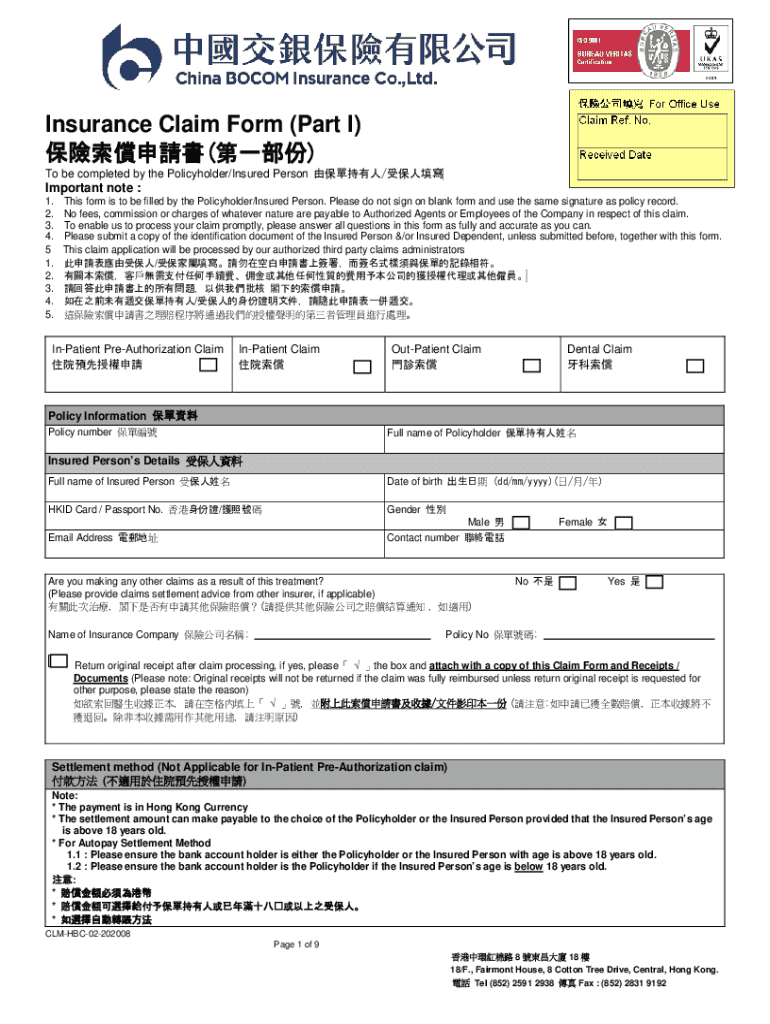

Get the free Insurance Claim Form (part I) and (part Ii)

Get, Create, Make and Sign insurance claim form part

Editing insurance claim form part online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance claim form part

How to fill out insurance claim form part

Who needs insurance claim form part?

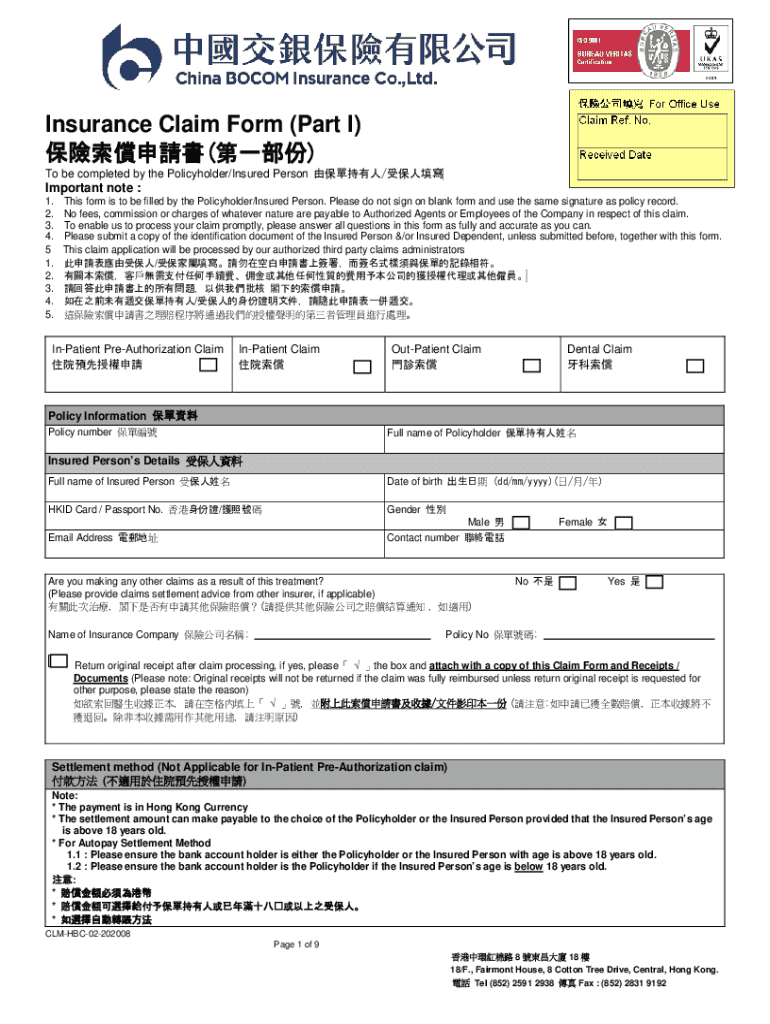

Complete guide to the insurance claim form part form

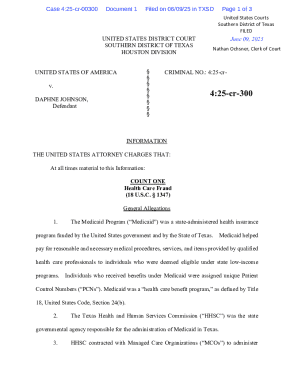

Understanding insurance claims

An insurance claim is a formal request made by the policyholder to an insurance company for compensation or coverage for losses incurred, as dictated by the terms of the insurance policy. The claims process helps policyholders recover from unexpected events, like accidents, theft, or health issues.

There are several types of insurance claims, including:

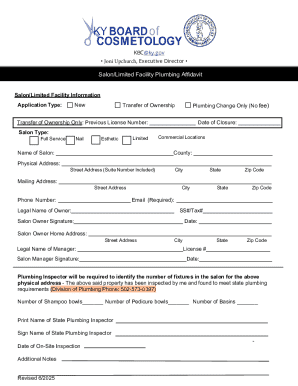

Essentials of the insurance claim form

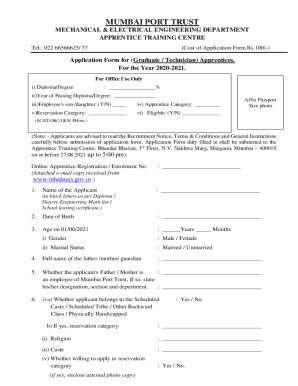

Filling out an insurance claim form requires providing accurate and thorough information. The form typically has several key components that ensure all necessary details are captured.

Providing complete and accurate information is crucial for expediting claims processing and avoiding complications.

Step-by-step guide to filling out the insurance claim form

Successfully filling out the insurance claim form necessitates a clear process. Here’s a step-by-step guide to ensure your submission is complete:

Editing and managing your insurance claim form

Managing your insurance claim form can be made easier with tools like pdfFiller, which allows you to edit your documents easily. You can add or remove information without hassle, ensuring your submissions are precise.

The benefits of using digital signatures on your claim include increased security and the ability to sign documents from anywhere. Furthermore, pdfFiller's collaboration features enable multiple team members to contribute to the claim process, streamlining communication and enhancing accuracy.

Common mistakes to avoid when filing claims

Navigating the claims process can be tricky, and certain common pitfalls can hinder your success:

Navigating claim status and communication

Once you've submitted your insurance claim form, monitoring its status is essential to ensure a smooth process. Most insurers offer online tools allowing you to check your claim status quickly.

Effective communication with your insurance provider is also critical. Track response times and maintain records of all correspondence, which can help if any discrepancies arise later.

What to do if your claim is denied

Encountering a denial can be disheartening, but there are steps you can take. Understanding common reasons for claim denials—such as policy exclusions or inadequate documentation—is key.

If your claim is denied, consider the following actions:

Special considerations for unique claims

Certain claims may require specialized handling, such as claims for natural disasters, medical expenses, or business losses. Familiarize yourself with your policy's specific provisions regarding these scenarios.

For instance, medical claims often require submitting patient requests for medical payment along with detailed billing, while claims related to natural disasters may need extensive documentation of damage.

Tips for a successful claims experience

To enhance your claims experience, it's essential to adopt best practices. Timeliness is critical, as many insurers require prompt notification of incidents.

Building a rapport with your claims adjuster can also facilitate smoother communication and enhance the likelihood of a favorable outcome.

Leveraging online platforms for claim management

Using a cloud-based solution like pdfFiller can greatly enhance your claims management experience. With features for real-time collaboration and document management, it simplifies the process.

Digital tools can also future-proof your claims process by ensuring that all necessary documentation is easily accessible and modifiable as needed.

Troubleshooting common claim issues

Understanding limitations within your policy is key to managing expectations. Address common issues like billing problems promptly to avoid complications that could delay your claim.

If you encounter coverage disputes, maintain open communication with your insurer and refer to your policy documents for clarity.

Enhancing your claim management process

Incorporate digital tools into your claims management strategy. Continuous documentation of incidents throughout the policy year ensures you are well-prepared should the need for a claim arise.

Additionally, integrating claims management into your overall financial planning helps you anticipate potential losses and manage your insurance appropriately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance claim form part directly from Gmail?

How do I fill out insurance claim form part using my mobile device?

How can I fill out insurance claim form part on an iOS device?

What is insurance claim form part?

Who is required to file insurance claim form part?

How to fill out insurance claim form part?

What is the purpose of insurance claim form part?

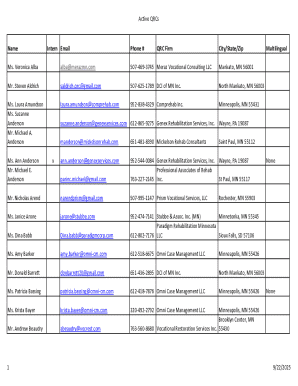

What information must be reported on insurance claim form part?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.