Get the free Tax & National Insurance When Self Employed

Get, Create, Make and Sign tax amp national insurance

Editing tax amp national insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax amp national insurance

How to fill out tax amp national insurance

Who needs tax amp national insurance?

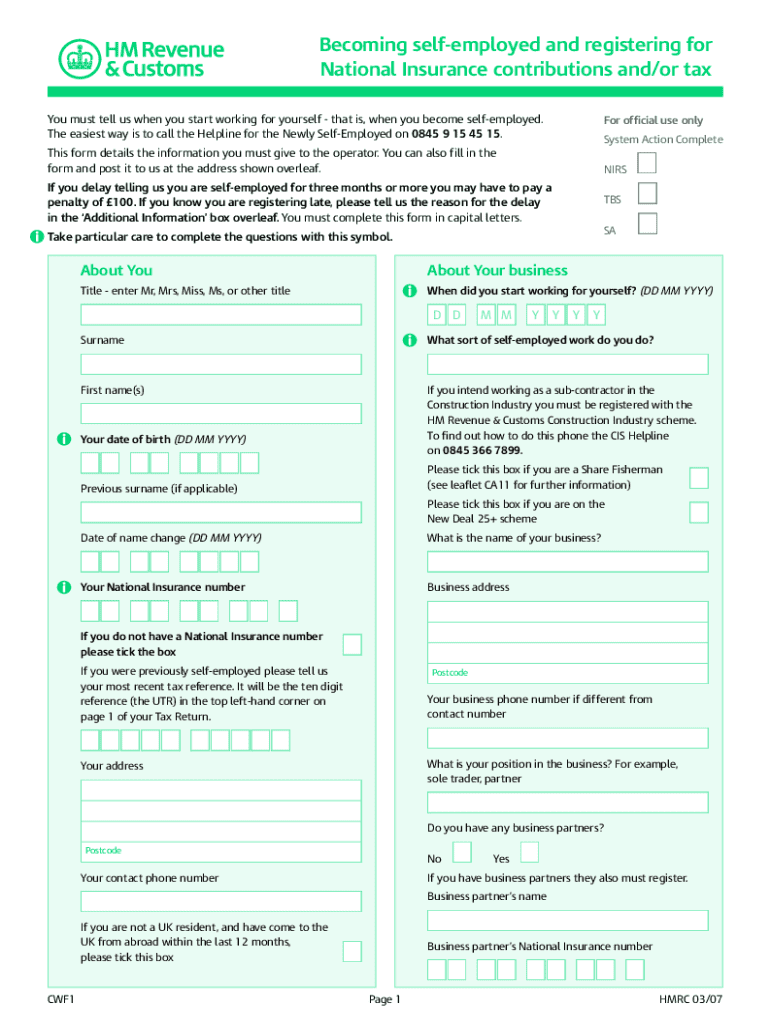

Comprehensive Guide to Tax and National Insurance Forms

Understanding Tax and National Insurance

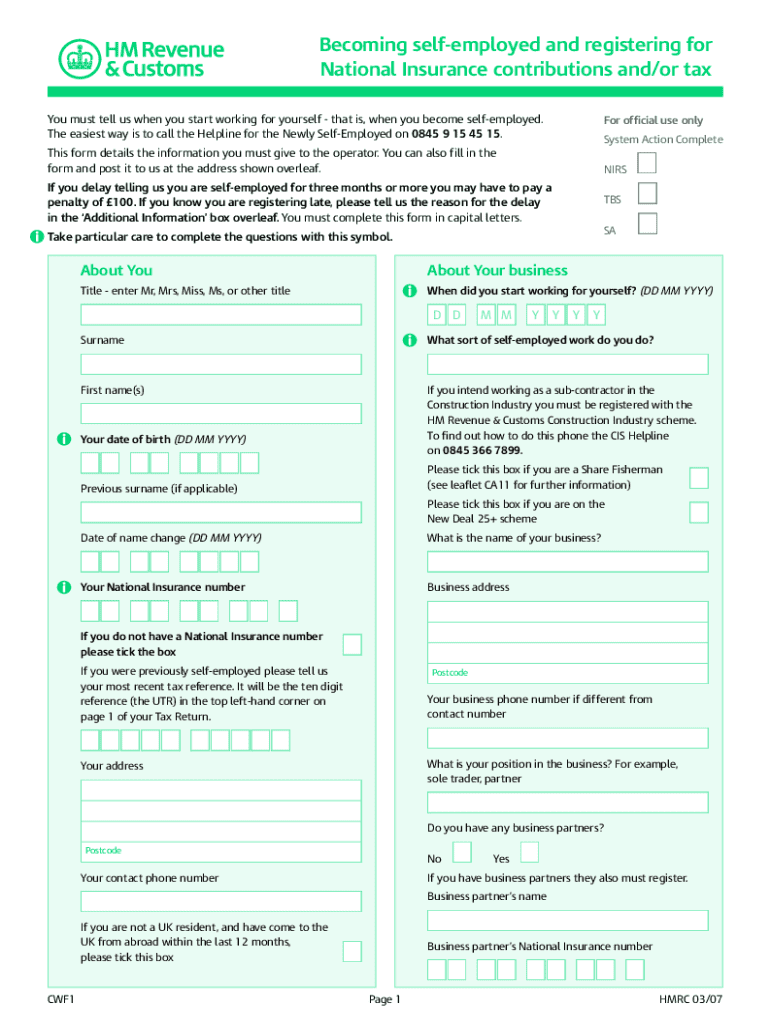

Tax and National Insurance (NI) are essential components of the UK's financial system, directly impacting individuals and businesses alike. Taxes provide the government with revenue to fund public services, while National Insurance contributions are pivotal in establishing entitlement to benefits, including the state pension. Understanding the nuances between these two financial obligations is crucial for effective personal finance management.

While tax is generally deducted from your income based on the amount you earn, National Insurance is specifically aimed at building your contributions record. This distinction is vital: taxes fund general government spending, whereas National Insurance often relates directly to individuals’ future entitlements to benefits and pensions.

Ensuring proper documentation is of utmost importance when it comes to filling out your tax and National Insurance forms. Incorrect information can lead to financial penalties, delayed benefits, or challenges in claiming what you’re entitled to. Hence, it’s essential to pay attention to detail when navigating these forms.

Types of National Insurance Forms

There are several types of National Insurance Contribution (NIC) forms, each serving their unique purpose based on your specific employment scenario. Understanding which form to submit is crucial for maintaining an accurate National Insurance record.

Self-employed individuals require different NIC forms compared to those in salaried positions, as their contributions are calculated differently. Form C1 is often used for self-employed NICs, while employees typically have their contributions managed through the PAYE system. Keeping these distinctions clear will help you avoid gaps in your contributions record.

Tax return forms, such as the Self Assessment tax return, are equally pivotal. These forms require accurate reporting of your income and expenses, ensuring you meet your tax obligations while maximizing any potential deductions.

Filling out your tax and National Insurance form

Completing a tax or National Insurance form can seem daunting, but breaking it down step-by-step can simplify the process. Each form has distinct sections, typically requiring personal information, income details, and specifics regarding previous contributions.

Start by carefully reading each section to understand what information is needed. For instance, when filling out a Self Assessment tax return, ensure your income sources are comprehensively detailed to avoid discrepancies.

To further streamline the process, interactive tools like those available on pdfFiller can assist with online calculators and templates tailored for tax and National Insurance forms.

Editing your form after completion

Mistakes happen, and fortunately, pdfFiller allows for quick and efficient edits. If you spot an error after submitting your tax and National Insurance form, the platform's editing tools are user-friendly and effective.

From adding signatures to filling out additional fields, pdfFiller makes it simple to adjust forms as necessary. Users can access their completed forms anytime, ensuring that they remain current and accurate.

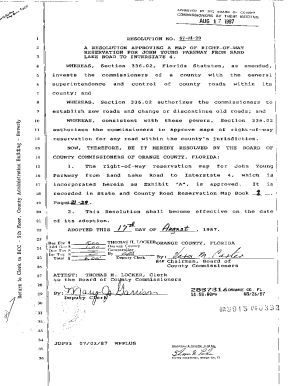

Submitting your tax and National Insurance form

Once your tax and National Insurance form is complete, the next step is to submit it. Depending on the form type, you can submit your documentation either online or by postal service, catering to your convenience.

Pay attention to the submission deadlines to avoid penalties. Late submissions can incur financial penalties, emphasizing the need for timely and efficient processing of all tax-related documents.

Tracking your submission is equally essential. Checking that your form has been processed and confirming receipt is recommended to avoid future issues.

Addressing common issues and questions

Gaps in your National Insurance record can negatively affect your entitlement to benefits, especially the state pension. Understanding these gaps and addressing them promptly is crucial for maintaining a healthy contributions record.

If you discover a gap, check your contributions record with HM Revenue and Customs (HMRC) to identify the years affected. This also applies to situations where you need to 'make up' a NIC shortfall. You can usually do this by making voluntary contributions, contingent on meeting certain eligibility criteria.

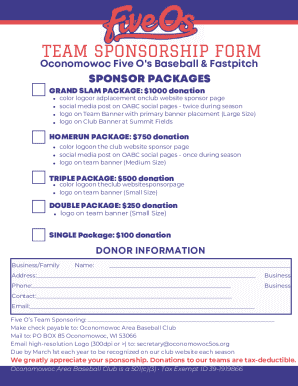

Benefits of managing your forms with pdfFiller

Utilizing pdfFiller not only simplifies the task of filling out tax and National Insurance forms but also enhances your overall document management. The platform’s comprehensive features enable you to store, share, and access forms securely from anywhere, making your document handling seamless.

Moreover, pdfFiller places great emphasis on data security and compliance. With stringent measures in place to protect your data, users can feel secure that their sensitive information is managed appropriately while meeting regulatory requirements.

Additional considerations

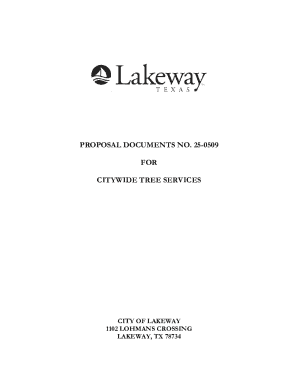

It's crucial to keep up with changes in tax legislation and National Insurance policies, as these can significantly impact your financial obligations. Regular updates can be found on official government sites and can often alert you to changes that may affect your contributions record or tax responsibilities.

Additionally, understanding how your National Insurance contributions relate to future benefits is an integral part of financial planning. Keeping track of your contributions will aid in assessing not only your current state pension eligibility but also future planning for retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax amp national insurance in Gmail?

How do I fill out tax amp national insurance using my mobile device?

How can I fill out tax amp national insurance on an iOS device?

What is tax & national insurance?

Who is required to file tax & national insurance?

How to fill out tax & national insurance?

What is the purpose of tax & national insurance?

What information must be reported on tax & national insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.