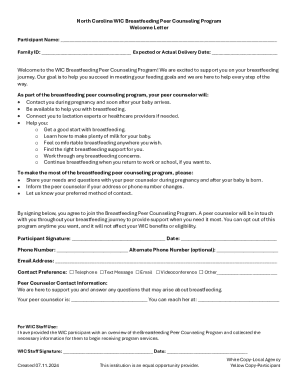

Get the free Official Form 201

Get, Create, Make and Sign official form 201

How to edit official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

Official Form 201 Form: Your Comprehensive Guide

Understanding official form 201

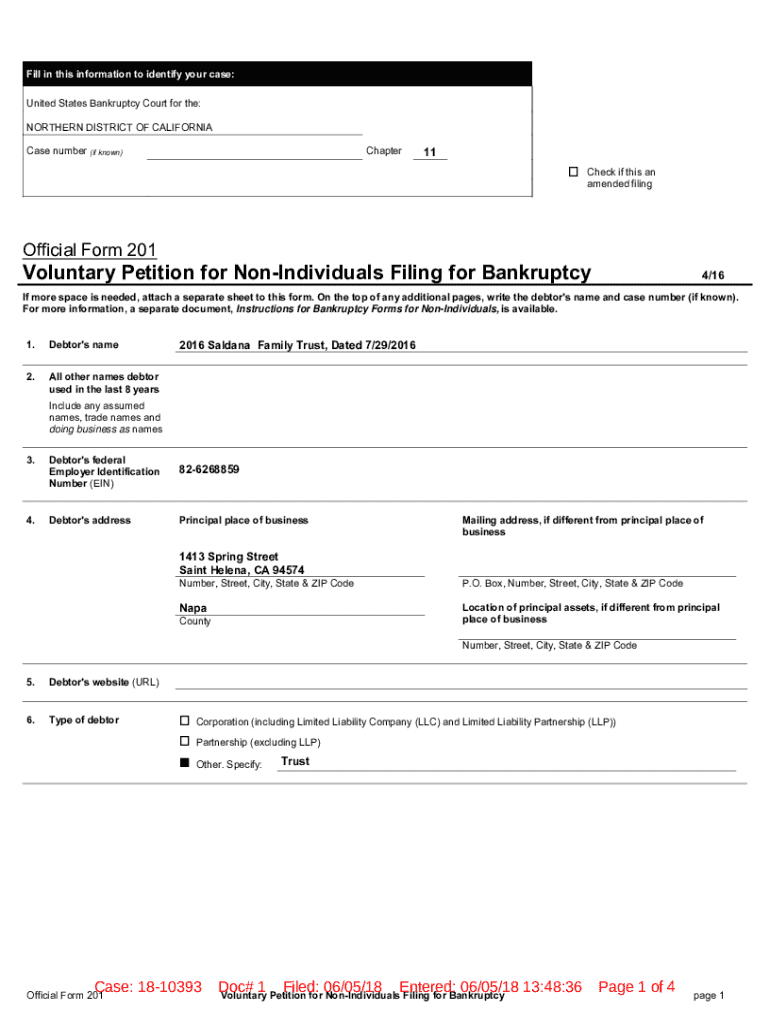

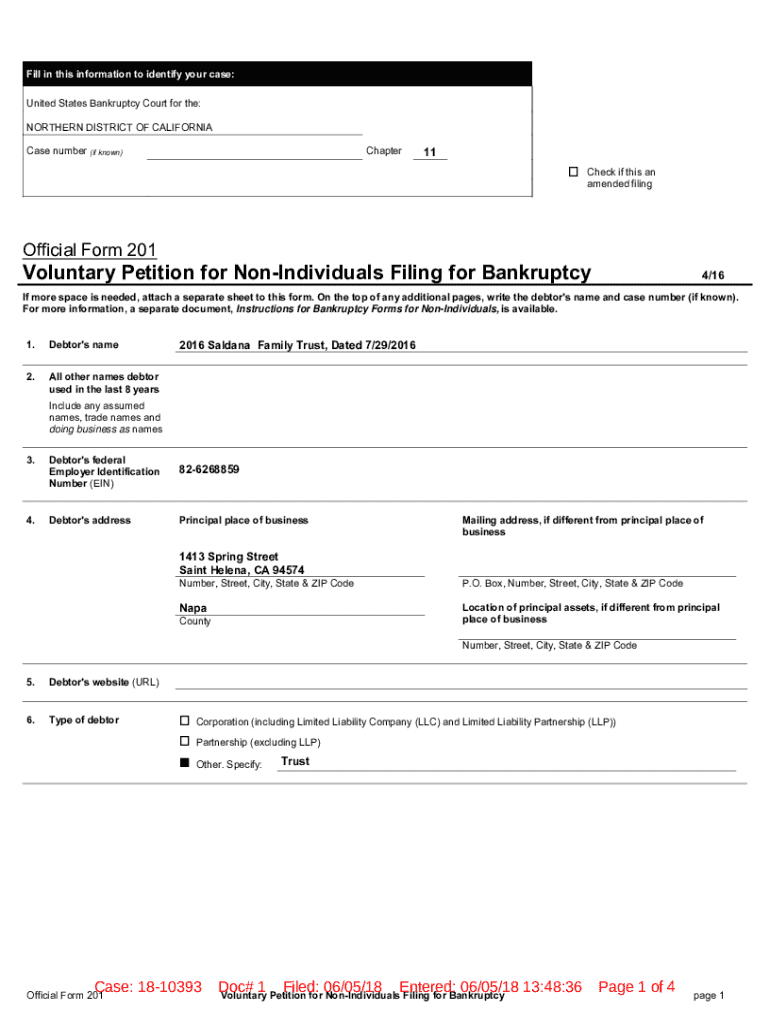

Official Form 201, often referred to as the 'Voluntary Petition for Individuals Filing for Bankruptcy,' is a critical legal instrument utilized within U.S. bankruptcy proceedings. Its primary purpose is to officially request bankruptcy relief under Title 11 of the U.S. Code. This form serves as the foundation for initiating the bankruptcy process for individuals seeking protection from creditors.

Accurate completion of Official Form 201 is vital. Errors or omissions can lead to delays in the bankruptcy process or, in some cases, denial of the petition. Therefore, filers must ensure all information is precise and up-to-date. Misrepresenting information can also lead to legal penalties.

Common uses of Official Form 201 include cases of Chapter 7 and Chapter 13 bankruptcies. Individuals facing overwhelming debt often rely on this form to seek relief, ensuring they can discharge certain debts and protect their essential assets.

Key components of official form 201

Understanding the structure of Official Form 201 is crucial for proper completion. The form contains several sections that gather essential information regarding the debtor's financial situation. The required information includes the case number, debtor details, and creditor disclosures, alongside a full disclosure of assets and liabilities.

Breaking down the form into its sections aids in understanding what information is required:

To ensure clarity and completeness in each section, filers should double-check their entries for accuracy and ensure all required fields are filled out correctly.

Step-by-step guide to filling out official form 201

Completing Official Form 201 can seem daunting, but following a structured approach simplifies the process. Start by gathering all necessary documents. Organizing relevant financial documentation such as bank statements, pay stubs, tax returns, and a list of debts will streamline your filing process.

Next, proceed to fill out each section of the form with detailed attention. For example, provide personal financial information accurately in Section 1 and carefully detail your creditors in Section 2. Be mindful of complex scenarios, such as instances involving joint debtors or special creditors, which may require additional documentation.

After completing the form, a thorough review is important. Common mistakes include incorrect case numbers, misspelled names, and missing creditor information. Double-checking your entries ensures accuracy and reduces the risk of delays. A meticulous review can save time and prevent complications during the bankruptcy process.

Editing and updating official form 201

Once you submit Official Form 201, you may need to make amendments or corrections. In situations where information changes post-filing, it is essential to understand how to update the form. The process typically involves submitting an amended form to the bankruptcy court, detailing the revised information. Always keep the court informed to prevent potential legal issues.

Utilizing platforms like pdfFiller can make the editing process seamless. You can easily update your forms electronically, ensuring accuracy with integrated tools. Here's how to use pdfFiller for your Official Form 201 edits:

The cloud-based platform of pdfFiller enhances document management. You can access your files from anywhere, collaborate with others, and ensure your documents are secure.

Signing and submitting official form 201

Understanding who must sign Official Form 201 and under what circumstances is crucial. Generally, the individual filing for bankruptcy must sign the form. In many cases, electronic signatures are accepted, which can expedite the submission process significantly.

When submitting the form, follow these instructions for successful submission:

Failing to submit on time could lead to unfavorable outcomes, including the rejection of your petition, so timeliness is essential.

Interactive tools and resources for official form 201

Accessing templates and examples of completed Official Form 201 can significantly ease the filing experience. Various reliable websites offer pre-filled templates designed to guide users through the form completion process. These resources can be incredibly beneficial, especially for first-time filers.

Analyzing case studies of successful submissions can also provide insights into the common pitfalls to avoid and best practices to follow. Filers often have common questions about deadlines, necessary documents, and processes surrounding the form. Addressing these FAQs can ensure a smoother filing experience.

Collaborating with teams in document management

Collaborative document tools play a pivotal role when teams must manage complex filings like Official Form 201. Efficient communication and feedback loops allow team members to share insights and ensure a high level of accuracy throughout the process. With pdfFiller, multiple users can work on the same document simultaneously, enhancing teamwork.

When sharing Official Form 201 with stakeholders, it’s essential to maintain privacy and protect sensitive information. Establish clear guidelines for securely sharing completed forms. Ensuring that only authorized individuals have access to sensitive data is paramount, especially in legal contexts.

Best practices for managing your forms long-term

Implementing effective digital document management strategies is crucial for long-term success. Organizing forms digitally allows for easy access and retrieval, which is beneficial when files must be referenced in the future. Utilizing tools that offer tagging or folder organization can significantly enhance efficiency.

Consideration for legal compliance is also important; staying up to date with regulations and addressing any changes affecting your form submission ensures you remain compliant with legal standards, thus protecting yourself and your interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify official form 201 without leaving Google Drive?

Where do I find official form 201?

How do I execute official form 201 online?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.