file Form 990-PF?

Private foundations that are classified as 501(c)(3) organizations by the IRS generally must file Form 990-PF annually, regardless of their financial status. The eligibility criteria typically include foundations that have been created through a charitable endowment or foundation trust, either by an individual, family, or corporation. Smaller private foundations that meet certain conditions regarding their annual gross receipts may find exceptions but still hold some level of obligation to report.

It’s important to note that while most private foundations are required to file Form 990-PF, there are several considerations regarding the filing status of smaller foundations or those with specific circumstances — such as foundations that qualify as 'non-functionally' private (those who spend sufficient amounts on charitable distributions). Consulting with a tax professional is advisable to navigate these details.

Filing requirements for Form 990-PF

Filing deadlines play a crucial role in managing Form 990-PF. Typically, the form is due on the 15th day of the 5th month after the end of the foundation's accounting period. For most private foundations operating on a calendar year, this means the due date falls on May 15th. It is essential to note that any delay in the submission of this form may result in penalties, which could escalate based on how late the return is filed.

Penalties for missing the deadline can range from a flat fee to increased charges depending on the duration of the delay. Private foundations may also risk losing their tax-exempt status if they consistently fail to file their necessary forms. Therefore, timely filing is a high priority for any organization maintaining a private foundation.

Exemptions and special cases

Certain private foundations may be exempt from filing Form 990-PF or have alternative filing options available. For example, organizations that have received a determination that their gross receipts are normally $50,000 or less and are classified as private foundations may not have to file. Additionally, foundations that are fully integrated with their charitable activities may find it best to follow streamlined guidelines set forth by the IRS, potentially avoiding the need to file a complete Form 990-PF. It's paramount for any foundation to be aware of the specific requirements that fit their classification.

Detailed breakdown of Form 990-PF

Understanding the individual sections of Form 990-PF is key to successful completion. The form is composed of various parts ranging from Part I to Part XII, each addressing unique aspects of foundation operations and finances. For instance, Part I requires a foundational overview, including operational information, while Part II lists asset distributions and management, highlighting how foundations allocate their funding to charitable purposes.

Each part of the form demands specific data, including information about income, expenses, and financial activities. The key financial information reported often centers around: 1. Total revenue from the foundation's investments and activities. 2. Contributions received during the reporting period. 3. Details regarding distributions to grantees and the nature of those grants, emphasizing efforts made towards fulfilling the foundation’s mission. 4. An overview of assets and liabilities to depict the foundation's fiscal health at the end of its accounting period.

Step-by-step instructions for filling out Form 990-PF

Filling out Form 990-PF requires meticulous preparation. Before starting, it’s vital to gather all necessary documentation, such as balance sheets, income records, and prior year’s forms. Accurate accounting methods should be employed in documenting revenue, expenses, and grant activities to ensure coherence and accuracy throughout the process. Establishing a checklist of the necessary documents can greatly assist in organized preparation.

When filling out the form, consider the following practical tips: - Carefully follow the numbering system presented in the form; this will help avoid unnecessary mistakes. - Use clear and concise language to describe your foundation's activities and expenses—avoid jargon that could lead to confusion. - Review each section multiple times prior to submission—consider asking a colleague for a second opinion to spot potential errors. Common pitfalls to avoid include incomplete entries and inconsistencies across financial data.

eSigning and uploading your form

Once your form is completed, utilizing pdfFiller's interactive tools can facilitate the eSigning process, allowing you to fill out, sign, and manage your document from a single cloud-based platform. The platform provides user-friendly features to ensure that even complex documents are easy to handle. Choose between electronic submission for quicker processing or the traditional paper filing method, depending on your organization’s preference and infrastructure.

Managing and maintaining your Form 990-PF

After submitting Form 990-PF, organizations may find circumstances requiring amendments or corrections. It’s possible to file an amended return, particularly when errors are identified post-submission. Utilizing tools like pdfFiller allows you to revise and manage your submissions efficiently, ensuring compliance with IRS requirements. When amending filed forms, ensure you follow the IRS guidelines, as there are stipulations regarding the timeframe and nature of amendments.

Record-keeping best practices should also be adopted post-filing. It’s critical to maintain copies of all documentation related to Form 990-PF, as it not only demonstrates compliance but also aids in future filings. Recommended tools for document management include cloud storage solutions like pdfFiller, which efficiently align with nonprofit state filing requirements and best practices for document retention, ensuring all necessary records are at your fingertips when required.

Understanding the implications of Form 990-PF

Missed deadlines for Form 990-PF can have significant repercussions. Understanding penalties and interest charges for late filing is essential for private foundations seeking to maintain compliance. Penalties may accrue on a daily basis and can reach thousands of dollars, depending on the size and the number of days late. Beyond financial burdens, recurring late filings could endanger an organization’s tax-exempt status, creating additional complications in operation.

If circumstances arise that necessitate extended time for submission, foundations can request an extension via Form 8868. This allows an additional six months for filing Form 990-PF. Nonetheless, it’s important to initiate this request timely and be aware of crucial deadlines, ensuring that your organization continues to adhere to IRS stipulations throughout the process.

Additional considerations for Form 990-PF

Confidentiality and transparency are balancing act concerns for private foundations filing Form 990-PF. While complete financial disclosure is mandatory, there are also privacy considerations — particularly regarding the identities of beneficiaries, which may not require public disclosure. Understanding these nuances is crucial for maintaining both transparency with the IRS and confidentiality regarding sensitive information.

Staying informed about changes in IRS regulations is another vital aspect of managing Form 990-PF. Regularly monitoring updates from the IRS can prevent potential compliance issues that may stem from shifts in filings or guidelines. Engaging with tax professionals or legal advisors in the nonprofit sector can also provide insights into remaining compliant with evolving regulations.

Utilizing pdfFiller for efficient form management

pdfFiller offers seamless integration with document management systems, providing significant benefits for private foundations. By utilizing a single cloud-based platform, organizations can streamline the entire process of creating, editing, and managing Form 990-PF. This enhances efficiency, collaboration, and overall compliance efforts across teams, whether they are in the office or working remotely.

Moreover, pdfFiller includes features that remind users of upcoming filing dates, which helps ensure compliance with IRS due dates and regulations. By tracking changes in regulations and deadlines within the same platform, organizations can foster a proactive approach toward maintaining their tax-exempt status and meeting nonprofit state filing requirements while avoiding costly penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990-pf from Google Drive?

How can I send form 990-pf to be eSigned by others?

How do I edit form 990-pf on an Android device?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.